The Real World Asset (RWA) theme has been somewhat overshadowed this quarter, with interest and Capital flows into RWA projects in general dropping sharply. Ondo (ONDO) has also fallen 65% since its June ATH. With expectations of the Fed starting to cut interest rates, how will projects like ONDO fare?

Here are BeInCrypto's reviews and notes on the opinions on this matter.

Also Read: BlackRock's $10 million purchase of ONDO raises hopes of a return to $1

RWA projects like ONDO will be affected by the FED's rate cut.

Arguably, the most prominent application of RWA to date is the Tokenize of US Treasury bonds. And with the Fed maintaining high interest rates, companies with exposure to US bonds have seen significant profits. Tether is a prime example.

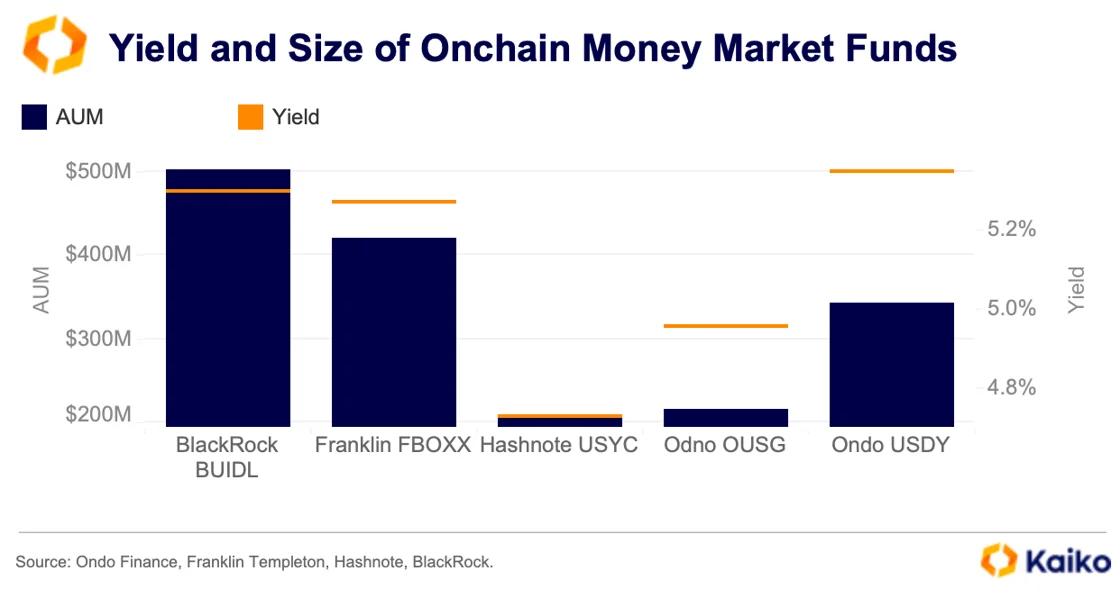

Most RWA projects in the Crypto market today are also tied to short-term US debt instruments. From Blackrock’s BUIDL to Franklin Templeton’s FBOXX, Ondo Finance’s OUSG and USDY, and Hashnote’s USYC, all offer yields that match the Fed’s interest rates.

Total assets under management and yields of US bond Tokenize projects. Source: Kaiko.

Total assets under management and yields of US bond Tokenize projects. Source: Kaiko.Therefore, the Fed's interest rate cut will have a significant impact on these projects. Especially when the minutes of the July FOMC meeting showed that FED officials are signaling that they will start cutting interest rates in September. CME FedWatch said there is a 69.5% chance of a 25 basis point interest rate cut next month. Regarding the impact on ONDO, there are many conflicting opinions as follows:

- The Kaiko chart above shows that Ondo is currently the project with the largest yield with an AUM of about 350 million USD. The yield that Ondo provides is up to more than 5% (Annual Percentage Yield). ONDO cannot maintain a higher yield than the FED, so Ondo can adjust the Yield to suit the macro changes. Psychologically, investors receiving lower yields is not a positive thing. So the Capital flow into Ondo will decrease.

- However, Ondo project insider Ian De Bode – Ondo’s chief strategy officer – argues the opposite. He says, “As investors become more sophisticated, they realize that Tokenize Treasury bonds outperform stablecoins, providing benefits that stablecoins do not.” Or Timo Lehes – co-founder of Swarm Markets – Chia : “Regardless of whether the Fed cuts rates or not, we expect Tokenize Treasury bonds to continue to grow, as any yield is better than nothing.”

Thus, insiders believe in US bond Token , while common logic is concerned that RWA Capital flows will be affected when the FED cuts interest rates.

Determine ONDO price range for positive and negative scenarios

From now until September, new news may continue to influence and change expectations for a Fed rate hike, not to mention other unexpected news from the crypto market in particular. Therefore, it is necessary to determine in advance the possible volatility range to plan your trading, regardless of the impact, good or bad.

ONDO 2-day technical analysis with RSI and Volume Profile.

ONDO 2-day technical analysis with RSI and Volume Profile.The ONDO technical chart shows that the most positive scenario for this quarter is for ONDO to increase to the range of $0.79 – $0.99. The negative range for the quarter is between $0.79 – $0.22. Positive technical signs are for ONDO price action to close the daily candle above $0.79 or the 2D RSI indicator to cross above the 50 Medium (as shown). Otherwise, the predicted Fed rate cut could exacerbate the decline of ONDO to its listing low.

Also Read: 10 potential Real World Asset (RWA) projects worth watching in 2024

Join the BeInCrypto Community on Telegram to learn about technical analysis , discuss cryptocurrencies, and get answers to all your questions from our experts and professional traders.