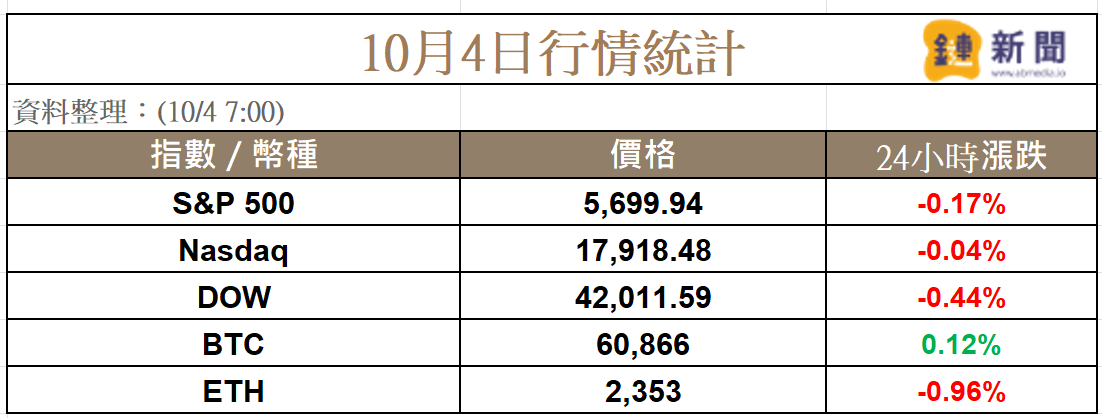

Geopolitics in the Middle East continued to be tense. The day before the non-farm payrolls report was released, the major U.S. stock indexes closed slightly lower. Bitcoin briefly fell below 60K last night, and Ethereum also returned to around 2,300. JPMorgan Chase believes that increasing geopolitical tensions will drive “depreciation trading” dominated by gold and Bitcoin. Is there a chance that the crypto market will usher in an “Uptober”?

Table of Contents

ToggleMarkets focus on U.S. jobs report

Yesterday (10/3) it was announced that the number of people filing for unemployment benefits in the United States last week was 225,000, slightly higher than the expected 222,000. But Hurricane Helene's raging through the southeastern United States and strikes at Boeing and ports could distort labor market conditions in the short term.

The September employment report to be released on Friday is important economic data that may affect the Fed's policy. Economists polled by Reuters expect 140,000 jobs to be added, with the unemployment rate expected to hold steady at 4.2%.

According to CME FedWatch , traders estimate that the probability of a 50 basis point interest rate cut next month has dropped to 32.8%, down from 49% a week ago. The probability of just one rate cut increased to 67.2%.

Geopolitical tensions bring 'devaluation trade'

JPMorgan analysts said rising geopolitical tensions and November's presidential election are driving investors toward gold and bitcoin as safe-haven assets, which they call a "debasement trade."

This “depreciation trade” is driven by a variety of factors, including rising geopolitical uncertainty from 2022, ongoing inflation concerns, large government deficits in major economies, and waning confidence in fiat currencies, especially in some emerging markets.

However, while gold prices have risen on lower U.S. Treasury yields and rising geopolitical risks, a similar situation has not yet occurred for Bitcoin.

When is "Uptober" coming?

Analysts at QCP Capital believe the downturn is temporary. It also emphasized the strong correlation between the performance of cryptocurrencies and the U.S. stock market, expecting that as the stock market recovers, the cryptocurrency market will follow suit.

Bitcoin fell below 60K last night, reaching $59,828. After Bitcoin falls below the neckline, can it stage a "coffee cup pattern" similar to the US stock market? It will take time to prove that it will bring the "Uptober" market that everyone is looking forward to.

Note: "Coffee Cup Type": After the completed arc bottom, a platform finishing area is carried out to form a cup handle shape, and then it breaks through the previous high.