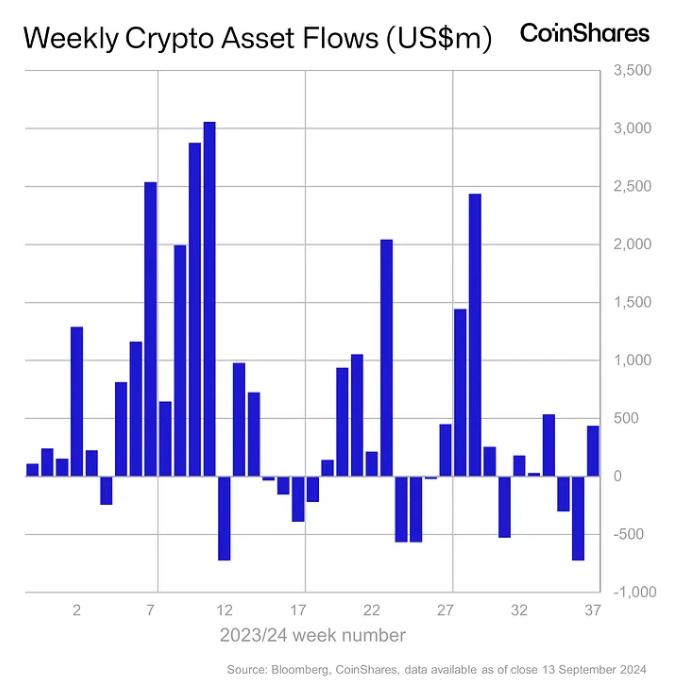

According to CoinShares, crypto funds at asset managers such as BlackRock, Bitwise, Fidelity, Grayscale, ProShares, and 21Shares returned to net inflows of $436 million globally last week, after two consecutive weeks of net outflows.

“We believe the increase in inflows over the weekend was due to a significant shift in market expectations for a 50 basis point rate cut on September 18,” CoinShares Head of Research James Butterfill wrote in a report on Monday, following comments from former New York Federal Reserve Bank President Bill Dudley last week.

However, volume remained steady for the week at $8 billion — well below the $14.2 billion Medium for 2024, Butterfill noted.

Weekly Cryptocurrency Flows | Source : CoinShares

Bitcoin -based funds once again led the flow, recovering and generating $436 million in weekly net inflows after a 10-day chain of $1.2 billion in net outflows. Short Bitcoin flows also reversed, recording $8.5 million in net outflows after three consecutive weeks of inflows.

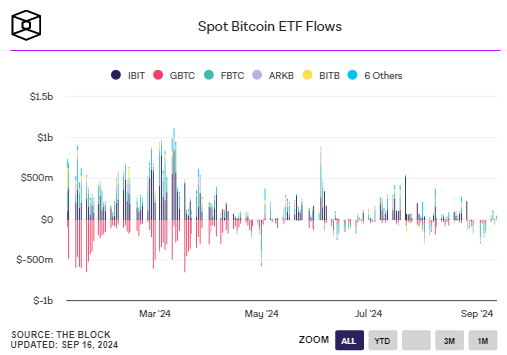

The U.S. market also dominated, with spot Bitcoin ETFs in the country accounting for $403.9 million in weekly net inflows. Funds in Switzerland and Germany also saw net inflows of $27 million and $10.6 million, respectively, while Canadian products saw net outflows of $18 million.

Source: The Block

Solana investment products also saw net inflows of $3.8 million last week — the fourth consecutive week.

However, Ethereum-based funds continued to struggle, generating another $19 million in net outflows last week, adding to the $98 million outflows the week before. According to TradingView, the ratio between BTC and ETH fell below 0.04 over the weekend for the first time since April 2021.

You can XEM the Bitcoin price here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Dinh Dinh

According to The Block