The oracle network Chainlink has made significant progress in expanding its ecosystem in recent days. These developments have sparked renewed interest among long-term holders, who have begun moving their tokens in anticipation of a price increase.

However, LINK's weak price response in recent days suggests that it may have other plans.

Movements of long-term LINK holders

This week has seen a flurry of positive developments within the Chainlink ecosystem. According to BeinCrypto, the most notable announcement was on Tuesday that Chainlink Labs had partnered with Fireblocks . On Monday, Chainlink announced at SmartCON 2024 that its Cross-Chain Interoperability Protocol (CCIP) had officially launched on ZKsync's Era mainnet.

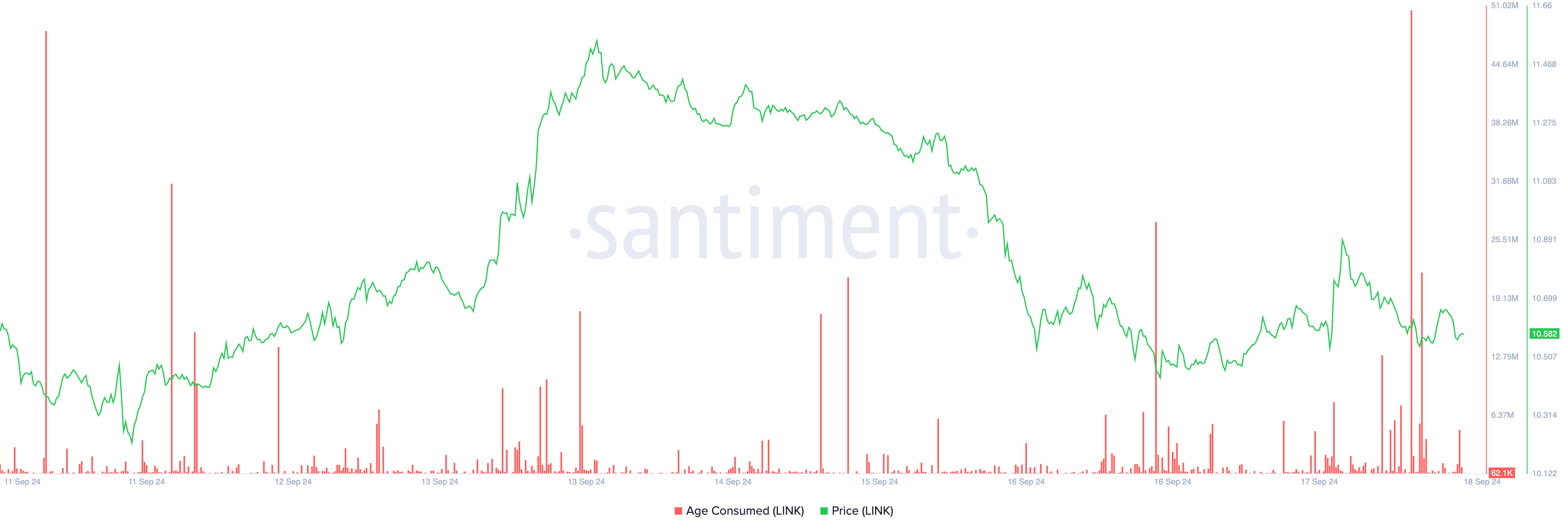

This development has prompted long-term LINK holders to move their previously dormant tokens in anticipation of a price increase. This is reflected in the sharp increase in LINK's age consumption indicator.

According to chain data, LINK's age burn, a metric that tracks the movement of long-held tokens, reached a seven-day high of 50.51 million on Wednesday morning. This surge occurs when long-term holders make rare moves, often signaling a shift in market trends.

This indicator is also a good indicator of local lows, often following a surge in Chainlink price after a surge in value. This situation also occurred with LINK, where the token price briefly surged to $10.63 after a surge in age consumption, before falling back to $10.58.

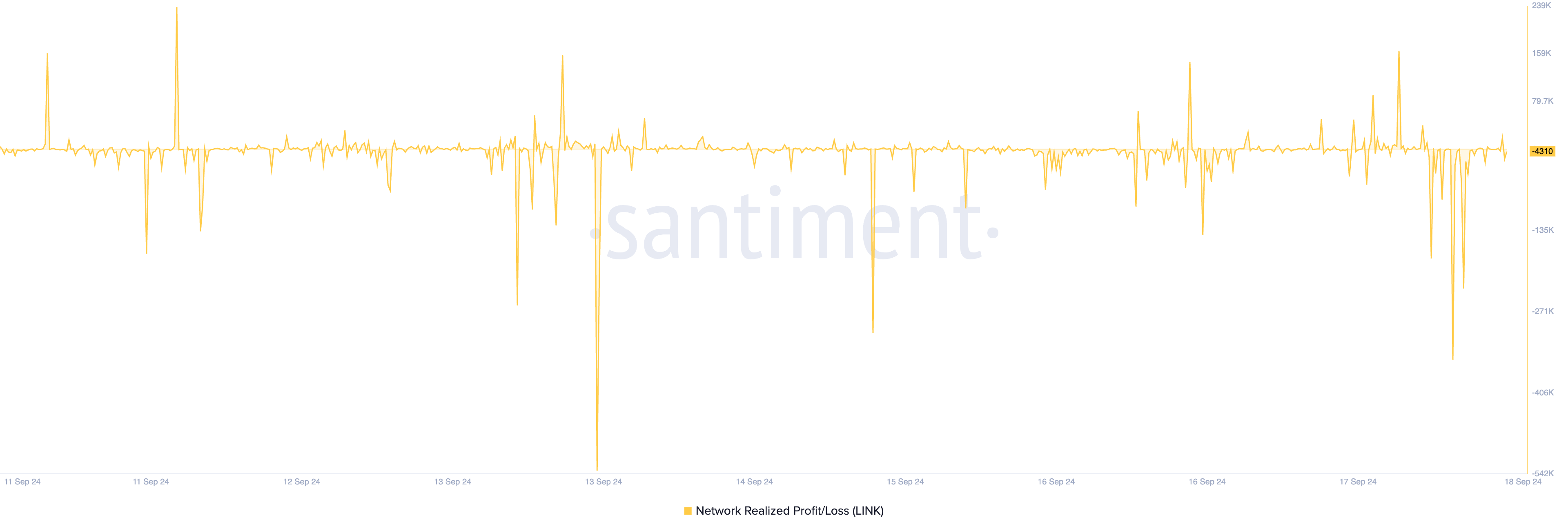

Furthermore, the token's network realized profit/loss is another metric to consider. This metric tracks the average profit or loss of all LINK tokens that change addresses daily, and it declined on Wednesday morning.

These declines typically signal a short-term surrender by the "weak hands" and a re-entry by the "smart money," marking a local price low and the beginning of a price recovery.

Chainlink Price Prediction : A Downtrend Is Likely to Increase

However, Chainlink's price recovery may be difficult in the short term. As reflected in the technical setup, the market is quite bearish on this altcoin.

LINK is currently trading at $10.58 per coin. This price is below the 20-day exponential moving average (EMA), which tracks the average price over the past 20 days. When an asset's price is trading below the 20-day EMA, the market is in a downtrend, and recent selling pressure has outpaced buying pressure.

If selling pressure intensifies, Chainlink's price could fall to $8.08 . This level was last seen on August 5th, when liquidations exceeded $1 billion.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

However, a change in market trends could push Chainlink's price above the $11.24 resistance level. A break above this level could lead to further increases to $13.73, which could pave the way for a move toward $17.22.