TRX, the native coin of the Tron blockchain, has been in a downward trend since August 25. At the time of writing, it is trading at $0.14, a 13% drop in its value.

As the bearish outlook grows for the tenth-largest cryptocurrency by market cap, technical configurations suggest that TRX will continue its downtrend.

Tron Derivatives Traders Are Turning Attention

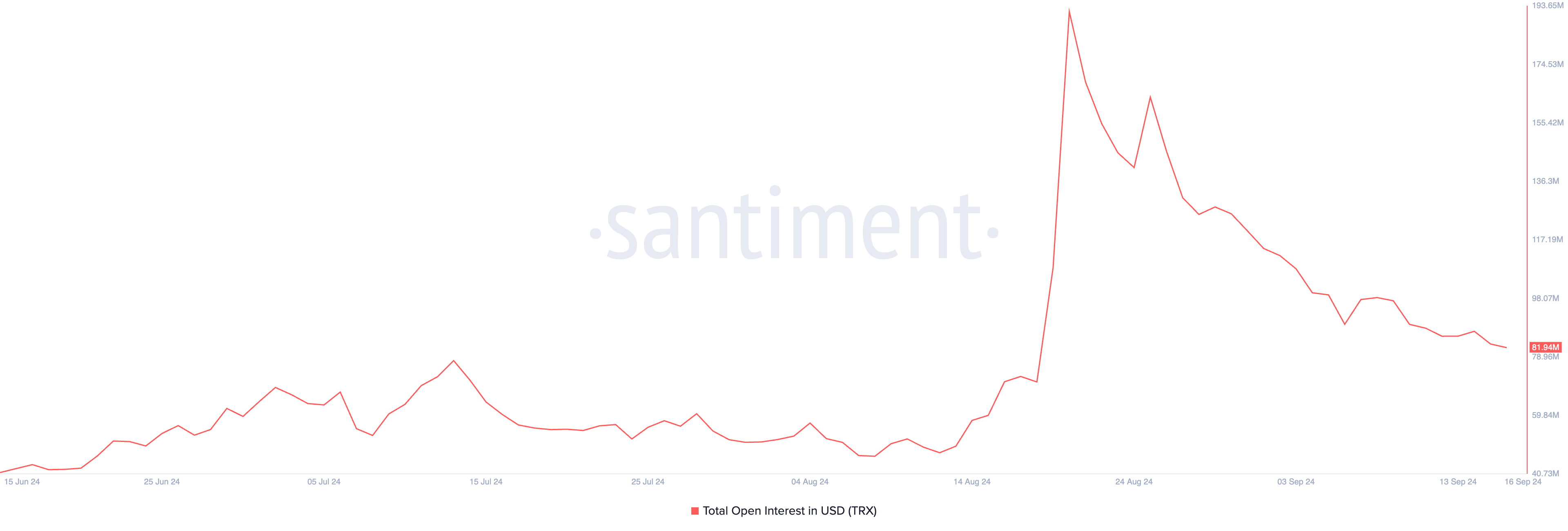

The decline in TRX derivatives market activity clearly indicates a decline in demand for this altcoin. After reaching a yearly high of $191 million on August 21, open interest, which represents the total number of open contracts, has been trending downward.

Current open interest stands at $82 million, down 57% since August 21.

A decline in the open interest of an asset often indicates a decline in trading activity or weakening investor interest. This reflects a loss of confidence in positive price momentum, even with TRX’s negative funding rate.

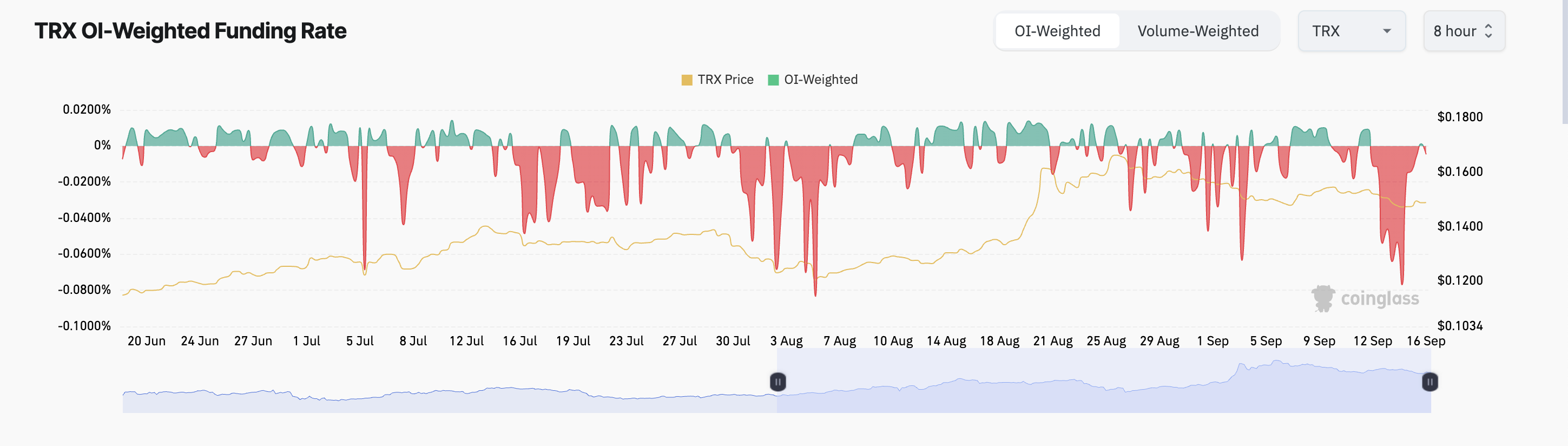

According to on-chain data, TRX’s funding rate has been mostly negative over the past month. The current funding rate is -0.0047%.

Read more: 7 Best Tron Wallets to Store TRX

A negative funding rate means that more traders are holding short positions, indicating that more traders expect the price of TRX to fall rather than rise.

TRX Price Prediction: Support Line Breaks, More Likely to Drop

The price decline of Tron since August 25 has led to the formation of a descending channel. This is a bearish pattern characterized by rising lows and falling lows. The upper line of the channel currently acts as a resistance level for TRX at $0.14, while the lower line also acts as a support level at $0.14.

Tron's Moving Average Convergence/Divergence (MACD) indicator measures trend direction and potential price reversals. Currently, TRX's MACD line (blue) is below the signal line (orange) and is trending towards the zero line.

When the MACD line crosses below the signal line, this indicates a weakening of short-term momentum. A further decline below the zero line confirms the downtrend, increasing the likelihood of a continued downtrend.

Read more: How to Buy TRON (TRX) and All You Need to Know

If demand for TRX continues to weaken, the price may break through the support level and fall to $0.13. However, if the market sentiment changes and demand for TRX strengthens, the price may break through the resistance level and target the recent high of $0.17.