The leading cryptocurrency is currently at a crossroads. Indeed, Bitcoin is facing a crucial Q4, as it eyes a continued drop or a surge above the $70,000 level. The former is certainly in play and would have the asset continuing its recent fall below the $50,000 mark.

That dire state would have the asset’s price a far cry from the $73,000 record price it reached in March of this year. With some promise showing in the accumulation of BTC, there is reason to believe it could return to similar levels. It would have to conquer notable obstacles it has been unable to overcome over the last six months.

Also Read: Will Trump vs Harris Debate Affect Bitcoin’s September Price Pace?

BTC to Fall Below $50,000 or Surge Above $70,000: That is the Question

For the last two months, Bitcoin has been in a unique position. Moreover, it has developed a tale of two paths. First, would have the asset dropping to significant lows, while the other would have the leading crypto rivaling its yearly high in a monumental surge.

Over the last 30 days, Bitcoin has fallen nearly 5% according to CoinMarketCap. Yet, it has rebounded slightly. Specifically, BTC has increased more than 1.2% in the last 24 hours to reach $57,230 Tuesday. Its next price movement could have massive implications.

Also Read: Bitcoin: Bernstein Says Donald Trump Reelection May Push BTC to $90,000

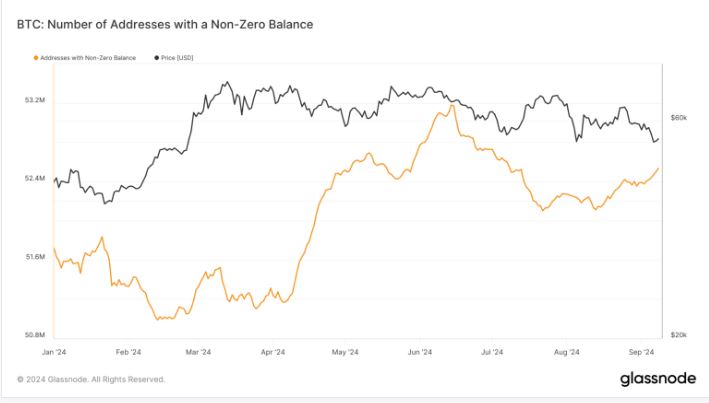

The token struggled to fend off increased selling pressure in August. A crypto market flash crash had the leading asset fall below $50,000. Yet, that has been unable to be sustained by bears. Glassnode data notes that accumulation has been a benefit in recent weeks.

According to the firm, addresses with a zero balance were up to 53 million this week. That is a notable increase from August figures, which neared 2024 lows. However, it has still not reached the prices seen in July.

Additionally, the exchange reserves of BTC have been lessening. Typically, this is a good sign for bullish perspectives. However, it doesn’t provide any more clarity as to where Bitcoin could go in Q4, or if $70,000 is still in the cards.

There is even more risk when factoring in far lower whale activity, IntoTheBlock data shows whales and BTC ETF demand has dropped notably in the last five months, Therefore, a stern drop to $50,000 is possible. All eyes are on the 2024 US election, as that could have a massive impact on its price.