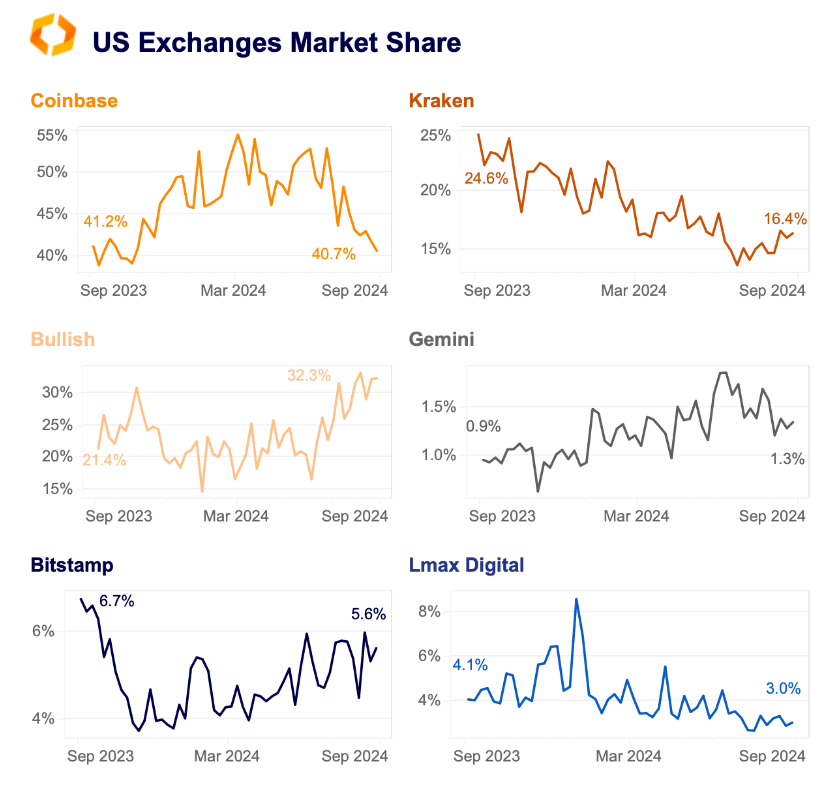

Coinbase has seen a sharp decline in market share as smaller exchanges gain market share in recent months, according to a September 9 report by research firm Kaiko.

Coinbase dominated more than half of the US cryptocurrency market share earlier this year, peaking at nearly 55% in March. However, its market share fell to 41% by early September, down from 53% in June.

The exchange that benefited the most from this shift was Bullish, whose market share nearly doubled from 17% to 33% over the same period. Unlike Coinbase, which primarily caters to retail investors, Bullish targets institutional clients.

Founded in 2021 as a subsidiary of blockchain company Block, Bullish is backed by PayPal co-founder Peter Thiel. The company recently made headlines for its acquisition of crypto-focused media outlet Coindesk.

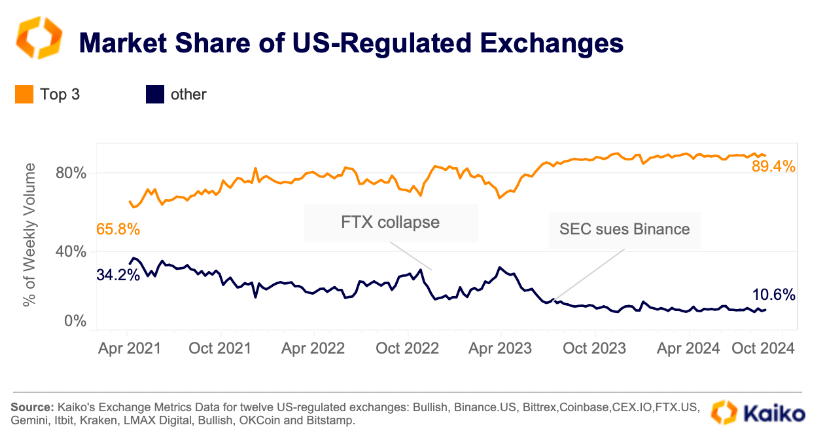

Top 3 dominant exchanges

Meanwhile, the top US exchanges have significantly expanded their market share since 2021. According to Kaiko, the three largest exchanges by volume now control nearly 90% of the market, up from 66% in April 2021.

In contrast, the market share of smaller exchanges has dropped from 34% to 11%.

Kaiko explained that this is due to a number of factors, including tighter regulations, reduced trading activity during the 2022-2023 bear market, and the dominance of major exchanges like Coinbase and Kraken in institutional crypto trading.

Additionally, their increased dominance could also be due to the sudden collapse of FTX in 2022 and legal action against Binance.US.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.