In recent weeks, many altcoins have begun to outperform Bitcoin (BTC). This has led to speculation that the market may be heading towards an anticipated altcoin season, during which altcoins generate higher percentage returns compared to Bitcoin, attracting more investor interest and capital inflows .

While the recent price rally in major altcoins may indicate the early stages of this trend, this analysis examines whether the technical pattern is being followed.

Bitcoin Retreat, Altcoins Escape the Falling Wedge

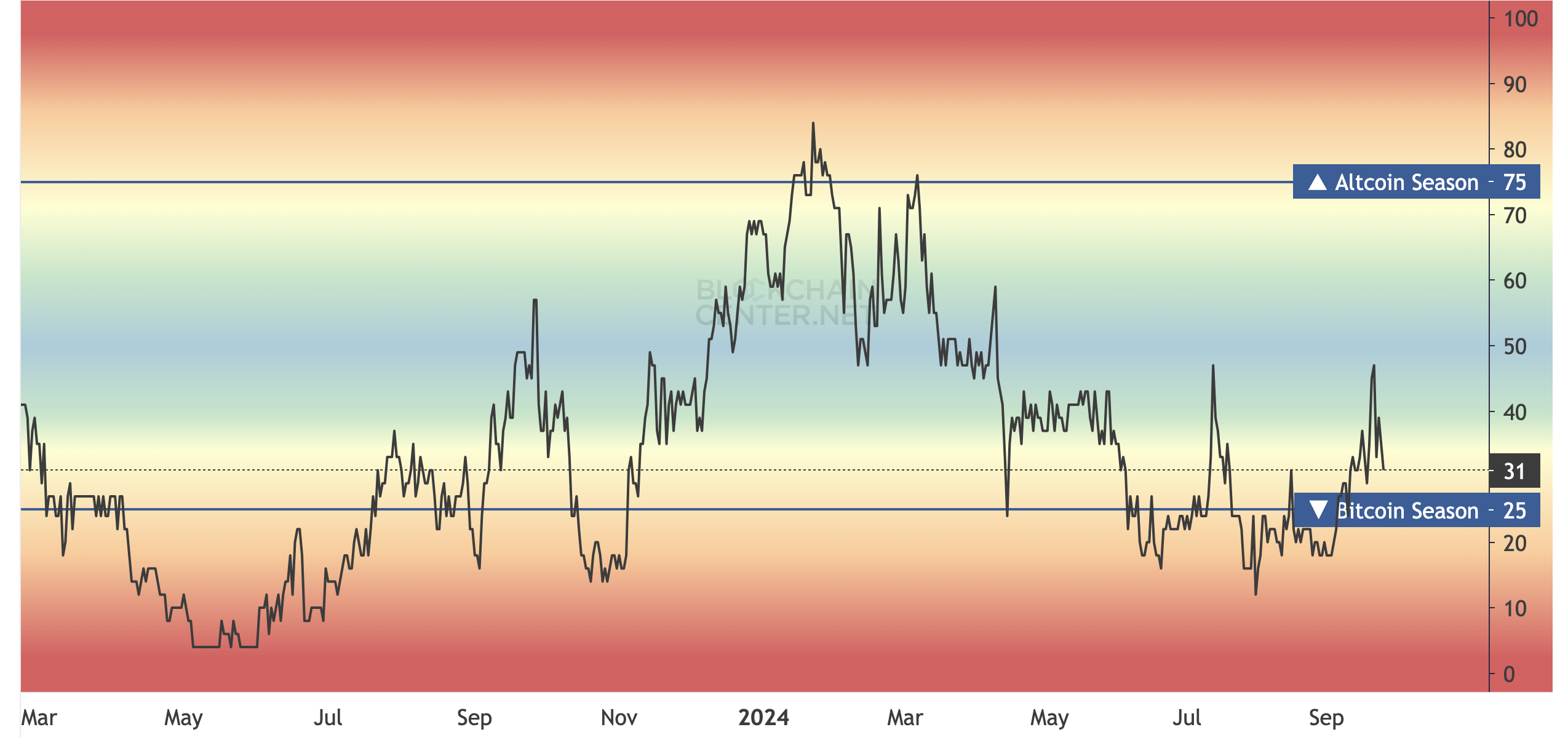

For an altcoin season to occur, at least 75% of the top 100 cryptocurrencies need to outperform Bitcoin in 90-day returns. This has not happened in the past six months, as Bitcoin’s overwhelming dominance in the market has sucked up altcoin gains.

However, things have started to change recently, according to Blockchaincenter. The Altcoin Season Index has increased from 18 to 31 a few weeks ago. This increase could be related to the price surge of cryptocurrencies such as Sui (SUI), Bittensor (TAO), and Fantom (FTM).

Despite the improvements, it is important to note that it is not yet altcoin season. However, Bitcoin dominance (BTC.D) has decreased since September 19, according to the daily chart.

Additionally, the TOTAL2 chart, which shows the total cryptocurrency market cap excluding BTC, has increased by almost 18% since September 7. This performance gap is consistent with the notion that Bitcoin could soon be on the back foot and altcoins could take the lead .

In addition, BeInCrypto has confirmed that TOTAL2 has broken out of a falling wedge. For reference, a falling wedge is a bullish signal formed by two descending trend lines, one representing the highest highs and the other representing the lowest lows.

Read more: 10 Best Altcoin Exchanges in 2024

Breakouts from technical patterns indicate that sellers are starting to lose steam. As a result, buyers have taken advantage of this fatigue. If this trend continues, the altcoin market cap could soar to $1.3 trillion or even $1.5 trillion in a few months.

Analysts predict altcoin season is near

Following these developments, several prominent crypto figures have agreed that the altcoin season is very close . For example, the Negentropic account of X, run by Glassnode and Swissblock founders Jan Happel, Rafael Schultze-Kraft, and Yann Allemann, shared similar views.

“Swissblock altcoin signal is 53: We are moving into altseason! Altcoins will fly once BTC goes above 64.4k. Our framework shows beta play. WIF is strong . Up +16% today and beta to BTC is 3. Imagine the move as Bitcoin rushes towards its all-time high,” Negentropic said .

Miles Deutscher is another crypto analyst who shares this bullish view. According to Deutscher, TOTAL3, which shows the market cap of altcoins excluding Ethereum (ETH), could break out if it is not rejected.

“Altcoins (TOTAL3) are on the verge of a huge breakout. There is a chance of rejection here, but if they break out – expect fireworks,” Deutscher wrote .

Interestingly, BeInCrypto’s TOTAL3 analysis has shown an increase of almost the same value as TOTAL2. It is also on the verge of breaking out of the descending channel on the daily chart.

Read more: 11 cryptocurrencies to add to your portfolio before altcoin season

If this breakout is successful, the altcoin season could accelerate and become a reality. However, it is important to continue to monitor Bitcoin’s dominance. If Bitcoin dominance (BTC.D) rebounds and altcoin market caps are rejected, the anticipated $1.5 trillion rally may not happen in the short term .