Solana (SOL) could have sparked a new rally after failing to break the local resistance level of $138 recently. Despite its strong performance last year, the market sentiment is changing and the $120 support level may not last long.

Solana's price action is under increased scrutiny as it approaches significant levels.

Solana faces new dangers

Solana is on the verge of forming a Death Cross, a bearish technical pattern where the 200-day exponential moving average (EMA) crosses above the 50-day EMA. If this happens, it could end the 11-month uptrend that began in October 2023.

The impending death cross is raising concerns among investors who have been bullish on Solana for nearly a year. A breakdown in the market structure could undo the gains SOL has made over this period.

Read more: 11 Solana Meme Coins to Watch in August 2024

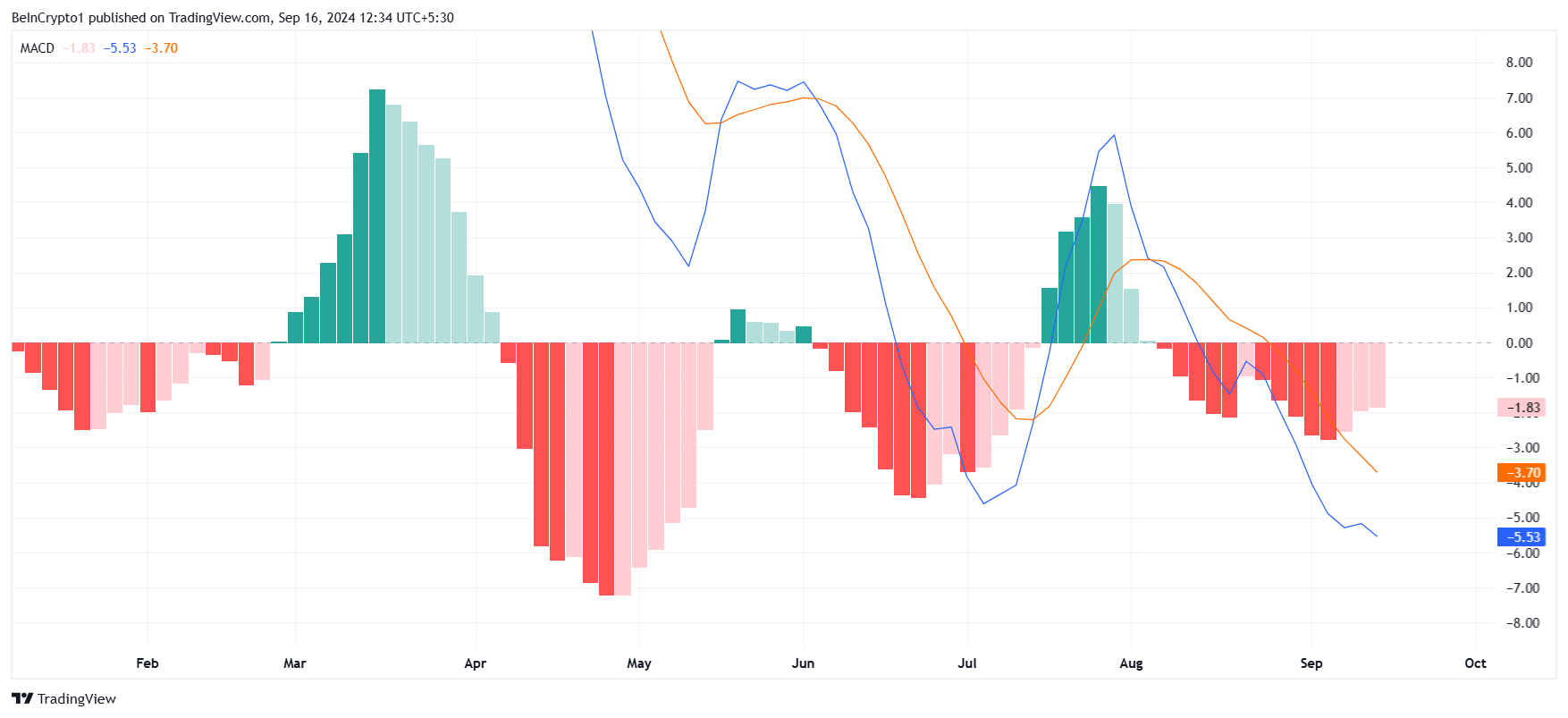

The macro view is bearish due to the possibility of a death cross, but the Moving Average Convergence Divergence (MACD) indicator provides a more detailed micro picture. On a short-term time frame, the MACD suggests that the bearish momentum may be weakening, which implies that Solana may bounce. The indicator shows a recovery near the $124 support level, providing hope for investors who are expecting a reversal.

If Solana can bounce back from the $124 level as it did in early September, it could prevent further losses. The MACD signal is uncertain for the long term, but there is room for optimism in the short term.

SOL Price Prediction: Finding the Way

Currently trading at $130 , Solana is eyeing a possible bounce from the $124 support level, similar to earlier this month. A drop below this level is unlikely in the near future, and even if it does happen, Solana has a significant safety net at $120.

Solana has been finding stability above $120 since March, with $138 currently being a key resistance level. A break above this level could see SOL continue its uptrend despite recent bearish concerns.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if a death cross occurs, Solana may face strong selling pressure, which could push the price below $120. This would invalidate the bullish-neutral hypothesis and result in significant losses.