Author: Artemis Source: OurNetwork Translation: Shan Ouba, Jinse Finance

Latest market trends

DeFi Ecosystem

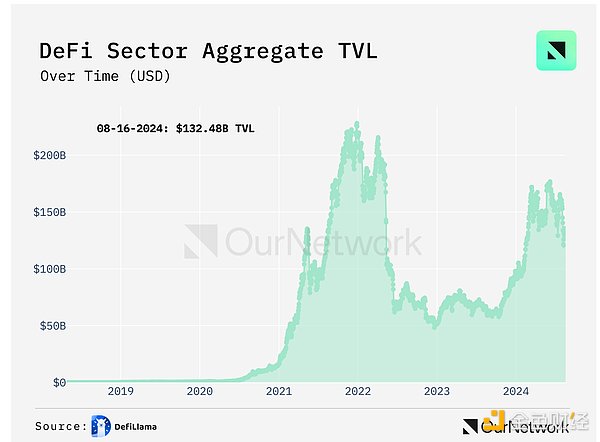

TVL up 50% year-to-date; DEX trading volume surges 3.6x

Since the beginning of 2024, DeFi has seen a resurgence, with total value locked (TVL) growing by more than 50% from $56 billion to $85 billion. Areas such as trading, lending, and liquidity staking have seen significant growth, with re-staking opening up new use cases for idle crypto assets. While growth has been flat recently, the numerous upcoming Bitcoin Layer 2s could unlock a new wave of DeFi use cases.

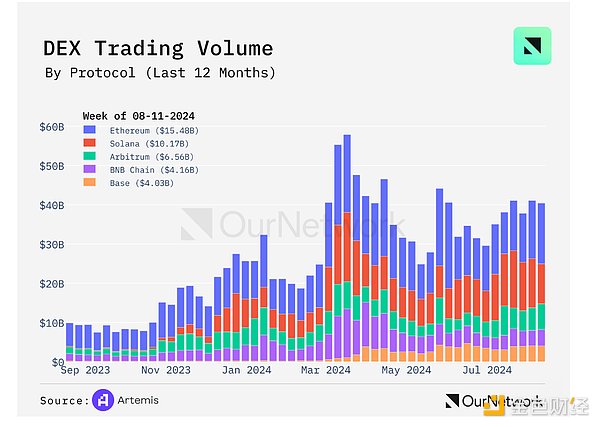

With the emergence of Layer 2 Base developed by Coinbase and a large number of new addresses joining Solana, DEX transactions have exploded. The weekly transaction volume of the top five blockchains has increased from about $20 billion at the beginning of the year to more than $40 billion today.

With the emergence of Layer 2 Base developed by Coinbase and a large number of new addresses joining Solana, DEX transactions have exploded. The weekly transaction volume of the top five blockchains has increased from about $20 billion at the beginning of the year to more than $40 billion today.

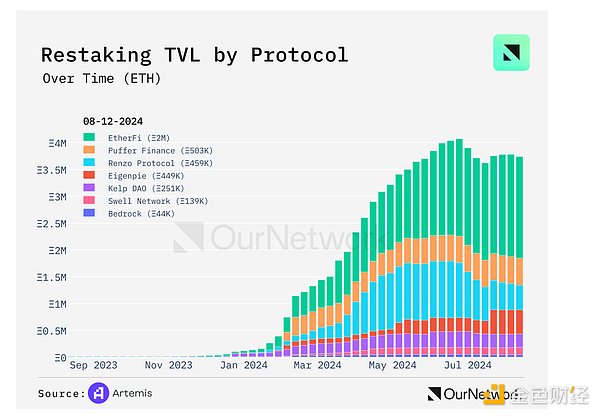

Restaking has also contributed greatly to DeFi’s resurgence. Currently, over 3.7 million ETH is locked in restaking protocols, with venues like Pendle driving more usage. As more AVSs emerge in 2024, the restaking landscape will continue to evolve.

DeFi on Solana

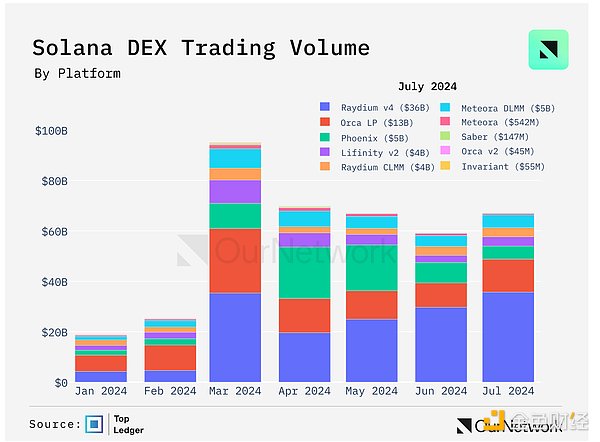

Nearing New Highs: Solana DEX Volume Nears $430 Billion Since January 2024

Since January 2024, DEX trading volume in the Solana ecosystem has exceeded $430 billion. In recent months, the average monthly trading volume has been between $60 billion and $80 billion, with an active participation rate of more than 34.5 million wallets. Jupiter Exchange contributed 52.8% of the total trading volume, with a trading volume of approximately $228 billion. In addition, the existence of trading platforms such as Orca, Raydium, Lifinity, and Meteora highlights the continued innovation in the DEX field.

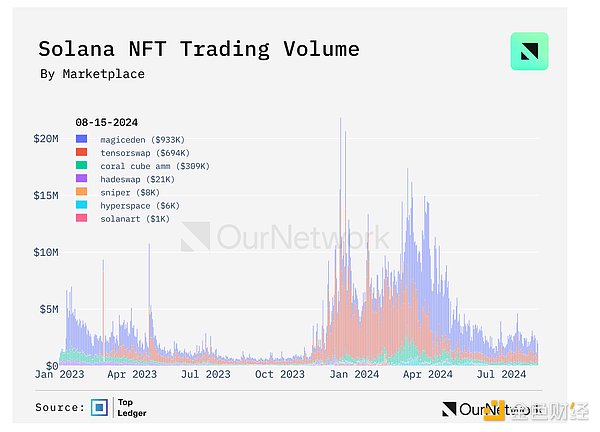

The secondary market for NFTs on Solana has experienced significant growth since January 2023, with trading volume reaching 41.3 million SOL, equivalent to $2.25 billion. The market remains strong and active, with 800,000 unique wallets acquiring 17.3 million NFTs.

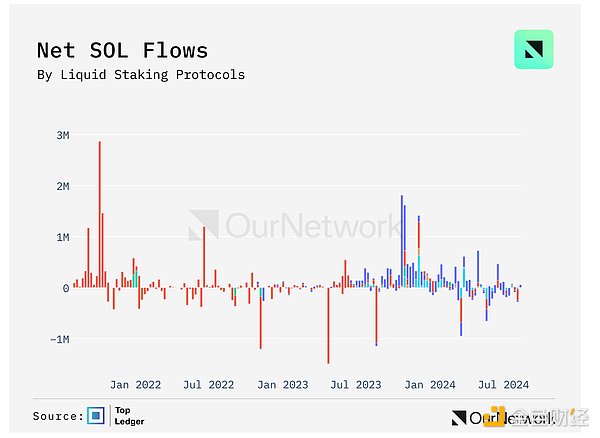

Since August 2021, 530,000 unique wallets in the Solana ecosystem have conducted 12.6 million staking transactions through various LST protocols. These protocols now collectively manage more than 24 million SOL in staked assets. Among them, Jito dominates, accounting for 50% of the total staked SOL.

The Token-2022 initiative on Solana has processed more than 18 million transactions and created 685,000 tokens, including 90,000 fungible tokens. As an upgrade to Solana's original token framework, it supports minting, burning, transfer fees, and interest-bearing tokens.

DeFi on BNB

According to BNB Chain’s 2024 Outlook, one of its main goals this year is to provide one of the most robust and active ecosystems for DeFi builders.

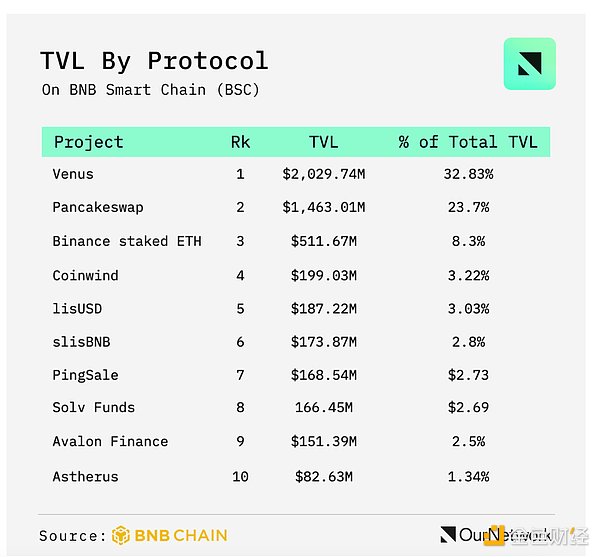

BNB Smart Chain (BSC) has a total locked value of approximately $6.2 billion, ranking third in Layer 1, behind Ethereum and Tron. In BSC, Venus and PancakeSwap have a total locked value of approximately $3.5 billion, leading the way.

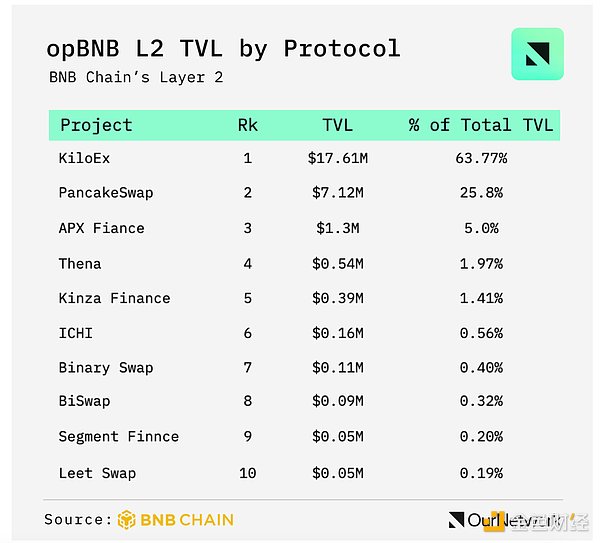

In addition to BSC, the BNB Chain ecosystem also has a Layer 2 network called opBNB, which currently has a TVL of about $27 million. The most prominent protocol on opBNB is KiloEx, a peer-to-pool perpetual DEX that offers high-leverage options. KiloEx currently accounts for nearly 64% of opBNB's TVL.

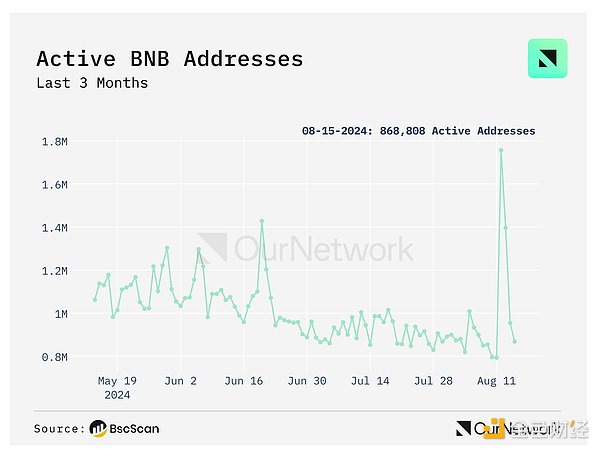

BSC has a scalable ecosystem and a thriving user base. With nearly 1 million DAUs and the lowest gas fee among L1 chains (less than $0.03), BSC is extremely attractive to developers. Its EVM compatibility, fast finality, and on-chain governance further enhance its advantages as a DeFi platform.

BSC has been stress-tested live to demonstrate its true scalability. On December 7, 2023, BSC set a new record of processing 32 million transactions. Despite the surge in transaction volume, BSC has maintained the gas price at 3.7 Gwei, close to its average of 3 Gwei (now down to 1 Gwei), and transaction fees remain at the standard $0.03 due to the capacity of 140 million gas per block. This transaction took place during a surge in transaction volume, and you can see that the transaction fee is still the standard $0.03.

DeFi on Avalanche

Active and loyal users on Avalanche will receive $6 million worth of AVAX and COQ rewards

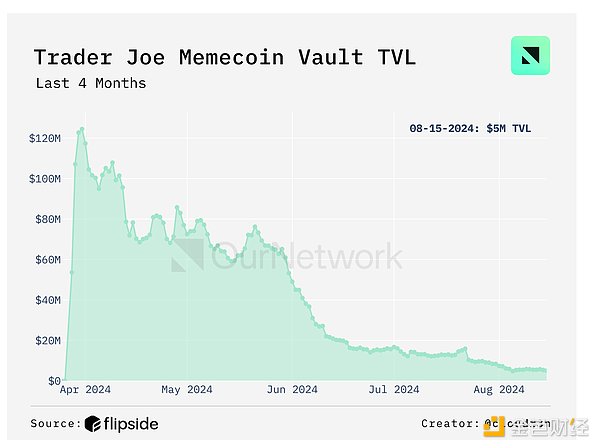

Avalanche is a Layer 1 blockchain with high throughput and a customizable virtual machine. During the community airdrop, the Avalanche Foundation airdropped a total of $3.9 million in AVAX and $2.1 million in COQ memecoin to a total of 8.3k users. These users were participants in the Memecoin Rush program and Diamond Hands, who deposited funds into Trader Joe's Memecoin Rush Vaults. In one week, the 10 Avax community coin vaults reached a peak TVL of $125 million with more than 12,000 depositors.

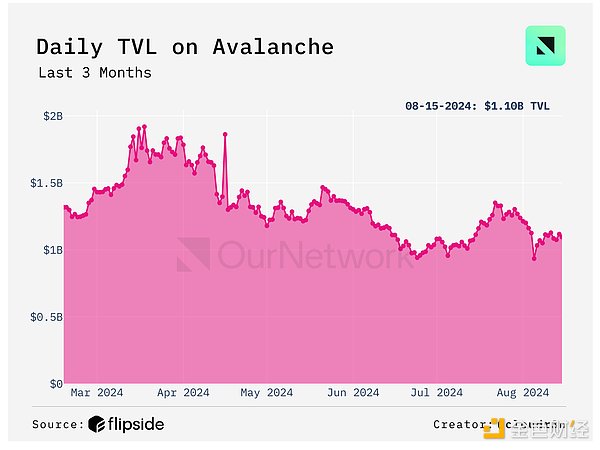

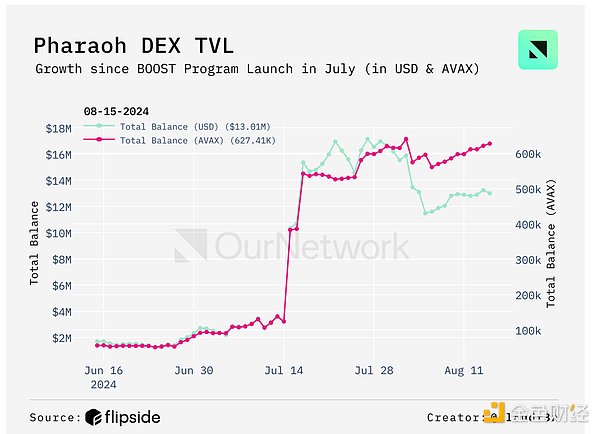

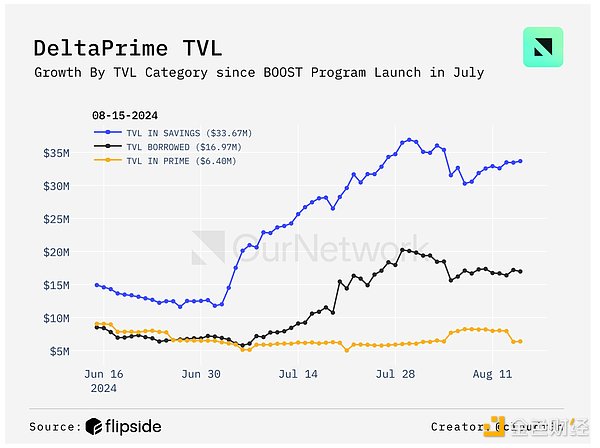

TVL on Avalanche fell 43% from a peak of $1.9 billion in March 2024 to $1.1 billion in August. The liquidity staking sector saw the biggest drop at -$100 million, mainly due to the price drop of AVAX. DEXs saw a significant increase of over $17 million, with exchange Pharaoh contributing $10 million. Multi-faceted protocol DeltaPrime saw the largest increase at $12 million.

The Avalanche Foundation launched an incentive program called BOOST in July to support its DeFi ecosystem. There are signs that BOOST is working - since the program launched, TVL on Pharaoh has increased 3x to over $13 million, while savings deposits and borrowing on DeltaPrime have both increased nearly 3x to $32 million and $17 million, respectively.

This address received the highest LB incentive - 43 AVAX worth!

This user has $120k in 2 pools (ggAVAX-AVAX and GGP-AVAX) and the liquidity shape is only 1 bin! Imagine the Impermanent Loss and the time it takes to add, rebalance and remove the same position.