That man is back again.

Last week, according to the U.S. Bureau of Prisons website, CZ, who had been in prison for nearly four months, would be released on September 29. The latest news shows that CZ has left the prison after 118 days in Lompoc Prison No. 2 and has been transferred to the Reentry Management Office RRM Long Beach, where he is still in custody.

After this news, the market was full of excitement. Binance's new coins once again topped the list of gainers to welcome the upcoming return of the spiritual leader, and there were constant praises on the X platform.

After all, the current relatively sluggish market really needs a shot in the arm.

To review the situation, in November last year, Binance reached a solution with the U.S. Department of Justice (DOJ), the Commodity Futures Trading Commission (CTFC), the Office of Foreign Assets Control (OFAC), and the Financial Crimes Enforcement Network (FinCEN) regarding investigations into Binance’s historical registration, compliance, and sanctions issues.

CZ eventually admitted to violating the Bank Secrecy Act, the International Emergency Economic Powers Act, and the Commodity Exchange Act by conducting unlicensed money transmission business, conspiracy charges, and prohibited transactions, and paid a sky-high fine of US$4.368 billion, setting a record for the largest fine in FinCEN's history.

The initial expected sentence was 18 months, but the Ministry of Justice later wanted to increase it to 3 years. However, after considering 161 letters of support and his voluntary confession, CZ was finally sentenced to four months in prison in April this year. His sentence officially began in June and he is expected to be released from prison on September 29.

A four-month sentence is actually not that long, but since November last year, Rachael Teng has officially become the new CEO of Binance. During the nearly one-year power transfer at Binance, the dangers and opportunities of Binance have been vividly reflected.

In terms of opportunities, CZ's departure officially ushered in a compliance era for exchanges and even the crypto space, announcing the official end of the Wild West. Exchange compliance became a general trend, and it was also after this that Bitcoin ETF officially brought institutions into the crypto space. Thanks to CZ's turnaround, Binance was able to get rid of its historical baggage first and gain a better opportunity to operate in the market in the name of compliance.

Rachael Teng's promotion is based on this. Professional managers with complete political and business backgrounds can better lead Binance to complete global compliance construction. The follow-up is exactly the same. Although there is no plan to return to the United States for the time being, Binance already has 19 licenses around the world. This year, it has newly obtained compliance licenses in Thailand, India and Brazil. Its achievements in compliance are obvious to all.

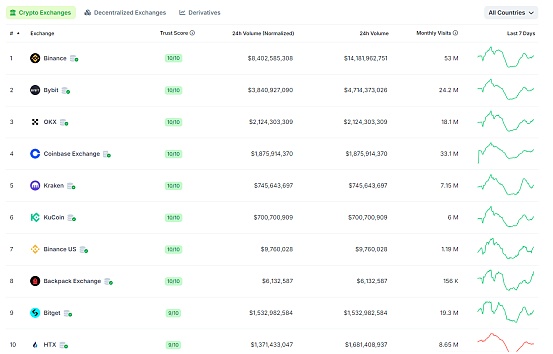

Initially, the market suspected that CZ's departure would affect Binance's operations, but judging from the data alone, Binance's performance this year is still quite impressive. Coingecko shows that Binance's daily trading volume remains relatively stable, with 24-hour trading volume ranking first among all exchanges, and monthly visiting users reaching 530 million. According to DefiLlama data, from the end of November last year to now, Binance's net inflow of funds has exceeded US$4 billion, firmly sitting on the top of the exchange. Just a few days ago, Rachael published an article stating that Binance's historical trading volume exceeded US$100 trillion in early September.

Overall, after leaving the strong support of the big boss, Binance seems to have done a pretty good job, but on the other hand, a new crisis is slowly approaching.

In terms of compliance, Nigeria dealt a heavy blow to Binance at the beginning of this year. In February, it announced that Binance was suspected of conducting illegal financial transactions on its platform. Later, it accused Binance of contributing to the collapse of its own fiat currency. There was a rumor that the authorities wanted to demand a fine of 10 billion from Binance. Although the rumor was later overturned, the Nigerian authorities still detained Binance executives Tigran Gambaryan and Nadeem Anjarwalla on the pretext. Until now, the feud between Binance and Nigeria has not ended, and Gambaryan has not been released.

On the other hand, the whirlpool of public opinion has never left Binance.

At the end of last year, due to the unsatisfactory new projects on Launchpad, Binance encountered doubts about "Bestie Coin", saying that Hooked Protocol, with unclear product attributes, low popularity, and limited experience of team members, could IEO only because of the friendly relationship between Dovey Wan of Primitive Capital and He Yi. In April, after Space ID and Open Campus IEO, the rumor intensified, and some users on X even sarcastically said that Binance had a Bestie Coin section. At that time, He Yi responded that Binance definitely did not have a Bestie Coin section, and at the beginning of this year CZ issued three key directions for Binance's 2023 plan. The first was education, followed by compliance and product services, and then gradually calmed down public opinion.

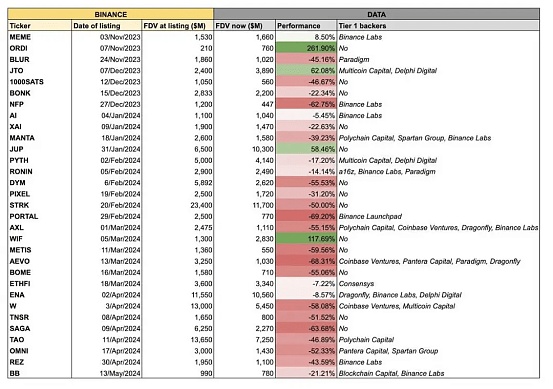

If the girlfriend coins were just a small circle of verbal disputes, it didn't take long for high FDV tokens to follow suit, sparking a big debate in the entire crypto market. First, Tradetheflow pulled out a table, pointing out that the currencies listed on Binance in the past six months generally performed poorly, and even many of them were cut in half after being launched. The common point is that these currencies all showed significant high FDV characteristics, which in turn triggered a debate between Dragonfly and a16z on MEME and VC tokens. In this context, Binance was accused of frequently listing coins to drain the market's liquidity, causing a recession in copycats, and only serving VC tokens, deviating from the community and becoming an accomplice in cutting leeks. The market soon sounded a boycott.

On May 20, Binance announced a public recruitment plan for listing projects in a timely manner. According to the announcement, tokens launched with high valuations and low circulation will lead to huge selling pressure when they are unlocked in the future. Such a market structure is not good for ordinary investors and loyal community members of the project. In order to cultivate a healthy industry ecosystem, Binance will take the lead in supporting small and medium-sized cryptocurrency projects.

On June 16, He Yi also responded to FDV and Girlfriend Coin in the community AMA, saying that the anti-VC wave and the popularity of memecoin reflect the lack of high-quality assets in the market. He hopes that more projects with real business models can be built on the blockchain, rather than just staying on the concept of nothingness. He also admitted that the investigation was insufficient when the Hook was launched.

In fact, after this, Binance was cautious about the listing of VC tokens, and the frequency of listing high FDV coins decreased rapidly, and began to move closer to the community's MEME tokens and the popular TON ecosystem. After NOTCoin fired the first shot, DOGS followed closely, and Hamster and Catizen were also launched on Binance. As of now, Binance has launched 6 TON ecosystem-related coins. However, this move has aroused dissatisfaction in the community, pointing out that Binance's logic of listing coins is unclear, and the listing of coins has shifted from application value to traffic value. Listing coins for the purpose of making quick money is actually lacking the original intention of the industry. The dispute over the size of Nerio further fermented the controversy. The listing of projects with a market value of less than 20 million US dollars on Binance became the focus of criticism for a while, and market manipulation was also mentioned again, and there were endless complaints about rat warehouses.

Faced with various doubts, He Yi again maintained stability. Not only did he write a long article in response, he also elaborated on the current coin listing process and the four major coin listing standards. He also humbly stated that "I am not necessarily right."

Interestingly, the core reason for all the public opinion whirlpools turned out to be Binance’s innovation. In the current market environment, Binance hopes to seek change in stability to expand its sectors and gain a larger share. However, it is precisely because of the seemingly aggressive innovation and the disappointing performance of the new coins that it has been accused of losing its original intention and lacking a vision. He Yi’s responses have also been attacked as being too active and not like a helmsman.

Ultimately, the Binance in the minds of users is still the Binance led by CZ. At that time, the rapid growth of the industry's trends paralyzed users' tolerance bottom line. Users were accustomed to the founder's silent working style, and they also hoped that Binance, as an industry weather vane leading crypto growth innovation, would continue to be a symbol of Binance's success.

But it is worth mentioning that the current market environment is not as good as before. In the past two years of development, not only has the compliance sickle been hanging high, but the entry of Wall Street institutions has added uncertainty. The crypto market is no longer based on exchanges as the core of absolute discourse power, and the winter of primary market investment institutions is coming. The lack of market liquidity is prominent, and innovative applications are rare. PvP has become popular, leaving only MEME prosperity, and even the operation and promotion of projects have appeared in the event in a brand new way. All of this reflects that the industry has entered a reshuffle period, and exchanges have inevitably taken off the cloak of faith and finally came to the world in a commercialized original posture.

Based on this context, the market has high expectations for CZ's return, hoping that he will return again to lead the crypto in a storm to find a new direction. However, it should be emphasized that as part of the plea agreement, CZ will be banned from participating in the company's daily operations for three years. Of course, his equity in Binance is still real and valid, so he can still pay attention to the company's performance as a shareholder, or replace or nominate a new board of directors or a new CEO.

However, due to CZ's position in Binance and the existence of co-founder and partner He Yi, it is very likely that he will participate in the company's operations in other ways. However, given that the two external supervisors appointed through the plea agreement will also pay close attention to similar situations, for safety reasons, it can be foreseen that CZ will indirectly guide the company's operations.

As early as after reaching a plea agreement, CZ had already expressed his intention not to serve as any form of CEO and would focus on investing in blockchain, artificial intelligence and biotechnology companies. CZ's previous non-profit project Giggle Academy stalled after he was imprisoned, and the market can also look forward to the follow-up progress of this project.

Can CZ turn the tide? Judging from the current market situation, there are many difficulties. After all, this is a market problem, not a single individual problem. In other words, CZ is the one who climbed to the top from the old era, and the old narrative is no longer viable. Fortunately, new traffic is still pouring in, and younger and more creative groups are entering the crypto. At this time of change, how to accept and value new groups and new logic may be the problem that the legendary CZ needs to solve next.

On the other hand, no matter what, CZ’s return is still a huge boon to Binance, and it will also have a positive effect on boosting user sentiment. It is highly likely that the Binance series of currencies will see a rise, and some people in the market have begun to target the so-called concept of CZ being released from prison.

This shows that even though the market is no longer the same market, CZ is still the same CZ.