Author: IGNAS | DEFI RESEARCH

Compiled by: TechFlow

It’s common to be bearish on Ethereum (ETH) right now. Since the market low in early 2023, ETH has underperformed Solana (SOL) by a factor of 6.8, while ETH is down 47% relative to Bitcoin (BTC) over the past two years.

So, has the time for a rebound arrived?

Bearish arguments for Ethereum

There are many debates about the reasons for ETH’s poor performance, but I think there are a few key factors:

First, Bitcoin has been called “digital gold,” a narrative that is simple and easy to understand, especially for new average users and institutions. Ethereum’s story is more complex, and the popular “digital oil” analogy is neither appealing nor accurate.

Second, Solana is catching up with Ethereum: in terms of active users, transaction volume, and market attention, Solana sometimes even surpasses Ethereum.

Therefore, in cryptocurrency adoption, Bitcoin is the safer choice, while Solana is a riskier (lower market cap) smart contract investment option. Ethereum is sandwiched between the two.

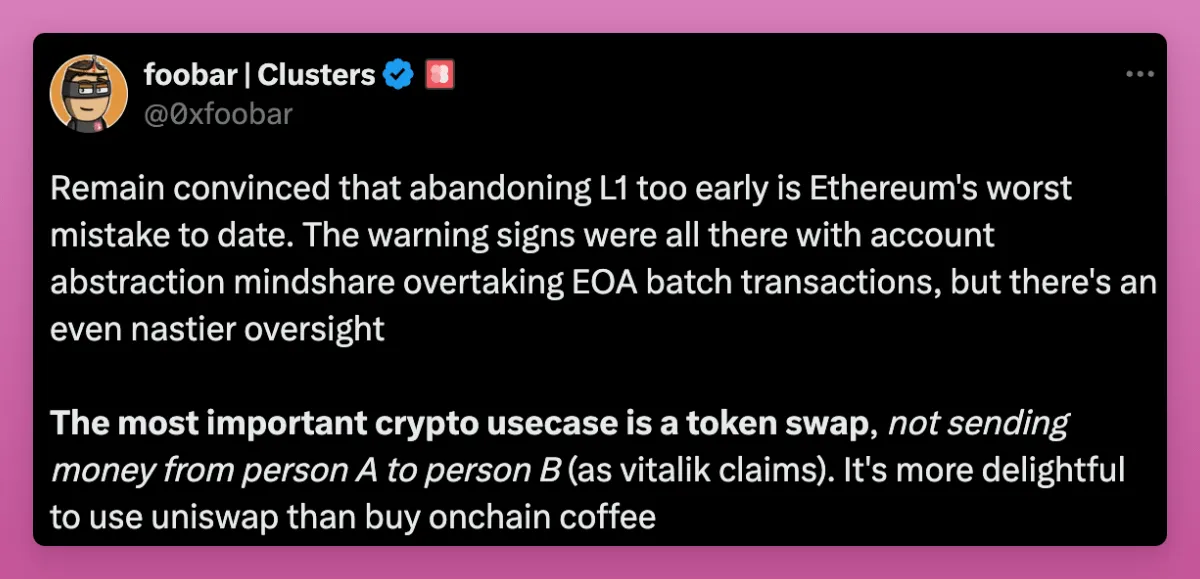

Furthermore, Ethereum’s modular approach combined with Layer 2 solutions (L2) has resulted in fragmented liquidity and a complicated user experience.

Speculators who bet on a modular approach spread their buying power across multiple ETH beta tokens, such as multiple L2, LRT tokens, and DA tokens. In contrast, betting on Solana only requires buying SOL.

I believed ETH would outperform BTC as market participants recognized the high yields of airdrop farming rewards. Indeed, my actual performance on ETH was much higher than the spot price would imply, based on re-collateralization protocol airdrops alone.

However, this did not generate FOMO for ETH, probably because of overexposure during the bear market, many people believed that ETH could not fail and therefore bought it in large quantities.

Relatively speaking, not many people in the crypto community hold SOL. When SOL rebounded, more crypto natives switched from ETH to SOL. In the absence of significant inflows of ordinary user funds, the price of ETH stagnated.

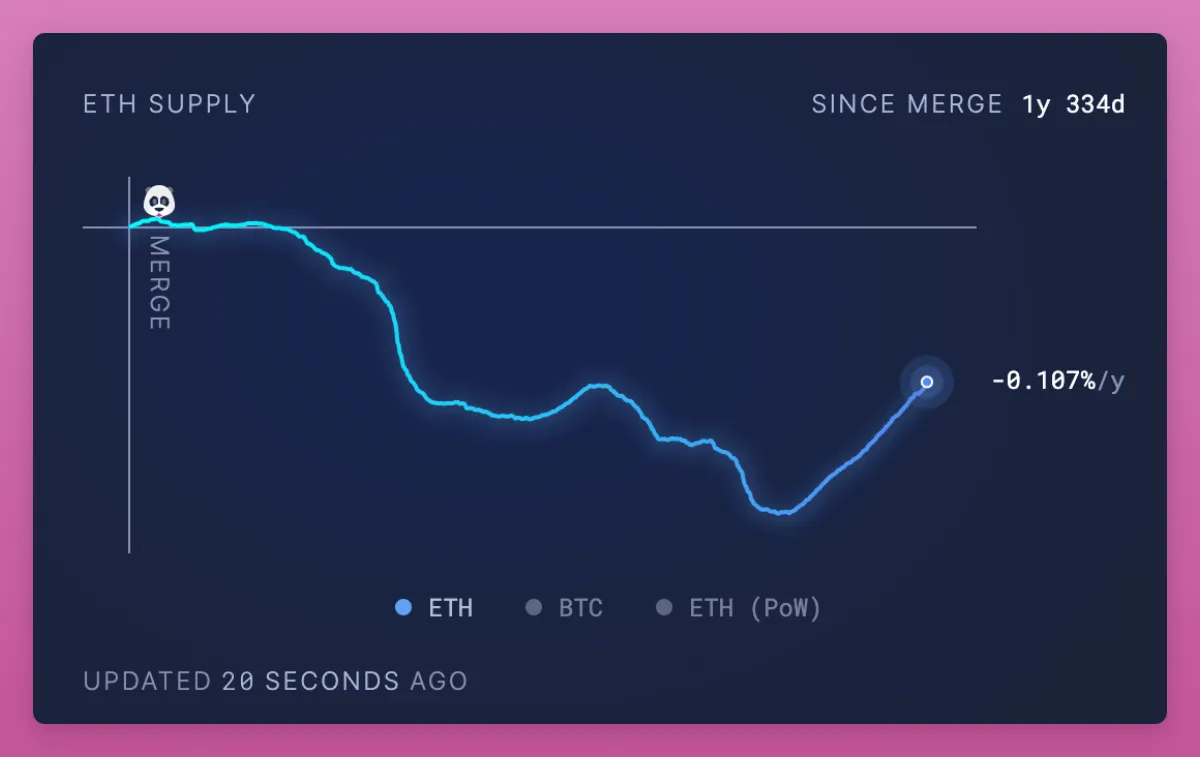

Another issue is the declining revenue and destruction rate of ETH.

After the EIP-4884 Proto-danksharding upgrade, the ETH burn rate decreased due to the decrease in fees paid by L2. Although ETH's inflation rate is still below 1%, this is a setback for those who are optimistic about ETH as an ultrasonic currency.

After the release of EIP-4844 in March, ETH's destruction trend reversed significantly.

There is currently little discussion on Twitter about "ultrasound currency".

While pessimistic arguments are emerging on the X platform, the sentiment on ETH still tends to be optimistic, although not as strong as that of BTC.

Instead, let’s explore the bullish arguments for Ethereum.

Bullish arguments for Ethereum

There are many reasons to be optimistic about ETH. I asked my followers on X to share their thoughts.

If gas prices can stay around 20 gwei, Ethereum will be seen as both deflationary and scalable, making it an attractive and efficient network. Notably, ETH’s gwei has been below 20 since March.

Regular users can now stake ETH independently from home, increasing its decentralization and attracting individual investors and validators using consumer-grade hardware.

The strong developer community and accumulated intelligence within the Ethereum ecosystem supports continued innovation and the robustness of the network.

Ethereum is considered the leading smart contract platform with no real competitors, maintaining reliability and decentralization.

Ongoing developments like layer-2 solutions and interoperability improvements are key factors for optimism, while ongoing work aims to reduce fragmentation and increase network efficiency.

An increasingly clear regulatory environment, particularly in the U.S. and EU, has bolstered confidence, allowing institutions like BlackRock to adopt Ethereum.

Improved staking options allow all ETH holders to participate in network security without requiring extensive technical knowledge or resources.

Major institutions like Coinbase and BlackRock have indicated increased adoption of tokenized real-world assets (RWAs) on Ethereum.

Ethereum’s potential for expansion in DeFi capabilities and stablecoin dominance provides considerable room for growth and market leadership.

The renewed enthusiasm and collective pride among Ethereum holders and users contributes to the positive outlook and increased market interest.

I also asked some well-known Ethereum people why they are bullish on ETH. Among those who responded were Camila Russo (founder of The Defiant) and Christine Kim (Galaxy researcher).

Here are the reasons why Camila is bullish on ETH:

Mature DeFi ecosystem: Ethereum and its layer 2 solutions offer the most mature DeFi ecosystem in crypto, in terms of combined total value locked (TVL) and transaction volume. This liquidity and dapp concentration will attract more users, and activity will begin to be reflected on the layer 1 chain, driving gas fees up and burning more ETH. DeFi is one of the few crypto use cases in the financial sector that currently has meaningful product-market fit.

Decentralization and security: Ethereum’s decentralization and security have attracted the world’s largest institutions to trust it on the chain: Blackstone through its BUIDL fund, PayPal launched PYUSD, JPMorgan Chase, Santander and other large banks are testing blockchain settlement and tokenization on Ethereum, etc. Large institutions cannot afford the risk of blockchain downtime or validator/miner attacks and misconduct, and will continue to choose Ethereum. This will drive activity and prices up.

ETH ETF : ETH is one of only two cryptocurrencies in the United States that can be exposed through an ETF, which will provide long-term support for ETH prices.

Christine Kim highlighted the network effect of Ethereum:

I think one of Ethereum’s main advantages over its competitors is its network effect. Ethereum is the first general purpose blockchain (first mover advantage) and has the largest developer following (strong community/ecosystem), both of which I think contribute to the value of the network.

Indeed, Ethereum is where I would prefer to store my long-term assets. In contrast, Solana has experienced multiple outages, while Ethereum has shown good reliability over the years.

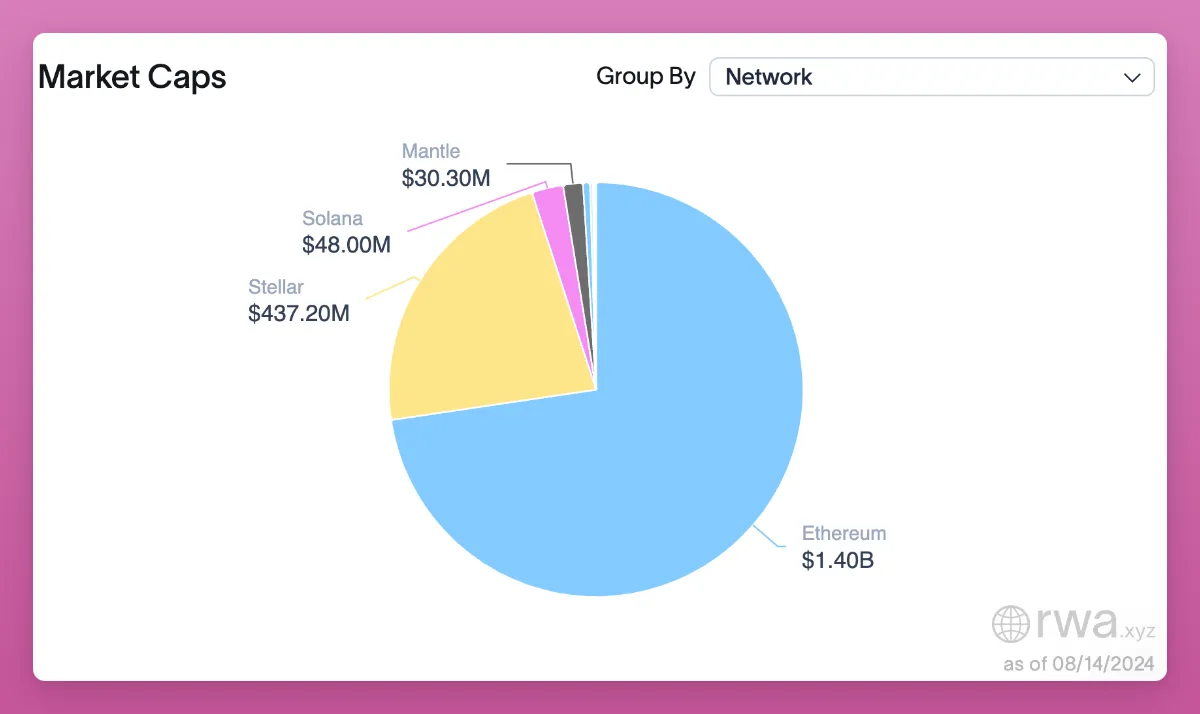

I am very bullish on Ethereum as a real world asset (RWA) chain for asset tokenization. For example, 52% of stablecoins and 73% of US Treasuries are tokenized on Ethereum.

Tokenizing US Treasuries - rwa.xyz

If you are bullish on memecoins, then Solana might be the choice for you, but for tokenizing billions of dollars of real-world assets, Ethereum is the safest bet.

Next, we will discuss an important issue: Layer 2s.

As a monolithic chain, Solana is fast and cheap, but it may still face performance limitations.

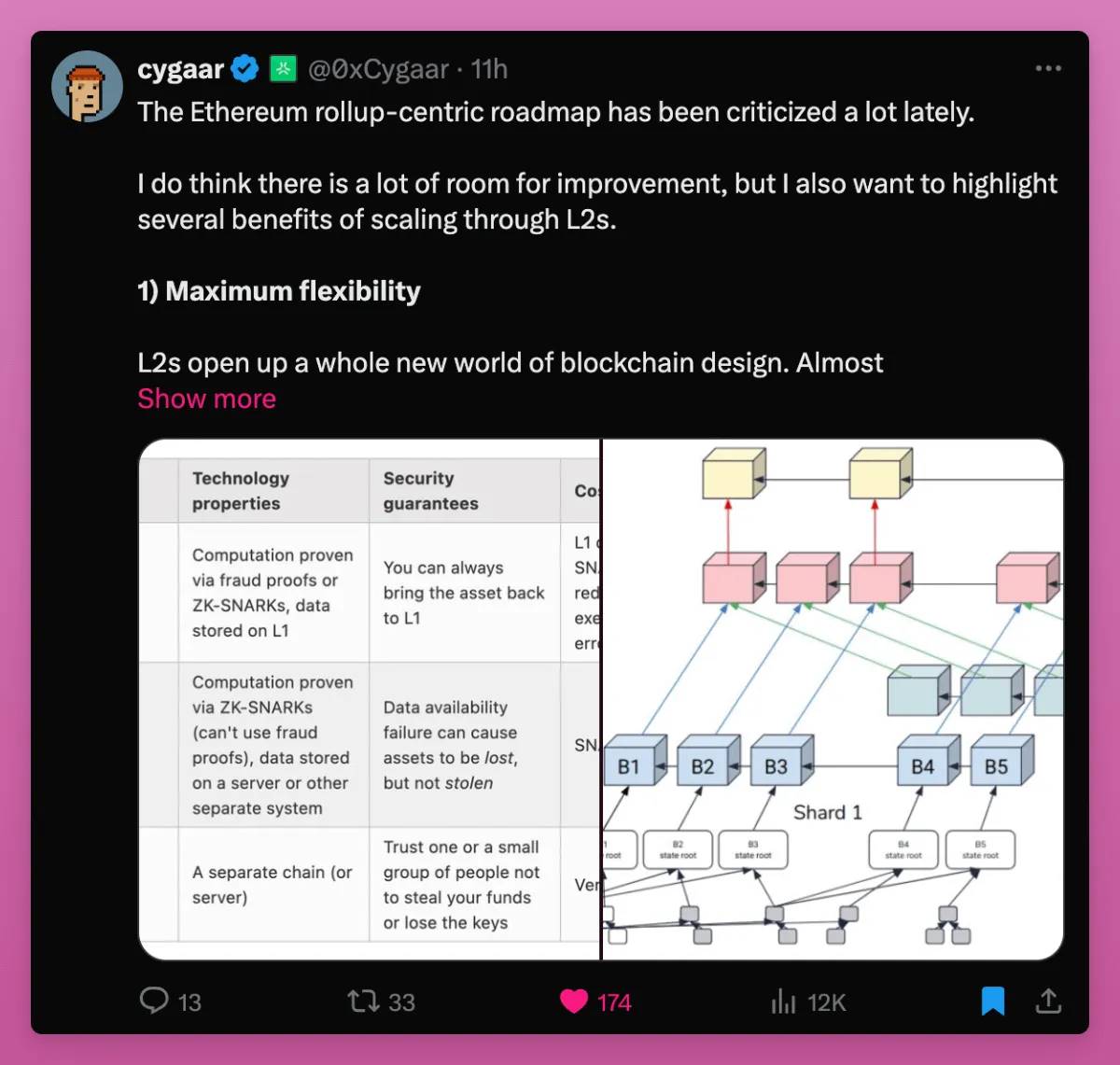

Modular expansion via L2 provides a long-term solution, as extensibility can be continually increased by launching L2 for specific use cases. L2 provides more room for flexibility, simplicity, and cultural sovereignty. Cygaar articulated this well in the following post:

The current liquidity fragmentation and degraded user experience due to reliance on bridges is hopefully a temporary problem. For example, Catalyst AMM will allow atomic swaps between different chains — eliminating the need for bridge assets. In this case, liquidity is still fragmented, but end users still get the best price because liquidity comes from multiple chains. More solutions like Catalyst are in development.

In addition, L2 itself is also undergoing major efforts.

Optimism is “ integrating with ERC-7683 to allow interoperability between the superchain and Ethereum’s other L2s via the application layer,” meaning all L2s in the Optimism ecosystem will feel like one.

Likewise, Polygon is building an AggLayer, “ which means one-click transactions across chains. It will reproduce the online experience, except in the protocol network.

There is also Caldera's Metalayer, Avail Nexus, and Hyperlane.

Multiple aggregation solutions are also a problem, but in the future, issues with liquidity and user experience should be resolved.

I think people underestimate how quickly this is happening.

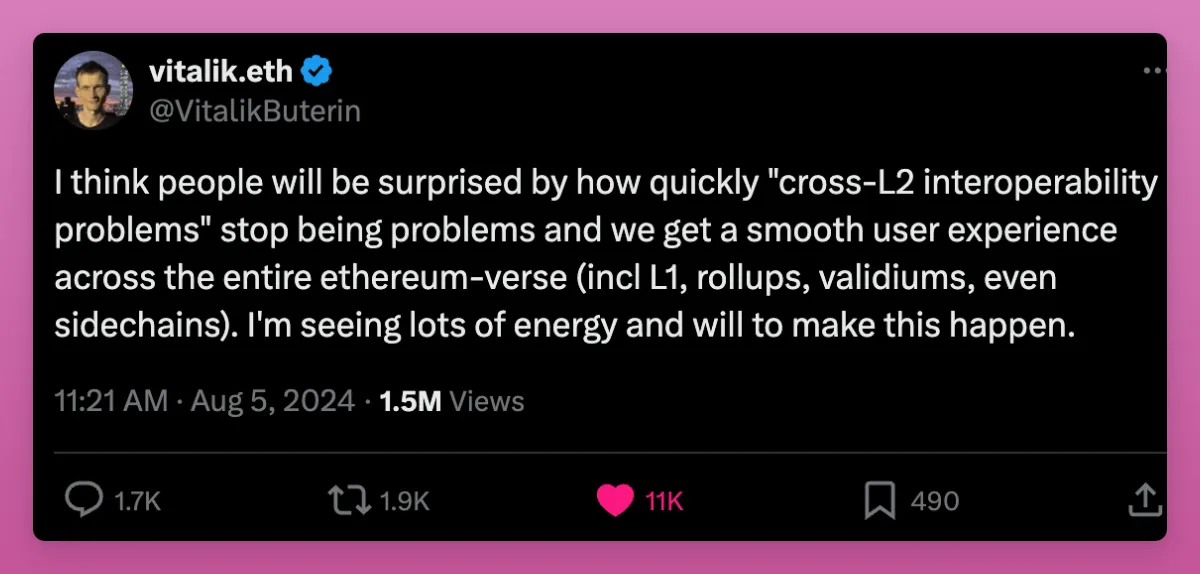

In fact, Vitalik himself said people would be surprised that “cross-L2 interoperability issues” would no longer be an issue.

If you need more optimism, check out Emmanuel’s post where he is optimistic about Ethereum’s strong community, continued innovation, and long-term resilience.

I would be very bullish if L2 fragmentation issues are resolved and adoption of RWA and tokenization continues to grow on Ethereum, but these are long-term factors.

In the near term, there is one catalyst that is rarely discussed, and that is the Pectra upgrade.

What is Pectra Upgrade?

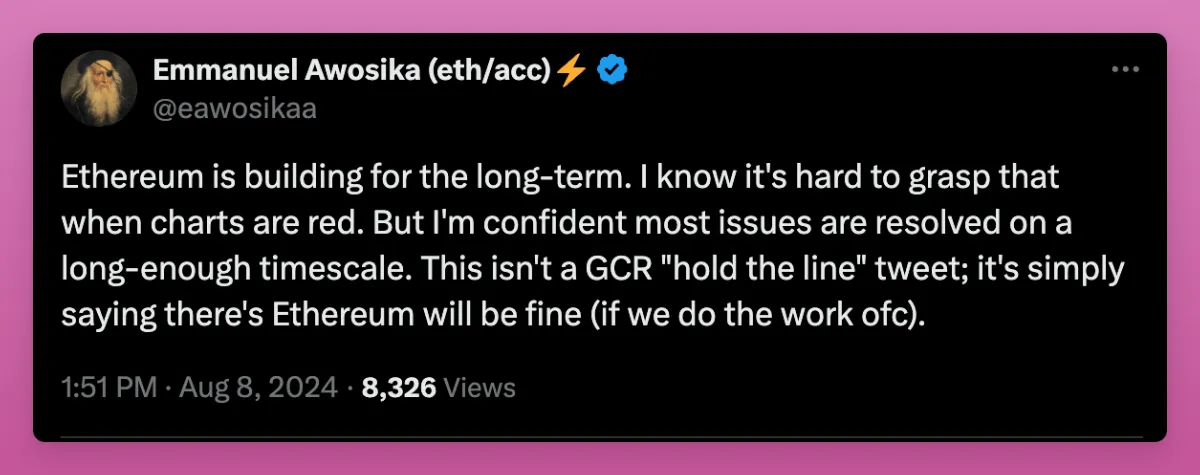

The Pectra upgrade is the next major milestone for Ethereum and is expected to be launched in the first quarter of 2025. It will integrate updates from Prague (the execution layer) and Electra (the consensus layer).

For more details on the timeline and specific EIPs, visit Ethroadmap.com.

While all major Ethereum upgrades have received a lot of attention, Pectra appears to be flying under the radar.

I understand this situation. Ethereum has undergone several major changes, including the migration from Proof of Work (PoW) to Proof of Stake (PoS), the launch of the ETH destruction mechanism, and EIP-4884. However, Pectra also brings some exciting upgrades.

Account abstraction: ultimately improving user experience

One important change in Pectra is how it handles account management.

Currently, managing a wallet requires many cumbersome steps, from signing transactions to managing gas fees on different networks. Through account abstraction, Pectra will simplify this process.

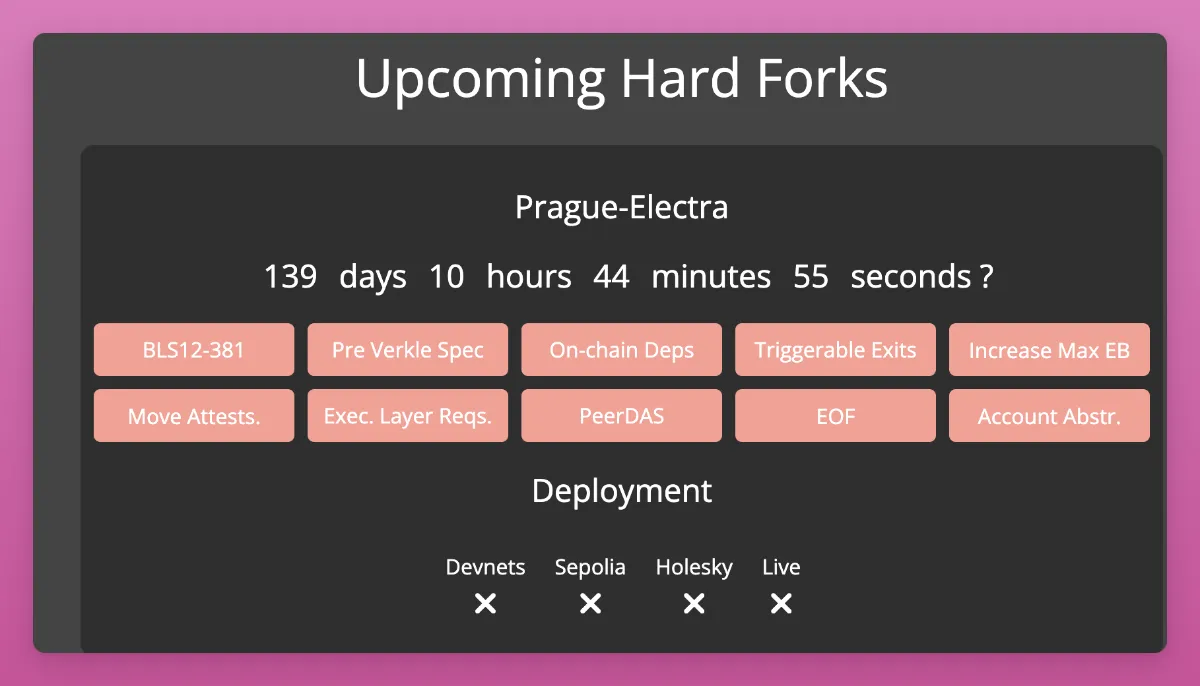

EIP-3074 and EIP-7702 are two proposed improvements. EIP-3074 allows traditional wallets (externally owned accounts or EOAs) to interact with smart contracts, such as supporting batch transactions and sponsored transactions.

EIP-7702 goes a step further and allows EOA to temporarily serve as a smart contract wallet during a transaction. This means that your EOA wallet becomes a smart contract wallet only during a transaction, and the specific implementation is to add the smart contract code to the EOA address. This concept is very interesting and I look forward to seeing its practical application.

In practice, this will bring the following benefits:

Approve USDC and exchange for UNI in one transaction.

Decentralized applications (dApps) can sponsor gas fees for users, thereby lowering the threshold for use.

Pre-approve the dApps you wish to use and set spending limits.

It’s worth noting that EIP-3074 seemed to be prioritized, while Vitalik finished writing EIP-7702 in just 22 minutes! EIP-7702 is also compatible with future account abstraction implementations.

The “EOA temporarily becomes a smart contract wallet” is pretty cool, as many dApps are generally not compatible with smart account wallets right now (e.g. when using Safe or Avocado for multi-signature). Hopefully, account abstraction will get more traction after the upgrade.

Staking Improvements

The Pectra upgrade brings a number of breaking changes for those running validator nodes.

EIP-7251 increases the maximum stake of a validator from 32 ETH to 2048 ETH, which enables large stake providers to consolidate their stakes, reduce the number of validators, and thus reduce the burden on the network.

This is also good news for small stakers, as it provides more flexible staking options, such as being able to stake 40 ETH or compound interest rewards. In addition, the ETH staking queue time will be shortened from hours to minutes.

I was looking forward to a major update related to MEV (Miner Extracted Value) mitigation, but it seems that this will not be included in the Pectra upgrade.

Scalability improvements

Pectra introduced Peer Data Availability Sampling (PeerDAS) through EIP-7594.

Similar to Proto-Danksharding in the previous Dencun upgrade, PeerDAS will make transactions on L2 cheaper. However, I didn't find specific numbers on how much cheaper it will be (I think PeerDAS will be particularly useful during high usage periods). 0xBreadguy mentioned that Pectra will increase blob capacity by 2x-3x.

In addition, there are multiple technical upgrades such as BLS12-381 for shortening BLS signatures, thereby reducing gas fees, and EIP-2935 for verifying transactions without requiring the entire blockchain history.

Together with the Verkle tree transition (EIP-6800) that will eventually replace the existing Merkle tree structure, these EIPs will make light clients more secure and make it easier for nodes to participate in the network, thereby increasing decentralization.

Another important change is the improvement of EVM, involving 11 EIPs, which will make it easier to write and deploy smart contracts, reduce costs and improve efficiency. In other words, development on Ethereum will become smoother.

Check out this post from Ethereum Intern for a simple explanation of the impact of the technology upgrade.

I was looking forward to Single Slot Final (SSF) coming with the Pectra upgrade, but it is not yet included in the upcoming Osaka upgrade.

Vitalik shared in December 2023 that SSF is the simplest way to solve most of the flaws in Ethereum PoS design.

Currently, Ethereum’s proof-of-stake consensus takes about 15 minutes for a block to reach finality, meaning it cannot be changed or deleted without significant financial penalties. SSF aims to reduce this time to one slot, about 12 seconds, ensuring that blocks are confirmed almost immediately after creation.

In practice, this would mean faster and more secure bridges, and faster CEX deposits. It’s disappointing that this hasn’t happened yet. Its exclusion from the upgrade is bearish and shows that Ethereum developers are still not prioritizing L1 scaling. I would become more optimistic if there were clearer signs that the core ETH community is focusing on L1 scaling. At the moment, it doesn’t seem to be a priority.

Regardless, Pectra is a technology upgrade, but I believe the market is underestimating its significance.

Now, let’s talk about the price of ETH.

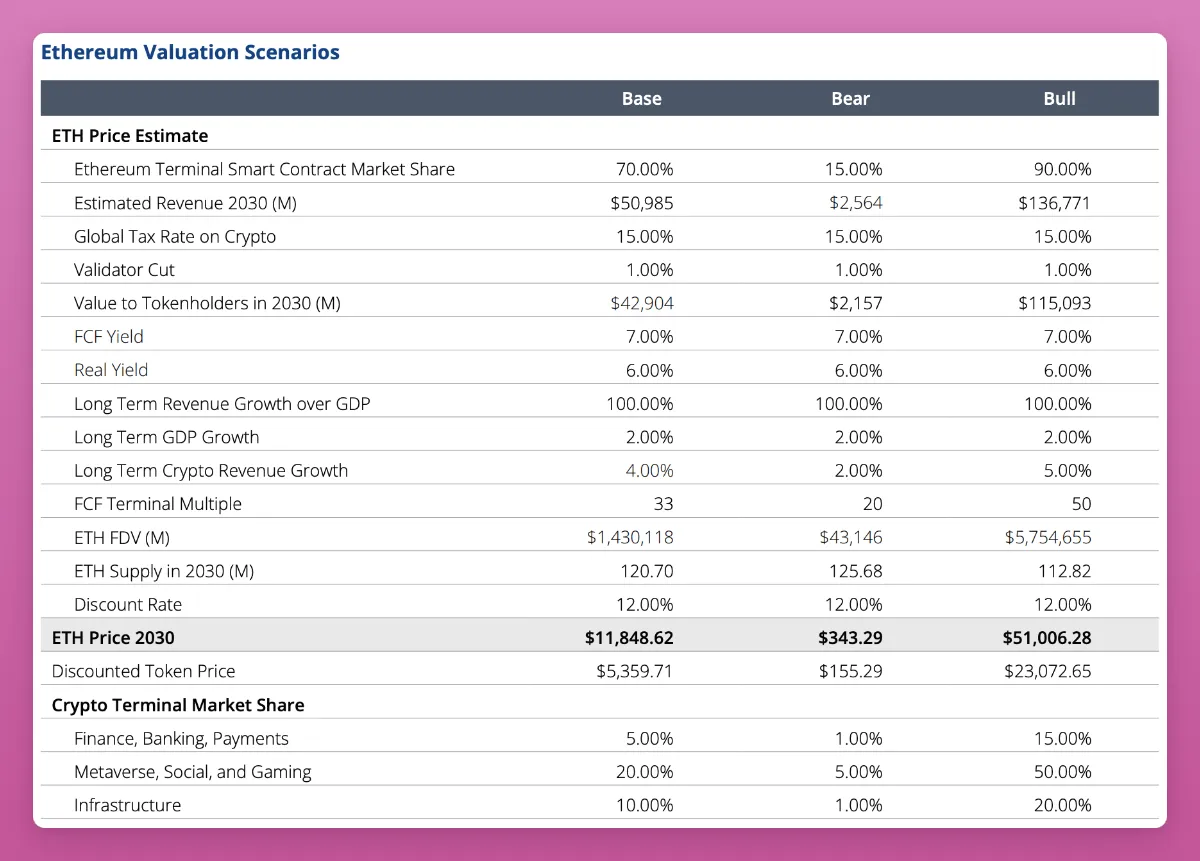

VanEck’s base case price prediction for ETH is for it to reach $11,800 by 2030.

To be honest, the $11,800 prediction looks relatively pessimistic (I expect the price of ETH to be higher in five years), but note that VanEck’s base case forecast for Solana by 2030 is only $335.

Therefore, according to the basic forecast, ETH has a potential of 4.4 times, while SOL has a potential of only 2.2 times. It should be noted that both of these forecasts were made a year ago, when the ETH ETF had not yet been launched, so I am looking forward to seeing their updated forecasts.

By the way, if you need more optimism, Ark Invest CEO Cathie Wood expects ETH to rise to $166,000 and BTC to $1.3 million by 2030.

However, I am more interested in the $51,000 bullish scenario for ETH. Anyway, VanEck’s ETH price prediction is based on the following points:

VanEck assumes that by 2030, Ethereum will have a 70% market share among smart contract platforms, leveraging its position as the dominant open-source global settlement network.

Ethereum’s annual revenue is expected to grow from $2.6 billion to $51 billion, with the growth coming primarily from increased transaction fees, MEV (miner extracted value), and the introduction of “security as a service” (SaaS) — using ETH to secure other protocols (restaking).

Ethereum is expected to capture more economic activities in multiple fields such as finance, banking, payment, metaverse, social, gaming, and infrastructure.

Ethereum’s potential as a store of value asset is also taken into account, with its utility further enhanced through smart contract programmability and cross-chain messaging technology (smart collateral).

Below is a summary of the base, bear and bull scenarios.

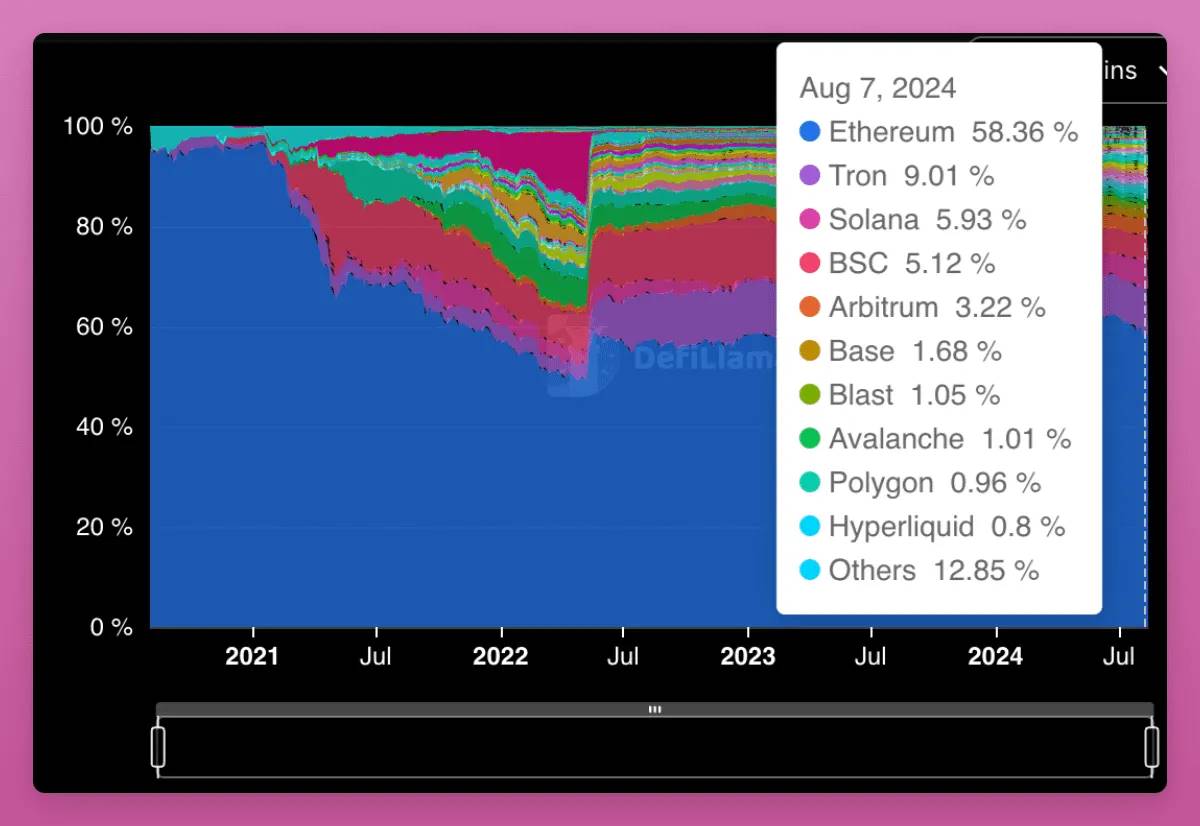

The base case scenario of 70% smart contract market dominance seems pretty reasonable to me, even though Ethereum’s dominance is only 58% right now (but about 65% if you count all L2s). Despite SOL’s crazy run-up, dominance has remained the same since the beginning of 2022.

TVL (Total Value Locked) dominance will be a key metric as institutions seem to be very focused on this.

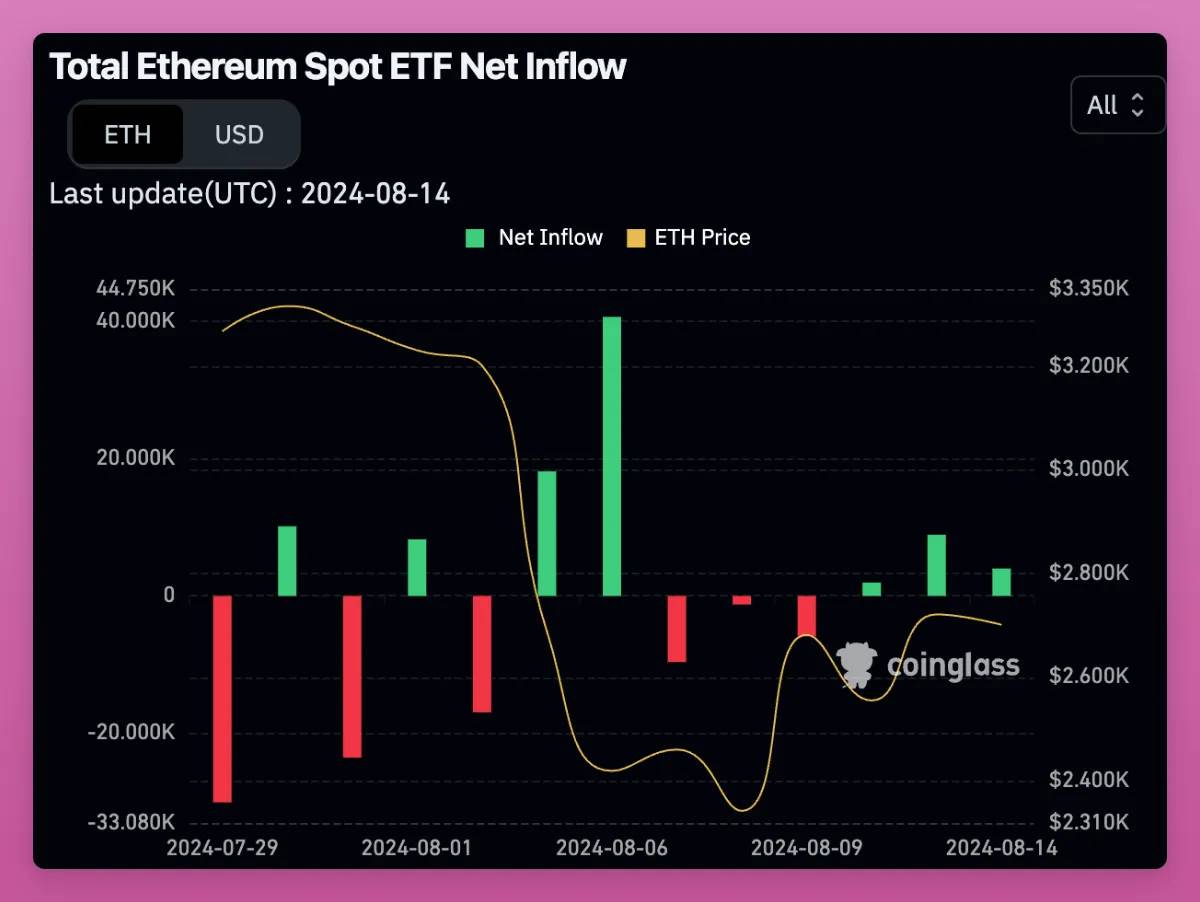

Another metric that both institutional and retail investors are watching is the flow of funds into ETH ETFs.

Ethereum ETF

If someone had told me a few months ago that ETH had an ETF but was trading below $3,000, I would probably have thought the cryptocurrency was in a bear market.

While it’s too early to tell, the situation for the ETH ETF looks increasingly positive as time goes on. Grayscale’s outflow rate is declining rapidly, and net inflows have been positive for three consecutive days. This suggests that those who needed to exit Grayscale have already done so.

We’ve already gotten a glimpse into the scale of Grayscale’s potential impact, but the upside will be a pleasant surprise. If this trend continues, the outlook for ETH looks pretty bullish!

So, given everything that’s going on with Ethereum, are you bullish?