Author: Emma Cui, Thura Aung Source: LongHash Ventures Translation: Shan Ouba, Jinse Finance

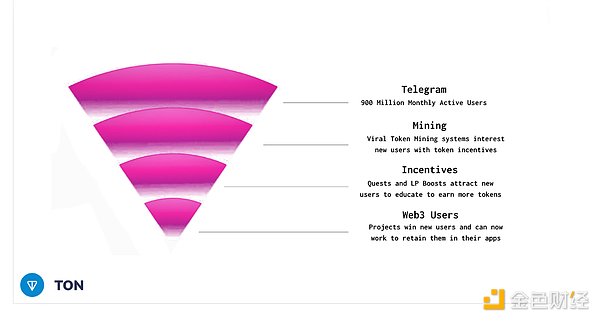

The TON ecosystem has undoubtedly piqued everyone’s interest over the past few months. As the entire crypto industry is eager for breakthrough applications and mass adoption, Telegram’s 900 million users provide a compelling potential opportunity for the TON ecosystem to achieve this grand vision.

Is this just another buzzword that crypto natives/speculators are following for the sake of price action, or does TON present a real opportunity for crypto to cross the chasm? We quickly scanned the ecosystem to understand the opportunities and risks.

hope

The TON team has often explored the idea of a super app, similar to China's WeChat, which aims to combine services such as instant messaging, social networking, DeFi, and e-commerce, all based on TON's blockchain technology. Their vision is for the app to become a gateway to Web3, aiming to attract hundreds of millions of users and enable billions of transactions in Telegram's user-friendly and seamless environment, leveraging its existing user base. The ultimate goal is to leverage TON's existing distribution channels to gradually introduce and familiarize Telegram's loyal audience with on-chain workflows.

While we believe it is a difficult task for TON to follow in WeChat’s footsteps and become a super app, given the unique environment in which WeChat grew, such as the support of the Chinese government, seamless integration with all of China’s banking infrastructure, and the lack of competition in WeChat’s early stages, we are confident that the TON ecosystem is gathering momentum and is poised to become the largest Web 3.0 user onboarding channel in the short to medium term.

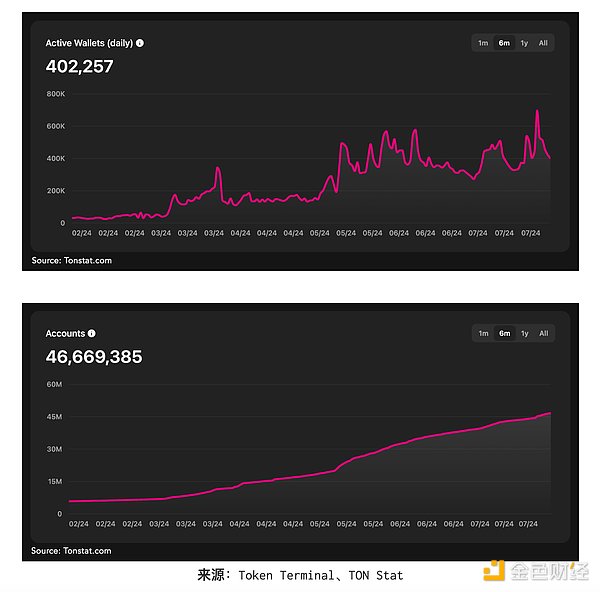

The explosion of on-chain metrics

The growth metrics of the TON ecosystem are impressive. In just six months, the number of daily active users on the chain has grown from 200,000 to 400,000, while the number of wallets has surged from less than 10 million to more than 46 million.

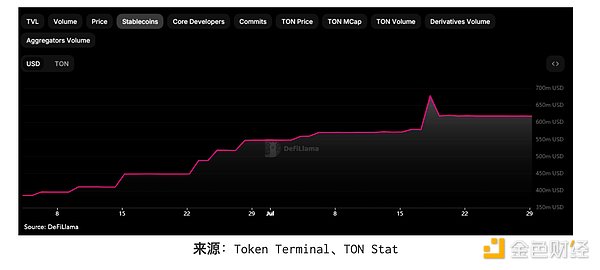

The growth of stablecoins

For any blockchain ecosystem to thrive, stablecoins have become essential to enable mature use cases such as fund transfers, DEX swaps, and Perp trading, so we view the integration and growth of stablecoins as a key indicator of ecosystem growth. Notably, in April 2024, Tether announced direct integration with TON to enable native minting and redemption. This allows for deeper DEX liquidity and the introduction of more capital. In just 3 months, stablecoin liquidity grew to over 600 million USDT.

Funding from leading funds and exchanges

Over the past two years, TON has attracted a lot of investment from both Eastern and Western tier-one funds. Notable investments include:

$6 million in funding from Runa Capital (European venture capital firm)

$10 million from DWF

$8 million from Mirana Ventures

Pantera recently announced its largest investment in TON ever

Additionally, TON received undisclosed amounts from major players such as KuCoin, Animoca, MEXC, Mask Network, CoinFund, Kenetic Capital, and Hypersphere. According to unconfirmed sources, the terms typically involve a 50% discount to the market price and a vesting period of one to four years.

Growth of the developer ecosystem and popularity of leading ecosystem projects

In the past twelve months, the number of developers in the TON ecosystem has grown from 100 to 300, with significant contributions from the Chinese and Russian communities. A unique integration with the Telegram app allows the creation of small applications called Telegram applets, which are cross-platform and sync across all devices running the Telegram app. This integration facilitates easy interaction with the TON blockchain directly within the app.

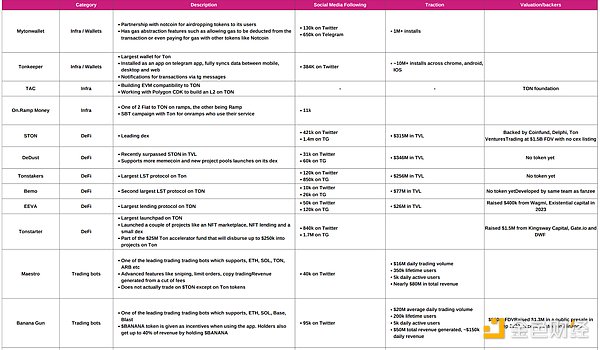

Some of the leading ecosystem projects include:

Telegram-based “click to earn money” game NOTcoin is listed on Binance, with FDV reaching an all-time high of $2.4 billion.

Banana Gun, the leading Telegram bot, was also listed on Binance shortly afterwards.

Telegram mini-game CATIZEN has received investment from Binance Labs.

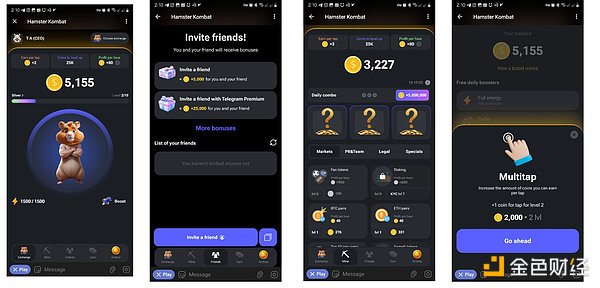

Another popular Telegram mini-game “Hamster Kombat” has recently been listed on OKEX.

Toncoin (TON) has also been listed on Binance since August 9. This listing will likely increase TON trading volume and provide better accessibility for those who want to hold TON.

The following is a non-exhaustive scan of the leading ecosystem projects being developed in the TON ecosystem, covering mini-games, trading bots, on-ramp/off-ramp infrastructure, and wallets and EVM layer 2.

General observations on why Miniapps are popular on TON

The most popular games like NOTcoin, CATIZEN, and Hamster Kombat are simple clicker games with strong financialization mechanics for easy adoption

Trading bots are a popular use case that found PMF during the meme trading craze

TON incentivizes the ecosystem through the TON Open League rewards program. Open League funds are distributed through performance-based competitions, a simple token mining mechanism, airdrops and tasks, and liquidity pool enhancements.

Notcoin is the first ecosystem coin to be widely integrated into the TON ecosystem, providing a launching pad for other projects to acquire customers.

Screenshots by CATIZEN

Screenshot from Hamster Kombat

Potential risks

Concentration Risk

$TON supply is quite concentrated as the top 100 wallets hold over 93% of the supply.

We can take some comfort in the fact that among the notable large wallets, the top 1 wallet address EQDtFpEwcFAEcRe5mLVh2N6C0x-_hJEM7W61_JLnSF74p4q2 holds 25% of the total supply and is the TON Believers Fund, a community-driven initiative to pool rewards and deposits and distribute them after a 2-year lockup period over 3 years starting October 12, 2025; the TON Believer Fund allows any TON holder to lock up their tokens for five years until October 2023. As of this writing, 1.3 billion Toncoin (over 20% of the total supply) are locked in this contract. The top 2 wallet addresses Ef8zMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzMzM0vF hold 13% of the supply and are responsible for validator selection and reward distribution. The smart contract is called the electoral contract. The TON Foundation has also deactivated about 1.1 billion TONs held by large early miner wallets. Telegram CEO Pavel Durov said in a post in his TG group that Telegram will limit its supply to 10% and will sell excess reserves to investors with a 1-4 year lock-up and vesting plan.

Platform Risk

Reliance on the Telegram platform carries significant risks. Any changes in Telegram’s policies or user base could directly impact the TON ecosystem.

Regulatory risks

Regulatory uncertainty surrounding cryptocurrencies and blockchain technology could affect the development and adoption of TON. This includes potential crackdowns or strict regulation by governments around the world.

Technical risks

While innovative, the technical architecture of the TON network also carries certain risks: the use of a custom programming language FunC and the TON Virtual Machine (TVM) could be a barrier to developer adoption compared to more widely used languages such as Solidity (EVM) or Rust.

Overall UX/UI needs improvement

We are confident that there is ample room for TON ecosystem applications to improve the overall UX/UI experience. Our research analysts have tried various applications and reported several issues:

Experience a long transaction confirmation time (about 10-30 seconds).

Sometimes connecting to dApps can be difficult.

It seems that quite a few games and dApps have issues with latency and low quality.

There are a lot of scam apps and links on social media and Telegram app.

Certain ads in the wallet can drain the wallet through spam transactions.

in conclusion

The TON blockchain, while still in its early stages, holds great promise. Its integration with Telegram’s 900 million users provides a unique opportunity for mass adoption. Rapid growth in on-chain metrics, strong support from major funds, and the success of various ecosystem projects highlight its potential.

However, challenges remain. TON must address concentration risks, platform dependency, regulatory uncertainty, and technical barriers. Improvements in user experience and interfaces are also necessary for wider adoption.

Despite these challenges, TON has been able to leverage Telegram’s extensive user base as a strong onboarding and user acquisition channel.