Despite volatile market conditions, crypto investors remain steadfast, with holdings remaining stable or even increasing in key global regions. The “Global State of Crypto 2024” survey provides a comprehensive look at the long-term commitment of crypto investors during uncertain times.

The survey highlighted strong commitment from investors in the US, UK, France and Singapore.

Retail Crypto Investors Are Not Selling

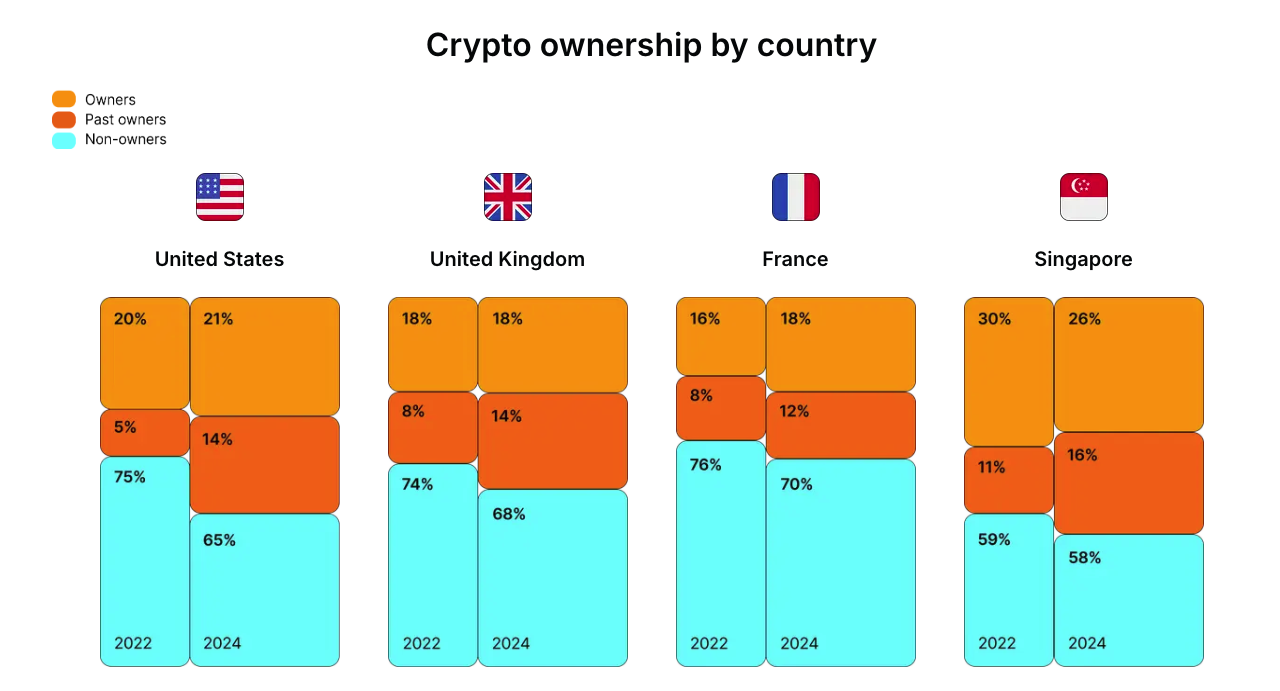

In the United States, 21% of adults reported owning cryptocurrency, mirroring the figure from last year. Similarly, 18% of UK residents still hold digital assets.

In France, cryptocurrency ownership increased from 16% in 2022 to 18% this year. However, Singapore saw a drop from 30% to 26%.

These numbers are underpinned by a clear driver – long-term investment potential. About 65% of cryptocurrency owners across these countries are buying and holding crypto with the future in mind. Furthermore, 38% see their digital assets as a buffer against inflation, demonstrating a strategic approach to this volatile market.

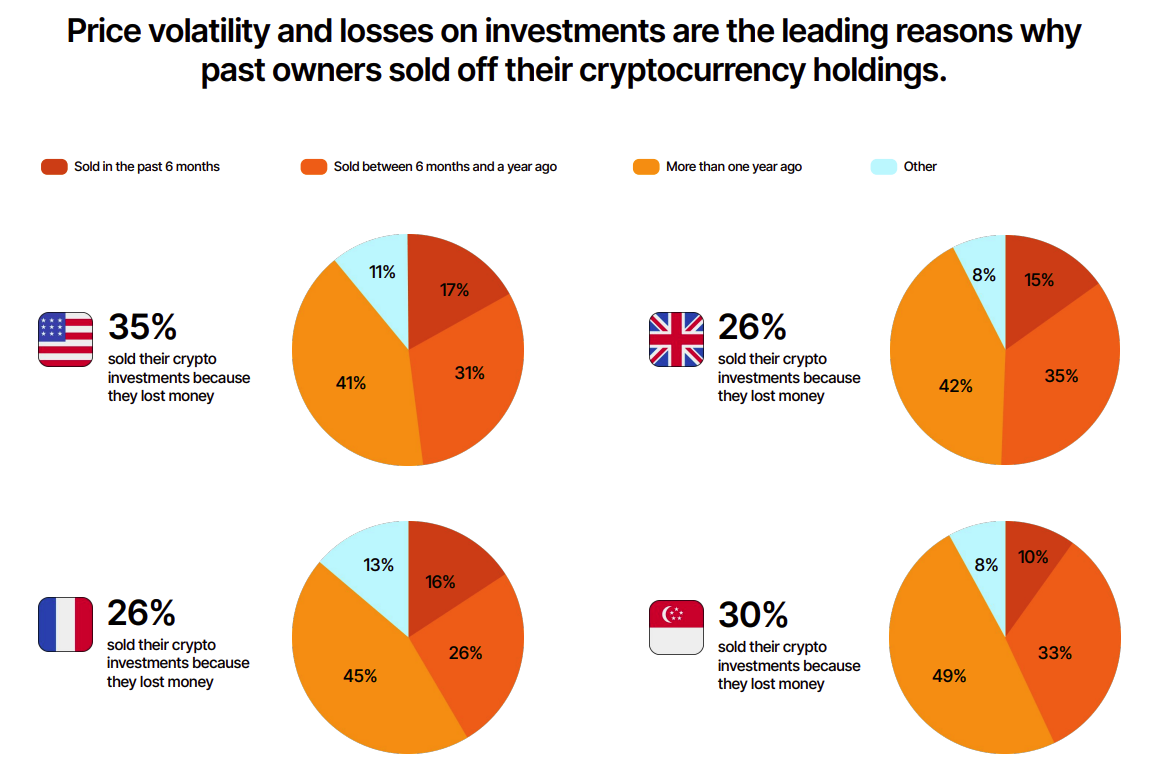

The resilience of crypto enthusiasts extends beyond ownership. Survey data shows that fewer investors have sold their assets in the past six months than those who sold more than a year ago. In Singapore, only 10% sold recently, compared with 49% who sold more than a year ago, suggesting a shift to more bullish sentiment.

Additionally, those who have previously left the market appear ready to return. More than 70% of former cryptocurrency owners are considering reinvesting in the coming year, motivated by the positive outlook for the asset class. Of current owners, 57% are confident enough to make crypto a major part of their portfolio, and 27% of former owners are likely to return to the market soon.

Another CoinGecko survey supports these findings, showing that 54.1% of investors remain optimistic about the market’s long-term potential.

FOLLOW US ON FACEBOOK | TELEGRAM | TWITTER

Disclaimer: All content on this website is for informational purposes only and does not constitute investment advice. Readers should conduct their own research before making any investment decisions. We are not responsible, directly or indirectly, for any damages or losses arising in connection with the use of or reliance on any content you read on this website.