The Federal Reserve has cut interest rates by 50bp, which provides favorable liquidity conditions for Bitcoin prices to rise. However, such a large cut is risky, and cryptocurrency profits are not guaranteed.

Global liquidity is likely to increase, but that doesn’t mean Bitcoin inflows will occur.

Interest Rate Cuts, Global Liquidity, and Bitcoin

The Federal Reserve has decided to cut interest rates by 50bp, and the price of Bitcoin is skyrocketing . Given this situation and the overall trend of the market, many community members are expecting a Bitcoin bull market .

But interest rate cuts alone won’t guarantee these favorable market conditions, and other factors are important. The key to understanding all of this is global liquidity.

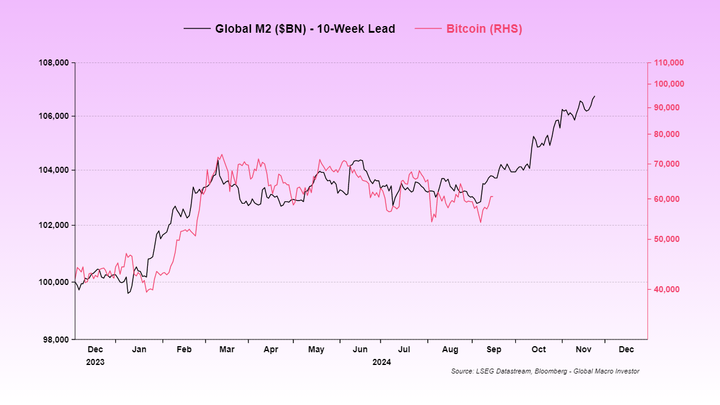

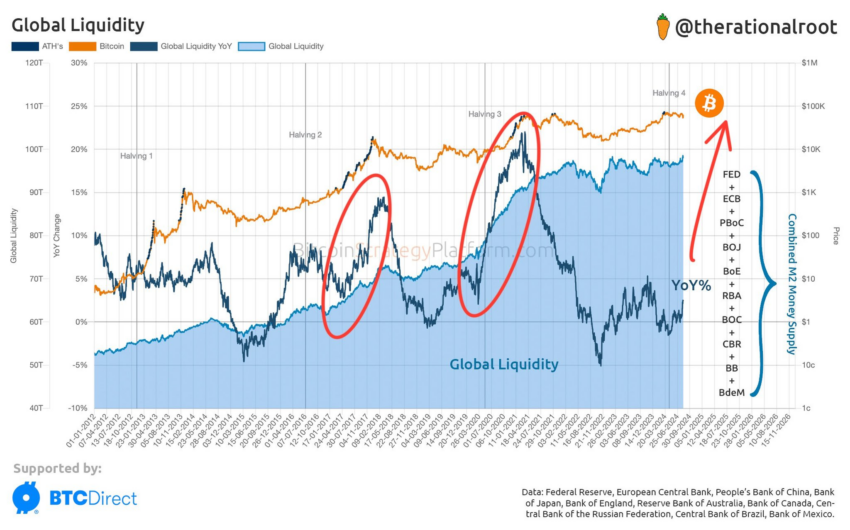

At first glance, Bitcoin’s price seemed to be going heavy for a few weeks. But a closer look shows that it’s actually getting closer than it was before. Raoul Pal, CEO and founder of Global Macro Investor, said the correlation is “very close” through 2024.

When compared to data on global liquidity (L2) and Bitcoin price from previous years, the closeness this year is striking.

In an exclusive interview with BeInCrypto, Adrian Fritz, Head of Research at 21Shares, explains the relationship between cuts and liquidity.

“The upcoming Fed rate cut could result in short-term Bitcoin price volatility. However, the magnitude of the cut will play a key role in shaping market reactions. A more aggressive 50bps cut could provide short-term liquidity relief,” he added.

“More aggressive” rate cuts have been made , and Bitcoin has already responded accordingly. The dollar is the global reserve currency, and US rate cuts have an established impact on liquidity and market risk. Cryptocurrencies provide a valuable liquidity store for international markets, and this dynamic continues to grow.

WeRate co-founder Quinten Francois points out that there is a trend towards a surge in liquidity, and Bitcoin is sure to benefit from it. Seems simple, right?

Read more: Bitcoin Halving History: Everything You Need to Know

Trends pointing to a surge in liquidity in 2024. Source: Quinten Francois

Volatile Market Risks

Rob Viglione, CEO of Horizen Labs, also discussed these dynamics with BeInCrypto. Like Fritz, he expects a 25bp rate cut.

“A 25bp cut is generally expected, so we don’t see a huge price action, but in the short term, the direction is positive as investors move to more volatile assets. In the long term, lower interest rates will continue to favor riskier assets like Bitcoin. Investors will seek higher yields outside of traditional investments,” Viglione argued.

But both men underestimated the extent of the cuts. Viglione said there would be no major price changes in the 25-point scenario, but the cuts would be much more severe.

In other words, the market may be ready for a big run. But there may also be risks between Bitcoin and big success.

“A 50bp cut could also heighten concerns about deeper economic challenges or the risk of an impending recession. This could trigger a price pullback, especially considering Bitcoin’s recent failure to break $60,000 and the historically poor performance of both Bitcoin and the broader market in September,” Fritz concluded.

Fortunately, Bitcoin has already surpassed $60,000 . Bitcoin can be considered a risky asset, and low interest rates are favorable for such assets. All conditions currently seem reasonable to expect a price increase, provided investor confidence remains high. No one knows the future, but we may see $100,000 Bitcoin sooner than we think.