The Bitcoin (BTC) price recently fell 7.8% to $60,000. However, as the king of cryptocurrencies recovers from this drop, support from a group of major investors could push the price higher.

Institutional investors in particular are driving Bitcoin’s upward momentum, and their influence could push BTC to $70,000.

We need institutional investor demand, as demonstrated by Bitcoin ETFs

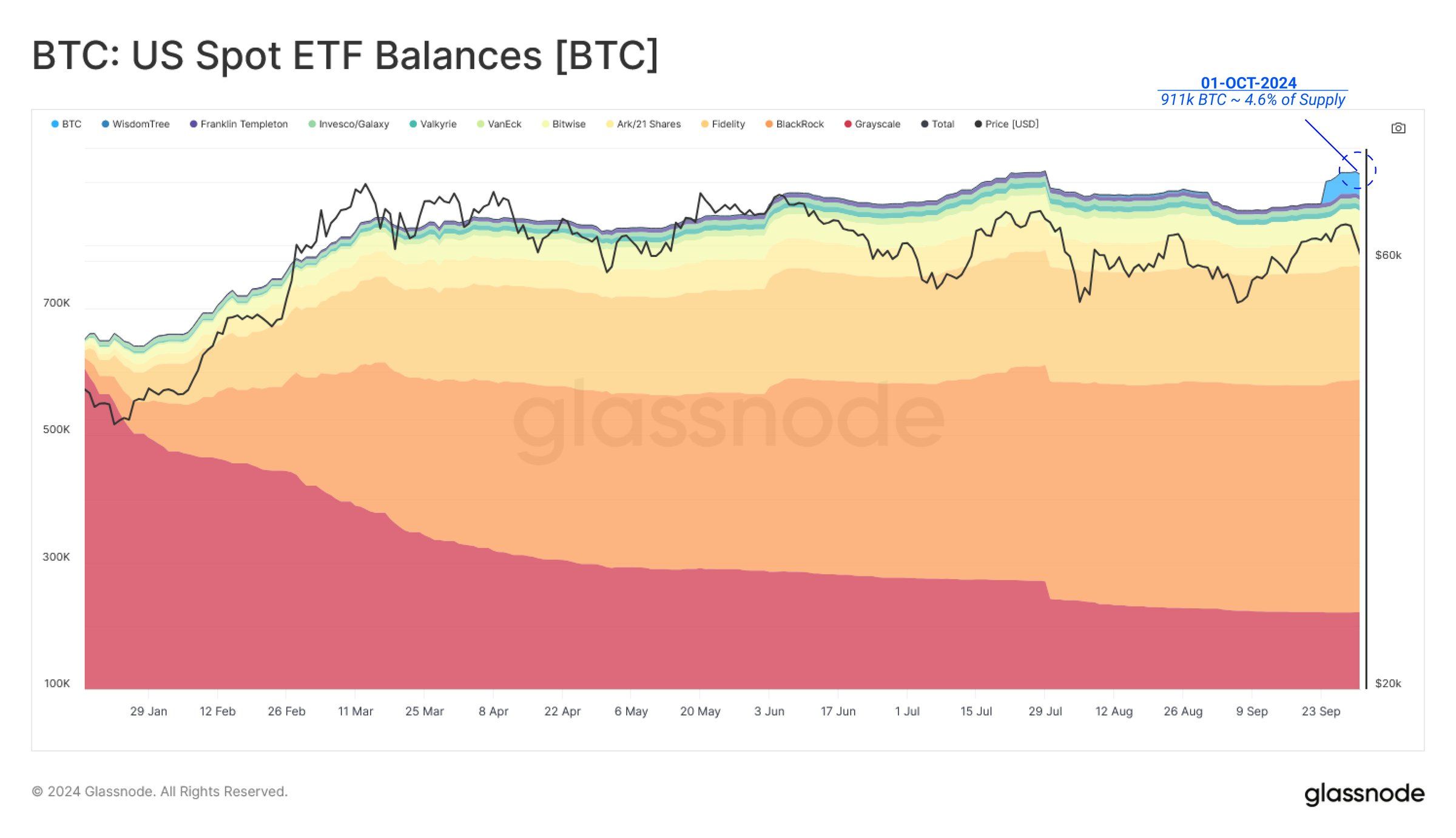

Institutional investors are important to Bitcoin’s potential recovery and future growth. According to data from Glassnode, Bitcoin exchange-traded funds (ETFs) currently hold $58 billion worth of BTC. This represents about 4.6% of Bitcoin’s circulating supply, indicating strong demand for regulated exposure to the cryptocurrency.

Institutional demand suggests that large investors see Bitcoin as a viable and valuable asset. As these investors continue to accumulate BTC through ETFs and other regulated vehicles, they contribute to the long-term growth and stability of the coin. Their influence could push Bitcoin’s price to $70,000, especially if demand continues.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

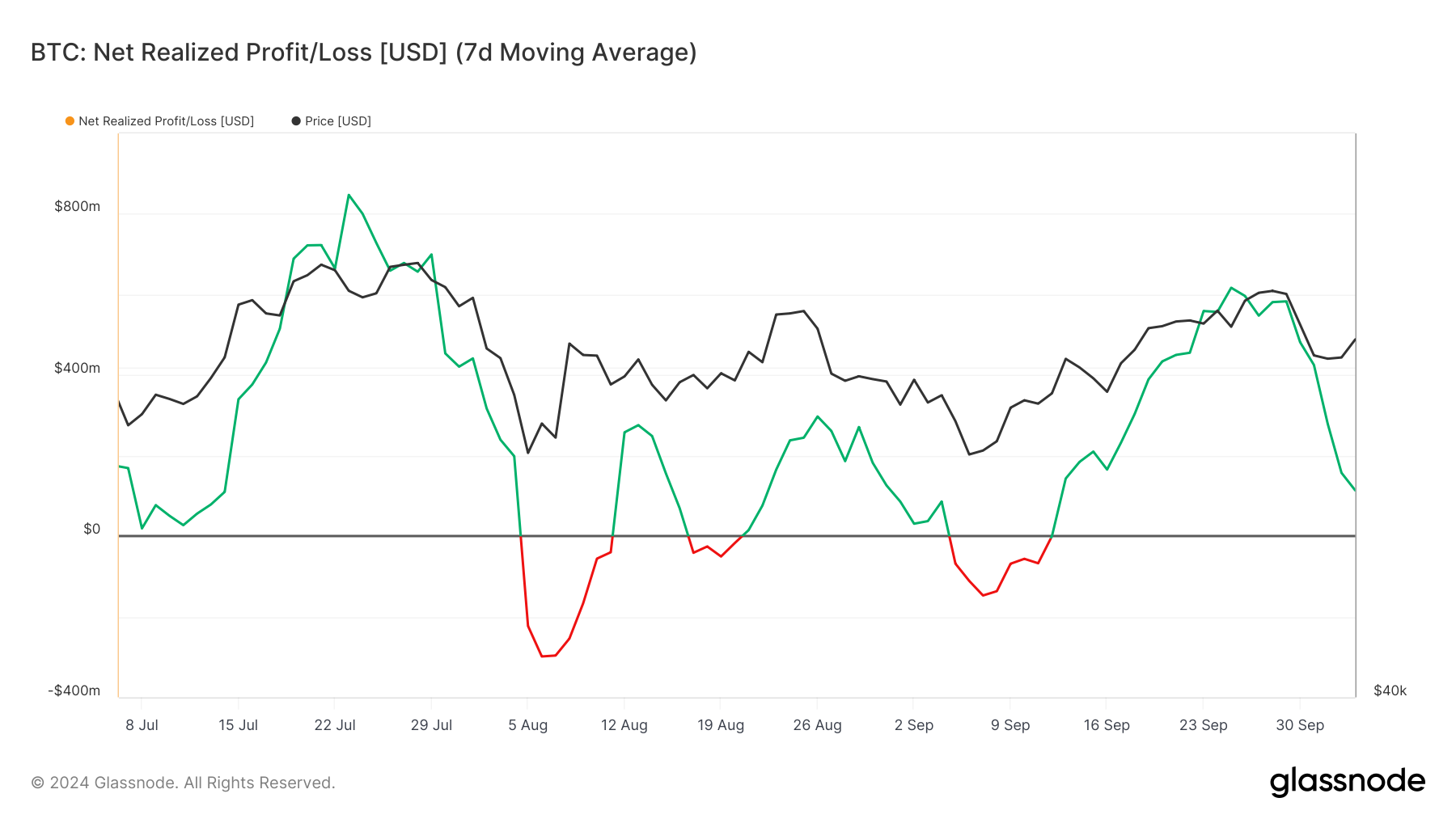

The overall macro momentum of Bitcoin is also favorable for the possibility of a price rally. The net realized profit/loss indicator, which tracks investor sentiment and behavior, has recently declined, indicating that profit taking is slowing down. This change suggests that selling pressure is decreasing, giving Bitcoin room to bounce.

As selling sentiment weakens, Bitcoin’s price could benefit from a more balanced market. The reduction in profit taking could allow for a more stable price environment, increasing the likelihood of a sustained recovery. With institutional demand remaining strong and selling pressure easing, Bitcoin could be on track for a price rally.

BTC Price Prediction: It Must First Cross $65,292 Again

Bitcoin is currently trading at $62,353, slightly above the important support level of $61,868. This is a positive sign, but BTC needs to break the important barrier of $65,292 before it can target $70,000. Breaking this resistance is essential for the next phase of Bitcoin price action.

The above-mentioned factors suggest that price appreciation is possible, but steady growth supported by sustained institutional demand is needed. If institutional investors maintain interest in BTC, Bitcoin could break the $65,292 barrier and approach $70,000.

Read more: Bitcoin Halving History: Everything You Need to Know

However, if institutional demand weakens or large investors withdraw, Bitcoin may struggle to surpass $65,292. In such a situation, BTC may test the $61,868 support level, which would invalidate the bullish outlook and delay further gains.