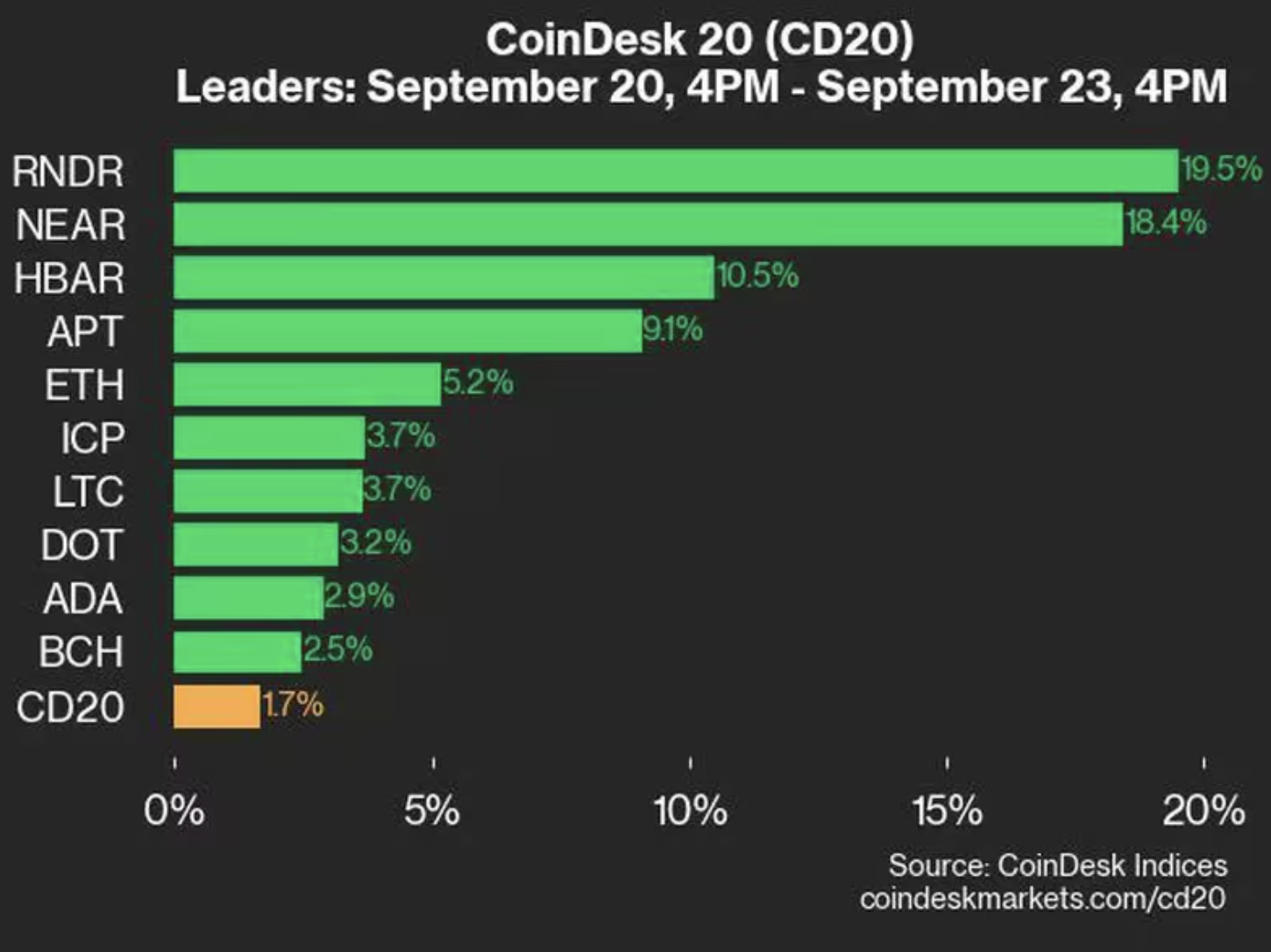

NEAR, RNDR, TAO and LPT all saw double-digit gains as AI-focused tokens were the best performers in the CoinDesk 20 Index.

The artificial intelligence-related cryptocurrency led the crypto rally on Monday as Altcoin continued to shine relative to Bitcoin (BTC).

The native tokens of first-layer blockchain Near (NEAR) and decentralized computing platform Render (RNDR) have risen 18%-20% in the past 24 hours. They are the fastest gainers in the broad market benchmark CoinDesk 20 Index, which is up 1.5% over the same period.

Decentralized machine learning protocol Bittensor (TAO) has gained 17% in the same period, while Livepeer (LPT) has also added gains after Barry Silbert, CEO of crypto investment firm Digital Currency Group (DCG), called the token a “low-profile crypto AI play” in an X post. The token is part of Grayscale’s decentralized AI fund and is issued by DCG’s asset management subsidiary.

Meanwhile, Bitcoin was up less than 1% and underperformed, struggling to reclaim its key 200-day moving average just below $64,000. Ethereum’s ether (ETH) was a relatively strong performer, returning 3.5%.

Another standout performer was the native token of blockchain data availability project Celestia (TIA), which rose 12% on Monday on news that its ecosystem development organization Celestia Foundation raised $100 million in investment led by Bain Capital Crypto. The price action may have been driven by Democratic candidate Kamala Harris reportedly saying at a fundraiser that she would be a tech-friendly president and would “encourage innovative technologies like artificial intelligence and digital assets.”

In traditional markets, gold prices hit a new high and stocks were slightly higher, continuing their gains since the Federal Reserve cut interest rates by 50 basis points on Wednesday.

Chicago Fed President Austan Goolsbee said Monday that this could be the first of multiple rate cuts next year. "We have a long way to go to get interest rates down to neutral over the next 12 months," Goolsbee said. The Fed's economic projections show a neutral rate of nearly 3%.

Bitcoin price expected to hit new highs in Q4

Markus Thielen, founder of 10x Research, told CoinDesk Markets Daily on Monday that the 2019 rate cut caused a drop in bitcoin prices, but if the rate cut was due to inflation falling to 2% rather than economic weakness, the rate cut could be good for bitcoin.

Thielen predicts that Bitcoin will break out from six months of sideways movement to a new all-time high in the final quarter, noting that there are multiple catalysts driving the cryptocurrency higher.

Historically, October to March is Bitcoin’s strongest period and also its biggest gains of the year.

Thielen said FTX assets may redistribute about $16 billion in assets to creditors in the coming months, with some of the funds flowing back into crypto assets.

The U.S. Securities and Exchange Commission approved the listing option for BlackRock’s Spot Bitcoin ETF (IBIT) last week, a positive move that paves the way for more financial instruments to be launched around ETFs and ultimately bring more institutional liquidity to this leading asset.

While many cryptocurrency investors are uncertain about who will be elected the next U.S. president in November, Thielen said the election “doesn’t matter” because government spending and deficits will continue to rise, which will benefit BTC.