Coinbase recently addressed rumors that it had issued Bitcoin bonds to BlackRock.

The rumors emerged after Tron blockchain founder Justin Sun criticized the company’s wrapped Bitcoin product, cbBTC.

Coinbase Clarifies ETF Operations Amid Bitcoin Bond Rumors

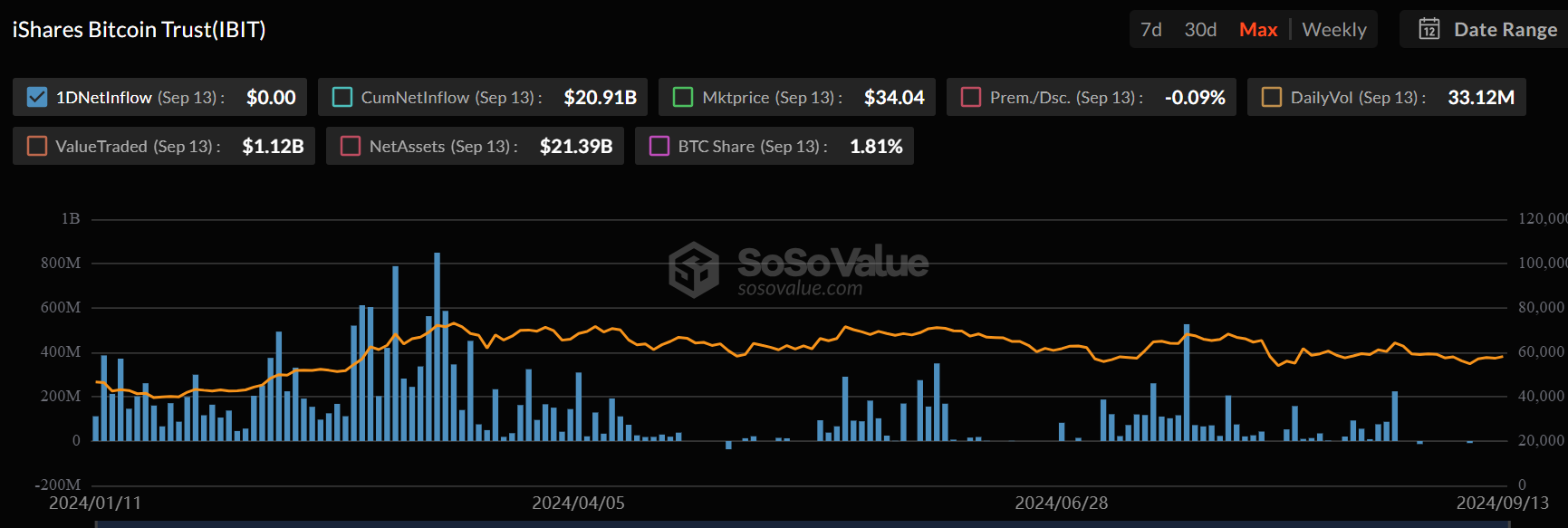

On September 14, cryptocurrency analyst Tyler Durden claimed that Coinbase issued BTC bonds to BlackRock, meaning BlackRock could borrow and sell Bitcoin without having to prove a 1:1 ratio.

Citing data from Cryptoquant, a cryptocurrency on-chain data platform, Duden claimed that Coinbase was the biggest buyer and seller at market highs and lows. He speculated that BlackRock could have a negative impact on the price of Bitcoin.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

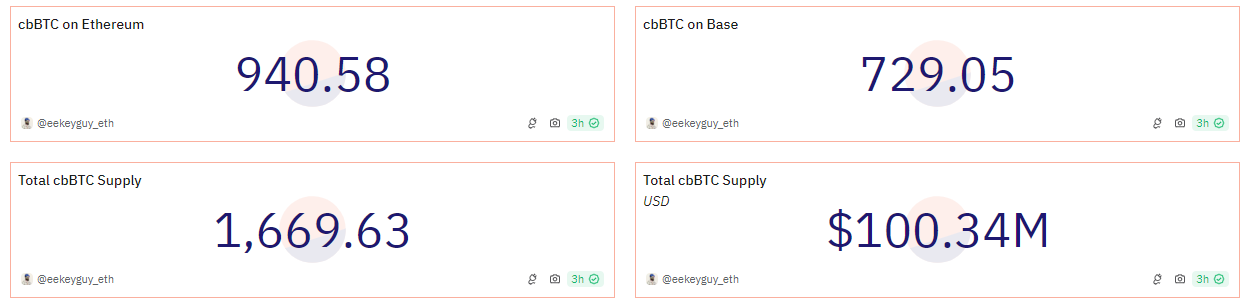

Meanwhile, Tron Network founder Justin Sun has previously stirred controversy over Coinbase’s new wrapped Bitcoin product, cbBTC . Sun claimed that cbBTC has no proof of reserve, is unauditable, and can freeze balances at any time.

“cbbtc is like central bank bitcoin. There is no more ridiculous combination than central bank and bitcoin. I think this is something Satoshi Nakamoto could never have imagined when he created bitcoin,” Sun added .

Coinbase CEO Brian Armstrong addressed cbBTC’s concerns by explaining how ETFs work in response to these claims. He explained that the issuance and burn of ETFs are typically settled on-chain within a day.

Armstrong also said his firm is not authorized to disclose the addresses of institutional clients , including BlackRock.

“If we need an audit, Deloitte audits us every year, and we’re a public company. I don’t think our institutional clients want to go through all their addresses. And it’s not our place to share that. This is what it looks like if you want institutional money to flow into bitcoin,” the Coinbase CEO emphasized .

Regarding cbBTC, Armstrong stated that users trust centralized custodians to manage their bitcoins, and Coinbase has never claimed otherwise.

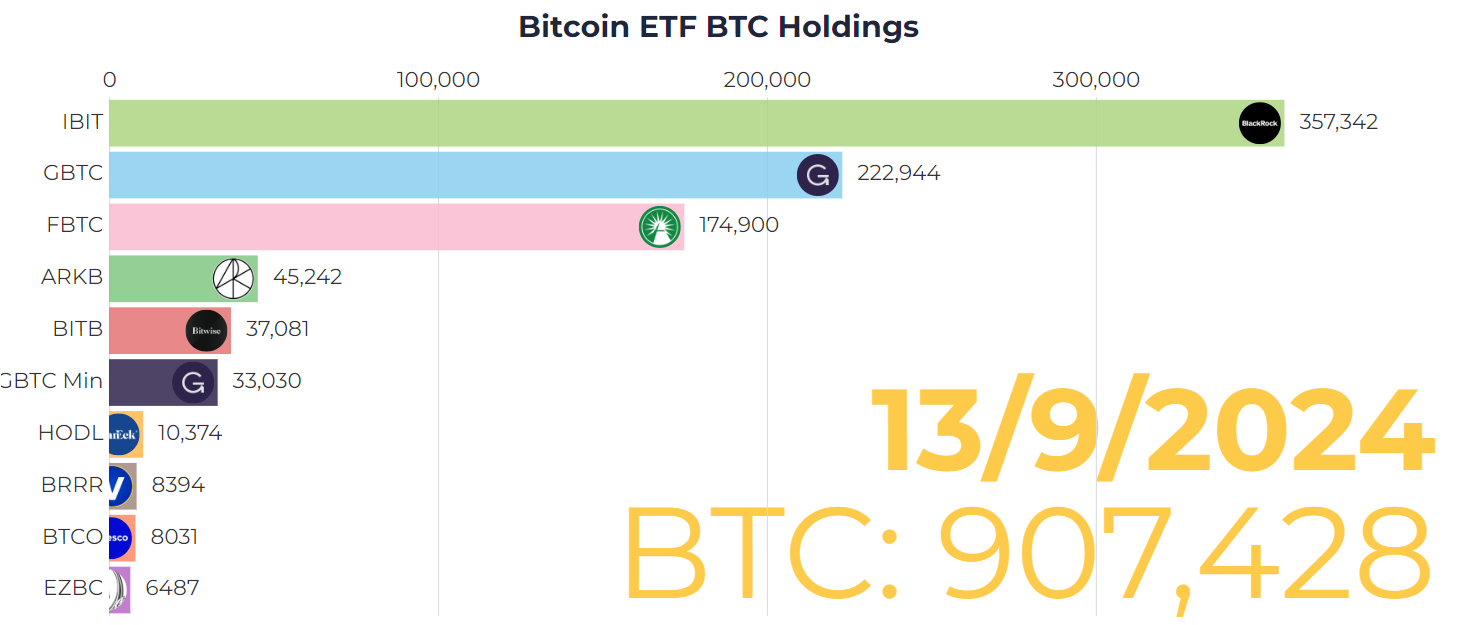

Other market experts have also sided with Armstrong and Coinbase. ETF Store CEO Nate Geraci has dismissed the rumors, emphasizing that the ETF fully owns the assets it claims to own.

“No matter what Coinbase does, the ETF owns 100% of the underlying BTC. It’s real. And it’s fantastic. That’s it. End of story. We’ve heard the same thing before with physical gold ETFs. People who keep doing this don’t understand how ETFs work,” Geraci wrote .

Read more: 7 Best Cryptocurrency Exchanges to Trade Bitcoin (BTC) in the United States

Meanwhile, Bloomberg analyst Eric Balchunas has noted that it is difficult for real market participants to accept that the ETF and not the exchange-traded funds are responsible for the recent Bitcoin price movements .

“I understand why these theories exist and why people want to blame the ETFs. It’s hard to imagine that indigenous HODLers could be the sellers. But they are. The problem is at home. All the ETFs and BlackRock have done is saved the price of BTC from the abyss multiple times,” Balchunas said .