As the cryptocurrency market prepares for a traditional “Uptober” rally, market participants are keeping a close eye on the movements of whales. These large holders are known to exhibit accumulation patterns, which serve as early indicators of potential price increases.

So what are these whales accumulating as we head into October?

Whales are interested in big assets

In an exclusive interview with BeinCrypto, Juan Pellicer, Senior Research Scientist at on-chain analytics firm IntoTheBlock, noted that as October approaches, crypto whales are focusing on high-cap assets.

“This trend is consistent with a cycle that is currently driven primarily by institutional demand. These institutional players generally prefer more established and liquid assets in the crypto space,” Pellicer said.

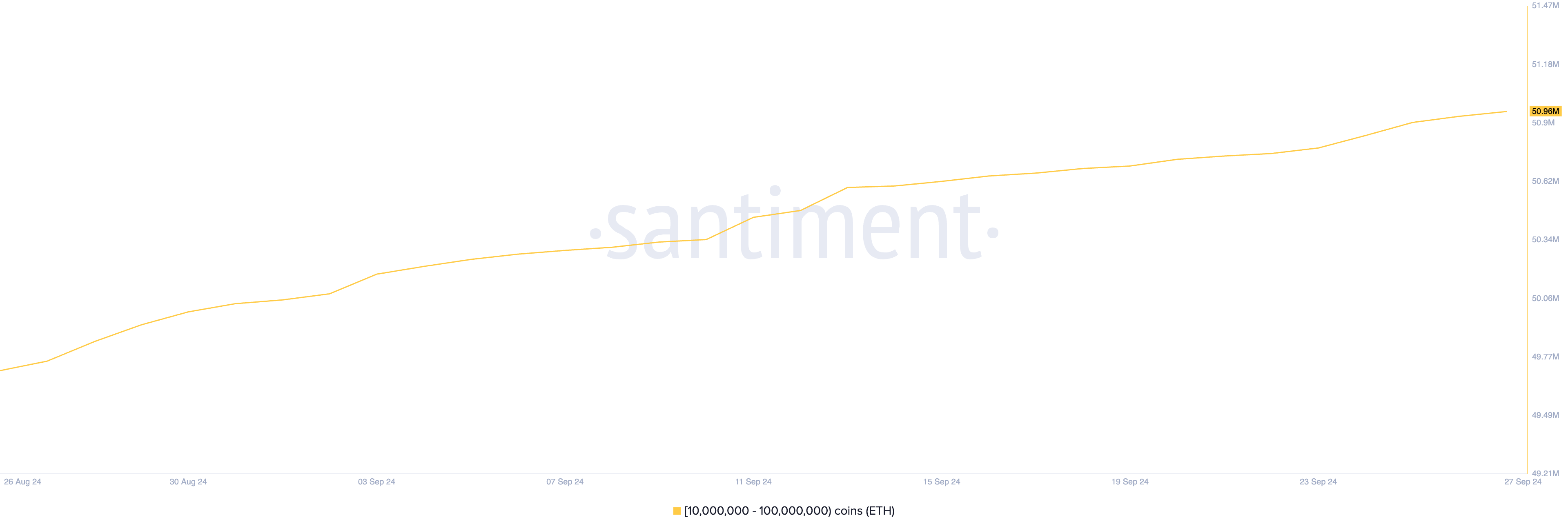

Major altcoin Ethereum (ETH) is one of the assets that these big holders are accumulating as we head into October. According to Santiment data, there has been a noticeable increase in ETH accumulation among wallet addresses holding between 10 million and 100 million ETH. In the past 26 days, this group has added 910,000 ETH, which is worth over $2.4 billion at market prices.

Dogecoin brings benefits to its holders

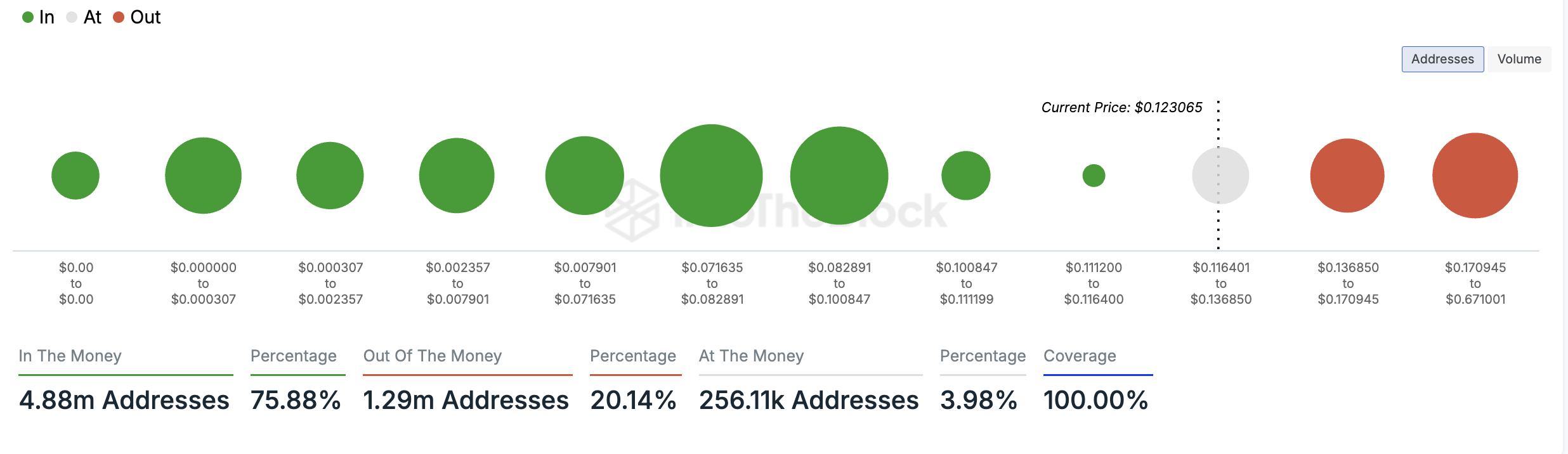

Another large market cap coin that crypto whales are accumulating as we head into October is the major meme coin Dogecoin (DOGE). This was triggered by the coin’s 24% price increase over the past month. As of this writing, the meme coin is trading at $0.12, its highest price since August 2.

Tracking the net inflows of large DOGE holders, we see that investors holding more than 0.1% of the coin’s circulating supply are increasing their holdings. In the past week alone, net inflows among large DOGE holders have surged by a whopping 134%.

In addition to the rising price of Dogecoin , the fact that most holders are making profits may be another reason why whales continue to accumulate the asset. According to the Global In/Out of the Money assessment of DOGE, 76% of all meme coin holders are making profits. In contrast, only 20% of all coin holders are making losses.

Toncoin sees increase in large transactions

TON, which is linked to Telegram, is another asset that is attracting attention from crypto whales. The number of daily large transactions involving this altcoin has skyrocketed over the past month.

According to data from IntoTheBlock, TON transaction volume has surged by 179% in the past 30 days for transactions between $1 million and $10 million. Similarly, large transactions exceeding $10 million have seen an impressive 83% increase over the same period.

Read more:What is Telegram Bot Coin?

An increase in the number of large trades in an asset is a bullish signal. When retail investors observe increased trading activity from large holders, this often increases their confidence, leading to more buying activity and continued price appreciation.