Bitcoin development company MicroStrategy announced that it has issued new shares to buy Bitcoin. So far, MicroStrategy holds a total of 244,800 Bitcoins, with unrealized profits of up to US$5.3 billion.

Table of Contents

ToggleMicro Strategy to Buy Another 18,300 Bitcoins

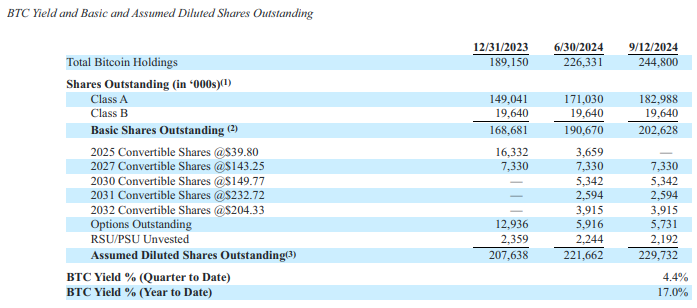

MicroStrategy purchased 18,300 Bitcoins for approximately $1.11 billion in cash between August 6, 2024, and September 12, 2024, at an average price of $60,408 per Bitcoin. As of September 12, 2024, MicroStrategy held a total of 244,800 Bitcoins, with a total cost of US$9.45 billion and an average purchase price of US$38,585/Bitcoin.

Based on the Bitcoin price of $60,300 as of press time, its unrealized profit is as high as $5.3 billion.

New shares issued to buy Bitcoin

MicroStrategy entered into sales agency agreements on August 1, 2024 with TD Securities (USA) LLC, The Benchmark Company, LLC, BTIG, LLC, Canaccord Genuity LLC, Maxim Group LLC and SG Americas Securities, LLC for the issuance of Class A common shares, with a total issuance amount of US$2 billion. As of September 12, 2024, MicroStrategy has sold a total of 8,048,449 shares in accordance with the sales agreement and received approximately 1.11 billion, all of which has been used to purchase Bitcoin.

“Bitcoin Yield” Has Reached 17%

MicroStrategy introduced a new key performance indicator "Bitcoin Yield" for its Bitcoin strategy this year. Bitcoin Yield is the ratio of a microstrategy’s Bitcoin holdings to its diluted shares outstanding. MicroStrategy believes that this KPI can be used to supplement investors' understanding and decision-making of buying Bitcoin by issuing additional common shares or instruments convertible into common shares. In its last financial report, MicroStrategy stated that its target is to grow at an annual rate of 4% to 8% in the next three years.

However, its “Bitcoin rate of return” so far this year has been as high as 17%.