With the launch of Babylon and the opening of Lorenzo staking, let’s talk about the recent development of the BTC ecosystem.

Editor's note: Today, Babylon, a Bitcoin staking protocol, has launched the first phase of the BTC staking mainnet launch, and Bitcoin holders can start locking BTC for staking. Fractal Bitcoin, a Bitcoin scalable network developed by UniSat, is also scheduled to be officially mainnet on September 1, attracting a lot of attention. The Bitcoin ecosystem has been active recently, and many users are optimistic that it may usher in another major ecological explosion in the near future. Lao Bai, a partner of ABCDE Investment Research , published his analysis of the development of the Bitcoin ecosystem on X. Mars Finance reprinted the full text as follows:

Since Ordi popularized the BTC ecosystem, BTC has actually quickly compressed the path that ETH has taken - first popularizing on-chain assets (ERC20) - then expansion solutions (Rollup) - and then Staking/Restaking. However, because there is no stabilizing force like the ETH Foundation and Vitalik Buterin to set the direction, BTC is basically in a situation where a hundred flowers bloom (luan) at once (qi) (ba) (zao).

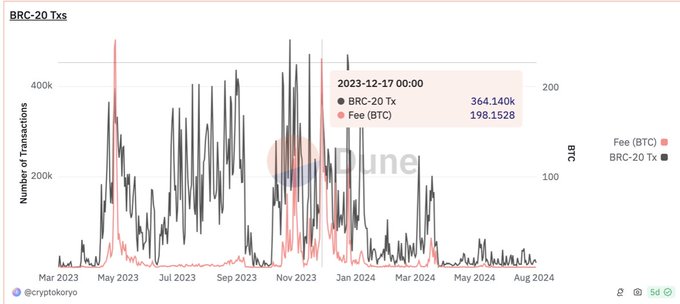

Ordinal became popular first on the asset side, and then Brc20, Arc20, Src20, Orc20 and other XX20s poured out like crazy. Many people were delighted last year that the BTC security model was likely to be solved (after another 20 to 30 years and four or five halvings, the block reward will be negligible, and there must be enough TX on the chain to pay the miners for the transaction fees). At the end of last year, when Inscription was frantically issuing new shares, the transaction fees did exceed the block reward. You can see from this chart that the transaction fees were as high as 300 BTC a day.

Let’s look at August… the daily transaction fee income was only a few BTC. Rune was popular for a short time in April and May, and then it died down.

After ETH’s ICO in 2017, the next expansion plan was represented by Merlin, which first used ETH’s EVM ready-made technology stack + a multi-signature side chain to run (Polygon - then called Matic did the same thing).

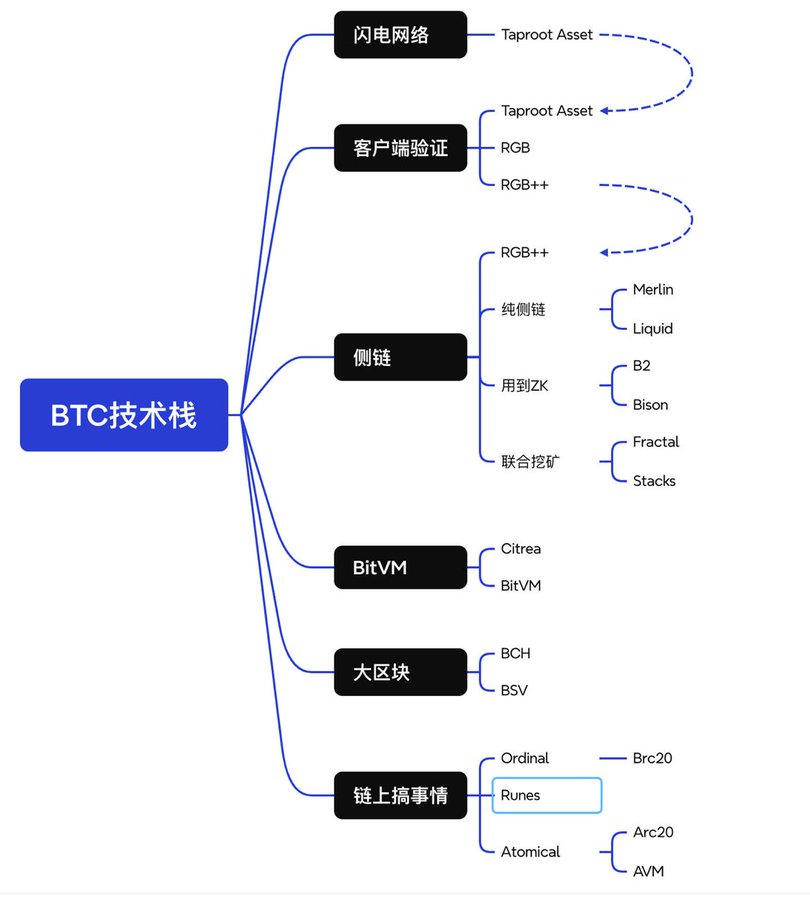

Then, as for the expansion plan, compared with the official Rollup on ETH, BTC has much more. I drew a simple diagram, which is basically like this (on-chain assets are also included as a technical branch).

Currently, Taproot Asset can only be used for transfers. The most BTC Native (that is, starting from the UTXO feature) are definitely RGB (will the mainnet be delayed in September?), RGB++ & UTXO Stack, and Unisat's Fractal (which has been very popular recently).

There is actually one route missing in the diagram, which is the 1.5-layer contract virtual machine extension. The representative is undoubtedly Arch Network. The recently discussed OP_NET is also one of them, but Arch uses ZKVM and OP_NET uses WASM.

As the technology stack of the expansion plan is too complicated, even more complicated than the assets, it is hard to say who will come out on top in the end. We can only say that each has its own advantages and disadvantages, and we will leave it to time and the market. It is not impossible to say that all of them will be falsified in the end. After all, the current main narrative of BTC as "electronic gold" does not actually require expansion. Expansion is more for the service of "on-chain assets". If the on-chain asset route does not take off, expansion will naturally lose its meaning.

Finally, let’s talk about the third stage (Staking/Restaking)

This route is actually more solid than the previous two routes, because it does not conflict with the electronic gold narrative at all, and is even a perfect complement - releasing the liquidity of gold and turning gold into an interest-bearing asset!

The most important project at this stage is undoubtedly Babylon , because BTC does not have the natural POS Yield like ETH. Under the premise of Lido, EigenLayer's Restaking narrative is more like a booster or icing on the cake for ETH itself. Babylon is a timely help for BTC. By restoring BTC through Trustless and generating Yield, BTC is no longer an interest-free asset "gold".

Two other projects worth mentioning in this area are Solv and DLC.Link. The former provides BTC with interest + SolvBTC liquidity through Cefi+Defi (one of the entrances to Babylon), while the latter uses DLC technology to mint dlcBTC in the context of WBTC’s current trust crisis. It “Trustless Bridges” BTC to ETH, Solana and other chains to participate in the Defi ecosystem. For ease of understanding, you can simply think of it as a decentralized and secure version of WBTC.

Let's get back to the topic, back to Babylon and Lorenzo. Babylon is undoubtedly targeting the ecological niche of EigenLayer, so there will naturally be an asset entrance, that is, the ecological niche of LST/LRT is also extremely important. EigenLayer has Etherfi, Renzo, Puffer, etc., and Babylon also has Solv, Lombard, Lorenzo competing for the entrance.

The differentiation among each company is greater than that of several leading LRT projects on Eigen. For example, in addition to Babylon, Solv also has income on Cefi, Defi, and cooperation income with various BTC/ETH-related projects and the second layer with Ethena, Merlin, Arb, etc.

Lombard has advantages in capital and circle resources . At the same time, the LBTC it issued is also the most secure one. The CubeSigner (a professional non-custodial key management platform) + Consortium (a consortium chain node network composed of industry leader nodes) used is the most balanced solution I have seen so far in terms of security and flexibility.

Lorenzo directly integrates Pendle's principal and interest separation function into it, with the liquidity staking token stBTC for the BTC principal part (the same for each staking project), and the liquidity staking token YAT for the interest part (different for each staking project). Lorenzo is also the only project on the market that provides users with YAT and points dual incentive system LST. The current total limit is 250BTC (to ensure user benefits), and there is still a capacity of about dozens of BTC. It is expected to be full soon, and it is on a first-come, first-served basis.

Finally, compared with the two directions of issuing assets and expanding the capacity on the BTC chain, the interest generation/liquidity release of BTC is a more visible and tangible direction, which can be seen from Binance's layout in this direction, especially the asset entry. Among the projects mentioned above, Renzo, Puffer, Babylon, Solv, and Lorenzo Binance have all invested. So you know, this track needs to be taken seriously!