Author: Scott Garliss, CoinDesk; Translated by: Tao Zhu, Jinse Finance

The inflation rate continues to decline.

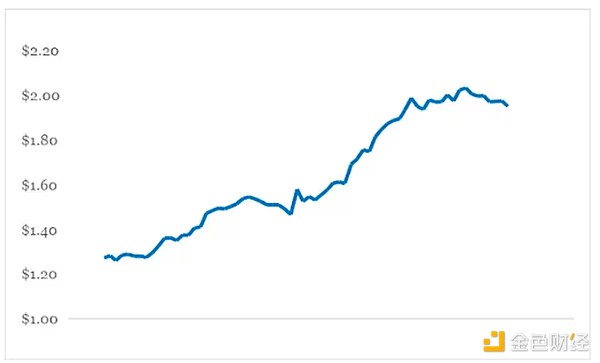

In the chart above, at the end of 2019, white bread cost $1.36. At the beginning of 2020, prices remained stable. Then, by the end of the year, they rose 13% to $1.54. In 2021, prices remained stable, then soared 21% in 2022. In 2022, the rate of increase slowed, increasing by another 8%. But this year, bread prices have stabilized and are down.

This dynamic reminds me of what's happening with inflation across the country. As the cost of goods has risen, demand has cooled. Individuals may not be going out to lunch as often as they once were. This dynamic change tells me that price pressures should ease further when August personal consumption expenditures are released in late September. This would support further rate cuts from the Federal Reserve this year and support a steady rise in risk assets such as cryptocurrencies.

But don’t just take my word for it, let’s look at what the data tells us…

If we want to understand PCE growth, we need to look at the big picture. Therefore, we have to look at this number on an annualized basis. That way, we don't let any one-off monthly surges distort the more important long-term picture.

The breakdown of the overall PCE index components shows that goods make up about 35% and services make up about 65%. Therefore, services will have a greater impact on the direction of the index. However, core PCE (minus food and energy) is what we really want to focus on.

So, let's go a step further. Food and energy are non-durable goods (goods with a useful life of less than three years). This subset makes up about two-thirds of the goods component of PCE, and durable goods (goods with a useful life of more than three years) make up another third.

Central banks like to exclude food and energy because those prices are more volatile. That way, policymakers feel like they are smoothing those numbers. So when we remove them from the inflation equation, we get the core PCE index, which is mostly made up of service prices.

Now, let's take a closer look at the services component. It explains the difference between the BEA and BLS inflation measures. This is why PCE growth tends to be lower than CPI.

In the PCE, housing including utilities is about 17%, health care is about 17%, financial services and insurance is about 8%, other services is about 8%, food (remember the service aspect) and accommodation is about 8%, recreation services is about 4%, and transportation is about 3%. This is very different from the CPI, where housing is over 36% and health services is only 6%.

According to the U.S. Bureau of Labor Statistics, in August, housing prices rose 0.5%, health care services shrank 0.1%, financial services fell 0.3%, insurance costs fell 0.2%, hotel room costs rose 1.8%, entertainment services remained unchanged, and transportation and warehousing services fell 0.1%.

If we adjust these numbers in a weighted manner, we see that the growth in August was closer to 0.2%. This is in line with the Cleveland Fed and the consensus forecast of 0.2% growth.

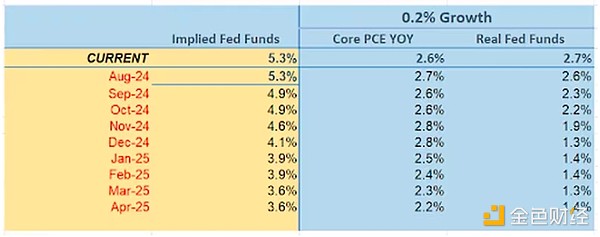

Now, let’s see what a 0.2% year-over-year increase would look like…

According to my forecast, a 0.2% monthly increase would translate into a 2.7% annualized increase in core PCE. This would be in line with Wall Street expectations for 2.7% growth, but below the Cleveland Fed's forecast of 2.8%.

More importantly, the average growth rate over the past six months would have been 0.2%. This would translate into a core annualized growth rate of 2.4%. This would be lower than the current growth rate, meaning that the pace of growth will continue to slow in the future.

If PCE behaves as I expect, it will boost the prospects for the Fed to ease monetary policy because, based on the new inflation rate and the effective federal funds rate, real interest rates will have a 2.7% downside cushion before they stop weighing on inflation growth.

In other words, this change will give our central bank enough room to start cutting rates without triggering a rebound in inflation. This should support the prospect of slower but not collapsing economic growth and support a steady rise in risk assets such as Bitcoin and Ethereum.