An on-chain indicator suggests more difficult times may await the crypto market.

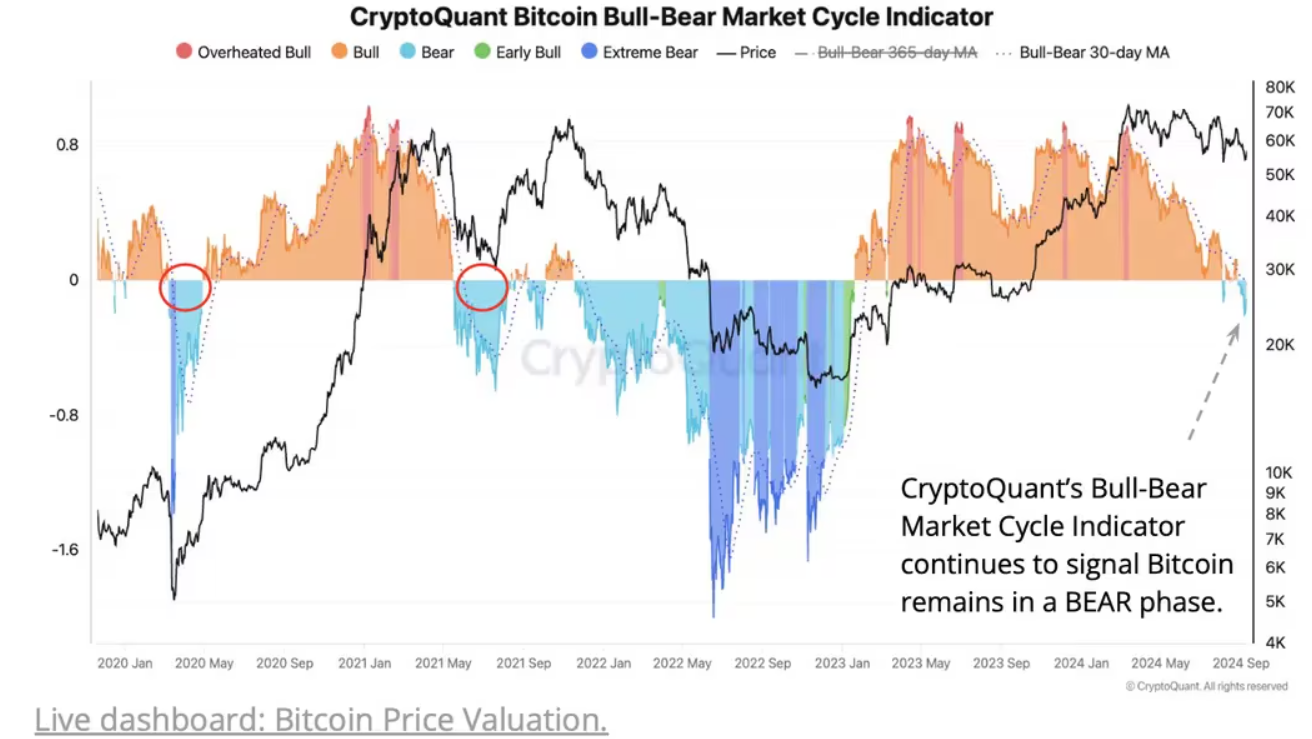

BTC Enters Bearish Phase | Source: CryptoQuant

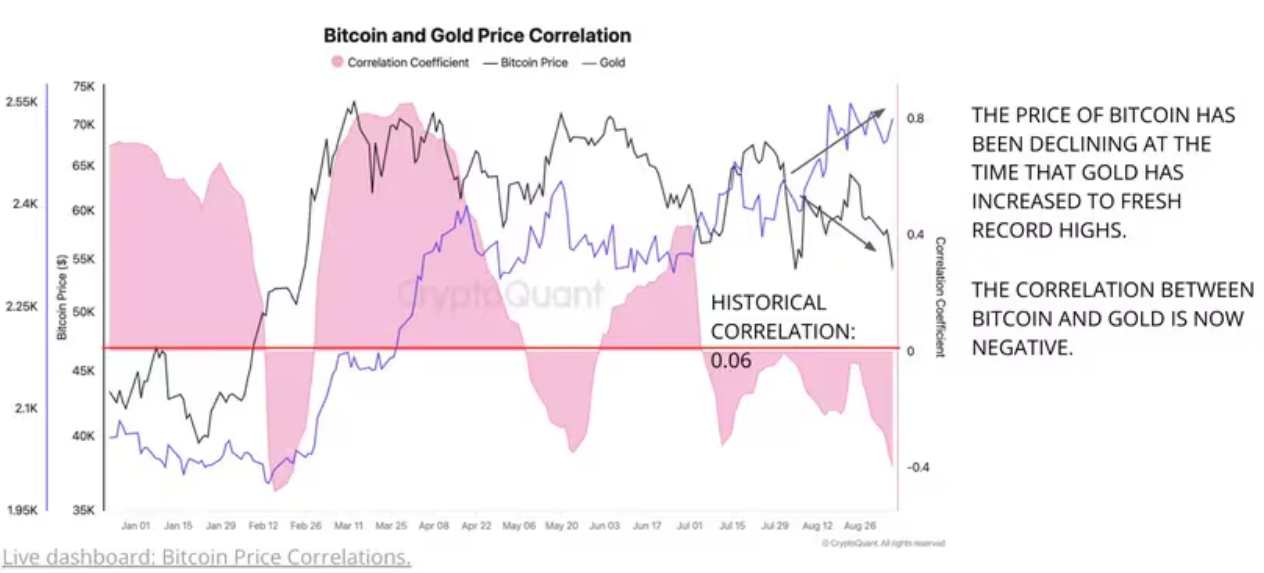

Investors in the current market conditions, with their risk-off sentiment, seem to be favoring traditional assets like Gold over Bitcoin (BTC).

According to CryptoQuant, the correlation between Bitcoin and Gold has been very negative recently, with Gold hitting a new record high above $2,500/ounce, while Bitcoin has fallen sharply and is now more than 20% below its historic peak above $73,000 in March. The shift to Gold and away from Bitcoin comes amid a difficult US stock market, with the S&P 500 down 3.6% since August 30.

BTC Price Performance vs Gold | Source: CryptoQuant

CryptoQuant's Bull-Bear Market Cycle Indicator has been in a Bear phase since August 27, when BTC was trading at $62,000.

The MVRV (market value to realized value) ratio has also been below the 365-day moving Medium since August 26, suggesting a further price correction is possible, according to CryptoQuant. The MVRV ratio falling below the moving Medium was a precursor to a 36% drop in May 2021.

According to CryptoQuant, Bitcoin’s price decline was also accompanied by weakness in the USD index (DXY), another indicator of broader risk-off sentiment and uncertainty.

You can XEM coin prices here.

Disclaimer: This article is for informational purposes only and is not investment advice. Investors should research carefully before making any decision. We are not responsible for your investment decisions.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter: https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

SN_Nour

According to Coindesk