As Bitcoin (BTC) fluctuates in a range, crypto traders and investors are focusing on key U.S. economic events this week that could influence price and set trends.

Bitcoin continues to trade between the psychological $60,000 level and the $57,000 level. Despite September’s challenges, traders are hopeful that “Uptober” will bring better market conditions.

The US market is about to welcome Donald Trump's decentralized finance (DeFi) project, World Liberty Financial (WLFI), tomorrow morning (Vietnam time).

“Join us live on Twitter Spaces for the launch of World Liberty Financial, the project that captures the future of crypto, leaving behind the slow and outdated big banks,” Trump declared in a recent message on X.

However, three important US economic data releases this week could also impact crypto portfolios. With Bitcoin up nearly 7% in the past seven days, whether that momentum continues will depend on how the market reacts to these reports.

The U.S. Census Bureau-Commerce Department will release U.S. retail sales data on Tuesday, providing important insights into consumer spending trends, which account for the bulk of the U.S. economy.

In July, US retail sales unexpectedly rose 1% month-on-month, reversing a 0.2% decline in June and far exceeding economists' expectations for a 0.3% increase.

Consumer spending is a key driver of economic growth, so strong August retail sales figures should ease recession fears, signal a healthy economy and boost confidence in riskier assets like cryptocurrencies and stocks.

The Federal Open Market Committee (FOMC) will make its interest rate decision on Wednesday, after the release of the CPI and other key economic data. Analysts are certain that the Fed will cut interest rates as inflation cools.

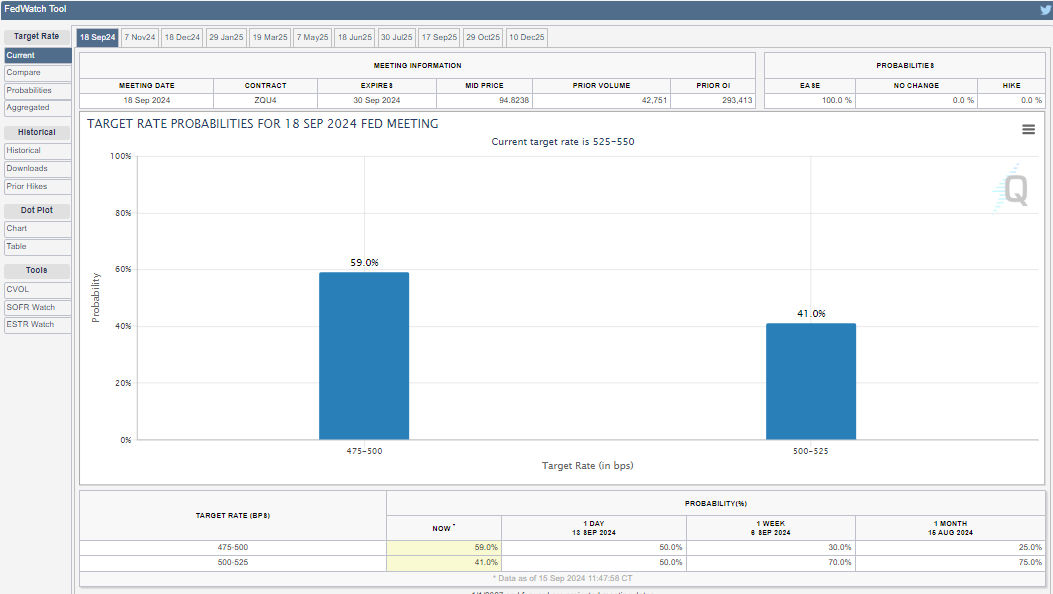

However, the size of the cut remains unclear, with market participants trying to figure out the Federal Reserve's preferred approach. According to the CME FedWatch Tool, there is a 59% chance of a 50 basis point (bps) rate cut and a 49% chance of a 25 bps cut.

Rate Cut Probability | Source: CME FedWatch Tool

The potential impact on Bitcoin and other risk assets will depend on what traders have priced in. A 50 bps cut could surprise investors, fueling market volatility. Conversely, a 25 bps cut would be in line with expectations, potentially prompting a more cautious Bitcoin reaction.

Notably, JPMorgan backed a 50 bps cut, despite the Fed's tighter monetary policy as inflation moves closer to its 2% target.

“We think there is good reason to accelerate the pace of rate cuts,” said Michael Feroli, U.S. economist at JPMorgan Chase.

However, the move could signal concerns about the economy, causing investors to shun riskier assets like Bitcoin. As such, most analysts expect a 25 basis point cut, as the current effective Fed Funds rate suggests that Fed policy has been quite tight.

“The current expectation is that the Fed will cut interest rates by 0.25%, which would be beneficial for financial assets like stocks and cryptocurrencies, as it reduces the cost of borrowing money,” Chia Mati Greenspan, CEO of Quantum Economics.

Following Wednesday’s rate decision, markets will be closely watching Fed Chairman Jerome Powell’s press conference for more details on future rate cuts. Based on current data and market sentiment, the Fed is likely to keep a soft landing for the rest of the year.

Initial jobless claims are also on the radar this week, providing insight into the current state of the labor market. Although the job market has softened, the unemployment rate remains relatively low.

The number of jobs fell sharply, in line with the normal market. The US economy reported that it added just 142,000 jobs in August, lower than expected.

However, the unemployment rate in August met forecasts at 4.2%, marking a slight improvement from the 4.3% recorded in July, indicating a decline in the unemployment rate.

Data due Thursday will reveal the latest developments in the U.S. labor market. While its impact may not be as direct or dramatic as other economic indicators, a rise in jobless claims could signal economic weakness. This could prompt some investors to turn to alternative assets, like cryptocurrencies, as a hedge against traditional markets.

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

According to BeInCrypto