Author: anymose Source: X, @anymose96

TL;DR

A new DEX standard based on Ethereum

Innovative LP and fee mechanism

LP lock-up for 5 days, the first token will be unlocked tomorrow (may trigger selling pressure)

Dubbed as the Pumpfun of Ethereum

An Easter egg

Just 3 days after its launch, EtherVista’s main token soared from $0.12 to $16.8, with a fully diluted market capitalization (FDV) of $16.2M and a total liquidity pool amount of $2.1M.

Is this just an ordinary, short-lived, on-chain meme project? After carefully studying the white paper, it is found that the developers have made some unique attempts in the innovation dilemma of the Ethereum Virtual Machine (EVM) market. Although it is not a big innovation, it does produce good results.

Project Overview

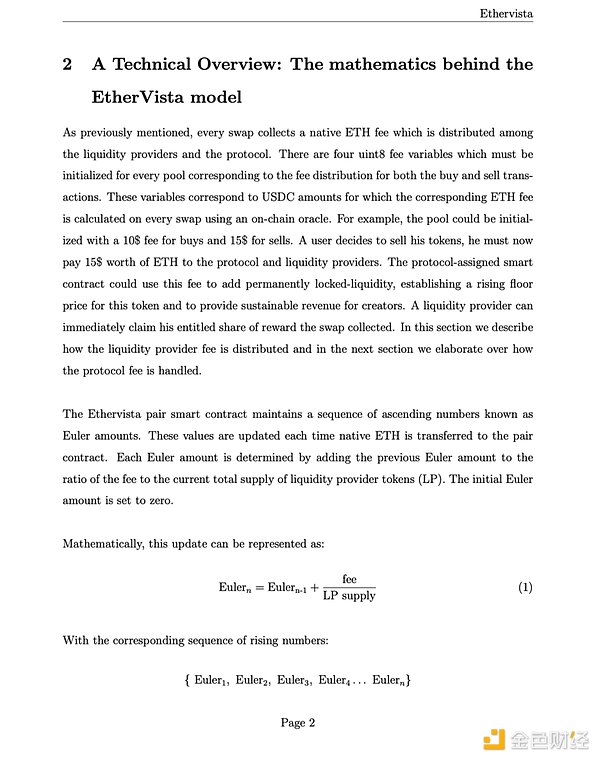

Similar to Pump, EtherVista provides a fair launch model, where 100% of the token supply will be allocated to liquidity providers (LPs) and locked for 5 days. Unlike other projects, users need to create tokens themselves, and LP destruction is not managed by the platform. EtherVista is more like a decentralized exchange (DEX), which changes the traditional model of charging by amount and adopts a fixed fee for each transaction, and the fee is rewarded to LPs and developers.

The core goal of the project is to incentivize long-term project success by rewarding liquidity providers and protocol fees.

$VISTA Token Mechanism

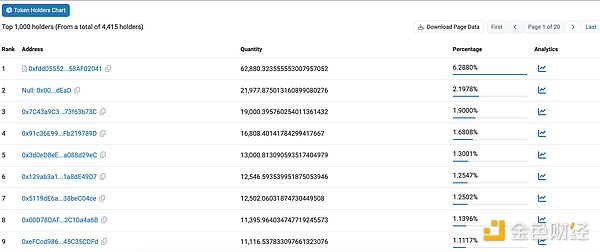

The platform token $VISTA is a deflationary token with a total of 1 million. A certain number of tokens are destroyed every day to reduce selling pressure and death spiral effects through handling fees. It is worth noting that the LP lock-up period is 5 days, and the first unlocking will be held tomorrow, which may face a greater risk of selling pressure.

Among them, the largest single coin holding address (contract) accounts for 6.2880%.

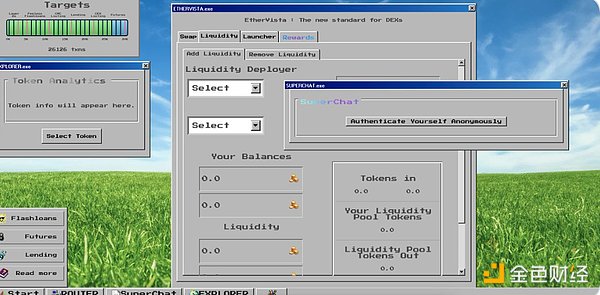

Bigger plans: Beyond DEX

DEX is only part of EtherVista's plan. There are still many unopened entrances on the website, including flash loan, futures contracts, lending and other functions. In addition, the platform has also launched Superchat, which is similar to Pumpfun. From the perspective of product architecture, EtherVista is more like a "stitched monster" that integrates multiple functions.

How to participate?

Buying coins : The easiest way is to buy platform tokens directly. In addition to the platform coin $VISTA, there are many other tokens launched here, but you need to pay special attention to trading risks. The platform is more inclined to reward project parties and LPs, and the gambling risk of short-term transactions is higher.

Issue your own tokens : Using the platform’s “launcher” function, you can plan and issue tokens yourself. This function is relatively complex, so it is recommended that you study it yourself.

Overall evaluation

Overall, EtherVista is a "stitched monster" that integrates and iterates Uniswap, Pumpfun, and various lending protocols. Although it is not a major innovation, it provides rewards for large operations through a fixed fee model, while discouraging small participants. This attempt is quite interesting and worth including in the watch list. After all, there have been few interesting new projects on Ethereum in the past six months, and EtherVista is a good exploration.

An Easter egg

It is worth mentioning that the author of the EtherVista white paper is named Vitalik Nakamoto , which adds a bit of mystery to the project.