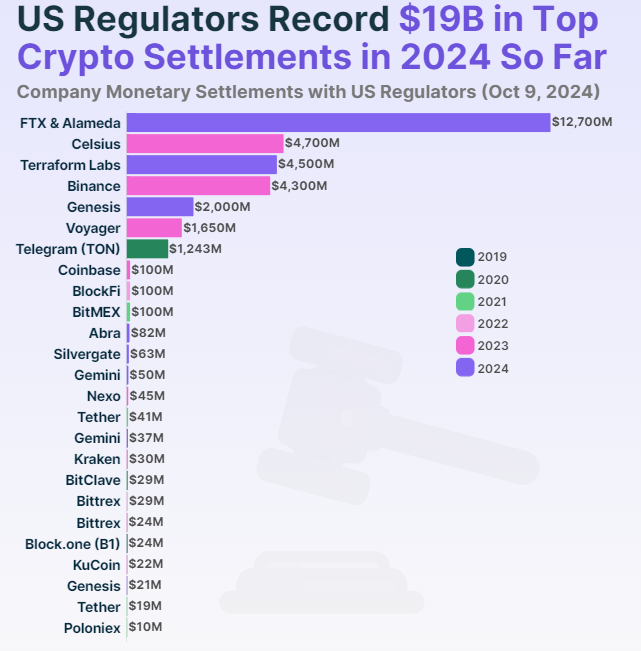

In the United States, under strict regulations, regulatory agencies have raised $19.45 billion in settlements with cryptocurrency-related companies in 2024.

With only two months left until the end of this year, and with enforcement being strengthened, this year could surpass 2023.

Major Corporate Settlements with US Regulators

As crypto enforcement actions continue in the US, according to a CoinGecko report, regulators have raised $19.45 billion from 8 settlements so far this year, up 78.9% from 2023.

The report explained that the US regulators' crackdown on the bankrupt crypto exchange FTX and its sister company Alameda Research has brought the highest crypto-related revenue this year. FTX and Alameda Research paid a record $12.7 billion fine to the CFTC in August.

Around $11.2 billion of this fund will be used to compensate FTX customers and creditors. The bankrupt crypto lender Celsius followed with a $4.7 billion settlement, and the Terra ecosystem, which triggered the 2022 bear market, recently paid $4.5 billion.

Binance, the largest crypto exchange by trading volume, is fourth with a $4.3 billion settlement after former CEO Changpeng Zhao stepped down. This resulted in a 4-month prison sentence for him.

Read more: Crypto Regulation: What Are the Pros and Cons?

16 out of the top 25 crypto settlements were made between the end of 2022 and 2024. This is the result of accelerated regulatory oversight following the collapse of Sam Bankman-Fried's crypto empire FTX. This event revealed the potential for corruption within crypto-related companies, leading to strengthened regulatory oversight to protect investors.

US Crypto Regulation Remains Controversial

Some attribute this to the SEC's tightening of regulations, especially after Gary Gensler took over as chairman. This was revealed in a joint statement that the SEC's Enforcement Division took 784 actions and imposed $4.9 billion in penalties and disgorgements in the 2023 fiscal year.

"Since Gensler's appointment as Chairman on April 17, 2021, the SEC has been frequently appearing in court to establish policy positions. This confirms the regulatory overreach that the industry has long known," noted Brendan Malone, Policy Manager at Paradigm.

Malone revealed that 92% of the SEC's actions against the crypto industry under Gensler were related to registration violations, 5% higher than under previous SEC chairs.

Meanwhile, Alexander Grieve, Vice President of Government Affairs at Paradigm, recently detailed the flaws in the SEC's policies. He cited examples such as "always having a wealth cliff buzzer ready" and using "forum shopping and Babel approaches", which undermine the enforcement actions of regulators.

However, the SEC and other regulators argue that they are strengthening regulatory oversight to protect investors. Nevertheless, there is a general view among industry sympathizers that the US's strict regulations are pushing innovation overseas, with regions like Hong Kong and the Middle East benefiting relatively from being more crypto-friendly.

Read more: Who is Gary Gensler? Everything You Need to Know About the SEC Chair