Last week, digital asset investment products saw a net outflow of US$726 million, of which US$643 million went to Bitcoin. However, "this coin" bucked the trend and saw an inflow of US$6.2 million, with the US Bitcoin spot ETF breaking away from its eight-day net outflow trend.

VX:TTZS6308

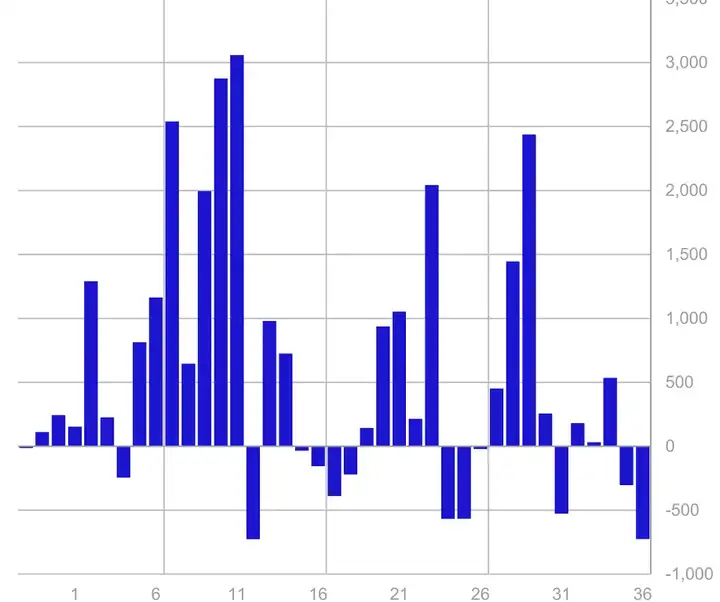

Institutional digital asset investment products saw outflows of $726 million last week

Digital asset investment products (ETPs) launched by institutions saw a net outflow of US$726 million last week, which was the same as the maximum outflow in March this year. The reason behind this may be related to the macro environment.

Last week's better-than-expected macroeconomic data increased the probability that the Federal Reserve will announce a 1 basis point interest rate cut in September, but as the employment data was lower than expected, the market is still divided on whether to cut 2 basis points in one go.

Currently, the cryptocurrency market is waiting for the results of the U.S. August CPI data tonight (9/11). If it is lower than expected, the probability of a 2-digit drop will increase.

US Bitcoin spot ETF ends 8 consecutive days of net outflows

The US Bitcoin spot ETF had experienced net outflows for eight consecutive days, but reversed on September 9, with a net inflow of US$28.72 million, while on the 10th the inflow expanded to US$116 million.

The US Ethereum spot ETF also saw similar capital flows. After five consecutive days of net outflows, it finally saw a net inflow of $11.44 million on September 10.

CPI will be released tonight, what do you think about the future of Bitcoin?

The U.S. Consumer Price Index (CPI) for August will be released at 20:30 today (9/11). It is the last important economic data before the Federal Reserve’s interest rate decision. The much-anticipated debate between presidential candidates Trump and Harris has also been held earlier.

Two big news are affecting the cryptocurrency market. Bitcoin rose back to $58,000 this morning, but fell back to around $56,600 at the time of writing. As the date of the US Federal Reserve's interest rate decision (FOMC) approaches, will Bitcoin rise or fall?

Market uncertainty is high

The main macro uncertainties at present include:

FOMC meeting on September 17-18

November's US presidential election results

The market generally predicts that the Fed will announce a 1 basis point interest rate cut in September, but the direction of interest rate policy is still uncertain. Although interest rate cuts are usually good for risky assets, historically, interest rate cuts often trigger concerns about economic recession, leading to a weakening market.

In this election, Bitcoin has seen many "Trump transactions," meaning it has fluctuated following Trump's polls and speeches, but if Harris takes a positive attitude toward cryptocurrencies during the campaign, it could bring unexpected surprises.

Be cautious about the short-term trend of Bitcoin. Although the daily chart closed well, more confirmation signals are still needed. The first bullish signal is to re-stand above the previous low of $57,400, and the relative strength index (RSI) needs to remain above 50.

The market currently lacks the momentum for sustained growth and requires more positive stimuli.

It is worth noting that last week, the global stock market value evaporated $4.1 trillion, the largest drop in two years. In such a turbulent environment, Bitcoin's performance remained relatively stable, rising 3.7% in the past week.

When everyone is panicking, it often means we may be closer to the market bottom than we think.

The CPI announcement tonight is likely to be positive and will stimulate a wave of market. It should go back and hit the 60,000 mark. Those who have short-term positions or buy the dips in the past two days and are currently making good profits can wait for the price to rise and find an opportunity to exit first, and then enter again after the correction stabilizes. Those who are heavily invested should just lie down and wait for the trend to change.