In recent days, Ethereum (ETH) whales have been constantly selling their coins, which has weakened the market. The surge in whales’ inflow to cryptocurrency exchanges has shown a strong desire to take profits as the coin’s price has surged by double digits over the past week.

Increased selling pressure is likely to limit Ethereum’s short-term upside potential.

Ethereum Whales Take Advantage of Price Rise

The price of Ethereum has risen 14% in the past week and is currently trading at $2,644. However, this uptrend may be met with resistance due to recent selling by some large holders, or “whales.”

On Monday, an early Ethereum ICO participant who received 150,000 ETH in the genesis block deposited 3,510 ETH ($9.12 million) to Kraken after more than two years of inactivity.

Over the weekend, another major whale that was holding a lot of ETH sold off its coins. In a post on X, on-chain insights provider Spotonchain said the whale deposited 15,000 ETH ($38.4 million) into the exchange. The whale has a history of selling ETH right before market declines. In July, it sold 10,000 ETH ($34.2 million) before a 7.6% drop, and in August, it sold 15,000 ETH ($39.7 million) before a 2.5% drop.

Read more: How to invest in Ethereum ETFs?

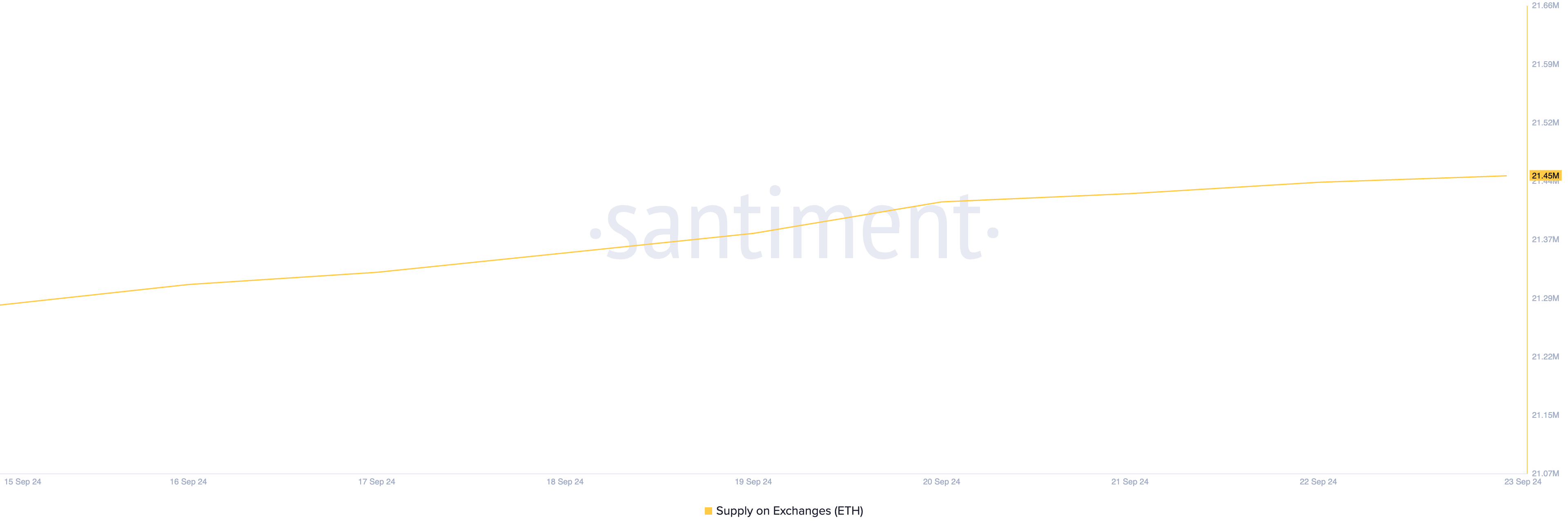

The actions of these whales have increased the supply of ETH on cryptocurrency exchanges. There are currently 21.45 million ETH stored on exchanges, worth over $56 billion. A total of 30,000 ETH ($79.2 million) has been sent to exchanges since September 20.

When the supply of an asset increases on an exchange, especially when there are large deposits from whales, this indicates profit-taking activity. This can lead to oversupply as there are too many sellers in the market, especially if no new demand enters the market.

ETH Price Prediction: Rise to $2868 VS Fall to $2111

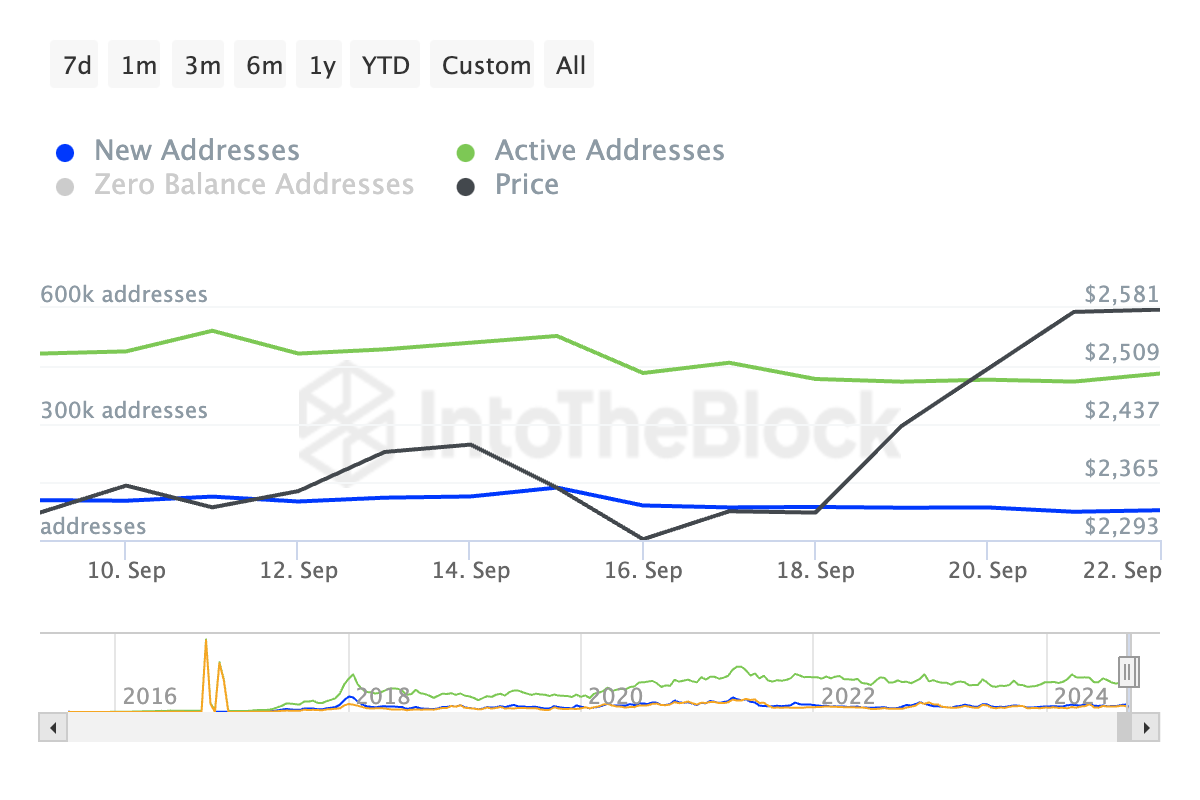

The decline in the number of new addresses created for ETH transactions over the past week supports this view. Data from cryptocurrency on-chain data platform IntoTheBlock shows that new addresses trading this altcoin have decreased by 43% over the past week. The number of active addresses on the network has also decreased by 18% over the same period.

A decrease in the number of active addresses for an asset can put downward pressure on its price. A decrease in network activity can reduce demand for the asset and increase selling as holders who fear losses try to exit their positions.

Ethereum’s recent 14% rally has pushed its price above the $2,579 resistance level. However, continued profit-taking by ETH whales could make it difficult for the coin to reclaim $2,868.

If the broader market also starts to dump coins, Ethereum price could retest the $2,579 level. If this support fails, the price could drop 18% to reach the August 5 low of $2,111.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

Conversely, if whales stop selling and new demand enters the market, Ethereum could rally another 8%, with a strong chance of breaking through the key resistance level of $2,868.