In the early morning of September 19, Beijing time, the Federal Reserve announced that it would lower the target range of the federal funds rate by 50 basis points to between 4.75% and 5.00%. This is the first time the Fed has cut interest rates since March 2020. Previously, in order to ease domestic inflation in the United States, the Fed raised interest rates 11 times from March 2022 to July 2023, with a cumulative increase of 525 basis points.

After the volatility triggered by the initial rate cut subsided, Bitcoin bulls began to gain momentum, with BTC pushing from the $60,000 support level to an intraday high of $63,903, before retreating to $62,971 at press time, a 24-hour increase of 2.05%.

Altcoin have seen impressive gains, with dozens of the top 200 tokens by market capitalization seeing double-digit gains.

Altlayer (ALT) led the gains, rising 42.1%, while Popcat (POPCAT) and cat in a dogs world (MEW) both rose 27.5%.

Welcome to join the exchange group →→ VX: ZLH1156

The current overall market value of cryptocurrencies is $2.19 trillion, with Bitcoin accounting for 57.1% of the market share.

At the close of the U.S. stock market, the Dow Jones Industrial Average initially closed up 1.2%, the S&P 500 rose 1.7%, both hitting new highs; the Nasdaq rose 2.5%. Star technology stocks rose across the board, with Tesla (TSLA.O) up 7%, Nvidia (NVDA.O) up 4%, and Apple (AAPL.O) up 3.7%.

The rate cut was rare and the market reaction was chaotic

Historically, the Federal Reserve's large-scale interest rate cuts have often led to economic growth, stimulated inflation, and given rise to asset bubbles.

This time, the Federal Reserve announced a 50 percentage point interest rate cut, an adjustment rarely seen in history. Bank of America had previously warned that a 50 basis point interest rate cut "makes no sense, is difficult to communicate, and could trigger a risk aversion shock."

The United States has only cut interest rates three times in history without experiencing an economic recession, namely during the Greenspan era from 1994 to 1996, the Asian financial crisis from 1998 to 1999, and the cash shortage in 2019. The three interest rate cuts were 25bp each. Some market analysts believe that this rate cut may make up for the July rate cut and is a manifestation of the Fed's lagging action, but Powell denied that the Fed's rate cut was delayed for too long and did not think that this action lagged behind the interest rate curve. This rate cut is precisely "a reflection of the Fed's commitment not to lag behind the economic situation."

Judging from the performance of assets during several rounds of large-scale interest rate cuts in history, three months after the Federal Reserve cut interest rates by 50 basis points, the S&P 500 index remained basically unchanged, but small-cap stocks soared, technology stocks performed well, value stocks once again outperformed growth stocks, the US dollar rose, metal prices soared, and the yield curve showed a bull market steepening trend.

I think the Fed will continue to cut interest rates as the start of the Fed's easing cycle often coincides with a time when risk assets perform poorly.

On the day when the interest rate cut was announced, U.S. stocks hit a new high, but ended up falling. The Dow Jones Industrial Average closed down 0.25%, the S&P 500 closed down 0.29%, and the Nasdaq Composite closed down 0.31%.

Judging from the current market reaction, the performance of the cryptocurrency market has benefited from the Fed's interest rate cut. Tradingview data shows that Bitcoin is currently in a buying state, and the moving average shows a strong buying state.

Retail sales exceeded expectations and were welcomed by the market, temporarily alleviating fears of a recession. We may see a recovery in investor interest in risk assets such as cryptocurrencies, stimulating more inflows into Bitcoin spot ETFs.

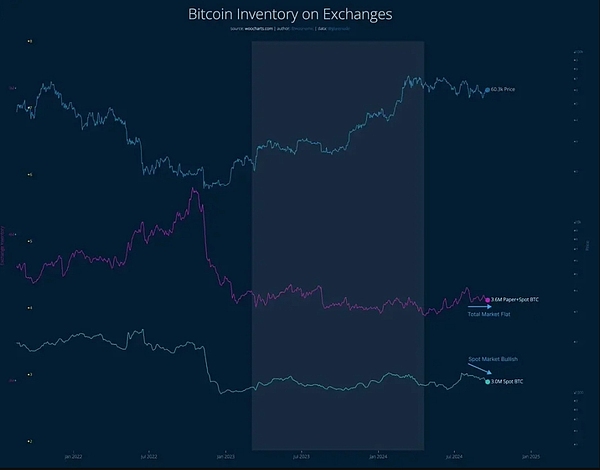

I think the bullish trend remains in the short term, but it may only be a week away, as I see a lot of spot BTC being snapped up, and the exchange derivatives inventory ratio remains flat, but this may change quickly if a short squeeze occurs. The chart pattern below is forming a bull flag, the current demand and supply are neutral bearish, but if some liquidations occur, there are signs of entering a bullish structure. Until then, we need to be cautiously optimistic.

According to on-chain data, the Bitcoin market is currently in equilibrium, with investors mainly holding, but market volatility may increase in the future: "The supply side is tightening, and the number of stablecoins in existence has declined significantly. However, the rising supply of stablecoins brings greater future purchasing power, creating a tension between current inactivity and potential future demand. This creates a spiral spring effect in the market, suggesting that volatility will increase further in the future."

It should be pointed out that the interpretation of the interest rate cut information by institutions needs to continue to pay attention to the subsequent net inflow of ETFs. According to SoSoValue data, on September 18, the US spot Bitcoin ETF reported a net outflow of US$52.83 million, ending a four-day net inflow of more than US$500 million. The outflow was led by Ark Invest and 21Shares' ARKB, with an outflow of US$42.41 million.

Pay attention to the subsequent rate cut rhythm and the general election

The Federal Reserve may continue to cut interest rates.

Nineteen members of the Federal Open Market Committee expect the Fed to cut interest rates further before the end of this year, including nine who expect a 50 basis point cut and seven who expect a 25 basis point cut.

In this Fed rate cut cycle, the extent of the rate cut has become a hot topic.

Biden said on social media X: "We have just reached an important moment: inflation and interest rates are falling, and the economy remains strong... Our policies are reducing (consumer) costs and creating jobs."

Harris also said the rate cut was welcome news. She issued a statement saying, "While the announcement (of a rate cut) is good news for Americans who have been hit by high prices, my focus is on continuing to lower prices."

Trump questioned the Fed's rate cut. When asked about his reaction to the rate cut during a campaign event in New York, Trump responded that it either reflects "a very bad economy": "I think if they're not just playing politics, cutting rates this much indicates a very bad economy. Either the economy is very bad or they're playing politics, there are only two possibilities. But this is a big rate cut."

Powell said at a press conference that there is no indication that the likelihood of a U.S. economic downturn is high.

Emanuel Coh, executive director of Barclays Capital Securities, believes that it may take two or three quarters for economic growth to rebound after the first interest rate cut, so it is uncertain whether the US economy can avoid a recession.

It is worth noting that despite the improvement in market sentiment, the timing of the Fed's rate cut may cause concerns.

If economic indicators deteriorate at the same time as a rate cut, this could be a sign of deeper economic problems. Traders should keep a close eye on key indicators such as employment data and leading economic indicators. Historically, large rate cuts, such as those in 2001 and 2007, have led to major market declines - the S&P 500 fell more than 40% within 350 days during both rate cuts as unemployment rose sharply.

Summarize

While this doesn’t necessarily mean a repeat, it’s critical to be aware of these patterns, especially as we go through a rate-cutting cycle. Unlike in recent years, when weak economic data was viewed as a positive catalyst for rate cuts, in this environment, worsening data could have the opposite effect, potentially dragging markets lower.

The article ends here. Follow the official account: Web3 Tuanzi for more good articles.

If you want to know more about the crypto and get first-hand cutting-edge information, please feel free to consult me. We have the most professional communication community, publishing market analysis and high-quality potential currency recommendations every day. There is no threshold to join the group, and everyone is welcome to communicate together!

Welcome to join the exchange group →→ VX: ZLH1156