The history of Ethereum began more than a decade ago when Vitalik Buterin , a talented mathematician, came up with the idea of creating a more advanced version of blockchain than Bitcoin.

Frustrated with Bitcoin's limitations, Buterin believed that blockchain could become a more powerful platform that could serve not only as a monetary asset, but also as a “world computer” – hosting decentralized applications through smart contracts without requiring too much human intervention.

Ethereum is now the second largest Cryptoasset in the world, supporting a trillion-dollar ecosystem of dependent networks. It is the blockchain of choice for many of the world’s largest asset managers, as well as hundreds of thousands of daily users on L1 and millions on L2.

Here are 11 of the most important milestones in Ethereum history and some major upgrades to look forward to.

In his late teens, Buterin first learned about Bitcoin through his father , a Russian engineer who immigrated to Canada with his family.

Not having much money to invest in Bitcoin or mining operations, Buterin worked as a cryptocurrency blogger and was paid in BTC in the early 2010s.

Recognizing Buterin's talent as a leading "thinker" and author in the field, Mihai Alisie – a Bitcoin enthusiast from Romania – expressed his desire to collaborate with him and the two launched Bitcoin Magazine together in 2012.

First page of the Ethereum whitepaper | Source: Ethereum.org

And just a year later, at the age of 19, Buterin released the Ethereum whitepaper outlining a “next-generation smart contract and decentralized application platform,” with the simple goal of overcoming Bitcoin’s “limited capabilities.” Buterin Chia :

“Think about the difference between a calculator and a smartphone. A calculator can do arithmetic in a minute, and that’s all it can do. But in reality, people want to do a lot more. If you have a smartphone, you have a calculator app on it. You have a music player, you have a web browser, you have pretty much everything you need.”

He was then awarded $100,000 by the Peter Thiel Fellowship to start working on the Ethereum platform.

Before Ethereum became the “empire” it is today, it went through a number of difficulties and conflicts during its development, including the famous “Red Wedding” event of the year.

As Camila Russo chronicles in her book “The Infinite Machine,” the co-founders gathered in Zug, Switzerland on June 7, 2014 to sign a document agreeing to convert Ethereum into a for-profit company.

But instead of signing a contract, things started to spiral out of control as tensions over Charles Hoskinson's management style, Amir Chetrit's contributions to the project, and Ethereum's future direction came to a head.

The decision on Ethereum's direction fell to Buterin, who acted to oust Hoskinson (who later created Cardano ) and Chetrit and establish Ethereum as a non-profit organization instead of a company.

“We had certain disagreements, and unfortunately they became a stain,” Chia JOE Lubin, co-founder of Ethereum.

Ethereum's next big step was raising Capital and gaining widespread public awareness in an ICO in 2014, selling millions of dollars in ETH to fund project development.

Between July 22 and September 2, 2014, Ethereum saw investors purchase over $18 million worth of ETH, paid for in BTC.

The Ethereum blockchain and its native Token ETH were officially launched on July 30, 2015.

ETH hit the market at $0.31 per ETH Token , marking an impressive return of around 1,000,000% for anyone lucky enough to hold ETH until today when the Token is priced at $2,332.

And it's rumored that JOE Lubin – co-founder of Ethereum and ConsenSys – has invested more in ICOs than anyone else.

Arguably, the infamous hack of The DAO – an attack in which hackers stole over 3.6 million ETH from The Decentralized Autonomous Organization – was a “revolutionary” event in Ethereum’s history .

The attack sent shockwaves through the market, sending ETH prices plunging from $20 to $9 in less than 36 hours.

After the attack, the Ethereum community Chia into two main factions: One wanted to continue operations as normal, while the other wanted to restore the network to its pre-attack state to fix the problem.

At that time, debates were rife over whether blockchains should be immutable records, with ‘code is law’, or whether their leaders could simply change history to erase unpleasant events. To this day, questions remain about whether Ethereum is on the right track.

Ultimately, the majority of the Ethereum community voted in favor of a “Hard Fork” of the network to restore the blockchain and recover assets lost in the mining attack.

One of the notable Hard Fork was the PoS blockchain that has helped maintain the Ethereum name to this day, while the “original version” of Ethereum – Ethereum Classic – is still a PoW blockchain.

One of the strangest things to ever happen to Ethereum was the birth of the CryptoKitties Non-Fungible Token collectible.

Launched in October 2017 by Vancouver-based studio Axiom Zen, CryptoKitties was designed as a serious experiment with blockchain technology, allowing users to collect and breed a variety of Non-Fungible Token .

By early December, CryptoKitties had gone viral, pushing the value of Non Fungible Tokens to $170,000. The demand and activity around CryptoKitties surged to the point where it clogged the Ethereum network, causing transaction fees to skyrocket.

CryptoKitties are now selling for an incredibly low price – just 0.002 ETH | Source: CryptoKitties

In response to the sudden outage, a talented team of Ethereum developers from MetaMask and Infura came together to implement rapid optimizations and find long-term scaling solutions for the network.

While there are still mixed opinions about the quality and value of the CryptoKitties project, we cannot deny the huge impact it has had on the growth of the Ethereum network or contributed to the Non-Fungible Token boom.

The summer of 2020, affectionately referred to by crypto enthusiasts as the “ DeFi summer,” marked a turning point in crypto history, as Ethereum suddenly became the cradle for a whole new type of financial activity.

New users flocked to the Ethereum network, eager to experiment with the hundreds of new protocols that were popping up across the network. This sparked an explosion in borrowing, lending, and trading digital assets across hundreds of protocols, many of which now form the backbone of today’s multibillion-dollar DeFi sector. Much of this activity was driven by “yield farmers” who were rewarded with Token for their activity. This was either a genius idea for accelerating financial cycles or an unsustainable Ponzinomic scheme.

Major Ethereum-based DeFi protocols that have flourished during the DeFi summer, including AAVE and Compound, now have tens of billions of dollars in total locked value and hundreds of millions of dollars in daily volume .

There has also been an explosion of food-themed DeFi projects, most notably SushiSwap, which Fork Uniswap and became infamous for its “vampire attack” to attract liquidation and users. After Chef Nomi withdrew $14 million from SUSHI, he handed over control of the decentralized exchange to up-and-coming young investor Sam Bankman-Fried.

AAVE boasts $13 billion TVL and $168 million daily volume as of August 9 | Source: defillama

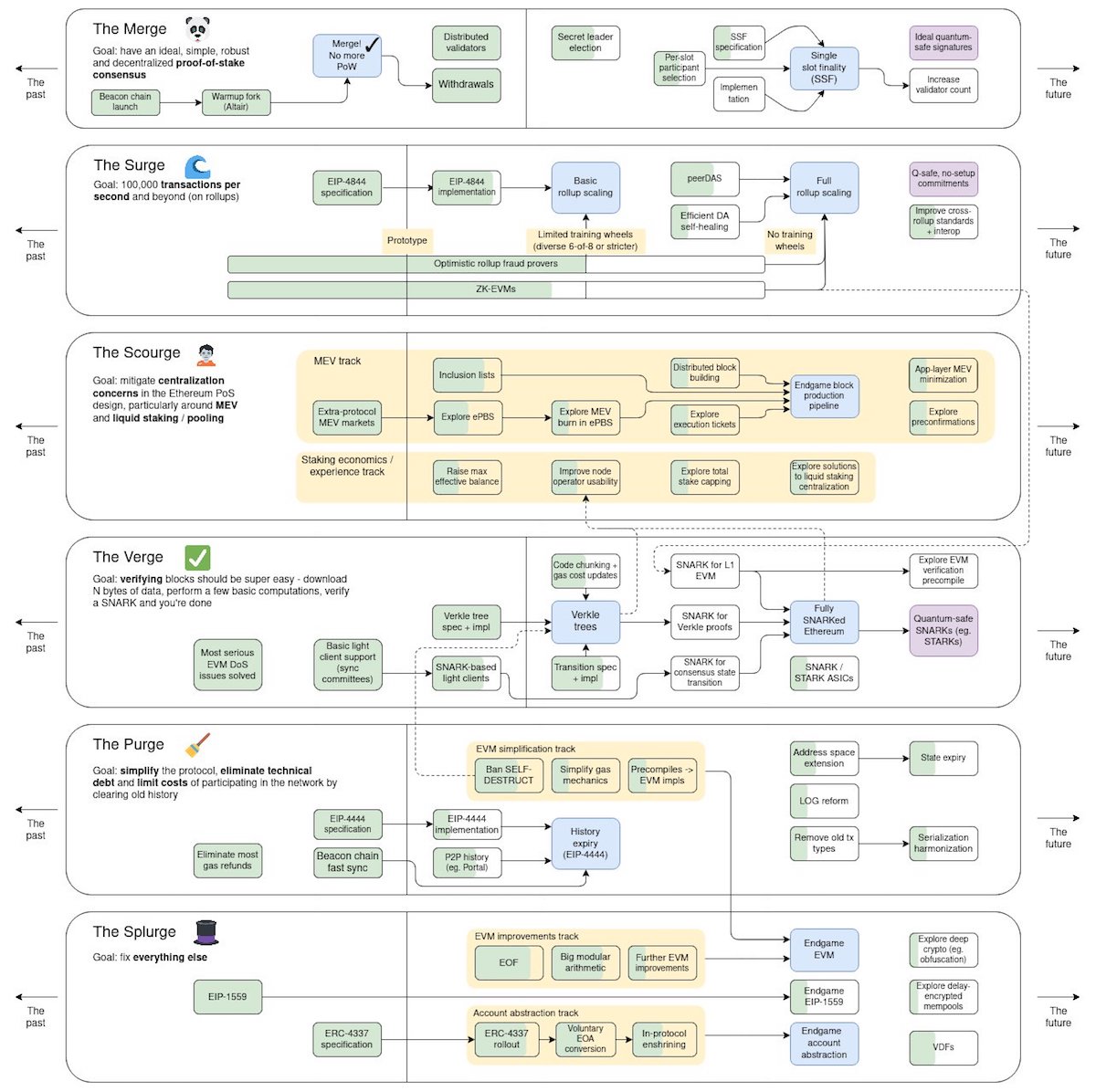

According to Ethereum developer Marius van der Wijden, one of the best things about Ethereum is its flexible development roadmap.

He Chia that the community is constantly “debating what to do and what to prioritize next,” which is important to maintain Ethereum’s decentralization and avoid hijacking.

This flexibility was demonstrated in October 2020 when Buterin abandoned the long-standing ETH 2.0 roadmap, which planned to scale Ethereum in a unified way using OG Shard – which looks like 64 Ethereum blockchains running together.

But Buterin abandoned this form of Shard (later implemented by projects like Near) because an alternative began to emerge in the form of Optimistic- and ZK-rollup projects, Layer 2 projects that take execution and computation off the mainnet but still inherit the security of the mainnet.

When research and development showed that this would be a viable path to scale, he announced a new “rollup-focused roadmap.”

The new rollup roadmap ensures that the Ethereum network will be forged into an optimal base-layer blockchain with the majority of scalability and testing taking place through Layer 2 networks, such as Polygon , Optimism , and Arbitrum. Optimistic Rollup are seen as a faster implementation solution, with ZK-rollups seen as the likely endgame.

“They’re leveraging a lot of the technological discoveries that we have today that we didn’t have 10 years ago. For example, data availability sampling… didn’t exist before 2017 – 2017 is when I published my first paper on it. Optimistic solutions and ZK-rollups didn’t really exist before around 2019,” Buterin Chia at the 2022 press conference at ETH Seoul.

Van der Wijden said the Merge event was what he considered the “most important” moment in the history of the Ethereum network.

The Merger is scheduled to be completed on September 15, 2022, marking a transition from the energy-intensive PoW consensus mechanism to the more environmentally friendly PoS mechanism.

“It was a huge effort by many people, all working together for a common goal. I am very happy that we did it. After seeing some of the numbers on electricity, CO2 consumption and e-waste, I am proud to be a part of it.”

The Merge has helped reduce Ethereum's energy consumption by 99% and brought about a major change in the network's Token mechanism.

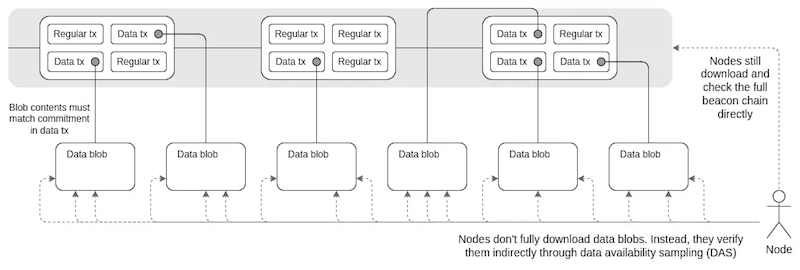

The next major step for Ethereum comes on March 13, 2024, when the Dencun upgrade is deployed to the network.

The Dencun upgrade introduced a set of nine different EIP , the most notable of which is EIP-4844.

EIP-4844 introduced proto-danksharding technology, which uses “blobs” – a mechanism that allows for separate and temporary storage of transaction data, to significantly reduce the fees paid for Block data on the Ethereum Layer 2 network.

How blobs work in storing transaction call data | Source: Ethereum.org

Dencun has seen a sharp drop in transaction execution costs on Ethereum Layer 2 networks like Arbitrum and Optimism; however, the side effect is that the total amount of ETH fees burned on the mainnet has also dropped significantly.

Matan Si, a contributor at eOracle, Chia that Ethereum's most important development since The Merge is the expansion of rollup and Layer 2 solutions.

“What excites me most about the future of Ethereum is the potential to bridge the gap between these execution layers and the real world. Connecting on-chain operations with off-chain data and computation will open up countless new use cases.”

One of Ethereum's most important milestones came on March 20, when asset management giant BlackRock launched its Tokenize fund on the Ethereum network.

Called the BlackRock USD Institutional Digital Liquidity Fund (BUIDL), this money market fund is fully backed by cash and US Treasury bonds, and offers investors returns paid daily to Token holders.

The move is seen as a strong endorsement of the reliability of the Ethereum network from the world's largest asset management firm.

According to data from rwa.xyz, the BUIDL fund currently has a market Capital of $517 million and has seen over $116 million in volume over the past month.

BlackRock's BUIDL Fund touts over $517 million in assets | Source: rwa.xyz

BlackRock CEO Larry Fink said that although he was initially “anti-crypto,” he has changed his mind and sees cryptocurrencies, especially Ether and Bitcoin, as an emerging asset class.

“For the last two years, I have been a big believer in ETH,” Fink Chia CNBC on Jan. 12.

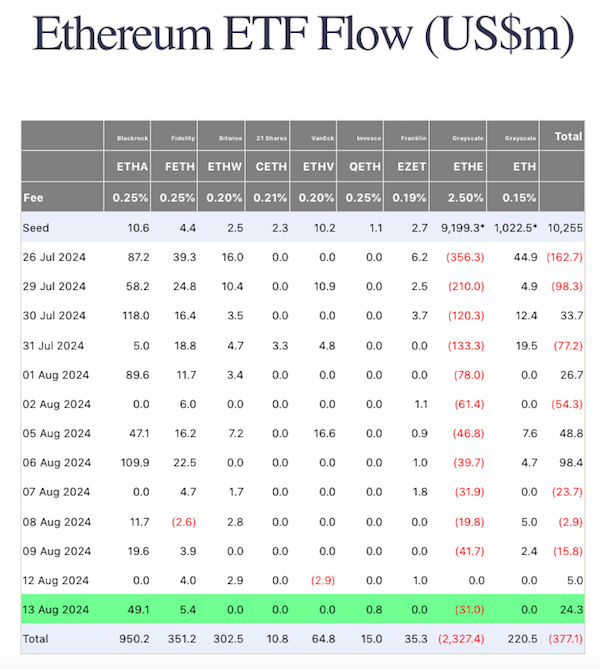

Approved by the SEC on May 23, the list of nine spot Ethereum ETFs was officially launched on July 23.

The launch of spot ETFs marks the first major step in the adoption of ETH as an institutional-grade asset.

Similar to BTC ETFs, this launch was relatively quiet as investors dumped their holdings in Grayscale, which charges 10 times more than other ETFs for the Grayscale Ethereum Trust (ETHE).

As of press time, the funds had seen net outflows of $390 million; however, ETHE inflows are slowing, and Nate Geraci, president of the ETF shop, said three weeks of inflows into BlackRock’s ETHA helped make it the sixth most successful ETF launched this year.

ETH ETF Cash Flows | Source: FarSide Investors

The next major step on the roadmap is the Pectra upgrade, which van der Wijden says will include “a series of upgrades” to the Ethereum Arm Virtual Machine that will enable new use cases, such as Trustless staking pools, and make life easier for developers.

Following Pectra is Verkle , or Verge as Vitalik calls it.

“With Verkle, we change the way we store state – all the accounts, balances, contracts – so it's easier to prove your balance is x at Block y.”

Van der Wijden describes the Purge as exactly that: a series of new upgrades that involve removing old functionality that is no longer useful to the network.

Van der Wijden explains:

“When Ethereum started, developers made a bunch of assumptions about how things would work, and many of them were correct, but some didn't turn out the way they expected.”

Latest Ethereum Roadmap | Source: Vitalik Buterin/X

“So we will gradually clean up some unused ‘paths’, like disabling Selfdestruct (already done in the last upgrade) or in the future, removing bloomfilters in receipts (this will help sync a node faster).”

At the highest level, Splurge is also somewhat understandable in that it includes new features that the Ethereum community is willing to “pay for.”

“They contain some of the changes mentioned above that make Ethereum easier to use and more beautiful. These changes will likely be rolled out along with other upgrades if we feel there is enough space in an upcoming Hard Fork .”

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Itadori

According to Cointelegraph