Binance Coin (BNB) holders have been waiting for months for the altcoin to recover to $600, and with the current high demand, this goal may be reached soon.

But sentiment turned bearish among futures traders as bearish bets began to mount.

Binance Coin, Short Selling Demand Increases

The price of Binance Coin has risen by 3% in the last 24 hours , reflecting the overall market rally following the first rate cut by the U.S. Federal Reserve .

Since the beginning of the month, demand for BNB has skyrocketed, with the current price at $557.11, up 14% over the past 13 days. However, futures traders are skeptical about the sustainability of the uptrend, with many opting for short selling.

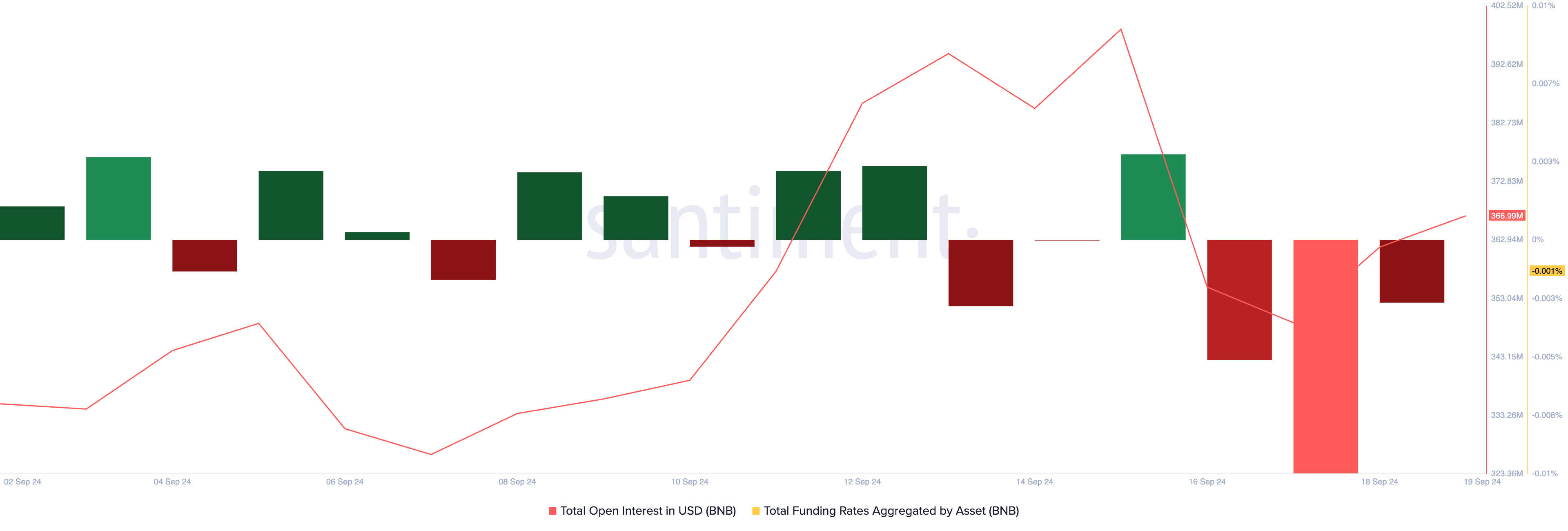

According to Santiment, BNB’s funding rate has been negative for the past three days and is currently at -0.001%.

Read more: How to Trade Cryptocurrency on Binance Futures: Everything You Need to Know

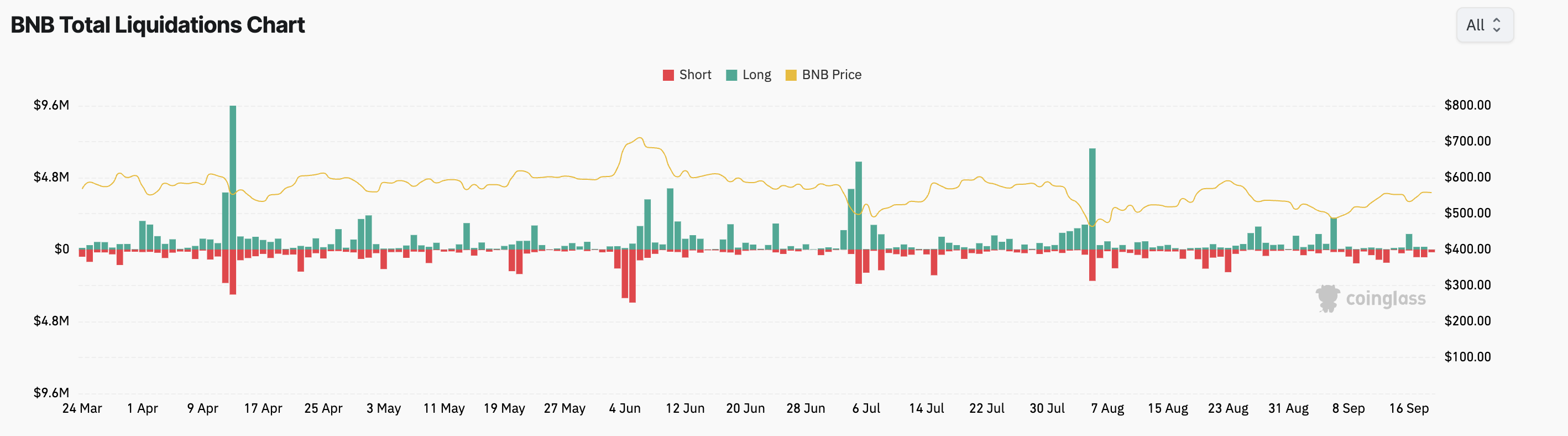

A negative funding rate indicates short-term pessimism, with more traders expecting a downtrend than a rise. However, the price of BNB rose despite these bearish bets, causing many short positions to be liquidated.

Short liquidation occurs when traders who expected the price to fall have to buy the asset back at a higher price to cover their losses. When the price of BNB exceeded a certain level, traders with short positions had no choice but to liquidate their positions to minimize their losses.

According to cryptocurrency derivatives data platform Coinglass, BNB short liquidations totaled $1.3 million since September 16.

BNB Price Prediction: More Likely to Rise

The Moving Average Convergence/Divergence (MACD) indicator for BNB suggests the possibility of continued uptrend momentum. The MACD line (blue) is above both the signal line (orange) and the zero line, indicating strong bullish sentiment and the possibility of a continued uptrend.

If buying pressure continues, BNB could rally towards the $592.30 resistance level. If it breaks this level, the coin could target $637.80.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, the bullish outlook could be reversed as investors begin to take full-scale profit taking, and the price of BNB could find support at $466.60.