Author: JamesX Source: X, @0xJamesXXX

Why do I say Web3 is not far from Mass Adoption?

In other words, the final outcome of Web3 mass adoption is actually Web2.5.

And introduce several projects and product ideas that can truly help web3 achieve mass adoption.

The picture below is the answer given by GPT after I asked him: "What problems does web3 still face on the road to achieving mass adoption?"

To be honest, there is nothing wrong with it, and it is basically stuck on the pain points of the industry. 3 and 5 are difficult to solve by product innovation and optimization within the industry, but the other problems are constantly being optimized and solved by teams within the industry.

Moreover, I have recently discovered several very impressive projects while using it and studying other research reports and data. They have been helping the web3 industry and are getting closer to the goal of mass adoption. So I will briefly write this content to share with practitioners in all industries.

1. Why does a wallet have to be used to log into the Web3 platform?

"Connect wallet" and the user experience of one wallet and one account have always been the core advantages that web3 industry practitioners believe are superior to the web2 industry.

However, this is also the biggest obstacle that prevents most users from starting to try to use the Web3 platform, because the learning threshold and risk of obtaining initial assets on the chain and using the web3 wallet are too high.

Therefore, why don’t we use the perspective of web2.5 to allow users to use various web3 platforms and register accounts without any web3 wallets? At the same time, with the continuous optimization of AA wallet products, users can enter the web3 world within a non-wallet/centralized exchange web3 application.

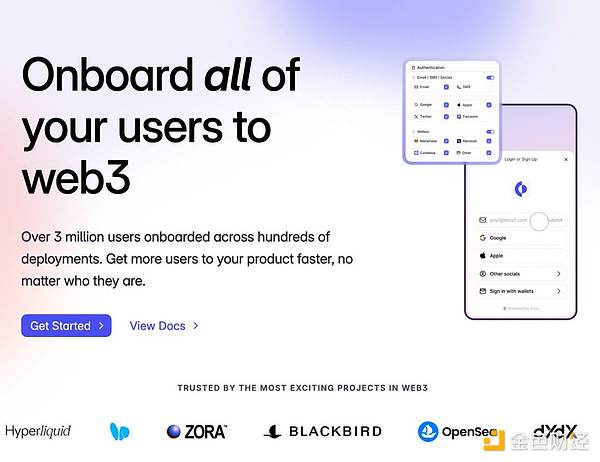

The most core product in this direction, @privy_io, supports almost all web2 and web3 account login systems and currently has more than 3 million users.

If you are a user/practitioner who likes to try the latest web3 products, you must be amazed at how popular Privy's login/account/wallet components are in web3 products in recent months, as well as how smooth the experience is.

I even found some apps that have no need for web3 asset interaction, but are using Privy's login component to attract high-net-worth web3 users who fit their user profiles. It can be seen that web2 and web3 are not two relatively isolated industries. Once the user experience of the product is smooth enough, why do we need users to have a wallet to log in to the web3 platform?

I have a bold assumption about the future. There may even be a type of DeFi platform (or on-chain financial platform) where users can complete one-click operations from traditional payment accounts (paypal, apple pay, credit cards) to obtaining on-chain assets and depositing them into on-chain protocols without a web3 wallet. (Of course, this is inseparable from the progress of the payfi narrative that we will talk about later)

2. Cross-chain interoperability/multi-chain account management — a track that will be unified in terms of user experience

Currently, the liquidity fragmentation problem of various L2s in the ETH ecosystem, as well as the Solana ecosystem, Move language ecosystem and even BTC ecosystem with different technical architectures is a core pain point that plagues the user experience of all chains.

Recently, a project @dappos, which has been talked about by many people in the Chinese-speaking area, has launched intend asset, an additional asset type that can be operated on multiple chains, allowing dappos to help the user ecosystem through asset staking. To a certain extent, it can solve the user pain points of having to pay high cross-chain costs and complicated operation steps.

But what I actually want to say is that this is essentially also a semi-centralized product model, and there is actually another role in the industry that can provide similar services, helping users obtain an "Intend asset" that can be transferred and used at any time on multiple chains through staking assets. This industry role is actually CEX.

Because: 1. The user experience of users depositing assets to Dappos for custody is not much different from the experience of depositing assets to CEX. 2. CEX exchanges, especially the leading CEXs, are actually the largest participants in cross-chain liquidity management/services. 3. CEXs have a natural desire not to bring user assets to the chain, so pledging assets to CEXs and asking them to provide you with an "intend asset" for you to use in an on-chain environment can help CEXs keep more user assets on their own platforms. 4. In the current industry context, the leading CEXs have better compliance and fund management security endorsements. (CEXs that may go bankrupt and issue p assets are not included)

However, due to the psychological shadow left by the previous collapse of FTX, whether there will be a model of providing large-scale services to users in the role of CEX in this narrative direction remains to be discussed by the industry, and everyone is welcome to leave a message below for discussion. (I have foreseen that some people will think this idea is stupid)

Let me make it clear: I am not saying that various cross-chain/ecosystem interoperability protocols & cross-chain bridges are useless. It’s just that the current experience, transaction fees and security are indeed not friendly enough. I also look forward to more chain-native, decentralized and trustless solutions in the future.

On the other hand, the current multi-chain users have another major pain point, which is the multi-ecosystem + multi-chain wallet management system. Although all mainstream wallets are constantly providing native support for new public chain ecosystem wallets, such as OKX Wallet and Phantom, they already support multi-ecosystem wallet management for one account (including but not limited to EVM, BTC, Solana ecosystem, etc.), but when users transfer or receive money, they still need to open the wallet and click on the address bar at the top to find the corresponding different address strings and then copy them.

Although there are various address abstraction services in the EVM ecosystem, such as .BNB .ARB, etc., with ENS as an example, and the Solana ecosystem also has its own .SOL service, users actually hope to use one product service to complete the multi-address management experience across ecosystems.

Debank provides a Web3 ID minting service, but the registration fee of nearly 100U has already discouraged me (and it requires assets to be deposited on Debank L2 before registering and paying, which is really a bad user experience.

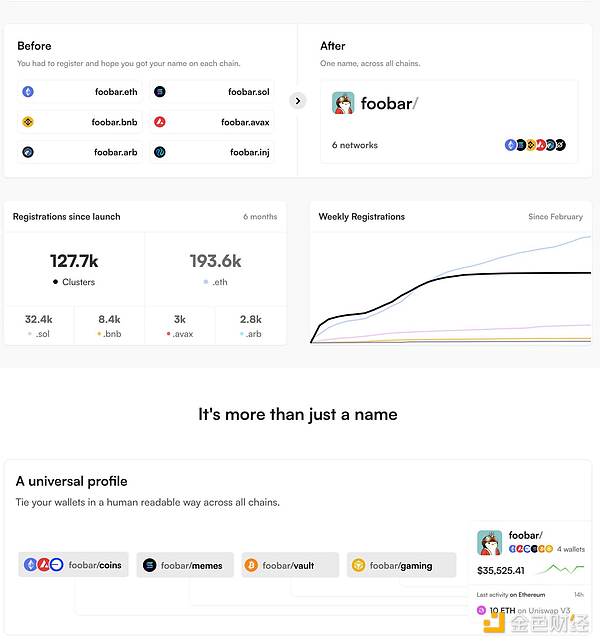

It wasn’t until I recently saw another project @clustersxyz that I felt enlightened.

Cluster is an All-Chain Name Service product based on Layerzero. Its product logic is also very simple. Users need to register an account name such as "jamesx/" and bind a main wallet. After that, they can generate a multi-chain wallet management account with one click. If you want to transfer money to my sol account, for example, just enter "jamesx/sol" and the integrated application will resolve it into the solana address under my account.

Currently, for an "xxxx/" account, one click will generate the corresponding addresses of 8 mainstream web3 public chain ecosystems: /evm /sol /btc /ripple /aptos /doge /tron /cosmos.

As long as there are enough protocols that integrate the address resolution of cluster accounts, this experience can be said to be very convenient (and the registration fee is currently as low as 0.01E, about 30 US dollars. Compared with the cost of registering .xxx accounts one by one and the lack of a unified management product, the cost and experience are very competitive.)

It is worth noting that the founder of Clusters is actually the founder of @delegatedotxyz, who already has sufficient industry experience and resources to help Clusters become more popular in the industry (with the support of Layerzero).

So my expectation for the future is: when receiving payment, I can use any jamesx/xxx as the payment account (even the email address may become the payment address of cryptocurrency after deeper product integration of privy), and when I manage assets on multiple chains, cross-chain can be as convenient as the experience of directly transferring funds from different accounts in CEX exchanges.

3. What is the essential difference between Web3 social and traditional social application tracks?

Web3 Social is a topic that cannot be avoided in the process of Web3 moving towards mass adoption. The industry has high hopes for the recently popular Ton/Telegram ecosystem and the Farcaster ecosystem that announced a $1 billion valuation this year.

Many people think that the core essence of web3 social networking lies in "decentralization", "censorship resistance", "permanent storage and immutability on the chain", etc., but I don’t think so.

Let’s talk about the two most essential differences between web3 social networking and web2 social networking, which I think many users or practitioners have not figured out.

Difference 1 (also the core difference that many practitioners have already understood): Web3 Social essentially has the underlying conditions for creating a new type of asset.

This is actually easy to understand, because the current web3 social projects all rely on the public chain ecosystem. Once there is a public chain, issuing various assets will become extremely convenient. The earliest NFT Gated social applications, users need to buy NFT to use the corresponding social applications, and then there are Token Gated social software, you must hold the corresponding tokens/NFT to enter the corresponding communication group, these are all assets first, then based on the assets to do social.

Later, everyone figured it out, I can create more value by issuing an additional asset. There is the fan key of http://Friend.tech, the Degen Tips token airdrop of the Farcaster ecosystem, and the recent projects of the Telegram ecosystem to earn tokens by using the dot dot dot + even-even to earn tokens. All of them have created a new type of asset with a new logic for users of social platforms and issued it. This logic has indeed created a considerable wealth creation and breaking circle effect, giving users a higher expectation of Web3 Social (expectation of making money).

This is indeed something that web2 social platforms are completely unable to do. For example, I cannot directly airdrop assets that can be traded in the secondary market to users of the Snowball APP, otherwise the results will definitely be even more exaggerated.

The second difference (a difference that most practitioners haven’t realized yet): the accessibility of social data and the fundamental subversion of social application development logic.

In the traditional social media arena, each application is actually a data island, so each social application needs its own independent account + data service system. Most platforms do not open external data acquisition interfaces. For those with external data API services such as Twitter, the data acquisition cost is also very high. Therefore, the third-party platforms that you see for Twitter account management/data services generally charge a not cheap membership fee to cover the data acquisition cost and make a profit.

Telegram is actually one of them, and has opened certain data APIs to miniapp developers. However, since TG itself is an instant messaging application, data such as address books or chat messages are private data, and ordinary users do not want to open permissions to developers. Therefore, the Ton ecosystem reference based on TG that everyone sees can only obtain some simple user information dimensions to determine how many tokens to airdrop to you.

Telegram miniapp development documentation: https://docs.telegram-mini-apps.com/packages/telegram-apps-sdk/init-data/user

But for Farcaster, this category itself is the underlying technical architecture of Web3 social that is benchmarked against Twitter's open social platform logic. For developers, it is equivalent to a Twitter where all user data can be freely obtained. For example, all public content published by your account and all social interaction data such as likes, comments and reposts can be obtained by any developer in the Farcaster ecosystem and used as a basis to build their own social applications.

The simplest logic is that you can see that in addition to the official client Warpcast, there is also the Takocast client made by the @TakoProtocol team, the recaster client independently developed by @0xHaole, and more than a dozen client applications with completely different focuses that I have experienced.

Each one has a different interactive experience, each one has a different recommendation algorithm feed, and each one has its own unique features that integrate other on-chain applications. However, every user can browse all the content in the Farcaster ecosystem through any client using the same account (although some platform algorithms will actively block some).

The logic of developing this application is subversive. It is completely impossible to achieve in the traditional social application field, except when there are several social project teams under the same company (such as Facebook, Instagram and Threads).

To give a more direct example, assuming that the underlying layer of Twitter is built on a web3 social protocol similar to Farcaster, I can completely develop an algorithm that only recommends the "Old Pervert Version of Twitter" that only contains borderline/pornographic content. In this client, the recommendation algorithm will only let you see content that matches this label, and the application team does not need to increase the number of "content creators" at the beginning, because they can directly filter and recommend the existing content data on Twitter.

This is the essence of web3 social that subverts traditional social applications, the developmental acquisition of user data and the convenience of ecological applications. This is why I say that BTC/ETH has built an open and anti-centralized financial operating system for the world, and protocols such as farcaster have built an open underlying technical architecture for social, content, and identity for the world. The application ecosystem derived from it will definitely not be smaller than the current DeFi or the so-called "Crypto" industry.

Moreover, these logics do not rely on any tokens and users can use them directly. Additional tokens or new asset types will only be an attractive point for this ecosystem in the early stages.

For example, I don’t even need to develop a social application based on your social data. I can develop an e-commerce application that automatically recommends products and various service consumption scenarios for you based on your social data, social graph data, and even on-chain asset data.

(Of course, as for concerns about user data privacy, I believe that as the industry develops, there will be continuous regulations and technical standards to be improved to meet the needs of more users.)

4. The popularity of Web3 finance still shows the compliance and PayFi track that the traditional financial industry is promoting

The two core logics of Web3 Finance

a. Crypto assets are recognized and accepted by the mainstream market as a store of value and investment target. I won’t go into details about this, as this is also the most basic narrative of the entire Crypto industry.

b. On-chain assets are used as settlement tools/payment tools to subvert the traditional off-chain payment system

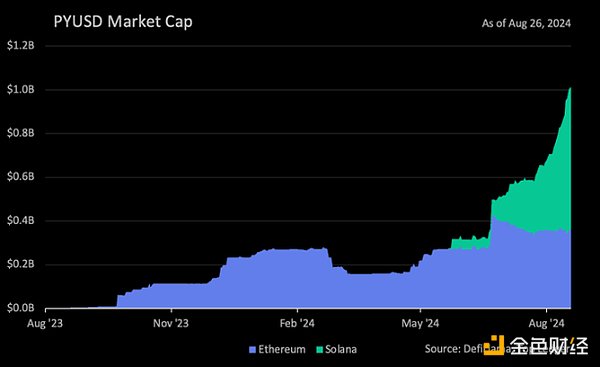

This is to remind everyone to pay attention to PYUSD, which is used by few Chinese people. It is a US dollar stablecoin issued by Paypal, the leading company in the North American payment system. I remember that it should have exceeded the level of $1 billion now.

Friends who have experience living in North America also understand that once PayPal makes an effort, it will soon be able to fully roll out PYUSD's payment channels.

Moreover, once PayFi is designed for offline payment needs, it will definitely have very strong local compliance requirements (refer to the domestic digital RMB), so those who can do this business must have very strong traditional financial industry or local resources, which means it is not suitable for small developer teams (unless your business cash flow is relatively gray).

Some people may ask, is there more room for the development of DeFi financial management? I personally think that the narrative space is not big. If you look at the semi-centralized Ethena and MakerDAO's upgraded SKY, you will know that it still needs a certain centralized financial team to intervene. In the process of continuous growth of the industry, there will definitely be stricter compliance and regulatory requirements. On-chain DeFi is more suitable for satisfying some relatively simple and direct profit logic, such as simple lending functions (and it is over-collateralized lending).

However, after companies like Paypel better help users complete the experience of depositing US dollars to on-chain U, the business and data of the DeFi track should have a relatively rapid growth in the short term, which can also solve the problem of high user deposit thresholds in the entire web3 industry.

Therefore, the future popularization and promotion of web3 finance is also a definite trend, but it is not so closely related to DeFi. It is more about "on-chain finance" supported by traditional financial companies.

So the above is my expectation for the future of Web3 Mass Adoption. Let me briefly summarize it:

1. A more web2-like user login/account experience.

2. More convenient cross-chain/cross-ecological asset transfers (cross-chain) and more optimized address management experience.

3. The developmental web3 social underlying technology architecture has spawned a new social application development ecosystem.

4. Daily on-chain financial payment/settlement experience (payfi) driven by more traditional financial forces.

But looking back, do you think it is better to call them web3 or web2.5?