VanEck, a digital asset management firm, recently published a review of the impact of the 2024 U.S. presidential election on Bitcoin. The firm believes that while both candidates, Kamala Harris and Donald Trump, have positive outlooks on Bitcoin, each will have different impacts on the digital asset market.

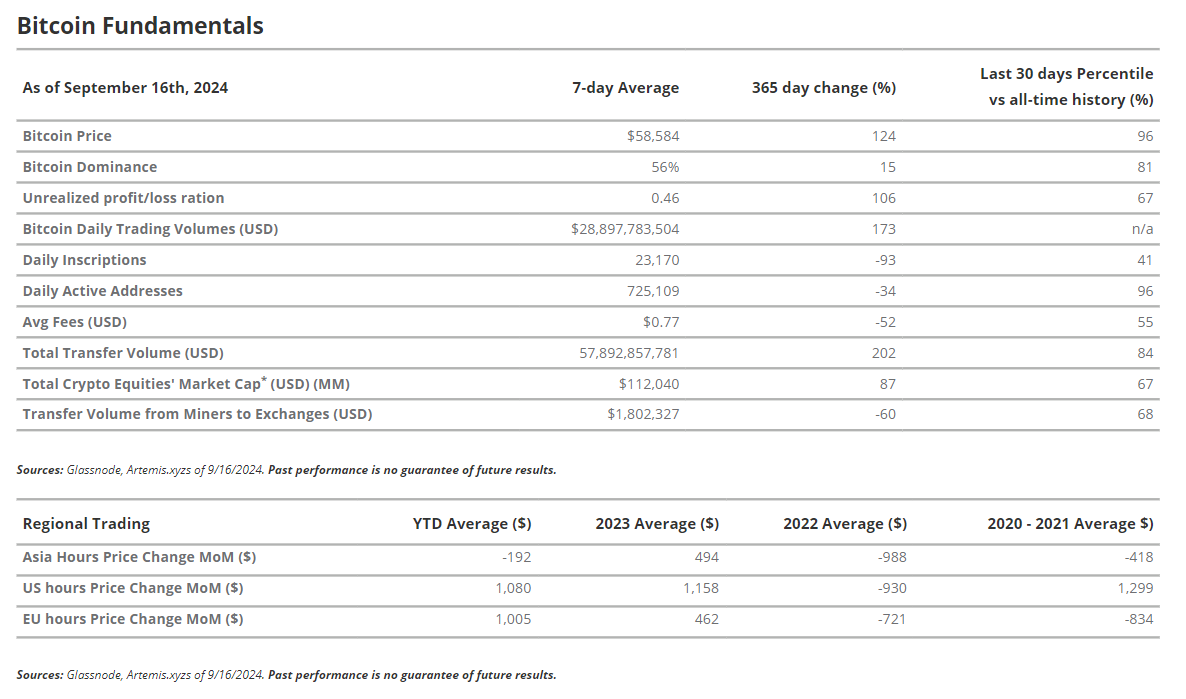

VanEck also noted that interest in Bitcoin has increased significantly year-over-year, driven by institutional demand and increased global adoption, primarily due to increased use of exchange-traded products (ETPs) and government involvement in mining and international trading.

President Harris Could Be Good for Bitcoin

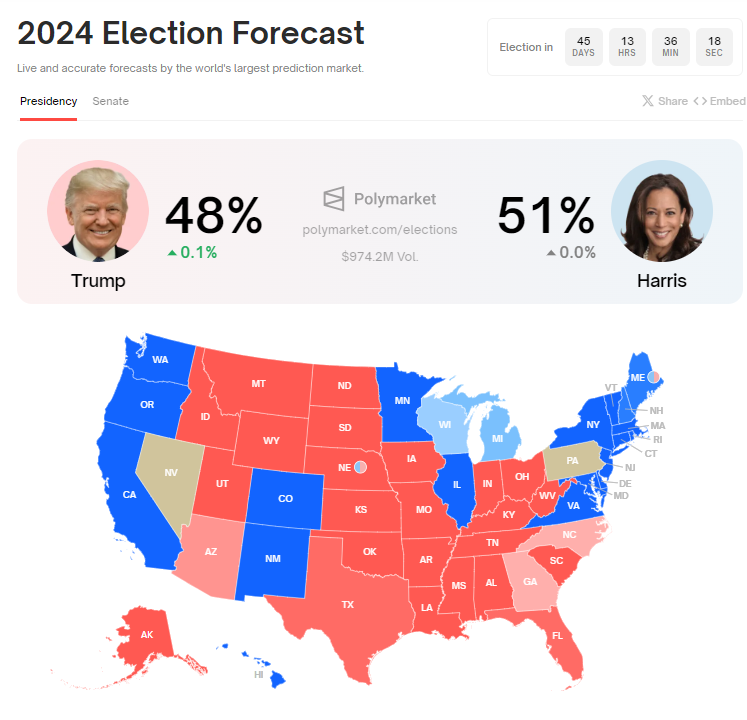

VanEck suggested in a report released on September 19 that a Kamala Harris or Donald Trump presidency would be good for Bitcoin. According to the firm, both administrations are expected to continue or expand fiscal spending, which could lead to additional quantitative easing that would favor the leading digital asset.

Matthew Siegel, head of digital asset research at VanEck, told X (formerly Twitter) that while a Democratic administration may seem unfriendly to cryptocurrencies, it could actually boost Bitcoin. VanEck explained that a Harris presidency could accelerate Bitcoin adoption by accelerating structural issues. With clear regulations in place, Bitcoin could outpace other digital assets.

“For Bitcoin alone, in our view, a Kamala Harris presidency would be better for Bitcoin than a second term for Donald Trump, as it would accelerate many of the structural problems that drove Bitcoin adoption in the first place,” VanEck wrote .

Read more: How could blockchain be used for voting in 2024?

However, VanEck warned that the crypto sector could face tighter regulation if Harris retains Gary Gensler as SEC chairman or teams up with someone like Elizabeth Warren.

On the other hand, VanEck suggested that a Trump presidency could be beneficial to the entire crypto industry. A Trump administration is likely to promote deregulation and pro-business policies, which could ease the regulatory burden on crypto entrepreneurs. Crypto stakeholders in particular favor Trump, citing his stronger pro-crypto stance .

“Regardless of the election outcome, the trend of increasing budget deficits and rising national debt is likely to continue. This suggests a weakening U.S. dollar, and Bitcoin has historically thrived in this macroeconomic environment,” VanEck added.

Growing interest and adoption of Bitcoin

VanEck reported that interest in Bitcoin has grown significantly over the past year, with institutional adoption reaching new heights. Bitcoin trading volumes have surged 173% year-over-year, surpassing stock trading volumes. During the same period, US dollar-based Bitcoin transfers have increased 202%, while retail on-chain activity has declined.

“As on-chain activity declines, Bitcoin’s price gains this year are better explained by its increased adoption as money: a means to store and transfer value,” VanEck wrote.

The company attributed this to increased institutional interest following the launch of a U.S. Bitcoin ETF in January. The spot ETF in particular has been a success, with inflows reaching around $18 billion since it began trading.

Read more: How to Trade Bitcoin ETFs: A Step-by-Step Approach

Additionally, countries like Kenya, Ethiopia, and Argentina have also started mining Bitcoin, increasing their sovereignty and institutional participation in the asset.

“We believe this trend is a key indicator of a global shift toward de-dollarization. […] The implications for Bitcoin are significant. Government-level mining and cross-border cryptocurrency trading could strengthen Bitcoin as a global reserve asset,” VanEck said.

Overall, the combination of institutional investment and government involvement increases Bitcoin’s appeal and positions it for continued expansion regardless of the outcome of the 2024 election.