The Bitcoin (BTC) market is currently sending mixed signals. On-chain data points to stability and caution, and it is unclear whether the coin is heading towards a high of $64,500 or a low of $49,500.

This article explores these on-chain metrics, what they mean, and what investors should pay attention to.

Crossroads for Bitcoin Holders

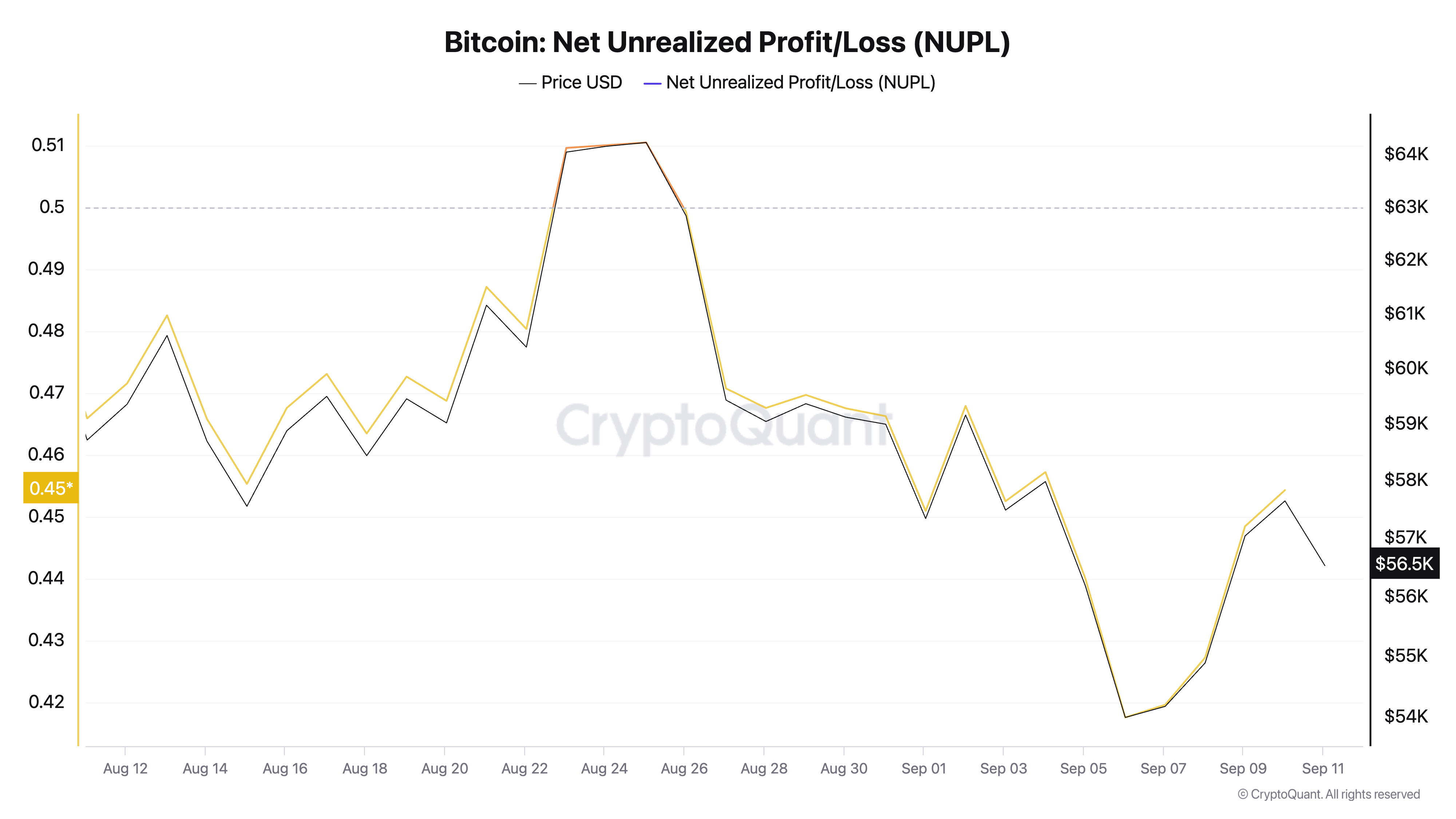

The first key metric to look at is Bitcoin’s Net Realized Profit and Loss (NUPL), which measures overall investor sentiment and profitability. The current NUPL is 0.45, which indicates that if investors were to sell their coins at the current market price, they would realize, on average, a profit of 44% compared to the last price they acquired the coins.

This level reflects relatively positive sentiment in the market.

However, according to CryptoQuant, the current NUPL value of BTC suggests that holders are hesitant to sell. This anxiety stems from the upcoming Consumer Price Index (CPI) release, a potential 50-point rate cut by the Federal Reserve (Fed), and uncertainty surrounding the upcoming US presidential election.

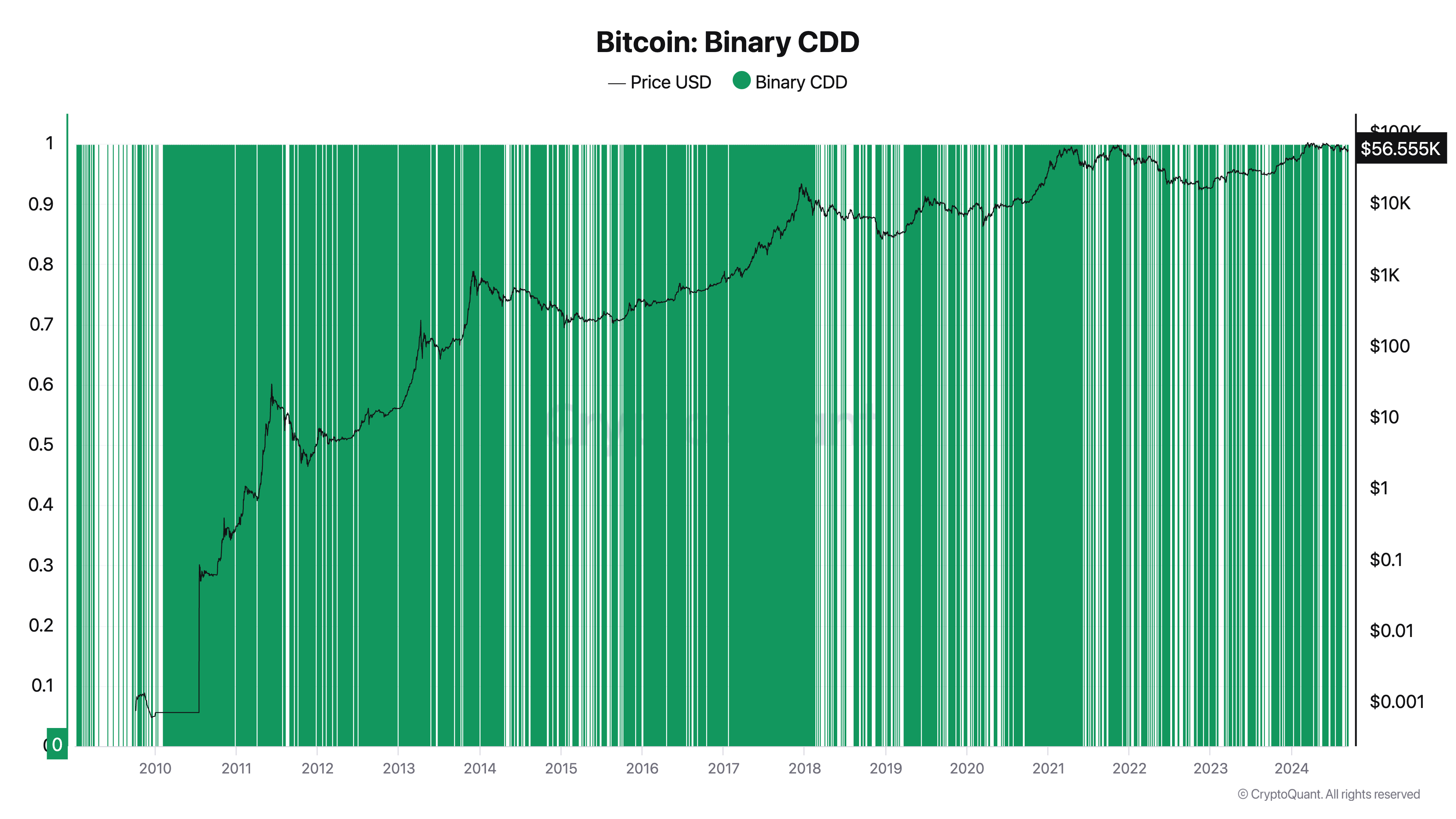

Despite this, many long-term BTC holders are showing strong HODLing behavior, which is reflected in the coin’s Binary Coin Days Breakdown (BCD) indicator, which shows that long-term holders are not moving their coins.

Read more: Where to Trade Bitcoin Futures: A Comprehensive Guide

Currently, this indicator is at 0.28, reflecting confidence in Bitcoin’s performance and market stability . Holders do not feel the need to move or sell their coins.

The combined NUPL and BCD results for BTC show a clear sentiment: investors are nervous about a potential price drop, but are reluctant to sell for fear of missing out on future profits.

BTC Price Prediction: Rally Above $60K or Drop to $49K?

Marcus Thielen, founder of 10X Research, warned in a note to clients that uncertainty around the U.S. presidential election, CPI, and FOMC meeting will largely determine Bitcoin price targets .

“The lower CPI reading could provide a temporary boost to positive momentum. However, with the upcoming FOMC meeting next week likely to introduce additional uncertainty, and the optimistic outlook for Trump remaining uncertain after Tuesday’s debate, Bitcoin could continue to search for stronger support levels for a larger rally through the end of the year,” Thielen wrote.

Mati Greenspan, founder and CEO of Quantum Economics, takes a more negative stance. The expert believes it is too early to think about a new high.

“Bitcoin’s price action has been sideways for more than half a year now, and there’s no telling when it will break out. Ultimately, this sideways movement is good for Bitcoin adoption, as price stability can be a key driver of growth and confidence,” Greenspan told BeInCrypto.

If the macroeconomic trends are favorable, increased demand for BTC will push the coin towards the $64,520 support level. If this level is surpassed, the leading coin could target $68,599.

Read more: 5 Platforms to Buy Bitcoin Mining Stocks After the 2024 Halving

However, if the bearish macroeconomic trend continues, Bitcoin’s price could fall to the August 5 low of $49,516.