Hot topics of Master Chat:

Today, let’s first discuss a question, which is noise and main theme. We can take the trend after the Bitcoin ETF was approved in January as an example. The part in the blue box is noise.

At that time, Grayscale was constantly selling, and the main theme was the yellow box. Various ETFs competed to buy Bitcoin and pushed up Bitcoin to 73K, and the master was also bullish on the benefits brought by the passage of ETFs.

Of course, we also suffered a slap in the face during the noise stage, so what will be the main theme now and what is the noise?

I think the clear shift of Powell in Jackson Hole is the main theme, and everything else is noise at this stage. I saw some people say that the market has already priced in the benefits of interest rate cuts, but if we look at the high point of Bitcoin in March, the CPI in the first three months of this year in the United States has exceeded expectations.

At that time, the market was still worried about the resurgence of inflation and whether the Fed would continue to raise interest rates. Later, inflation fell in the second quarter and expectations of interest rate cuts were revived. However, Bitcoin did not set a new high, and fell from 73K in March to a low of 49k in August.

In contrast, the U.S. stock market has been hitting new highs since March, so I don’t see that Bitcoin has already priced in any possible interest rate cuts. Perhaps with the implementation of the interest rate cut a few days ago and the substantial decline in the cost of borrowing in the capital market, the main theme of Bitcoin’s rise will gradually return!

Master looks at the trend:

Bitcoin is in a rebound phase today after the price dropped below the range before the release of multiple indicators.

In order to achieve a rebound, 62.6k can be observed as a short-term low in the short term. And it needs to return to the rising channel mentioned by the master yesterday and above 63.5K to change to a rebound view, and the current setting of 62.6k is a short-term low.

Resistance level reference:

First resistance level: 63500

Second resistance level: 63800

For a short-term rebound, 63.5k has become a key resistance, but since the price has broken out of the descending channel, the resistance area will become stronger.

Therefore, 63.5k can be set as an important resistance level. As the lows continue to drop, the price of the currency may consolidate near the first resistance level.

If it breaks through and then stabilizes, you can wait for the buying power and determine the callback range.

Support level reference:

First support level: 62900

Second support level: 62600

The first support is also the current low point, and this support level can be used as an entry opportunity for a short-term rebound. The current price is close to 62.9k, close to the lower limit of the range, and this is also a good profit and loss ratio area.

In today's trading, it is recommended to pay attention to the fluctuations in the range of 62.9k to 63.5k. Wait for the direction confirmation after the indicator is released, and then trade according to the trend.

If it returns to the channel, the rebound expectation can be maintained, but in the case of uncertainty as to whether the resistance breakthrough is successful, it is recommended to fully observe before deciding to enter the market.

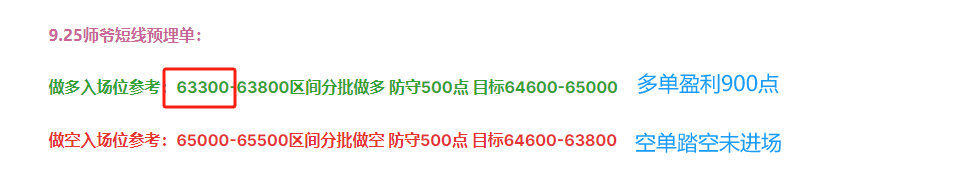

9.26 Master's short-term pre-buried order:

Long entry reference: 62100-62600 range, long in batches, 500 points of defense, 62900-63500

Reference for short entry: 63800-64300 range short in short 500 points defense target 62900-62600

The content of this article is exclusively planned and published by Master Chen (public account: Master Chen, the God of Coins). If you need to know more about real-time investment strategies, unwinding, spot contract trading methods, operating skills, and K-line knowledge, you can add Master Chen to learn and communicate. I hope it can help you find what you want in the crypto. Focusing on BTC, ETH and Altcoin spot contracts for many years, there is no 100% method, only 100% going with the trend; daily updates of macro analysis articles, technical indicator analysis of mainstream coins and Altcoin, and spot mid- and long-term review price forecast videos.

Warm reminder: Only the column public account (pictured above) in this article is written by Master Chen. The other advertisements at the end of the article and in the comment area have nothing to do with the author himself! ! Please carefully distinguish the true from the false. Thank you for reading.