Bitcoin surged above $62,000 after the US Federal Reserve's decision to cut interest rates.

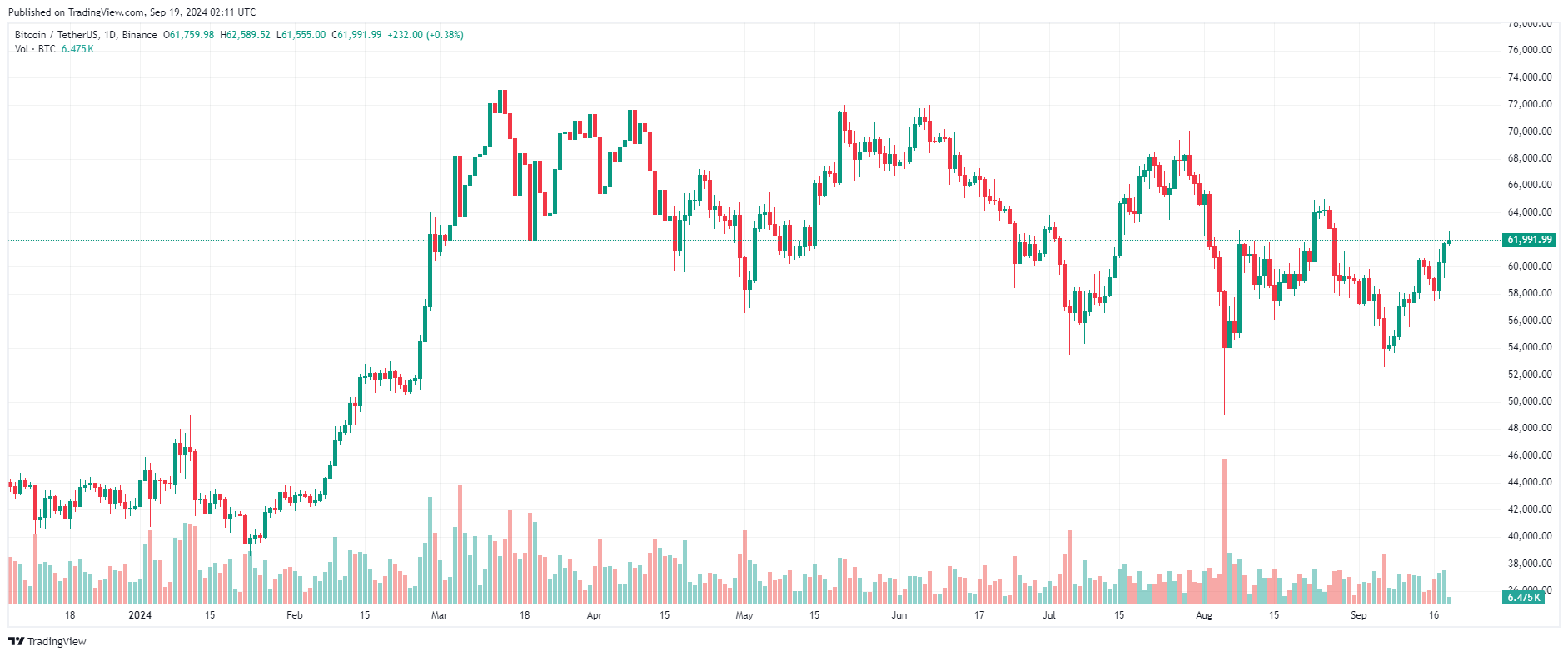

BTC Price Chart – 1 Day | Source: TradingView

US stock futures rose overnight on Wednesday as traders digested the Federal Reserve's decision to cut interest rates by half a percentage point.

Dow Jones futures rose 166 points, or 0.4%. Futures linked to the S&P 500 rose about 0.6%, while Nasdaq 100 futures rose 0.9%.

The U.S. central bank cut its benchmark lending rate to a range of 4.75% to 5.00% from 5.25% to 5.50% on Wednesday, surprising some investors who criticized the size of the initial cut. It was the Fed's first rate cut in four years.

After wavering, stocks eventually closed lower on Wednesday. Both the S&P 500 and the Dow 30 initially rose to new record highs shortly after the Fed announced its decision to cut interest rates.

Tom Porcelli, economist at PGIM Fixed Income, attributed Wednesday's market decline to Powell's emphasis that this 50 basis point rate cut does not set a precedent for further rate cuts.

On the reporting front, Darden Restaurants, shipping giant FedEx and homebuilder Lennar are all due to report results on Thursday. Traders will also be paying attention to August existing home sales and the latest weekly jobless claims.

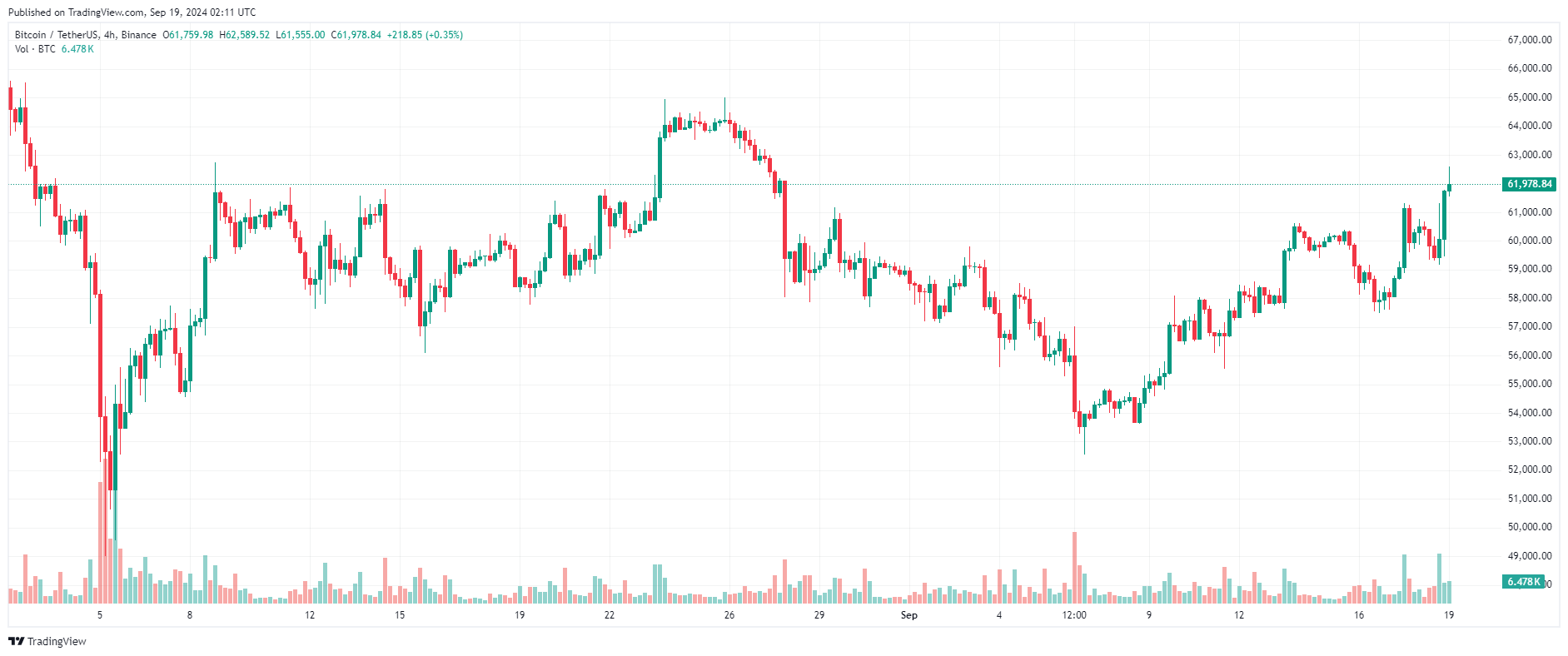

Bitcoin surged to the $62,000 region, hitting a local peak of $62,589, its highest level since August 27, after the US Federal Reserve (Fed) decided to cut interest rates by 0.5 percentage points. This is the agency's first rate cut in 4 years of implementing a policy of tightening the economy to deal with inflation.

The top asset also closed the daily candle above the $61,000 region, its highest close in September.

Currently, BTC is still trading around $62,000 with an increase of more than 3% in the past 24 hours.

BTC Price Chart – 4 Hours | Source: TradingView

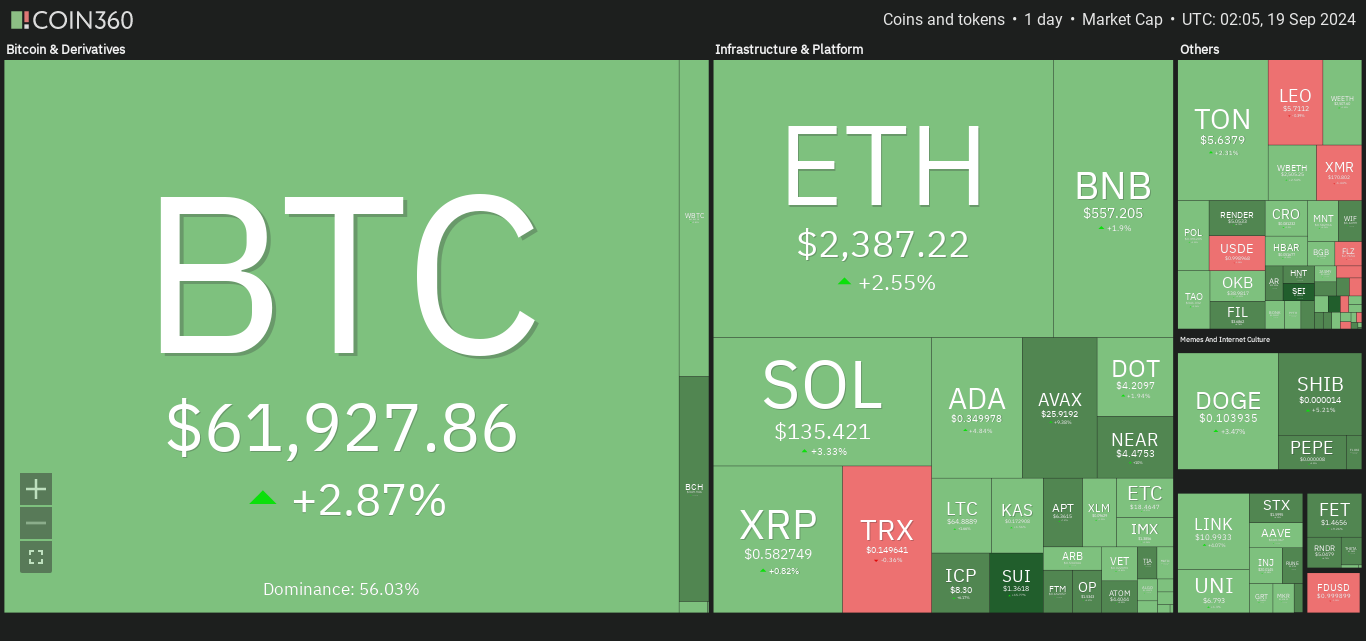

Altcoin market bounced back strongly yesterday.

Popcat (POPCAT) and Sei (Sei) are the two projects with the most outstanding performance when simultaneously recording profits of over 20%.

Sui (Sui), Fantom (FTM) , Celestia ( TIA ), NEAR Protocol ( NEAR ), Bitcoin Cash (BCH), Helium (HNT) followed with growth of over 10%.

Other major projects such as Artificial Superintelligence Alliance (FET), Avalanche (AVAX), Mantra (OM), THORChain (RUNE), Beam (BEAM), Wormhole (W), Akash Network (AKT), Ondo (ONDO), Aptos (APT), Filecoin (FIL), Render (RNDR), Theta Network (THETA), Arweave (AR), Stacks (STX)… climbed from 6-9%.

Source: Coin360

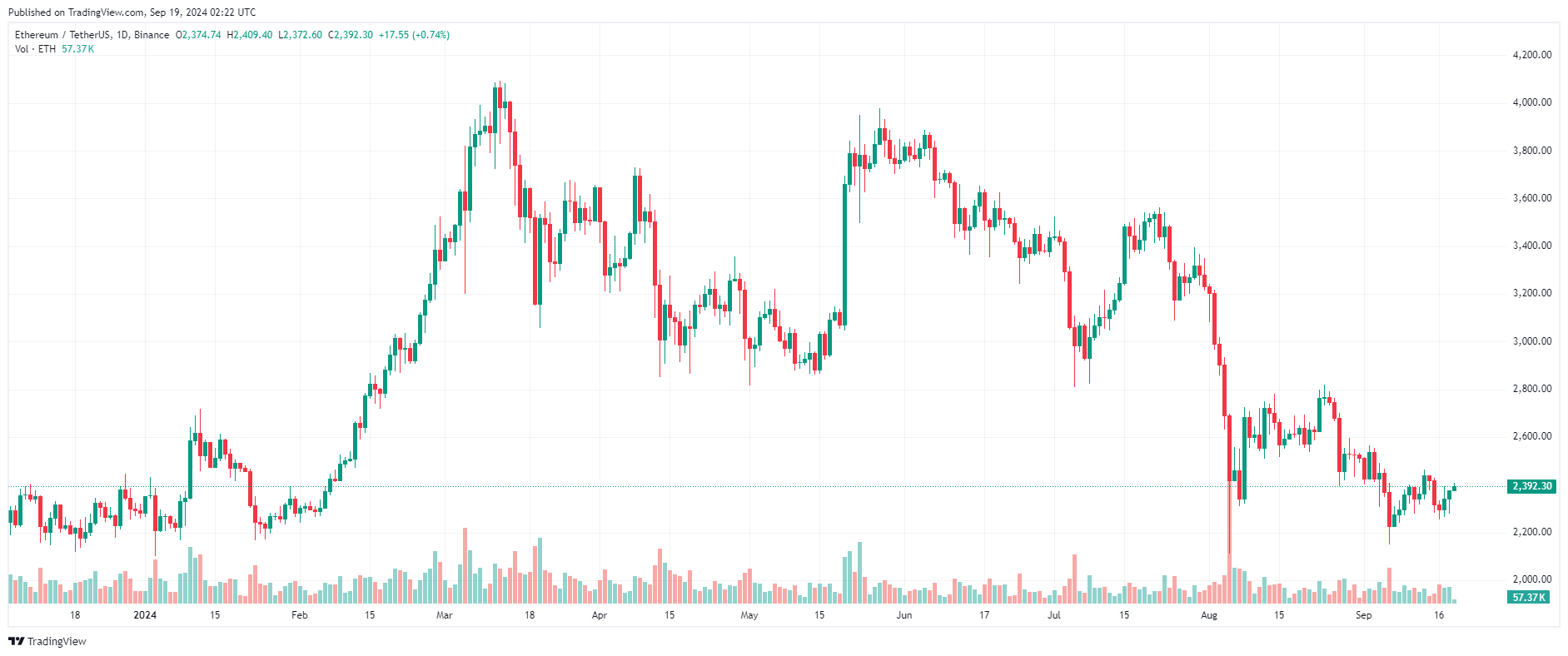

Along with the general bullish momentum of the market, Ethereum (ETH) also bounced to approach the $2,400 threshold.

However, ETH has yet to surpass this mark, with the price fluctuating around $2,389, up nearly 3% over the past 24 hours.

ETH Price Chart – 1 Day | Source: TradingView

You can XEM coin prices here.

The "Coin Price Today" section will be updated at 9:30 every day with general news about the market, we invite you to follow.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

Bitcoin Magazine