Bitcoin jumped nearly 6% after the world’s largest asset manager released a white paper highlighting the digital asset’s potential as a hedge against currency and geopolitical risks.

BlackRock has released a Bitcoin whitepaper to investors, calling it a “unique diversification tool” separate from traditional financial and geopolitical risks.

Bitcoin price bottomed Dip just before Bloomberg senior ETF analyst Eric Balchunas Chia the nine-page whitepaper in a September 18 post on X.

Bitcoin: A Unique Diversifier, BlackRock | Source: Eric Balchunas

Balchunas Chia BlackRock’s report at 11:21 p.m. ET, nearly an hour after Bitcoin began rising from its daily Dip around $59,354.

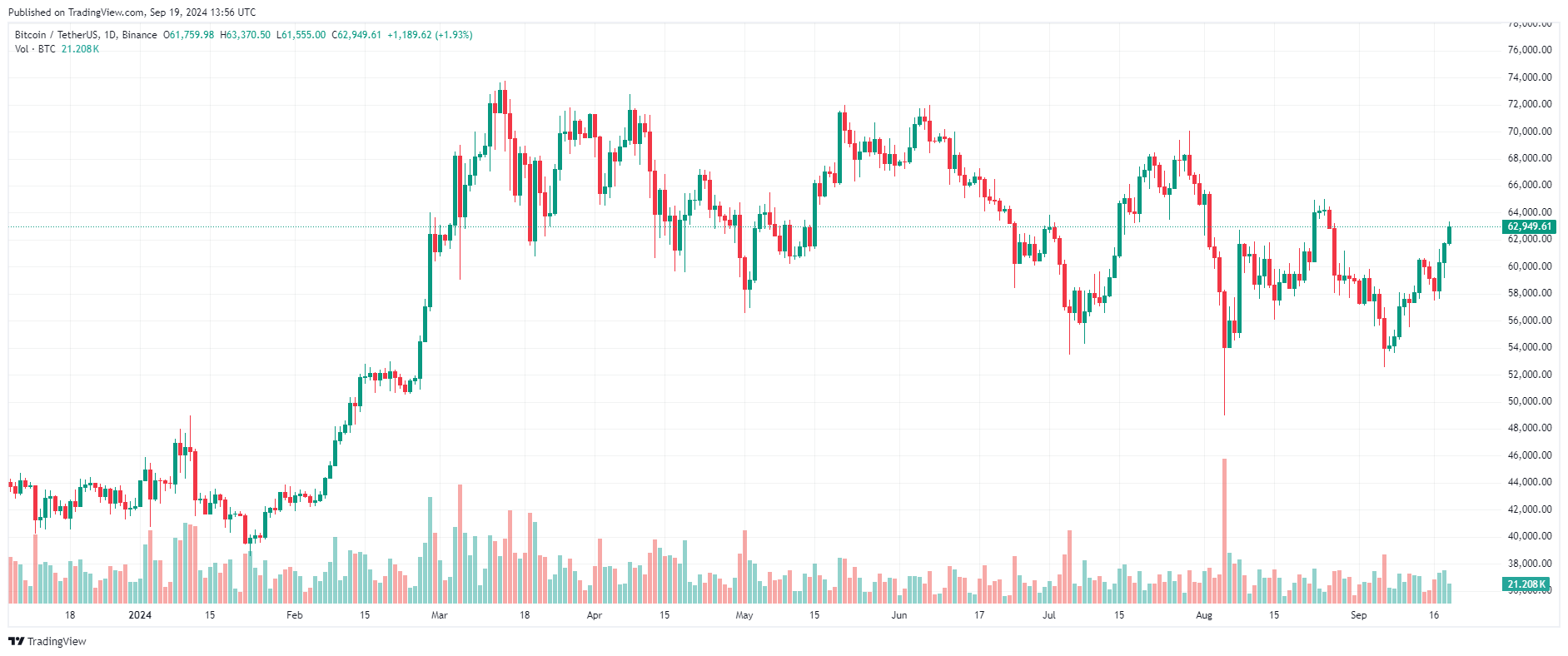

Data shows Bitcoin has rallied more than 6% since then to reclaim $63,000 after more than three weeks.

BTC/USD 1-day chart | Source: TradingView

Based on historical chart patterns and Bitcoin's Medium monthly returns in the fourth quarter of the year, some analysts predict Bitcoin will surge to $92,000 in three months, possibly starting in October.

BlackRock's whitepaper notes that Bitcoin's decentralized, permissionless nature makes it the world's first “truly open monetary system,” not just a cryptocurrency.

The asset management firm also praised Bitcoin for having “no counterparty risk” or reliance on centralized systems.

“These characteristics make it an asset class that is largely insulated from a number of important macro risks, including systemic banking crises, sovereign debt crises, currency devaluations, geopolitical disruptions, and other country-specific political and economic risks.”

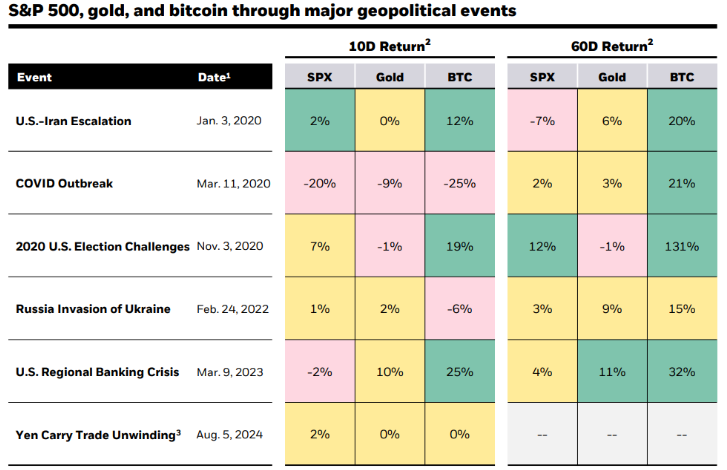

To highlight Bitcoin’s resilience, the asset management giant Chia a chart showing how the flagship asset’s returns have outperformed the S&P 500 and gold prices during previous major geopolitical events.

Bitcoin, S&P 500, gold, through geopolitical crises | Source: BlackRock

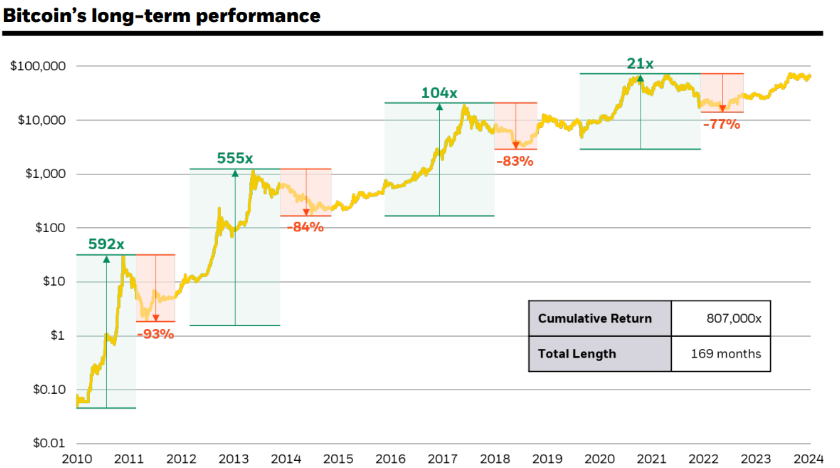

According to BlackRock's whitepaper, the path to Bitcoin adoption will be driven by macroeconomic concerns.

“In the long term, Bitcoin adoption trajectory is likely to be driven by concerns about global currency instability, geopolitical discord, financial sustainability, and US political stability.”

Bitcoin Long-Term Performance | Source: BlackRock

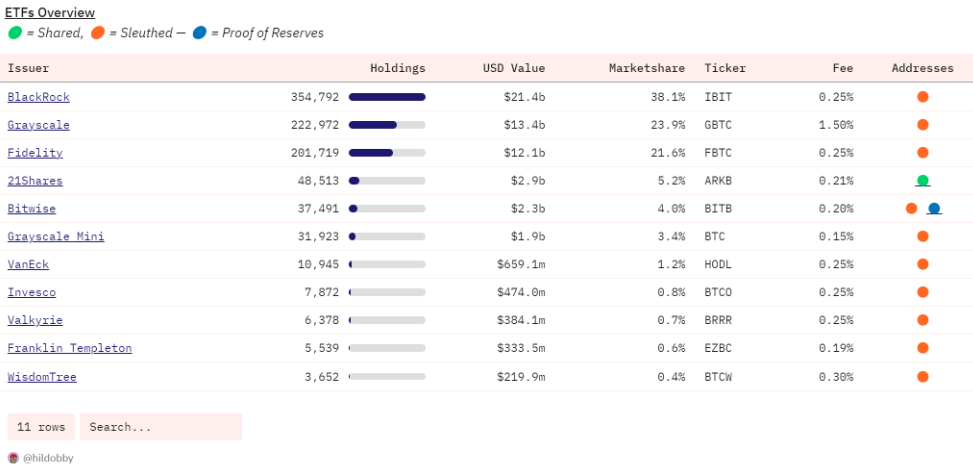

According to Dune data, BlackRock is the world's largest Bitcoin ETF issuer, holding over $21.4 billion in BTC, accounting for over 38% of the Bitcoin ETF market.

Overview of ETF Issuers | Source: Dune

You can XEM coin prices here.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Viet Cuong

According to Cointelegraph