What is different about the fundamentals of this round of meme coins compared to the past?

In the past, "Institutions are coming in!" was a rallying cry often used to excite users, creating an atmosphere where community users felt they were buying in below institutional costs. However, unless you carefully compare specific addresses, the fact of whether institutions have actually bought into this meme project is actually unknown. Even if institutions have bought in, they are usually secretive about it and quietly harvest the profits afterwards.

This round is completely different. During the peak of meme coins in March and April, many venture capital institutions openly stated that they would invest in meme coins, not just "a few" of the currently popular targets, but specifically set up funds for meme coins, treating Memecoins as legitimate blockchain projects to conduct market research and investigation.

This round, institutions have not only entered the market, but may also be better at playing the game than retail investors. The institutional capital that provides a safety net may also be a key factor in keeping some meme coins alive.

Is investing in meme coins on a regular basis a slow form of suicide?

Although they are meme coins, since there is (short-term) confidence that they will not go to zero, there can be the courage to invest long-term.

This has also given rise to a strategy of buying the top meme projects on each chain whenever the market experiences a significant pullback. As long as the projects do not go to zero, this strategy usually generates decent gains during the rebound.

But what if you don't just buy during pullbacks, but treat meme coins as valuable projects and invest in them regularly?

Regular investment is essentially a long-term investment strategy, the core of which is to average the investment cost and avoid the risk of buying at the high point in a one-time investment. This strategy is suitable for targeting stable, long-term valuable targets. Therefore, logically speaking, the high volatility and high risk characteristics of meme coins are actually not in line with the pursuit of stability and robustness in regular investment.

However, the crypto world has its own logic and market trends that often defy common sense. And even for investors who enjoy gambling on the meme track, most don't like to change positions frequently. Is it possible for the meme track to find a bit of the stability required for regular investment?

Let's do an actual backtest to see if investing in meme coins on a regular basis makes money or loses to zero.

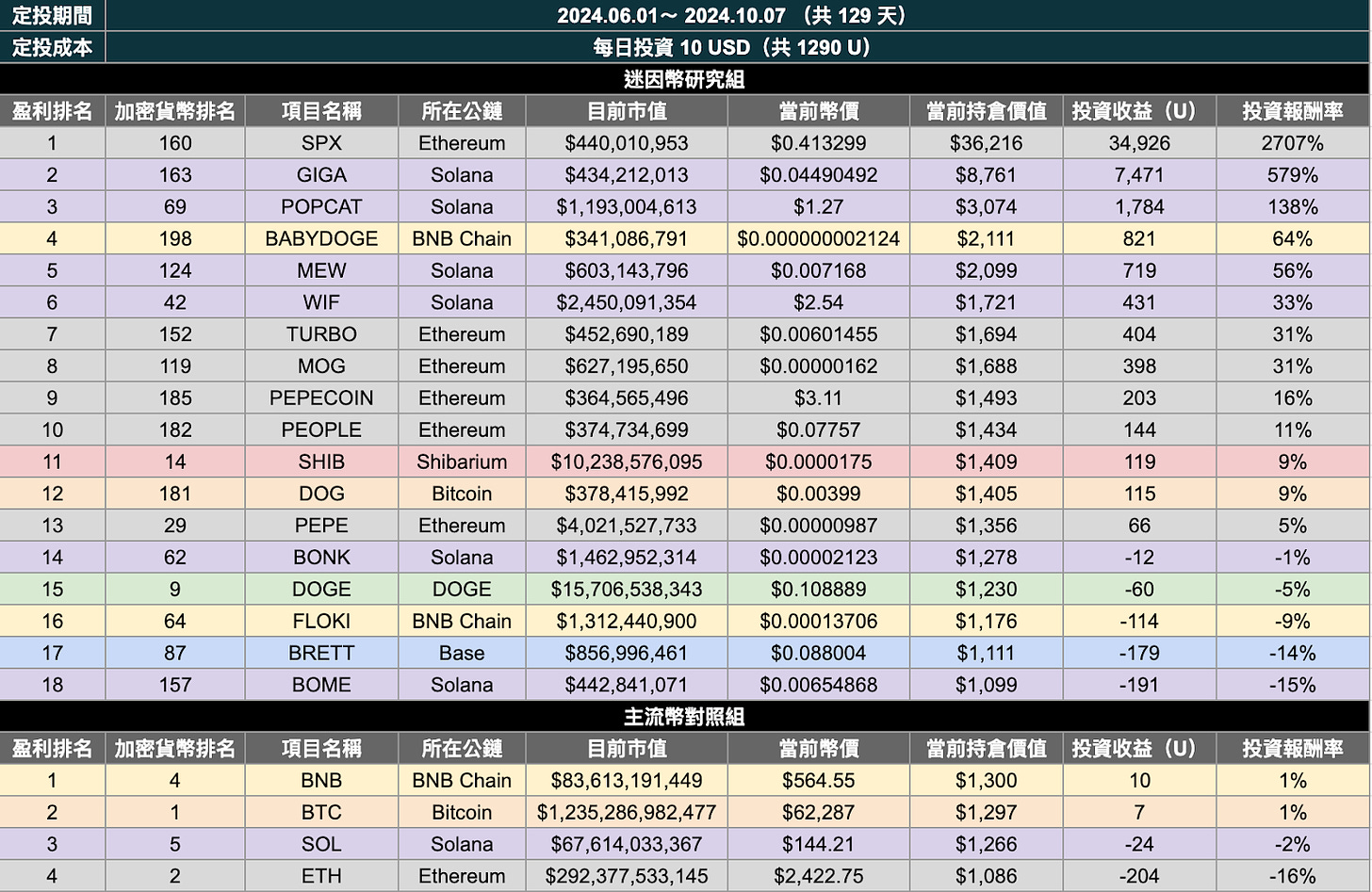

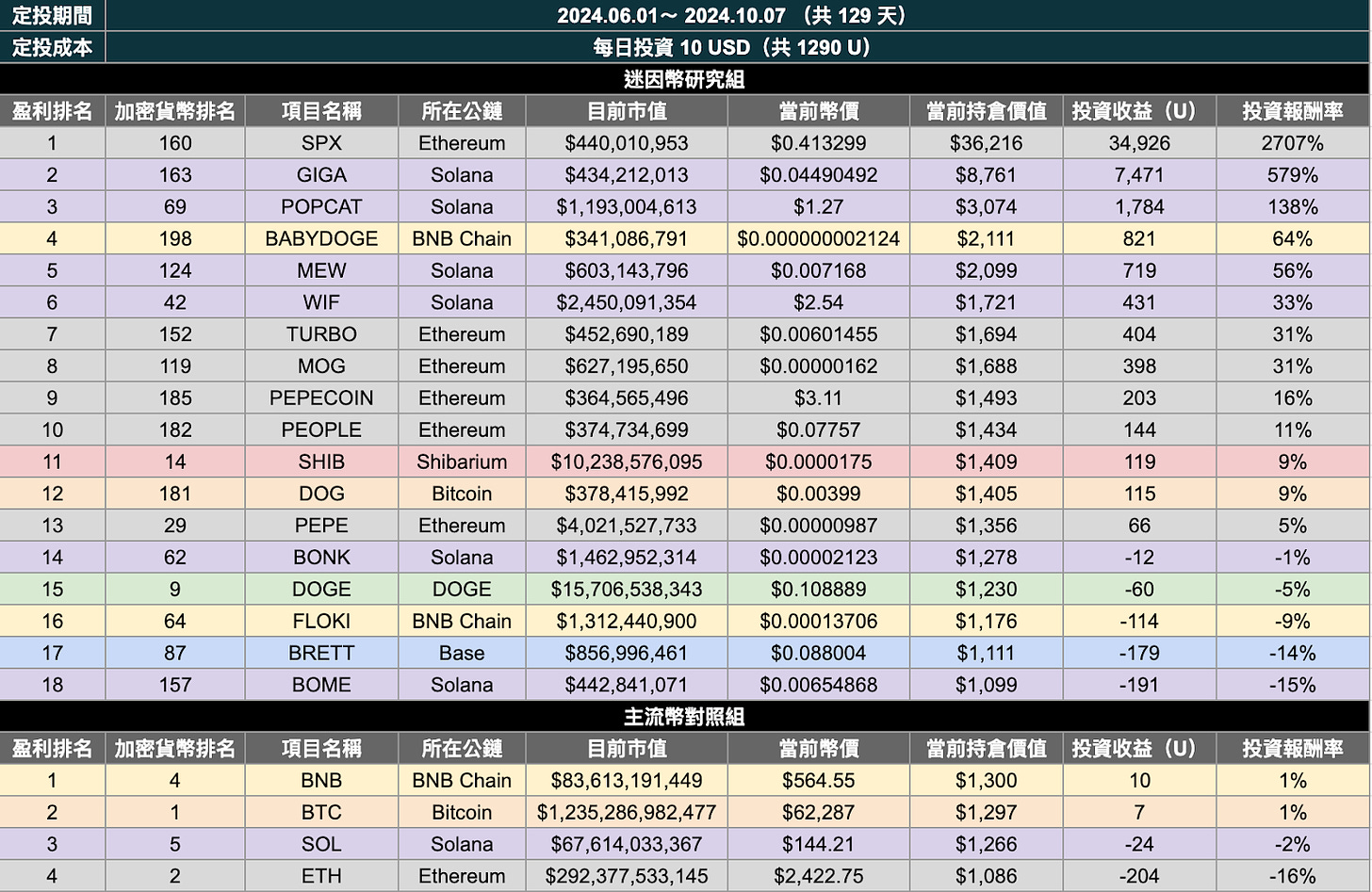

Actual Backtest: Regularly Investing in 18 Meme Coins

Before revealing the results, let me explain the backtest standards and methods.

Regular Investment in Meme Coins Statistics Method

・Based on the CoinGecko rankings, we studied the meme coins currently in the top 200 overall cryptocurrency rankings, and daily coin prices were also obtained from CoinGecko.

・The investment period must be extended to be meaningful, so we filtered out projects that have existed for at least 3 months since inception.

・June was the month when the overall market clearly started to decline, which is sufficient to test the performance of regular investment during a market downturn. Assume 129 consecutive days of regular $10 USD investment, for a total cost of $1,290 USD.

Regular Investment in Meme Coins Statistics Conclusion

・According to the screening criteria, there are a total of 18 meme projects that meet the standards.

・After 129 days of regular investment in meme coins, 13 projects had positive returns, and 5 projects lost money. The top 3 with the most recent explosive gains are:

- $SPX, maximum net profit $34,926, investment return 2707%

- $GIGA, maximum net profit $7,471, investment return 579%

- $POPCAT, maximum net profit $1,784, investment return 138%

The worst performer was $BOME, Solana's former superstar, with a net loss of $191 and an investment return of -15%.

・Among the top 5 projects by return rate: 1 is on Ethereum, 3 are on Solana, 1 is on BNB Chain. But overall, 6 are on Ethereum, 6 are on Solana, 2 are on BNB, 1 is on Bitcoin, 1 is on Base, 1 is on DOGE, 1 is on SHIB. Although everyone thinks the meme track is hottest on Solana this year, the statistics show that Ethereum is also not to be outdone!

・Which animal meme coin is the best performer? Of the 18, there are 3 cats, 7 dogs, 5 frogs, 1 human, 1 constitution, and 1 abstract meme token.

・10 of the projects have spot listings on the largest exchange Binance ($DOGE, $SHIB, $BABYDOGE, $FLOKI, $BONK, $WIF, $PEPE, $BOME, $TURBO, $PEOPLE).

If we include mainstream coins in the statistics: BTC, ETH, SOL, BNB

Usually meme coins and mainstream coins have their own supporters, and the reason why mainstream coin investors don't play meme coins is often due to smaller risk appetite and a greater willingness to exchange patience (time) for profits. So people should also be curious, if we compare regular investment in meme coins and regular investment in mainstream coins, who wins during this period?

If we bring in the common "regular army" of value investing, how do they perform in this 129-day period?

We can see that regular investment in Bitcoin, the cryptocurrency with the highest market share, and BNB, which has performed relatively well recently, can be said to have barely broken even during this period, with a 1% investment return only beating the bottom 5 poorly performing meme coins.

Small Summary of the Meme Coin Regular Investment Test

・High market cap meme coins may not be very resistant to downturns, but they tend to surge during rebounds.

・In terms of the animal series, investors still have a certain preference for the original dog-themed meme coins.

・The "buy new, not old" principle also applies here. Meme coins that have survived from the previous cycle have a certain community and purchase base, but their growth potential is relatively limited compared to the new coins that have emerged this cycle.

・Ethereum still has the ability to hype and consolidate memes, but the meme market on Solana is indeed more explosive and has better outburst power.

・Regular investment in meme coins cannot be done casually, regular investment should choose meme projects with market caps over $100 million, have been on major exchanges for a period of time, and have good liquidity, which are relatively safer.

・For those who regularly invest in mainstream coins, these over 100 days may have felt like a wasted effort.

A Thought to Encourage Everyone to Face Reality

Writing to this point, I still feel it's hard to say whether the impression drawn from this information is the charm of coins or the magic of dollar-cost averaging. Although most people's impression of this cycle is that Altcoins have fallen deeper and rebounded more slowly, in fact, after regular dollar-cost averaging, most high-market-value coins have outperformed mainstream coins.

But in contrast, the performance of coins has been so good, could it be, as the speaker @MustStopMurad at Token 2049 said, that the crypto market is an asset-centric market, so projects other than will all disappear in the future? I don't think so.

Because in a market, there must be a "main narrative" for there to be a "counter-narrative". In an exciting story, the protagonist and antagonist are interdependent, and is valuable precisely because it is in contrast to all the regular projects that they look down upon. If is a revolution to overthrow VC, then VC must exist for to continue the revolution. People won't want to look for high-value garbage in a place that has already been proven to be a garbage dump, but prefer to look for special opportunities in places that don't look so much like a garbage dump. I think a delicate balance will be reached between them, and this may be a benign challenge for the so-called "regular projects".

But these data and recent trends somewhat indicate one thing - we need to re-evaluate our risk and return model for coins.

If you are a player who is a little bolder in buying other Altcoins, but haven't played with coins before, or think you can only lose money in this track, it's not too late to start researching now. Even if your approach is value investing, you should probably have a little coin in your portfolio.