Bitcoin clings to $62,000, JP Morgan: Four major factors will help BTC soon usher in a violent bull market

This article is machine translated

Show original

Table of Contents

[10 月通常是較好的增長月份]

[Fed 降息效應尚未顯現]

[比特幣 ETF 期權獲准交易]

[以太坊 Pectra 升級即將到來]

Since the US Federal Reserve (Fed) announced a significant 50-basis-point rate cut last month, the cryptocurrency market has seen a rebound. Bit Bitcoin rose back above $64,000 on Monday (7th) after experiencing a decline due to geopolitical turmoil in the Middle East, reaching a high of $64,466.

However, selling pressure has emerged in recent days, and Bit Bitcoin has tested the $62,000 mark multiple times since midnight today (9th). Whether it can firmly hold this level and continue its upward momentum remains to be seen.

Regarding the market outlook, JPMorgan analysts released a report on Monday, identifying several key factors that could drive Bit Bitcoin higher in the near term:

**10 月通常是較好的增長月份**

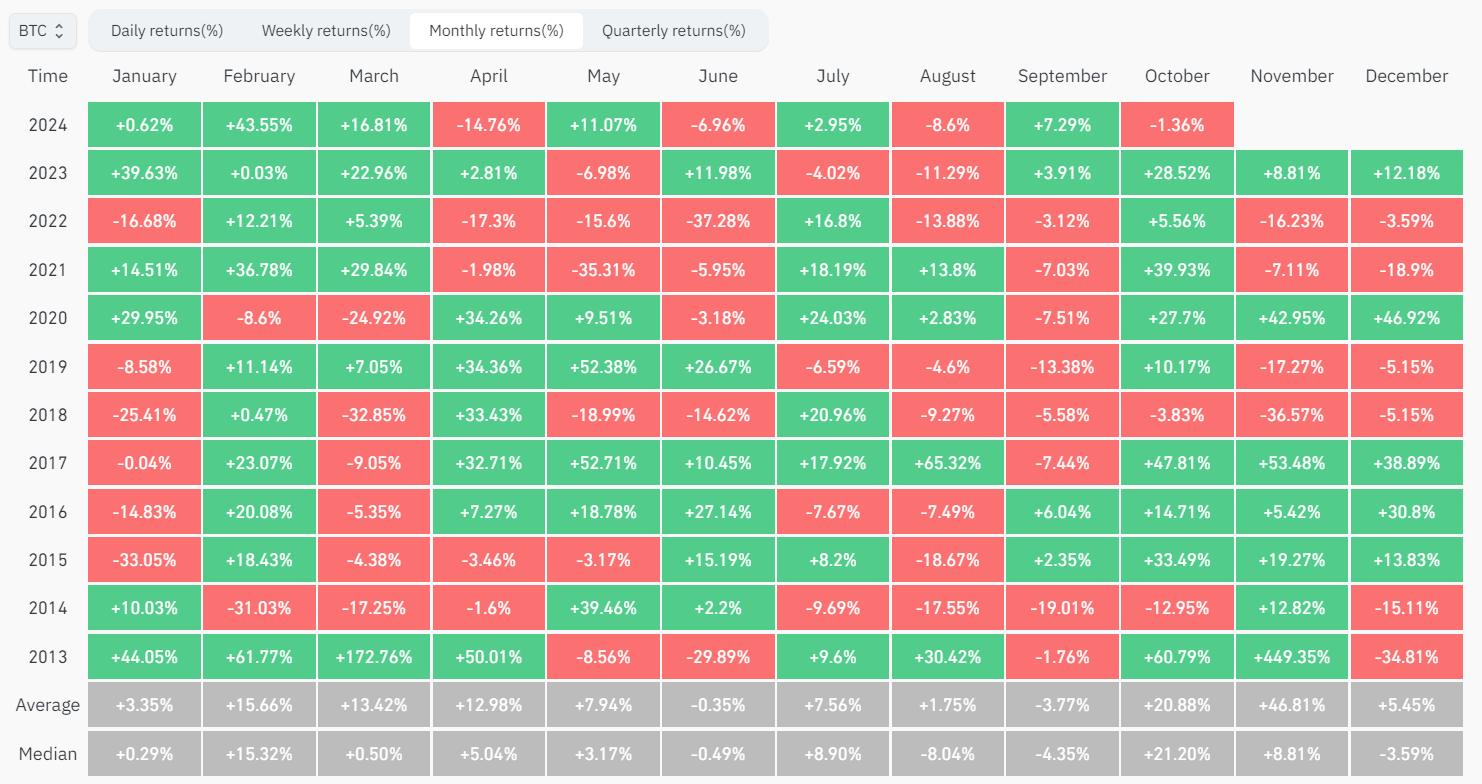

According to historical data, October is typically a better-performing month for the cryptocurrency market, often referred to as "Uptober":

> While past performance does not necessarily indicate future results, we believe the "Uptober" effect will continue to manifest.

**Fed 降息效應尚未顯現**

The potential impact of the Fed's rate cuts has not yet materialized, as the overall cryptocurrency market capitalization still has a relatively weak correlation of 0.46 with the US federal funds rate:

> Since the Fed's rate cut on September 18th, we have not seen a surge in cryptocurrencies due to the rate hike, and the market may still be waiting, before a rapid turnaround.

**比特幣 ETF 期權獲准交易**

In mid-September, the US Securities and Exchange Commission (SEC) approved the trading of Bit Bitcoin spot ETF options listed on the Nasdaq, which is considered another potential market growth catalyst:

> Through options trading, investors can now participate in ETF investments in a more flexible manner and increase the liquidity of Bit Bitcoin.

**以太坊 Pectra 升級即將到來**

Lastly, the analysts reminded investors of a significant upcoming event - the Pectra upgrade for Ethereum, which is expected to take place in Q4 or Q1 next year, following the previous Cancun upgrade:

> Pectra will implement over 30 Ethereum improvement proposals to improve network efficiency and expand account abstraction, among other changes.

>

> We believe this upgrade will bring structural changes to Ethereum, which can improve its operational efficiency and adoption in the long run.

**Extended Reading: [Ethereum's "Pectra Upgrade" Scheduled for Q1 2025, Introducing Account Abstraction Transition EIP-7702](https://www.blocktempo.com/ethereum-pectra-upgrade-targeted-for-q1-2025/)**

Sector:

Source

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content