Recent market activity has shown that crypto whales are actively buying Bitcoin (BTC), indicating a potential market recovery. This week, Spot On Chain highlighted some notable transactions, including a significant withdrawal by crypto whale 36LMb.

The investor moved 999.999 BTC, worth approximately $55.09 million, on Binance when the price of Bitcoin was $55,114 each.

Crypto Whale Buys $227 Million Worth of Bitcoin

This activity is part of a larger trend in which cryptocurrency whales have withdrawn over 4,014 BTC, or a total of over $227.7 million, in the past week alone. Notable withdrawals from Binance have involved several prominent figures:

- Cryptocurrency whale 1KuPi withdrew 1,110 BTC on September 2nd and 5th, worth $64.8 million.

- Crypto whale bc1qg moved 1,381 BTC between September 2nd and 6th, worth $78.25 million.

- A new cryptocurrency wallet – 39xG8, withdrew 100 BTC on September 4th, worth $5.65 million.

- Cryptocurrency whale bc1qd moved 433 BTC between September 5th and 9th, worth $23.93 million.

Read more: A comprehensive guide to tracking smart money in the cryptocurrency markets

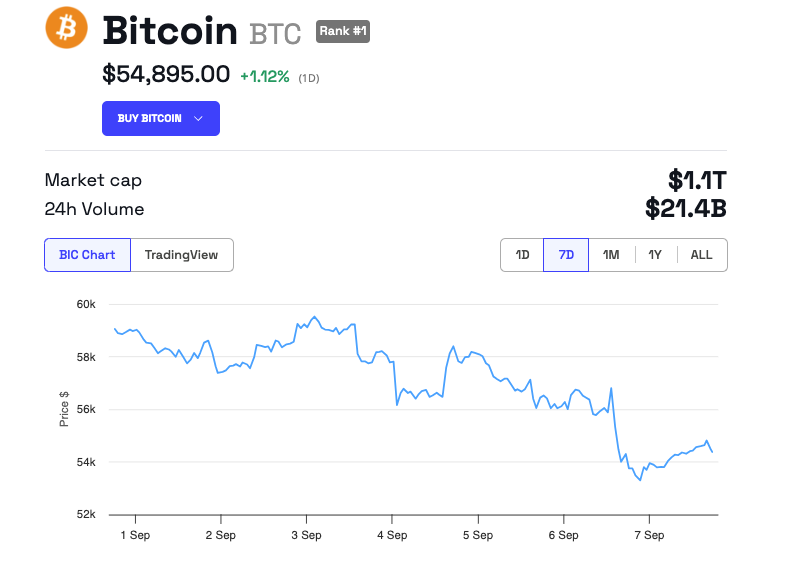

The move coincided with an 11% drop in bitcoin’s value last week, and was driven by increased outflows from U.S. bitcoin exchange-traded funds (ETFs), the longest streak of net outflows since they were listed earlier this year. Investors withdrew about $1.2 billion from spot bitcoin ETFs in the eight days through September 6 .

Bitcoin hit a low of around $52,550 last week, so this drop provided an ideal buying opportunity for whales. Historically, buying at these lows often foreshadows a market recovery.

“Last month we had the biggest spike in negative keywords since the big August crash… It ended up being the best time to buy,” said Brian Quinlivan, senior analyst at Santiment.

Bitcoin is currently trading near $55,000, having bounced about 4% from last week's lows.

During the recovery phase, some investors, such as Arthur Hayes, former CEO of BitMEX , liquidated their short positions on Bitcoin. Hayes secured a 3% profit. His decision followed comments from US Treasury Secretary Janet Yellen saying she would monitor potential risks in the jobs market.

“Bad Girl Yellen is watching; if the market goes down any further, she’ll definitely print money to lighten the mood,” Hayes humorously noted .

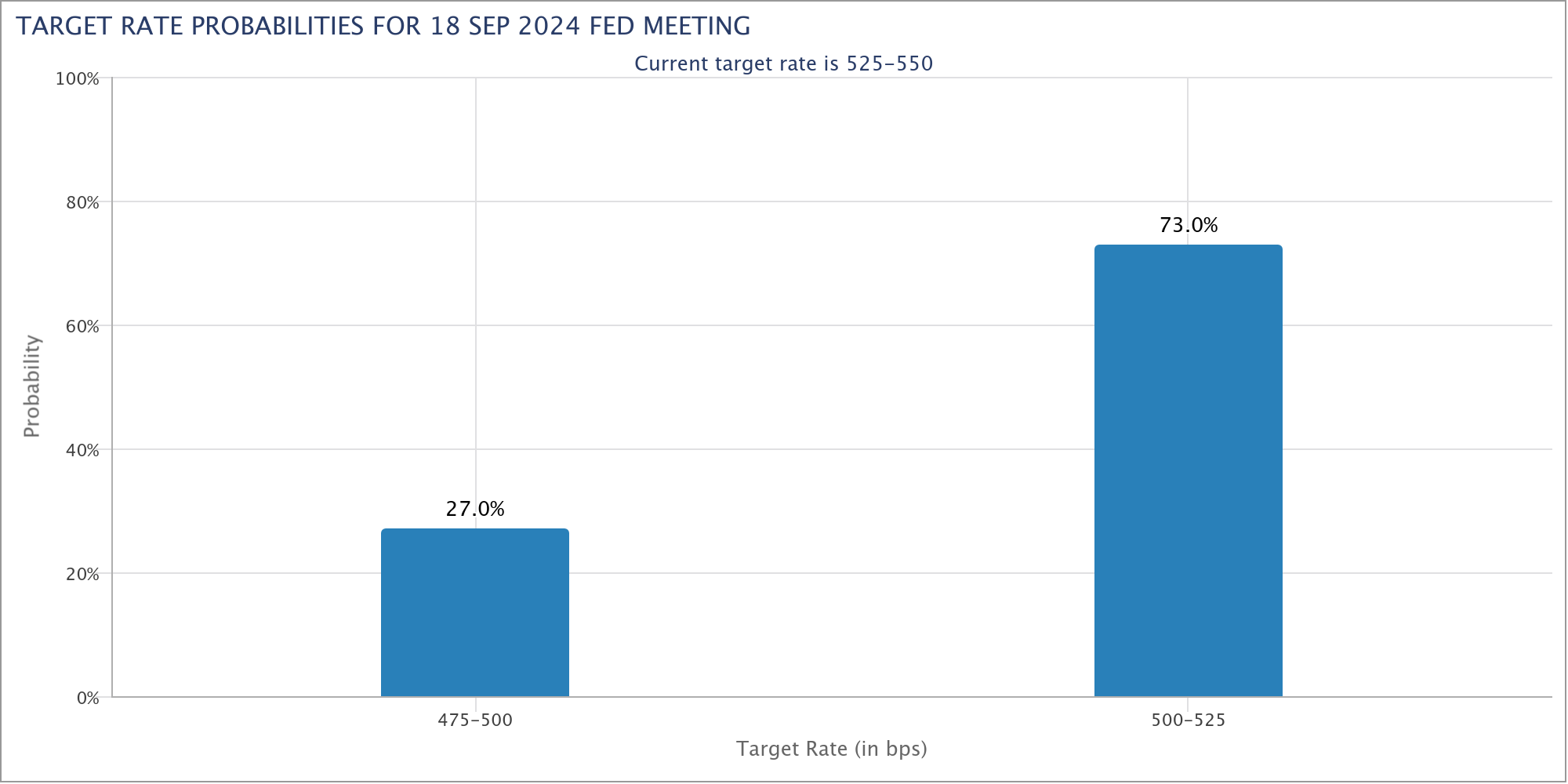

Economic data also influenced market sentiment. U.S. nonfarm payrolls data showed the economy added 142,000 jobs in August, below expectations of 164,000. The weak performance has analysts expecting a 50 basis point rate cut by the Federal Reserve in September.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

“We expect the Fed to cut rates by 50 basis points to get ahead of the curve. A 25 basis point cut would be too slow to prevent more damage given the lagged effects of monetary policy,” Marcus Thielen, 10X Research, said .