Written by: Mary Liu, BitpushNews

Crypto markets struggled to gain momentum on Monday as U.S. stocks moved higher as traders awaited Federal Reserve minutes and Powell’s speech at the annual Jackson Hole summit on Friday, where he is expected to provide clues on the extent of rate cuts.

According to Bitpush data, BTC hit a low of $57,818 in early trading on Monday, and then rebounded to above $59,000. Bulls are still struggling to overcome the resistance level of $60,000. As of press time, BTC is trading at $59,127, down 0.6% in 24 hours.

The Altcoin market was mixed, with most tokens following Bitcoin’s decline.

Among the top 200 tokens by market capitalization, Sui (SUI) led the gains, up 7.2%, followed by Wormhole (W) up 6.3%, and Aave (AAVE) up 6.1%. Popcat (POPCAT) led the decline, down 8.3%, Gravity (G) down 6.3%, and SATS (1000SATS) down 6%.

The current overall market value of cryptocurrencies is $2.09 trillion, with Bitcoin accounting for 55.8% of the market share.

At the close of the day, the S&P 500, Dow Jones and Nasdaq all rose, up 0.97%, 0.58% and 1.39% respectively.

Data from the Chicago Mercantile Exchange's (CME) FedWatch tool showed that traders currently see a 78% chance of a 0.25% rate cut at the Fed's September meeting, a 59% chance of a 50 basis point cut in November and a 42% chance of a 75 basis point cut in December. Ahead of Powell's speech, traders will closely analyze the minutes of the Fed's most recent meeting, which will be released on Wednesday.

Market sentiment is "sensitive and fragile"

"The global economy is in a delicate balance, vacillating between signs of recession and signs of economic recovery. This uncertainty has led to what many call a 'soft landing.' The Fear and Greed Index, a key measure of market sentiment, has been oscillating between fear and greed on a weekly basis, highlighting the fragile state of the market," Hyblock Capital analysts said in a report.

“In this environment, markets have become increasingly sensitive to any news, whether it’s a minor economic indicator or a change in the political situation,” they noted. “This heightened sensitivity has led to significant volatility, with even small changes in data such as retail sales or housing figures, or shifts in political outcomes such as Trump’s possible reelection, causing large market reactions.”

"An example is the recent overreaction to the yen carry trade situation, where most market participants suddenly expected an emergency rate cut," they said.

In addition to the macroeconomic environment, Bitcoin’s own indicators also show unfavorable factors. For example, the flow of funds in spot exchange-traded funds (ETFs) indicates that institutional investors’ interest has declined. According to Farside Investors data, the funds outflow from these products in the two weeks ending August 16 were $372 million.

Volatility will continue

Analysts at Hyblock Capital warned that last week’s volatility could continue.

“Last week, market volatility was clearly compressed, with the range between the weekly high and low prices being approximately 10%. Historically, such compressions have often been followed by major breakouts. The last similar market compression resulted in a 22% and 27% wider range in the subsequent two weeks,” they said.

“Adding to the potential for heightened volatility, both the Binance Volatility Index (BVOL) and the Deribit Volatility Index (DVOL), which measure 30-day implied volatility, trended higher over the weekend — the first time this has happened in quite some time,” they highlighted.

They noted that open interest has also been climbing steadily since the beginning of last week, “which typically means increased potential liquidations and stops, further fueling the potential for volatility. A key level to watch is the $57,290 – $57,340 range, where traders could get trapped. If the price revisits this area, it could become a psychological battleground where underwater shorts exit when they reach breakeven.”

"Despite these short-term uncertainties, the overall outlook remains positive. Central banks around the world are continuing to implement accommodative policies, and there are no clear signs of a credit crisis in bond markets," the analysts concluded.

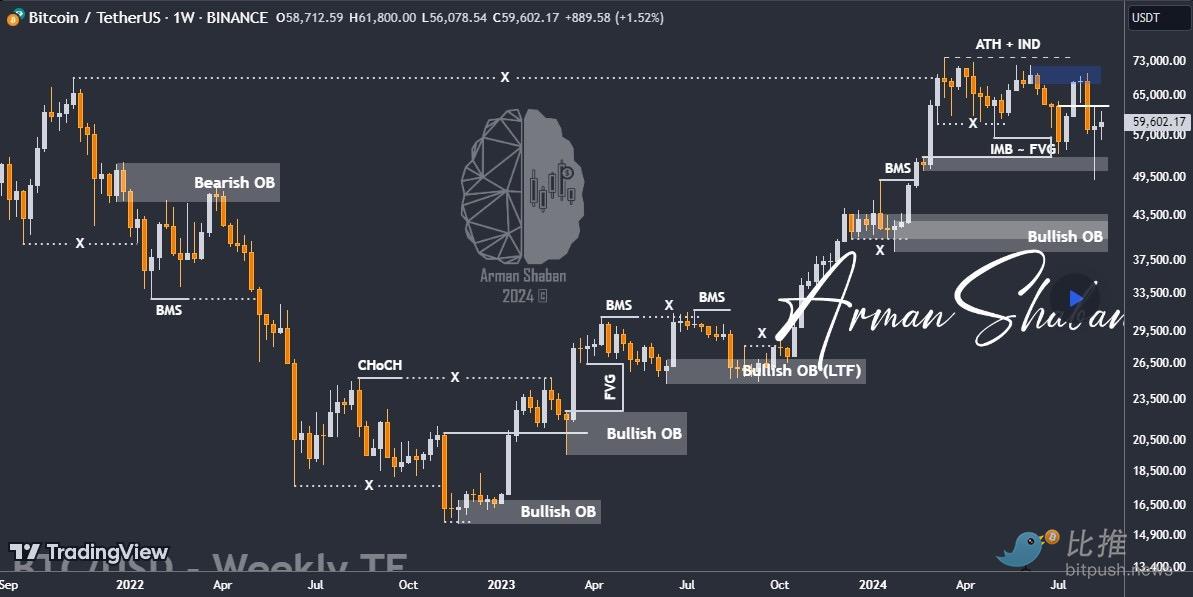

TradingView analyst Arman Shaban agrees with Hyblock Capital’s bullish view, saying that as long as Bitcoin bulls can stay above $58,700, BTC price should challenge higher resistance levels.

“By looking at the Bitcoin chart on a weekly timeframe, we can see that the price is currently around $59,500,” Shaban said.

The analyst believes: “The key level to watch is whether Bitcoin can hold $58,700, which in my opinion could soon lead to a rebound to $63,400. However, once this level is reached, we may see a short retracement. After observing this reaction, we can better assess the next potential move of Bitcoin.”

Analysts at Secure Digital Markets said: "Bitcoin remains constrained by the 20-day and 50-day moving averages, a trend that has persisted since the recent market downturn. Whenever the price approaches these resistance levels, sellers step in to push the price lower. A decisive breakout and close above $60,000 is key to signaling recovery potential. In addition, a sustained break above $63,000 could put the market back on a bullish trajectory."