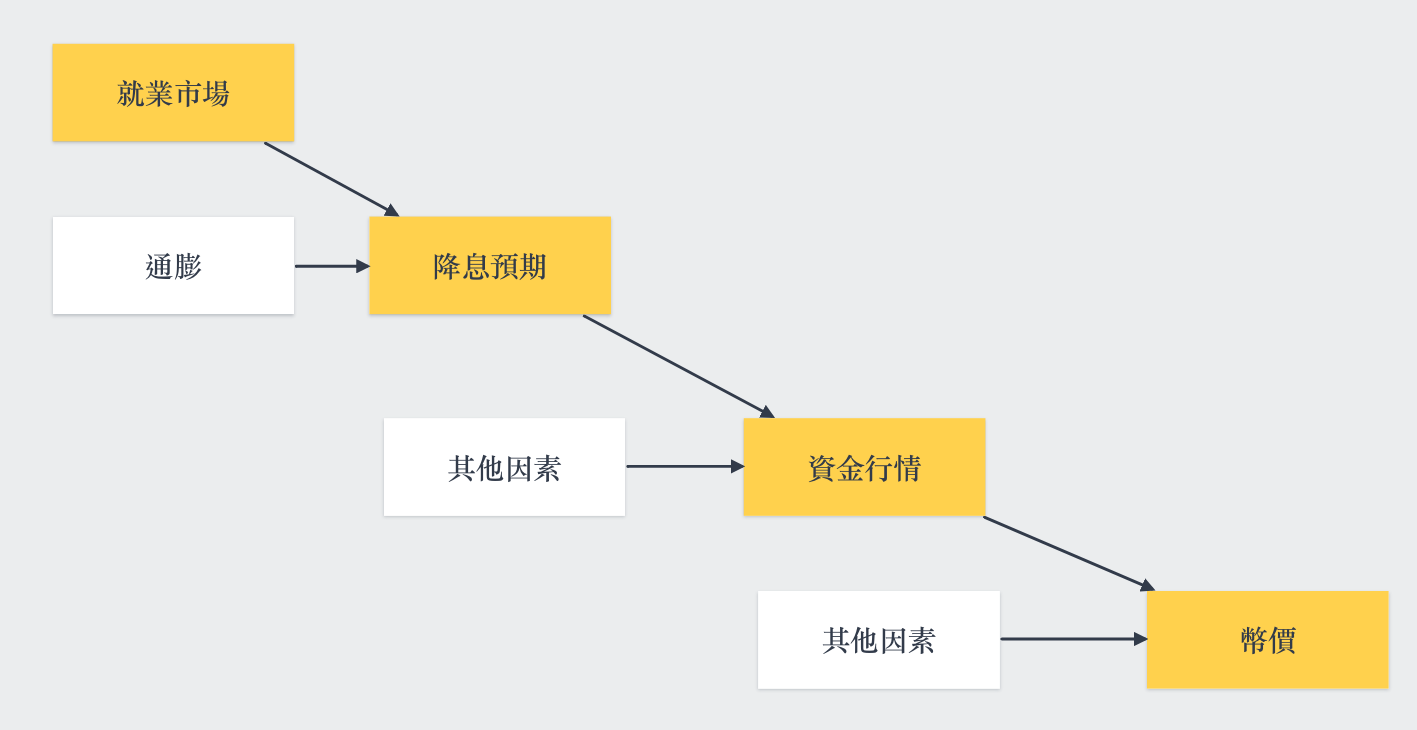

If companies no longer recruit in large numbers, it will actually affect the price of Bitcoin! ?

The story behind this actually has a lot to do with the American job market . Let's explain it step by step:

The job market affects the real economy

When the job market is strong, people have jobs and incomes, their spending power increases, and economic activities naturally become more active. On the contrary, when companies no longer recruit in large numbers, the unemployment rate increases and consumption power decreases, which will directly affect the real economy and slow down economic activities.

Real economy affects interest rate cut expectations

When the economy slows and the job market weakens, the market begins to pay attention to the Fed's actions. Expectations of interest rate cuts come not just from the economic slowdown, but from the public statements of Fed officials. For example, if the Fed Chairman states at a press conference that "every effort will be made to support economic recovery," this will immediately trigger market expectations for future interest rate cuts. The market is interpreting the Fed's policy direction, rather than making expectations based solely on economic data.

Interest rate cut expectations affect capital market

When the market expects the Fed to cut interest rates, investors usually plan ahead and inject more funds into the market. This is because lower interest rates mean that borrowing costs fall, making it easier for companies and individuals to obtain funds, which will allow more funds to flow into the stock market or other risky assets.

Funding trends affect cryptocurrency prices

When capital conditions tend to become looser and market funds are abundant, risky assets such as Bitcoin and other cryptocurrencies will benefit. Investors will believe that the market trend is good and invest money in these high-risk, high-return assets. Therefore, when the Fed expresses its clear intention to cut interest rates, it usually drives cryptocurrency prices up.

It can be seen that the job market has considerable influence on the prices of risky assets. Next, we will introduce how to test the constitution of the job market and help you gain a deeper understanding of the status of the U.S. job market.

Overview of key job market data

Basic data

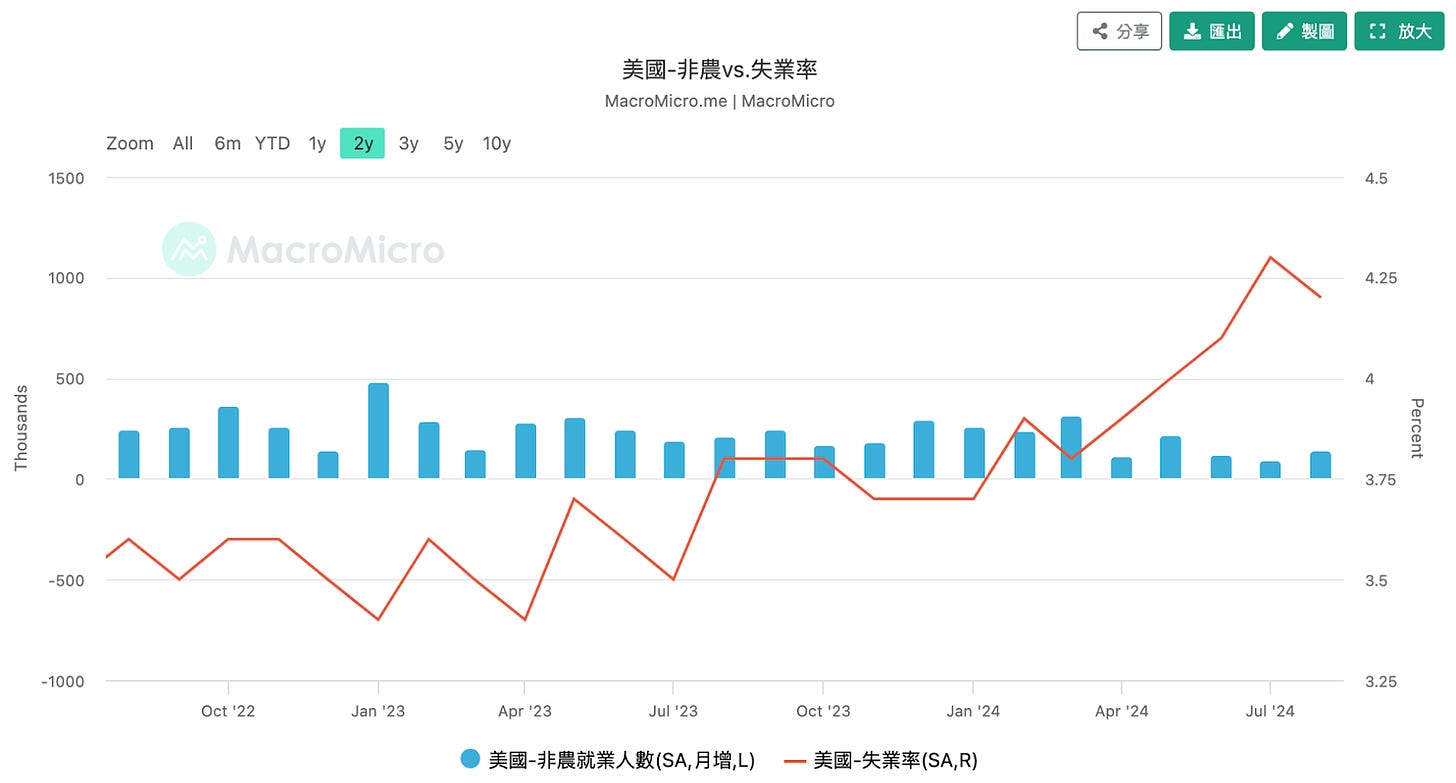

New non-agricultural employment and unemployment rate

Source: United States - Nonfarm Employment Diffusion Index | MacroMicro Financial M Square

Release time : 8:30 pm on the first Friday of each month, Taiwan time

latest data

Monthly increase in non-agricultural employment: 142,000 (previous value: 89,000)

Unemployment rate: 4.20% (previous value: 4.30%)

New non-agricultural employment

Reflecting the number of new jobs in the U.S. non-agricultural sector, referred to as "non-farm payrolls" or NFP, it is an important indicator of the vitality of the job market. When the number of new people is increasing, it usually means that the economy is active and the job market is strong; if the number of new people is decreasing, it means that job opportunities are shrinking and the economy may be slowing down.

unemployment rate

Indicates the ratio of unemployed people to labor force participants. Generally, a decrease in the unemployment rate means that more people have found jobs and economic conditions are improving; conversely, an increase in the unemployment rate means that more people have lost their jobs and the economy may be in a slowdown or recession. Sometimes there are exceptions to these situations that require further examination of advanced data.

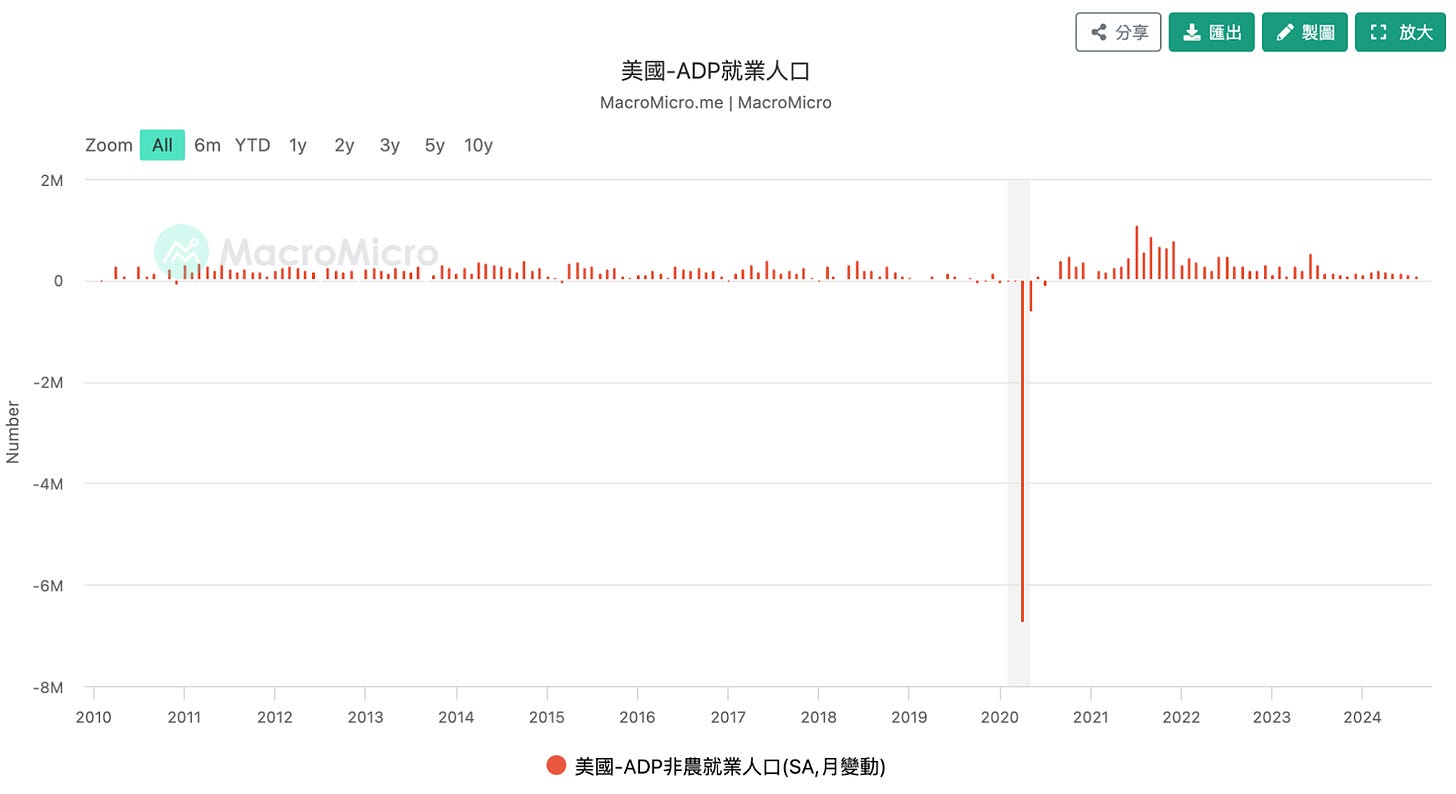

ADP employment population - small non-agricultural

Source: United States-ADP Employment Population | MacroMicro Finance M Squared

Release time : 20:15 on the first Wednesday of each month, Taiwan time

Latest figure : 99,000 (previous value: 111,000)

ADP employment data is released by the U.S. Automatic Data Processing Company (ADP). It mainly measures employment growth in private enterprises. The scope of interpretation is not much different from the number of new non-agricultural employment. It is commonly known as "small non-agricultural employment" and will start non-agricultural employment earlier every month. The employment report is released every two days, so the employment situation can be understood early before the release of the NFP report, which can be used as a major indicator of the number of employed people.

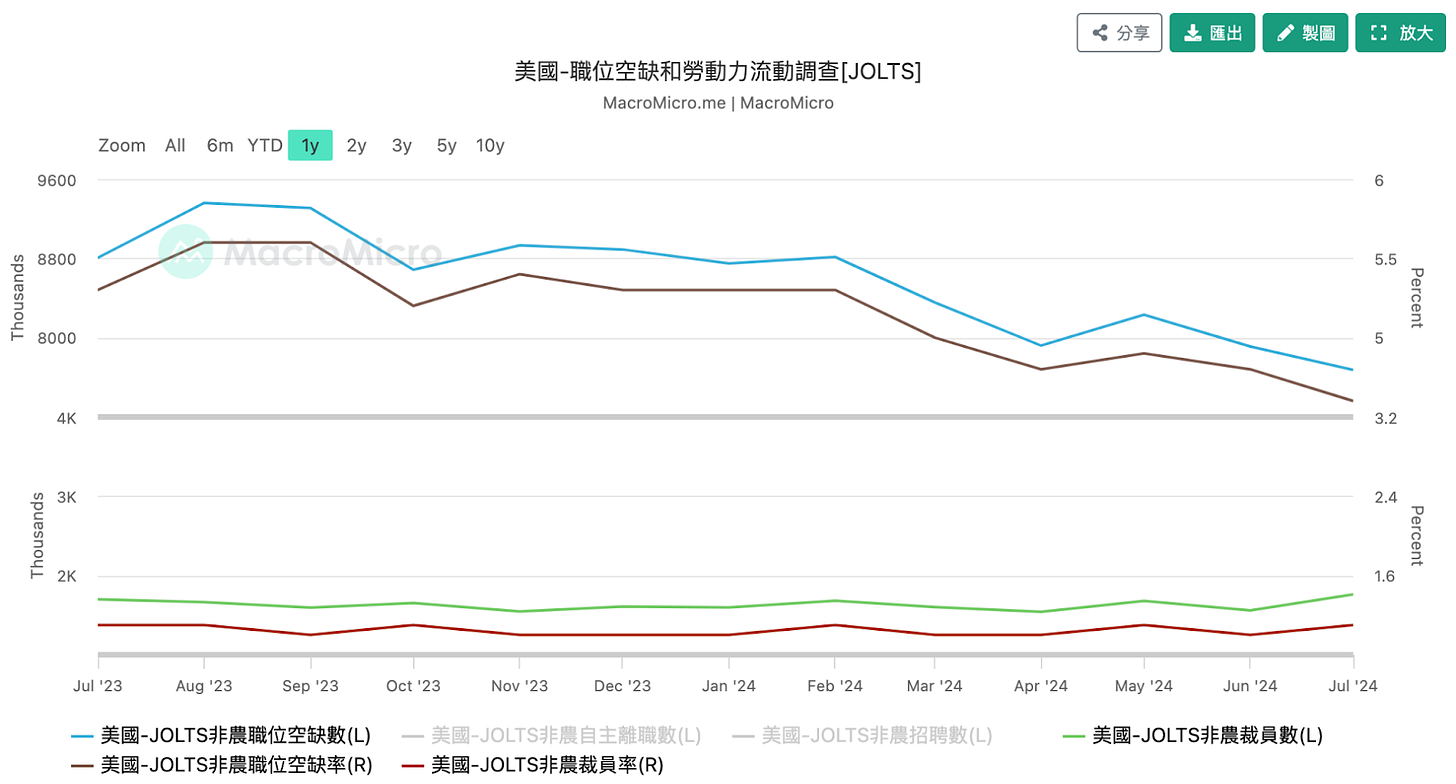

JOLTS: Number of job vacancies, number of layoffs, layoff rate

Source: United States - Job Vacancies and Labor Turnover Survey [JOLTS] | MacroMicro Financial M Square

Release time : 22:00 on the first Wednesday of every month, Taiwan time

Latest data:

Number of job vacancies: 7,673K (previous value: 7,910K)

Number of layoffs: 1,762K (previous value: 1,560K)

Layoff rate: 1.1% (previous value: 1%)

JOLTS is the abbreviation of Job Openings and Labor Turnover Survey

Job vacancies : Indicates the number of unfilled positions in a company. An increase in job vacancies indicates that companies have strong hiring demand and the job market is healthy; a decrease in the number of vacancies indicates that companies are less willing to recruit, the demand for jobs is reduced, and the economy may begin to weaken.

Number of layoffs and layoff rate : reflect the status of employees being laid off by the company. An increase in the layoff rate usually indicates that the company expects the economic situation to worsen and is downsizing; a decrease in the layoff rate indicates that the company is optimistic about the future economy and will reduce the number of layoffs.

Advanced data

Re-entrants and new entrants to the market as a proportion of the unemployed population

Release time : 20:30 on the first Friday of every month, Taiwan time

Latest data : 0.40 (previous value: 0.39)

This indicator reflects how many of the unemployed people are re-entering the labor market or newly entering the labor market, rather than being laid off or voluntarily leaving the job.

Higher data : It usually means that more laborers are re-entering the market to look for jobs, or that there are fewer layoffs. This may be a sign that the economy is improving and job opportunities are increasing. But it could also be that unemployment is rising because more people are unable to find work.

Lower data : Usually indicates a decrease in the number of people re- or new entering the market, or an increase in layoffs, which may represent a soft or unattractive labor market, or even a saturated job market.

Ratio of "vacancies" to "unemployed population"

Source: Ratio of job vacancies to number of unemployed people | MacroMicro Finance M Square

Ratio of job vacancies to number of unemployed people :

This metric measures the number of unfilled jobs for every unemployed person. A higher ratio means more job opportunities in the market, less competition among job seekers, and a better economy.

If the ratio is lower than 1, it means that there are insufficient job opportunities, fierce competition, it is more difficult for the unemployed to find a job, and the economic situation is poor.

The Current State of the Job Market: A Soft Landing? Hard landing? Recession?

The current economic data for September has been almost updated. Judging from the ratio of "vacancies" to "unemployed population" of 1.07 (one unemployed population only corresponds to one position), employment is in a "balanced" state. At the same time, the monthly updated JOLTS data shows that the number of job vacancies is gradually declining and the layoff rate is gradually increasing, indicating that a recession is still possible.

At 2 a.m. Taiwan time on September 19, the FOMC decided to cut interest rates by 2 yards. Powell mentioned that the current job market is still good enough, and the reason for cutting interest rates by 2 yards in one go was to accelerate the normalization of interest rates. With the real economy not in recession and the Federal Reserve issuing a strong dovish (loose economic) signal, the crypto market, especially Altcoin, has experienced staggering gains for two consecutive weeks.

Looking ahead to the ADP employment data , non-farm payrolls report (NFP) and JOLTS released in the first week of October, if the data shows that the economy is still solid, this wave of capital market will not shrink. When funds continue to flow in, you can expect the Altcoin in your wallet to explode.

Further reading

Subscribe to Biyan Weekly Newsletter , which will update two articles on the general economy and DeFi trends every week

What is CPI? Why does it affect the rise and fall of the cryptocurrency market?