Everyone thought September was going to be a bad month, but as usual, most cryptocurrency traders were wrong about what was coming next.

Yes, I know we got off to a bad start, but that doesn’t mean it’s over. If you look at Twitter and YouTube right now, you’ll see this chart showing how bad September was.

I even tweeted this chart recently, but the predictions keep getting crazier.

Some people think we will fall back to 45,000 in September, but you are smart enough to know what happens to crypto when everyone expects the same thing.

Market manipulators are the exact opposite, which is why today I’m going to analyze what I think is going to happen next and how I can take advantage of this.

I’m going to share some crazy things about Altcoin that 99% of the market is completely ignoring.

This is alpha you can only see here and may change your mind about the bull market. So be sure to read to the end. Let’s get started.

Bitcoin Price History – When Will the Crypto Bull Run Begin?

Let’s solve one problem first.

Yes. Bitcoin went from $15,000 to $74,000. Yes, it broke its all-time high. Yes, technically, the bull run has already begun.

But I'm not talking about a bull run. I'm talking about a crazy crypto bull run. One that only went up for a year. The kind we had in 2021 and 2017.

A real bull market.

When does it begin?

Well, first let's talk about what the opening looks like because it's different than what most people think. Most people think it starts with a giant green candle. Altcoin go up 2x, 5x, even 10x.

But it was boring at first.

The truth is, it progresses slowly at first. First, the market moves sideways, and sometimes even down. Then it levels off, and we start to see subtle signs of a bottom.

Then boom!

There were God candles everywhere, and everyone was saying, " I hope I bought the bottom. "

Bitcoin bottoming out? Market showing bullish signs

While everyone is talking about the bearish trend in September, I think we are seeing subtle signs of a bottom forming, rather than the drop to 45k as some have predicted.

Let’s look at a few of these signs.

➣ The first golden cross in Bitcoin history.

In traditional markets, these crossovers are viewed as bullish signals. ” Now, there is nothing guaranteed about a crossover, but I must point out that this is the first time in history that this has happened.

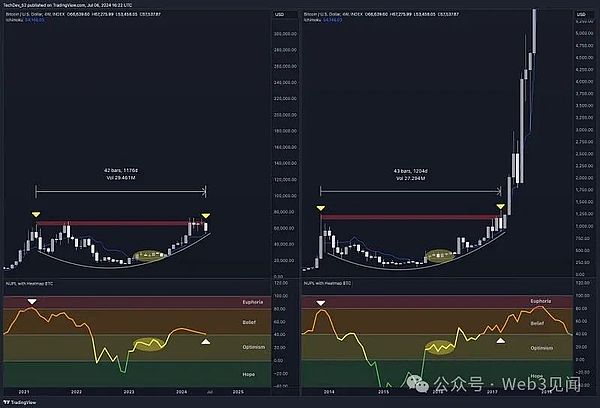

Speaking of history. It looks like we are seeing history repeat itself right now.

I talked about seasonal markets before.

It is normal for financial markets to fall in the summer because traders are on vacation. Summer is almost always bearish. As summer ends, everyone returns from vacation. Conditions tend to become bullish again.

Now September is the transition month between Q3 and Q4, which is why the bottom is usually solidified in September. At least for Bitcoin.

We will discuss Altcoin bottoming later. For now, let’s focus on Bitcoin’s bottoming in September.

This is a good example.

A year ago, Bitcoin was exactly like it is now. Bitcoin hit a low in mid-September and then started to rise in October.

History may be repeating itself, it is not uncommon for September to start poorly and then recover. Or it may go sideways until October.

This is by no means a bullish month, but it’s also not a month known for massive crashes. It’s a month known for bottoming. We can also zoom out and look at this pattern more broadly.

After the past two halvings, Bitcoin moved sideways in the third quarter, but more specifically, a bottom was solidified in September and then Bitcoin broke out in the fourth quarter.

Everything that is happening now in cryptocurrencies has happened in the past two cycles.

2.➣ We had an overnight crash and now Bitcoin open interest levels are even higher than before the crash.

This is what we want to see, because it reduces the chances of a massive nuclear explosion driving oil prices down to the low $50s, or even the low $40s.

This suggests a continuation of the overall range, consistent with September. Furthermore, we are entering a bear trap period.

Again, this is consistent with the bottoming seen in September. So we are now seeing signs of a bottom in Bitcoin. While this does not mean it cannot fall further, it does suggest that the overall trend may be shifting. This makes sense.

3. Most importantly, let's see what happens in September. Powell's September rate cut is almost certain.

We are now two weeks away from the first-class cuts. If you are wondering why this is important, it is actually much simpler than most people think.

I’ll break it down for you.

When interest rates are high, investors can earn good returns by investing in safe asset classes such as bonds. I mean, if you can earn 5% or even 10% on a government-guaranteed bond, why take so much risk?

That makes sense.

But when interest rates fall sharply, investors turn to riskier assets like stocks or cryptocurrencies for higher returns. That’s why lower interest rates could lead to higher cryptocurrency prices.

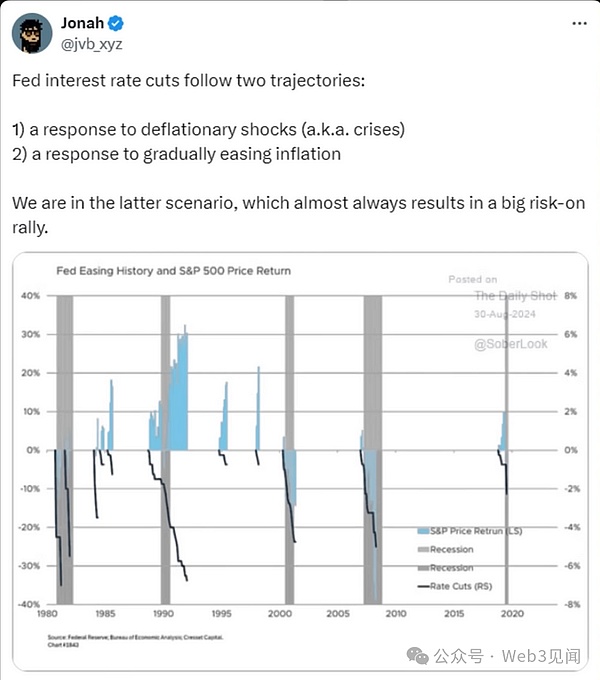

Now, the Fed typically cuts rates for one of two reasons: to respond to a deflationary shock or to respond to easing inflation. Historically, the second scenario almost always leads to a big risk appetite rebound, i.e. a rally in risk markets like stocks or cryptocurrencies.

This is one of the biggest refutations of the extremely pessimistic September Theory.

But it’s not just macroeconomics. September is packed with cryptocurrency conferences.

Three cryptocurrency conferences in September

We have three meetings this month.

Korea Blockchain Week is underway

Token 2049 Singapore Meetup

Solana Breakpoint 2024

This is important because the project shared a lot of positive news at the conference and generated a lot of hype.

Bitcoin bottom signal - BTC return rate in August and September

Bitcoin is sending some bottoming signals. Macroeconomic conditions are good and September is a peak alpha month for cryptocurrencies.

But the fact is that September is historically the worst month for cryptocurrencies.

But is this really the case?

Now I don’t blame anyone for sharing this Coinglass chart and saying September was the most pessimistic month because in terms of September closes, it was the most pessimistic month.

However, if you take a second longer to look at the numbers, you’ll notice that Bitcoin had two prominent bullish runs in August. One was in 2013 and the other was in 2017, both of which were deviations from the average. In fact, August’s gains were even more brutal than September’s - the declines were 17%, 18%, 9%, 13%, and 11% respectively in September last year.

If you look at every September since the bull run in 2017, most have been -7% or less. So once more bear markets hit in September, they won’t actually be that brutal.

If we see a fairly normal -7% drop in September, Bitcoin would only fall to $55,000.

It's no big deal.

A few weeks ago it was $48,000. For us, $55,000 is a piece of cake. Even if we look at the worst September drop in recent history, 13% in 2019. That's still above $48,000, still within range.

But honestly, since everyone is expecting a big drop in September and we are already seeing signs of bottoming, I wouldn’t be surprised if these drops are only temporary and this ends up being a slightly bearish month. Or who knows? After the rate cut, it could even be a bullish month.

Good news for Altcoin– Bitcoin surges and Altcoin follow

Now let's talk about a very important thing about alternative currencies that almost everyone ignores. They probably ignore it because they think it's bad news. But to be honest, I think it's good news.

So while Bitcoin usually surges in the fourth quarter after the halving and everyone is super happy, historically only some Altcoin follow Bitcoin. And arguably the most important Altcoin don’t follow.

The vast majority, if not all, of these cycle-defining Altcoin did not rally alongside Bitcoin in Q4 2020.

Something to remember is that historically the next two quarters are when Bitcoin and Altcoin bottom. Historically this is when the trend reverses and we enter the bullish season we are all so desperately hoping for.

This time around, we have something special happening in Q4 that I believe will make this period a little better for Altcoin.

FTX Payments Finally Started

$16B FTX Spend Begins — What Happened to FTX?

FTX was one of the largest cryptocurrency exchanges ever. When it collapsed, the exchange’s users lost more than $16 billion.

In the fourth quarter, that $16 billion will begin to be repaid to creditors, and it will be repaid in U.S. dollars. Think about what this means.

They are bringing degradation to cryptocurrencies…

The fourth quarter was $16 billion.

During the period we have just identified, the market historically emerged from the post-halving shock and began a vertical rise to new all-time highs.

Can you guess what these “Altcoin investors” will do with all this money?

Yes, you guessed it!