In past cases brought by the SEC against exchanges such as Kraken, Coinbase, and Binance, the SEC’s consistent accusation at the time was that some of the tokens on these centralized exchanges may be defined as securities, while the exchanges provided similar services without obtaining a securities dealer license. Subject to securities laws. Recently, the SEC updated the wording in its lawsuit with Binance, stating that although it uses "securities", it is only used as an abbreviation and does not mean that cryptocurrencies are equivalent to securities. This also makes the encryption community believe that it has gained first-line regulatory opportunities.

Table of Contents

TogglePositioning crypto asset securities, supervision is expected to be clearer

In court documents in the Binance case, the SEC added in a footnote: "When it refers to cryptoasset securities, it does not refer to the cryptoassets themselves, but to the entire set of contracts for the sale of such assets." In other words, the agency just Simply use "security" as an abbreviation.

The SEC stated that the agency maintains its consistent position and has always targeted the entire set of contracts for the sale and marketing of crypto assets. They have never targeted tokens. However, the agency said it would avoid using the abbreviation in the case against Binance and regretted causing any confusion.

The crypto community cannot forget SEC Chairman Gary Gensler’s famous saying that “most cryptocurrencies are securities” and is angry. He said: "Most cryptocurrencies are securities and called on cryptocurrency service providers to register with the SEC." However, because most cryptocurrency companies register as securities, it is equivalent to cutting off their own hands and it is impossible to fall into the trap. Therefore, Gensler's narrative Very dissatisfied.

Since "crypto-asset securities" are defined as securities because of their actual sales, this also gives many cryptocurrency issuers the opportunity to self-certify that they do not need to be subject to regulation.

( Gary Gensler: The vast majority of crypto tokens and ICOs violate U.S. securities laws )

Coinbase, Ripple legal counterattack, ridiculing SEC for changing stance

The SEC’s lawsuit against Binance involves multiple alleged violations of securities laws. It claims that 10 third-party crypto-asset securities are offered and sold as investment contracts on the Binance platform. The SEC claimed the assets met the Howey Test, which defines sales of securities as investment contracts.

The SEC filed an amendment to its complaint against Binance following a series of enforcement actions over the past few weeks. The agency reached a settlement with financial services firm eToro on Thursday, accusing the company of illegally operating as a broker and clearing house for crypto businesses. The term “crypto-asset securities” is used in the order .

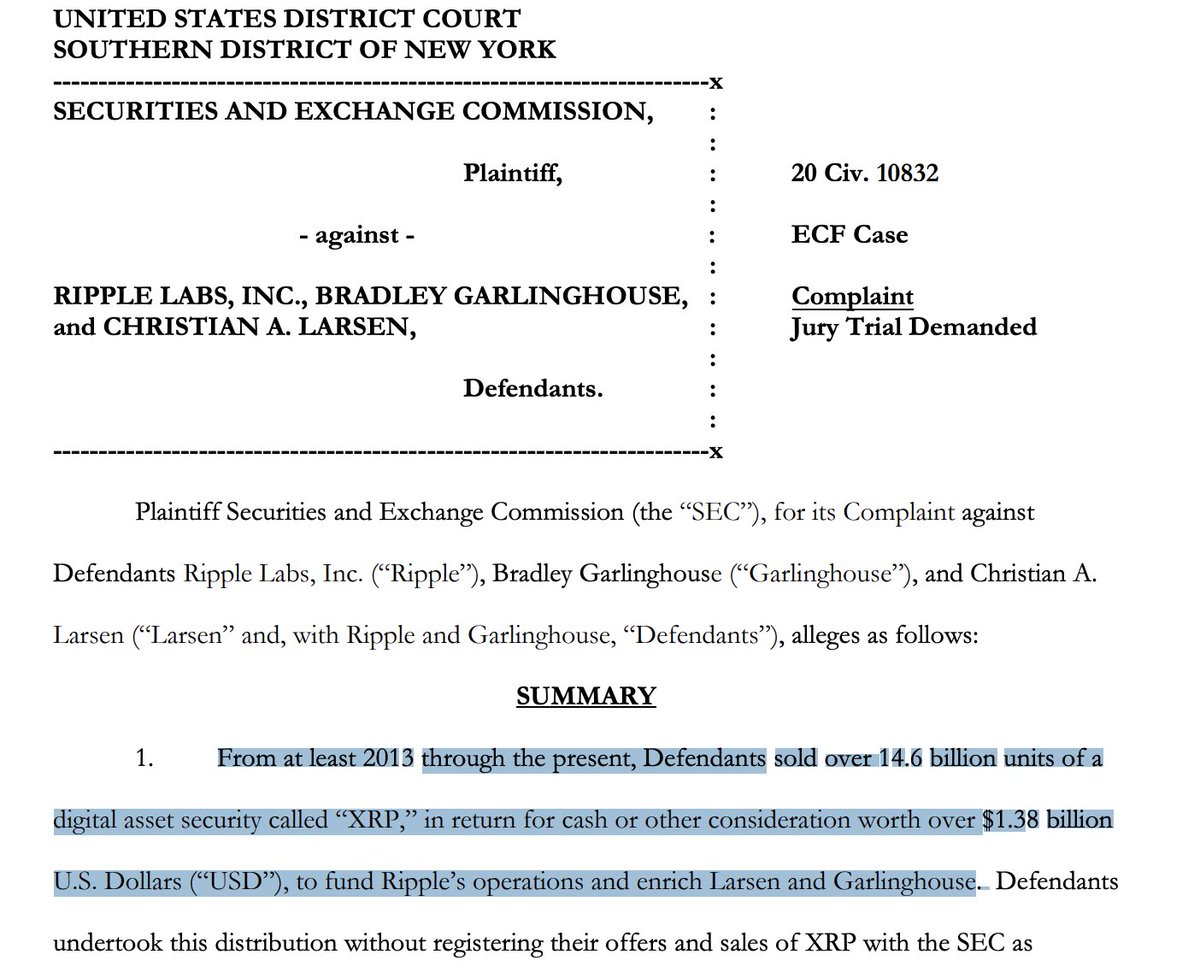

In response to the SEC's actions, Coinbase Legal Counsel Paul Grewal responded on Twitter: "The agency described the cryptocurrency XRP as a security on the first page of the complaint against Ripple. In the complaint, the agency referred to XRP as a "digital currency" Asset Securities".

Regarding the Ripple case, ABMedia previously provided a detailed explanation of the court documents and pointed out the crux of the matter and the reasons why XRP and other cryptocurrencies are not free from securities risks.