What is Lorenzo

Bitcoin Liquidity Finance Layer.

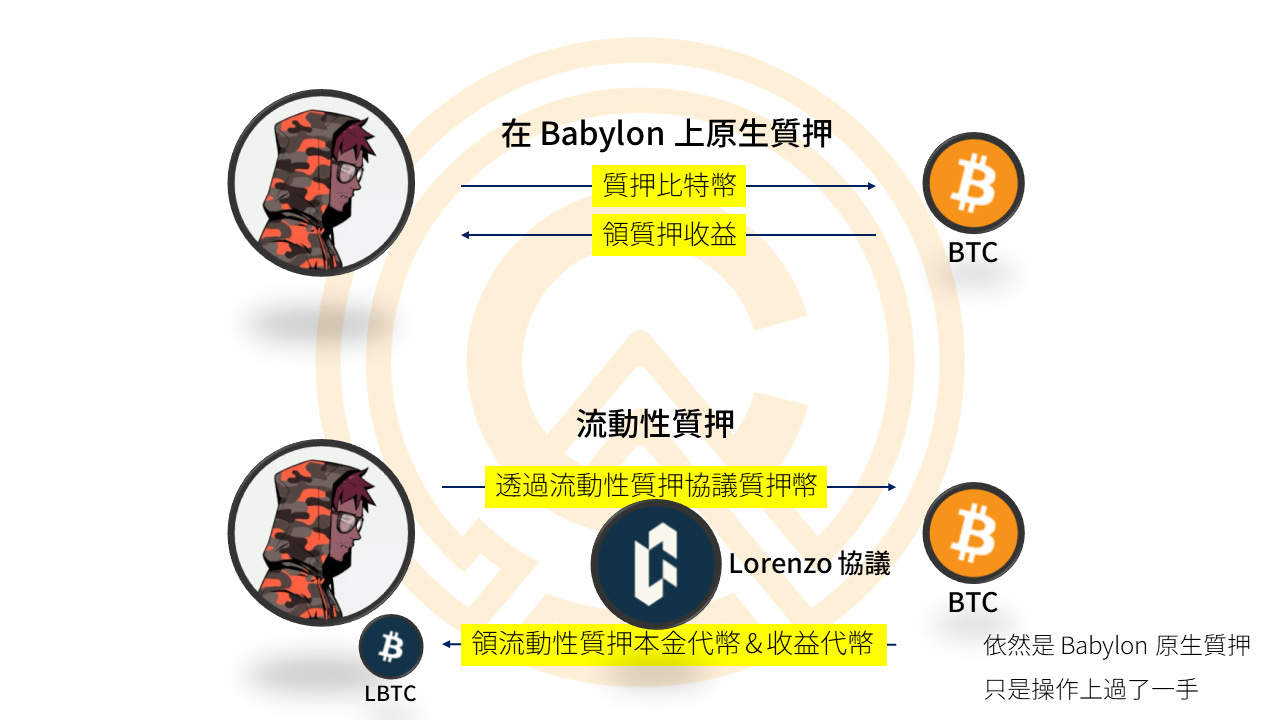

It is a chain, not considered layer 2 of Bitcoin. It mainly handles the issuance, transaction, settlement, etc. of Bitcoin’s liquidity pledge tokens. Lorenzo can be understood as Bitcoin’s liquid staking protocol, which is highly similar to the Bitcoin pledge agreement Babylon. Relatedly, Babylon handles the pledge, and Lorenzo converts this pledge into liquid pledge principal and income tokens, and handles principal redemption and income distribution, etc.

stBTC is a Bitcoin Liquid Principal Token (LPT) issued by Lorenzo.

Lorenzo is not just an on-chain protocol, it has its own blockchain, using the Cosmos application chain built by Cosmos Ethermint. It interacts with the Bitcoin blockchain through a relay and is responsible for processing the issuance of liquid pledged tokens (stBTC). Trading and Settlement.

To understand Lorenzo more completely, you not only need to understand Bitcoin's native staking protocol Babylon, but also have a basic understanding of mechanisms such as Liquid Staking Protocol(LSD) and restaking.

Bitcoin’s native staking protocol Babylon

Bitcoin is natively pledged on the Bitcoin chain, and pledged assets can be used to provide security on other POS chains.Liquidity pledge <br>Pledge locks the currency on the chain. Once locked, it cannot do other things and loses liquidity; the liquid staking protocol provides corresponding voucher tokens based on the pledged assets. The original currency is locked on the chain, but can be withdrawn The tokens are used to participate in other operations to release liquidity, which here refers to pledging Bitcoin to obtain stBTC.

re-pledge

The mechanism proposed by Eigenlayer is based on the concept that pledged assets can be rented to other chains as security guarantees. Any token has the opportunity to become a pledged asset, and liquid pledged tokens can also be pledged "again" to become the security of the second blockchain. Guarantee, here refers to the opportunity for stBTC to be pledged again and earn more than two kinds of pledge income at the same time.

Reference reading:

What is the popular narrative "restaking" in vernacular? What is the derived AVS?

Eigenlayer enters the next stage of growth and will help you interpret the upcoming AVS wave

Lombard|LBTC|Bitcoin Liquid Staking Protocol Raising $16 Million

Lorenzo profile

Project name | Lorenzo |

Token name | No token information has been announced yet, only Lorenzo Points are currently announced. |

Current main products | stBTC, Bitcoin liquidity staking token |

Ecology or public chain to which it belongs | It is a chain built using Cosmos and belongs to the Bitcoin ecosystem. Its application scope is liquidity staking, re-staking, DeFi, etc. |

team member |

|

Financing history | Binance Labs participated in the investment, the amount of financing was not disclosed |

Official link | Official website https://www.lorenzo-protocol.xyz/ Official Twitter https://x.com/LorenzoProtocol |

Introduction to Lorenzo

Lorenzo, established in 2022, with Binance Labs as its main investor, is the first Bitcoin liquidity financial layer. It also has the characteristics of Lido, Eigenlayer, and Pendle protocols. Simply put, it is based on Babylon's Bitcoin pledge, and then It combines liquidity staking, re-pledge, principal and income token split, etc., connects more DeFi applications, releases the liquidity of Bitcoin, and creates more income opportunities.

The Lorenzo chain is a Cosmos application chain built using Cosmos Ethermint, a Cosmos toolkit used to build EVM-compatible chains.

The concept of separation of principal and income is somewhat similar to the Pendle protocol:

Riding on the LSD liquidity staking craze, why did Pendle Finance, which surged 10 times in the bear market, become popular?

What is stBTC - Bitcoin pledged principal token LPT

When you pledge Bitcoin at Lorenzo, you will get stBTC in equal proportion (1:1). This is the certificate for the principal amount of Bitcoin pledged at Lorenzo, and it is the proof of the right to claim back the pledged assets in the future (Liquid Principal Token, referred to as LPT).

Lorenzo separates the "principal" and "revenue" of Bitcoin pledge. stBTC is the principal token, which is minted at 1:1 with the pledged Bitcoin. StBTC can also be destroyed to redeem Bitcoin.

The concept is as shown above. The main difference from traditional staking is that you will receive liquid staking tokens, which can be used to participate in other operations to earn additional income.

What is even more special about Lorenzo is that it splits the liquid pledge tokens into principal tokens (LPT) and income tokens (YAT), which respectively represent the right to receive principal and income after the pledge is completed.

Important: Gas on the Lorenzo chain is paid in stBTC. If the operation involves the Lorenzo chain, a little bit of stBTC will be deducted as gas. The actual stBTC received by pledging Bitcoin will not be exactly 1:1.

Q: Are stBTC and Bitcoin equivalent?

A: Not necessarily, probably not. Different from other encapsulated Bitcoins, although there is a corresponding Bitcoin behind stBTC, it represents the right to receive the principal when the Bitcoin pledge expires. In other words, it corresponds to the Bitcoin in the "pledge lock" concept. stBTC is more like a Bitcoin bond, there should be a slight discount, and the discount is equivalent to the Bitcoin interest rate recognized by the market at that time.

Q: What are the benefits of holding stBTC?

A: There will be no income in the future. stBTC is the principal token, and the right to receive income lies in the income token. It has not been divided yet. Holding stBTC can mainly earn Lorenzo Points & Babylon staking income.

Q: What are the uses of stBTC?

A: Just like ordinary tokens, it can be traded, liquidly mined, participated in lending agreements to earn interest, pledged again, etc. StBTC can be destroyed to redeem Bitcoins from Lorenzo.

Bitcoin Staking Yield Token (YAT)

Each different Bitcoin pledge project consists of different pledge objects and periods. For example, if the currency is entrusted to Dongdong for pledge, the period is three months. In this way, the total pledge reward can be calculated. The total rewards of different pledge projects will be different. .

Then Lorenzo separates the pledged principal and income:

The Liquid Principal Token (LPT for short) is the proof of the right to receive the principal upon maturity. The LPT of different projects may be different. stBTC is Lorenzo’s official LPT.

Yield Accruing Tokens (YAT for short) are proof of rights to receive pledge income. The income of different projects is different, and the YAT is also different.

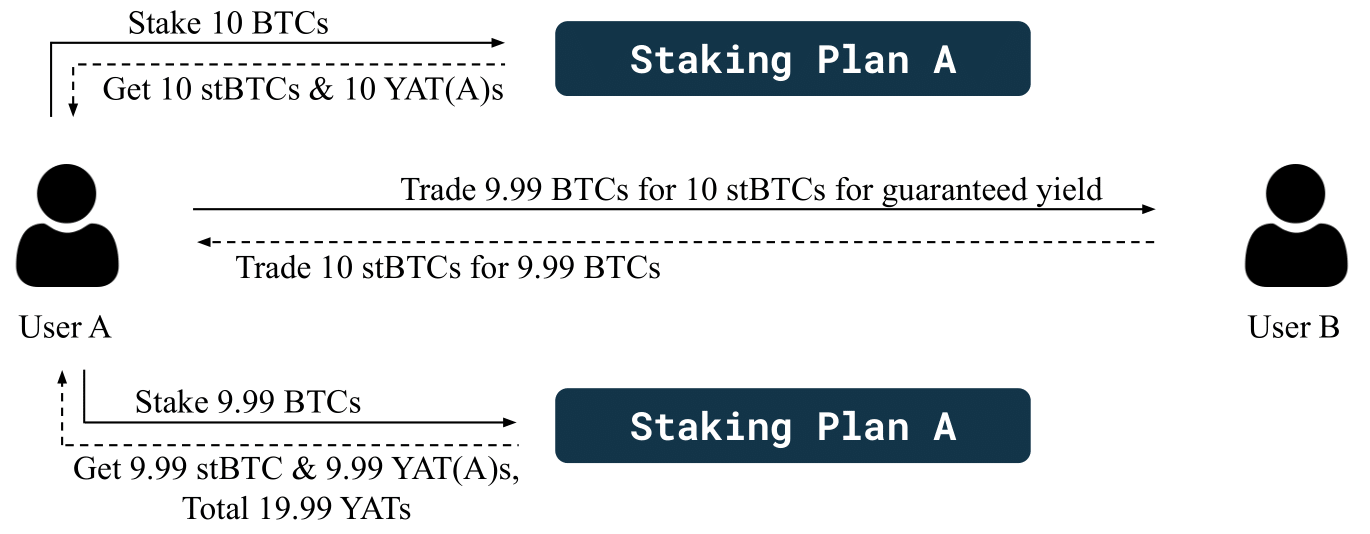

Both principal tokens and income tokens can be traded, and more complex financial segmentation designs also bring more income opportunities, such as leverage pledge:

>Stake Bitcoin to get stBTC + YAT

>>Sell stBTC to get BTC (there will be a slight discount, and you will get less and less BTC with each operation)

>>>Pledge BTC to get stBTC + YAT

>>>>Continue to operate to get more YAT, and participate in multiple pledge projects at the same time to get a variety of YAT

Each pledge plan has a term and different rewards. YATs of the same pledge plan are homogeneous to each other, while YATs of different pledge plans are different and irreplaceable. For example, YAT for Dongdong Plan/YAT for Xixi Plan, although both It is tradable but different YATs will have different market prices.

Before the staking plan expires, YAT can be freely traded; after the staking plan expires, YAT stops trading, and you can receive staking plan rewards based on the amount of YAT held.

Q: What benefits can you get from holding the income token YAT?

A: Different staking plans give different rewards, which are determined according to different staking plans.

Q: What are the uses of the income token YAT?

A: Before the staking plan expires, like ordinary tokens, it can be traded and participated in the DeFi protocol; after the staking plan expires, you can receive the staking plan rewards from Lorenzo.

Q: Why is it so complicated?

A: To maximize liquidity, imagine that you pledge a batch of coins for one year and expect a 20% return. Now you have a temporary need for funds. You can sell the principal tokens first, but retain the income tokens, and take the pledged principal first. You can use it (there will be some discount according to the market price), but you can still receive 20% return at maturity. It is difficult to do such an operation without dividing the principal income.

Lorenzo technical architecture

source: official document

Lorenzo's entire architecture consists of three main parts:

Cosmos application chain built using Cosmos Ethermint

A relay used to interact with the Bitcoin blockchain

A smart contract that handles the issuance, trading and settlement of liquid pledged tokens

To avoid the risk of centralization, Lorenzo cooperates with Staking Agent, an organization composed of relevant ecological giants. Staking Agent and multi-signature keys handle staking and delegation.

Staking Agent can create staking plans, and Lorenzo's long-term role is to monitor and manage Staking Agents and running staking plans.

Briefly describe the pledge process:

After initiating the staking request, the Staking Agent generates the corresponding address

The user deposits Bitcoin to this address

The Staking Agent completes the pledge of Bitcoin, and after the inter-chain interaction is confirmed, Lorenzo generates principal and revenue tokens on the user's EVM address.

When the pledge expires, the tokens and Lorenzo can be destroyed to receive the principal and pledge income.

Lorenzo is not only a liquid staking protocol, but also a liquidity re-hypothecation protocol

Currently, only Bitcoin pledges are accepted in the first phase, and the current phase is a liquid staking protocol. The next phase of the staking plan will accept more Bitcoin assets (including BTC, wBTC, BTCB, FBTC and stBTC). More other Bitcoin liquidity staking tokens may also be included, and the pledged Bitcoins can be accepted again. Pledge, then Lorenzo will be considered to have re-pledged the agreement.

Lorenzo Partner

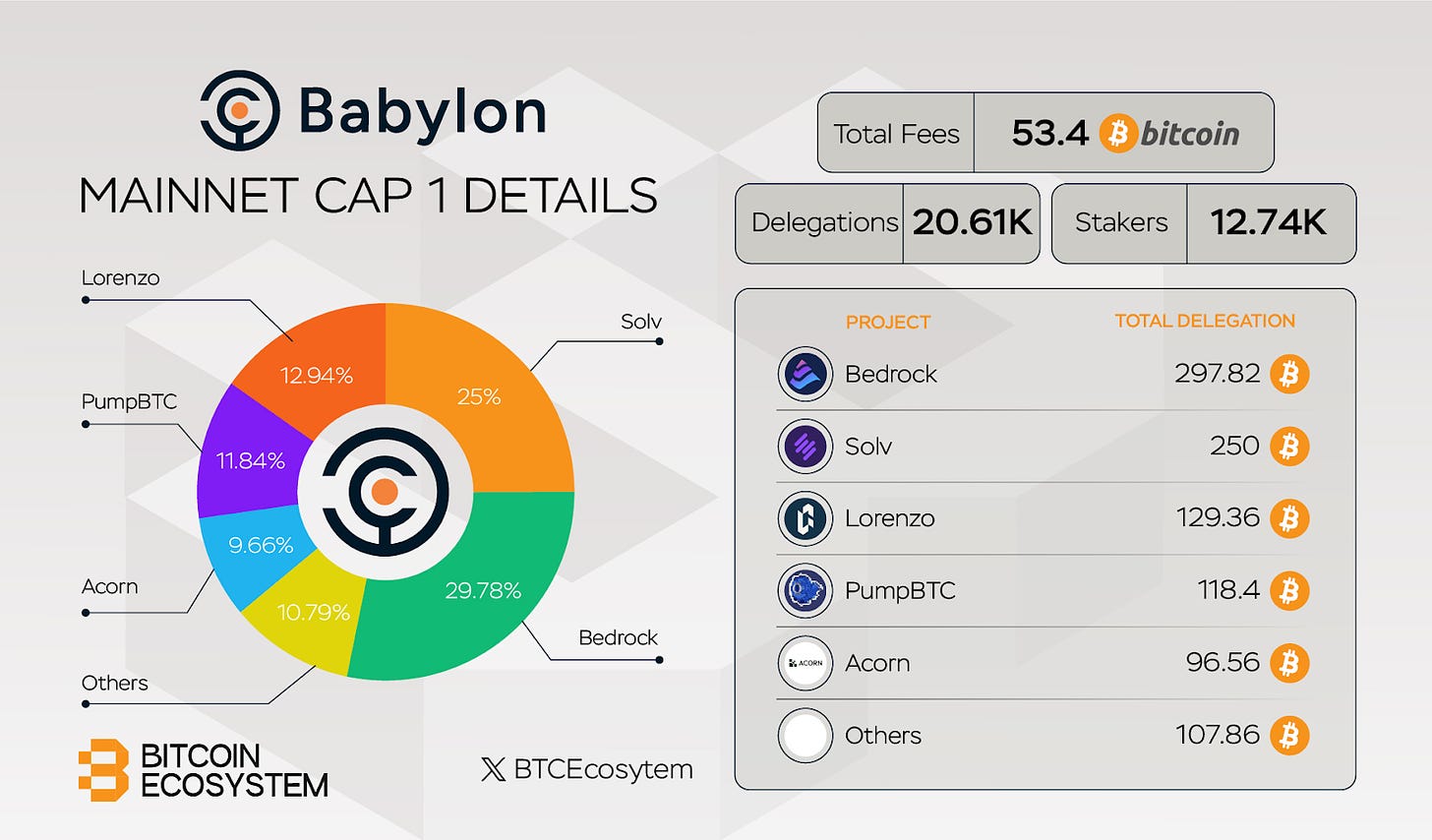

The most important partner is Babylon. According to information compiled by Bitcoin Ecosystem , of the 1,000 Bitcoin quota that was snatched away in just 6 blocks in the first phase of Babylon, Lorenzo grabbed 129.36, ranking third.

No. 1 Bedrock:

Restaking

The second largest Solv:

Multi-chain protocol Solv Protocol detonates the BTCfi ecosystem|Project introduction|Income opportunities

In addition, many project cooperation news have been announced in recent months. Most of the cooperation is to expand the application scenarios of stBTC. The cooperation projects include Scroll, Master Protocol, Fractle Finance, Enzo Finance, Satoshi Protocol, Macaro, Bitlayer, and BounceBit wait.

Lorenzo’s Tutorial on Staking Bitcoin – Obtaining Points for Ambush Airdrops

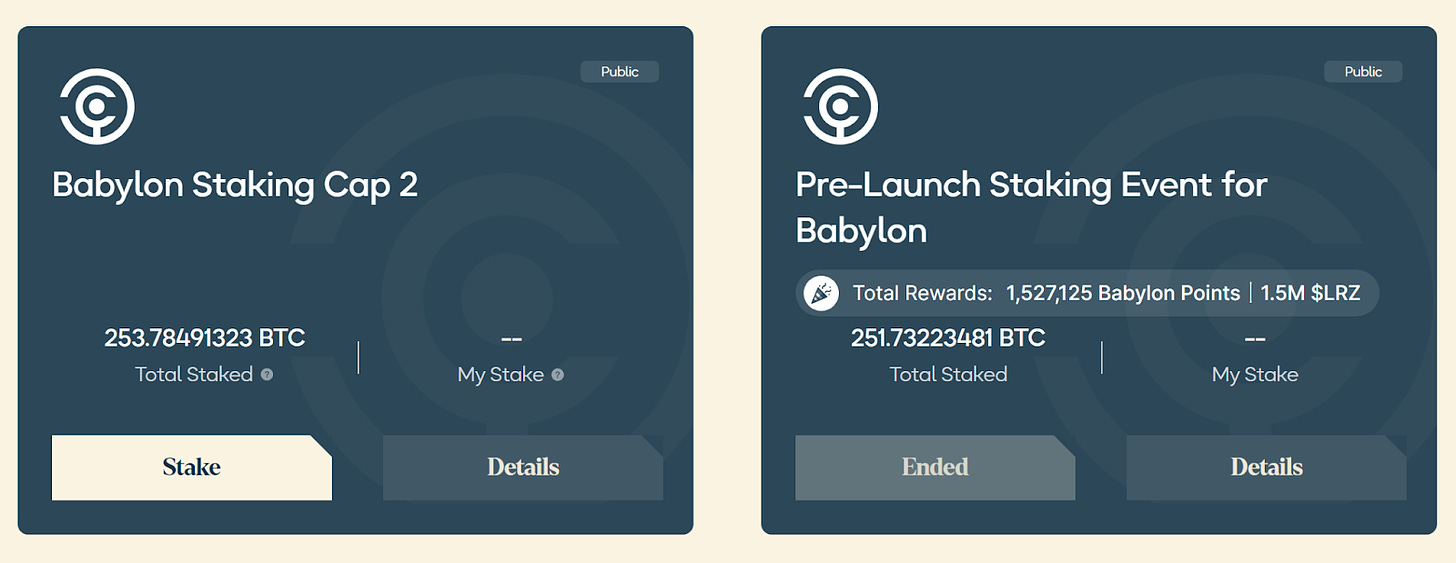

The Pre-Launch for Babylon on the right is the first phase of Babylon's opening of 1,000 quotas. It has now been completed. The one that can be operated now is the left side, which is for the second phase of pre-launch.

https://app.lorenzo-protocol.xyz/staking

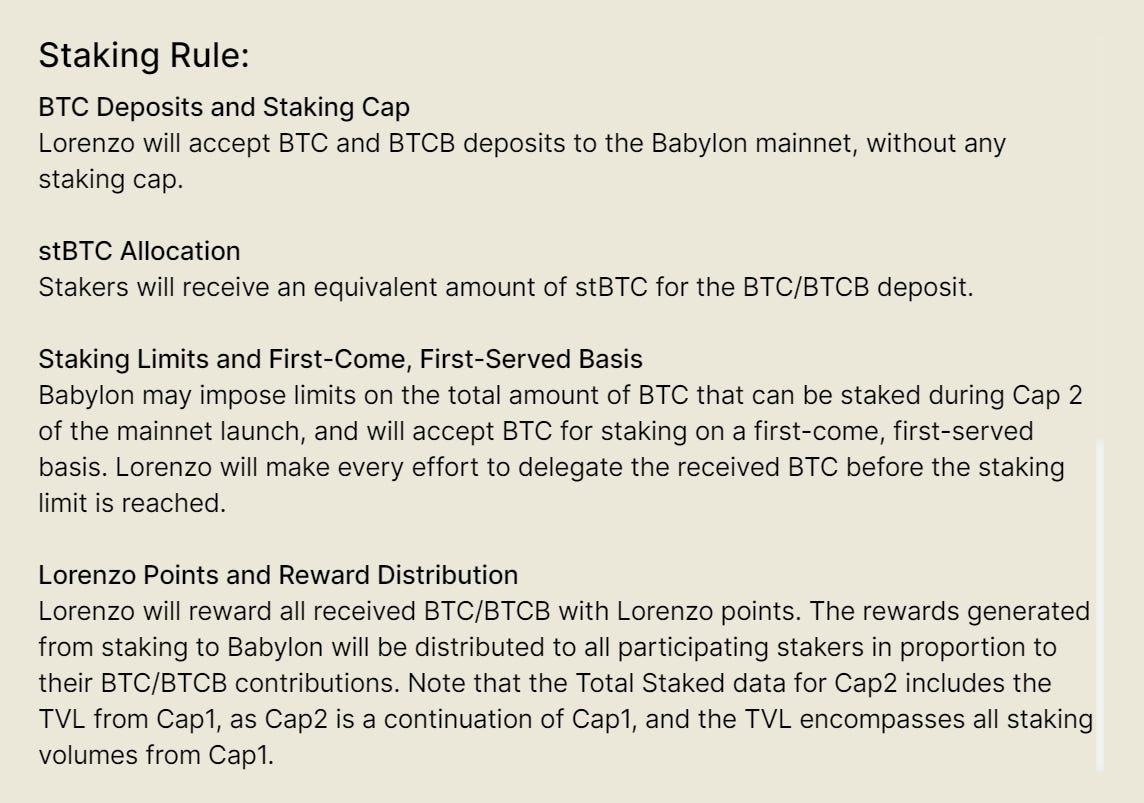

Lorenzo|Babylon Staking Cap 2 Participating Staking Rules

First explain the rules:

Lorenzo accepts BTC on the Bitcoin blockchain and BTCB on the BNB chain. There is no quota limit on Lorenzo's side, and all pledgers will receive the corresponding stBTC tokens.

This is to get a head start on the next phase of quota that may be released by Babylon. Lorenzo will do its best to entrust the coins to Babylon to allocate the quota.

All coins pledged on Lorenzo will receive Lorenzo points. As for the distribution of staking rewards issued by Babylon, they will be distributed according to the ratio of the final amount grabbed and the participant's contribution.

Lorenzo|Babylon Staking Cap 2 Participate in Staking Tutorial

Press Stake and jump to the operation page:

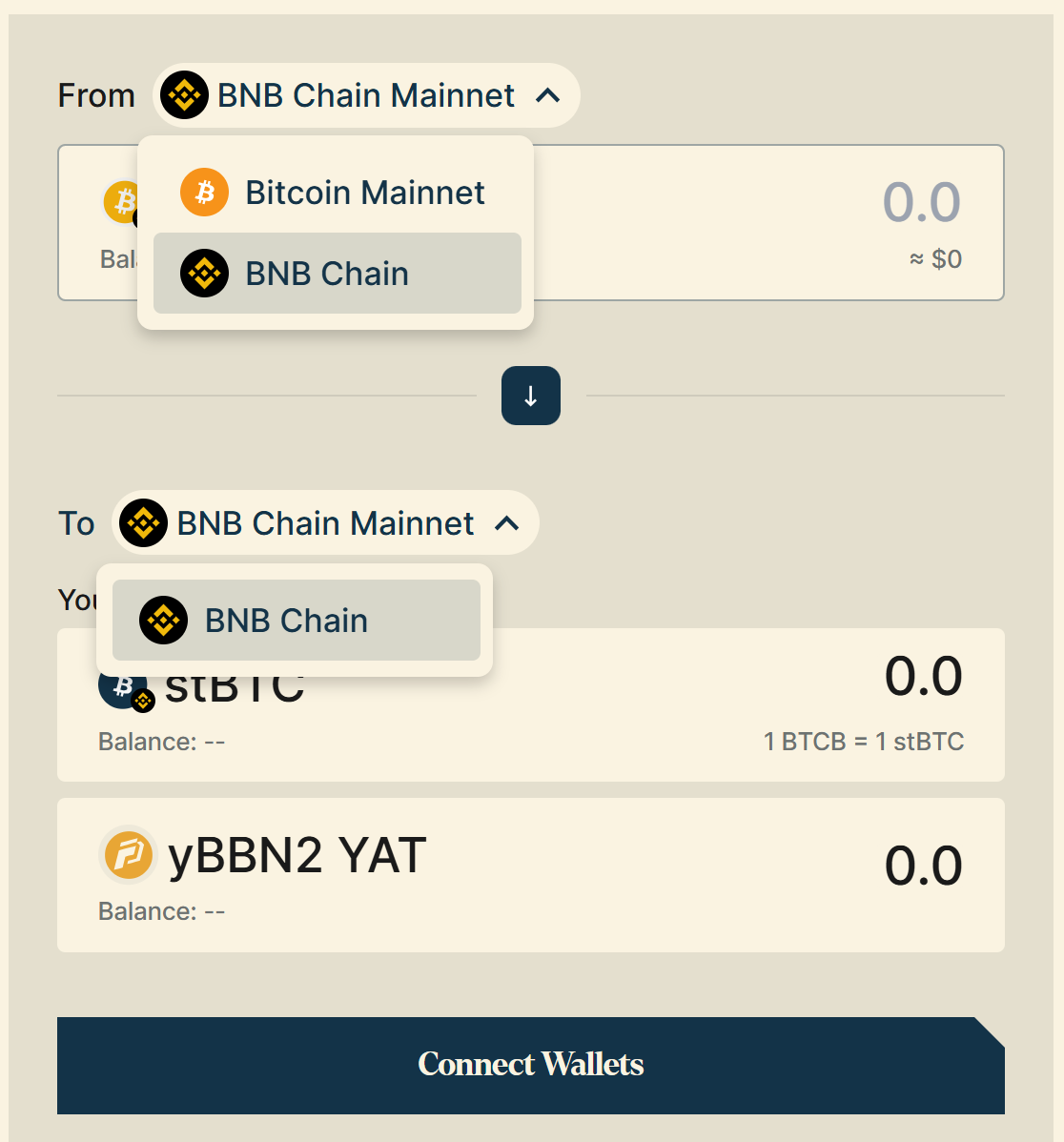

There are two pledge source chains:

Native BTC on the Bitcoin chain

BNB chain BTCB

The chain for receiving liquid pledged tokens is the BNB chain, and stBTC will be obtained in equal proportions according to the amount pledged. Currently, Lorenzo has just launched the first phase of the mainnet and has launched the YAT income token function.

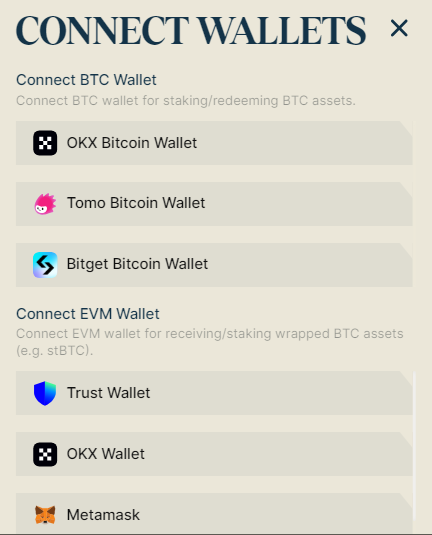

Before you start staking, you need to connect your wallet (Connect Wallets). Currently, these wallets are supported:

I am currently testing this article. Even if I use the BNB chain, I still need to connect two wallets (BTC and EVM) to operate. If you don’t have a Bitcoin wallet yet, please install it first.

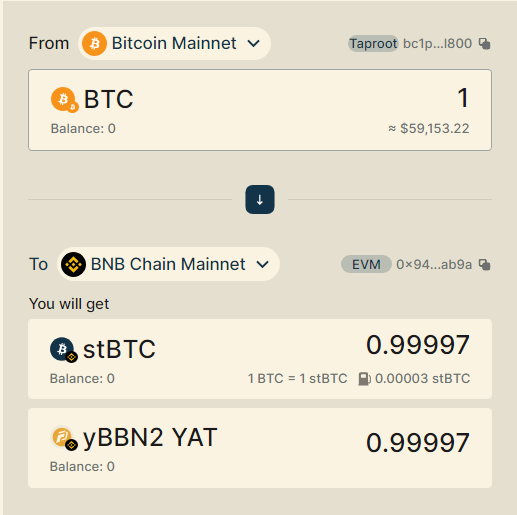

It should be noted that if you pay gas on the BNB chain with $BNB, you can receive a completely 1:1 liquidity token. However, if you pledge on the Bitcoin chain, you will go through the Lorenzo chain and pay gas with $stBTC, and the amount you receive is not Completely 1:1, as shown below:

After staking is completed, you can see the current points on the Rewards page. According to the official points article , the current points calculation is that each BTC pledged can get 1,500 points every day, and after completing the pledge, you will get a recommendation code, whether you use other people’s codes , or refer friends to use your code to get extra points.

As a reminder, Lorenzo will provide an estimated $1.5 million in airdrop rewards to early staking participants.

Lorenzo will offer an anticipated airdrop value of up to $1.5 million equivalent to users who successfully complete staking.

Summary - The rapidly developing "Bitcoin Ecosystem" and "BTCFi"

In the past, Bitcoin was unable to run smart contracts because of the rising tide. The previous bull markets such as ICO, DeFi, and NFT had nothing to do with Bitcoin. In recent years, popular ones such as Layer 2, re-staking, and modular blockchain seemed to It has nothing to do with Bitcoin either, but that’s different now.

Since the development of blockchain, although there are dozens of public chains and tens of thousands of cryptocurrencies, Bitcoin is still the most well-known cryptocurrency with the strongest value consensus. Bitcoin currently accounts for more than 50% of the market value, and most of them are idle. No application, no money efficiency. When the relevant technology develops to the point where it can also do these things on Bitcoin, you can issue NFT, pledge, re-stake, and participate in DeFi to earn income, this will release very huge potential. This can be seen from the recent hot participation in Babylon's open staking. As evidence, the 1,000 Bitcoin quota was snatched up in six blocks. Another Bitcoin liquid staking protocol, Lombard, has exceeded 200 million US dollars in TVL while still in private beta.

This bull market has reached this point and we can observe a phenomenon: Bitcoin continues to be the protagonist of the market. Maybe this phenomenon will continue, but the main word needs to be expanded a little: " Bitcoin ecology continues to be the protagonist of the market."

▌Keep up with the latest news with the Biyan community. Welcome to join the daily Biyan Chinese exchange group !

▌Subscribe to the daily Coin Research e-newsletter (1-2 articles per week to quickly understand market conditions, on-chain data and potential project developments)

Further reading

Lombard|LBTC|Bitcoin Liquid Staking Protocol Raising $16 Million