Can Pump.fun end the meme coin? Weekly review: Repercussions of meme coin launchers, evolution of restaking protocols.

1️⃣ Meme Coin Chaos Pump.fun, a very popular meme coin launcher on Solana, encountered many new critics this week who are worried that the platform’s newly updated token issuance mechanism will take all the fun out of speculating on meme coins.

In its short life, Pump has helped users create nearly 2 million unique Meme Coins, and while 99.99% of those tokens have failed to gain any meaningful value, the activity has made the Pump team very wealthy. They have earned $100 million in fee revenue since the platform launched in March.

Their success is accumulating. The platform recently eliminated its $2 fee for creating Meme coins, passing the fee on to the first buyer of the token (usually a bot). The shift has led to a flood of new coins on the platform, rampant speculation, and record fee revenue. In just one 24-hour period this week, Pump collected $5.3 million in fees.

All this activity has led to a lot of complaints on Crypto Twitter that the only winners in this new dynamic are the pump and dump. Can the platform sustain this kind of activity, or will traders turn elsewhere?

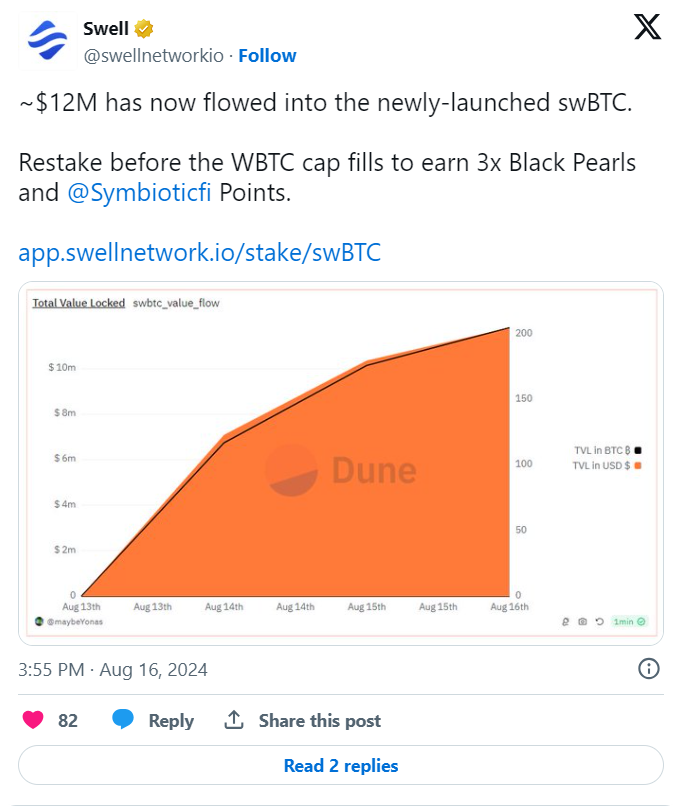

2️⃣ Restaking makes progress It’s been a big week for Restaking, with updates from EigenLayer and Symbiotic, and the launch of new non-ETH LRTs (liquidity re-staking tokens).

EigenLayer : On Wednesday, the leading restaging protocol announced support for permissionless token restaging, allowing any ERC-20 token to be used to secure AVS (Active Validation Service), essentially eliminating one of Symbiotic’s main competitive advantages.

Symbiotic: A competitor associated with Lido launched its development network this week and plans to launch a mainnet this quarter.

Bitcoin and Solana LRT: Etherfi and Swell both announced the launch of Bitcoin LRT, which will collect yields from Symbiotic, Karak, and EigenLayer. In addition, Renzo announced that they will be partnering with Jito, who recently announced the launch of their own Restaking platform, to launch LRT ezSOL on Solana.

3️⃣ Good data but poor price performance This week, the prices of Bitcoin and Ethereum fell sharply, even though positive inflation data drove a surge in traditional financial markets, which confused the bulls in the crypto market.

The unexpected drop comes after a summer filled with fear-driven selling that has many wondering if there are hidden forces at play — perhaps a redistribution of Bitcoin from Mt. Gox or the U.S. government moving seized Bitcoin to exchanges. With institutional adoption of Bitcoin increasing and the Federal Reserve all but certain to ease policy in September, the lack of a positive uptrend in prices is puzzling and continues to defy expectations for a bullish market.

4️⃣ A turning point for crypto payments? Apple’s latest announcement could be a watershed moment for crypto payments. The tech giant announced it will open up its NFC payment chip to third-party developers, a move that could bring crypto payments into the mainstream faster than ever before. The policy shift allows developers to integrate “tap to pay” functionality directly into mobile wallet apps, potentially making stablecoin transactions as easy as swiping a credit card. This development builds on the momentum of Coinbase’s Smart Wallet and Token Transfer Link, furthering the suite of tools driving crypto payments into the mainstream.

5️⃣ The turmoil of Wrapped Bitcoin WBTC has sparked controversy this week as issuer BitGo announced a joint venture with BiT Global to transfer majority control of WBTC multi-signature keys to Justin Sun's team. The move has set off alarms across the industry, with many concerned about the security of the $9 billion in assets managed by WBTC. The response was swift, with MakerDAO halting lending of WBTC. Meanwhile, Coinbase took the opportunity to preview its alternative product, cbBTC, which looks set to launch soon.