Today, a $1.61 billion Bitcoin and Ethereum options contract is set to expire in the cryptocurrency market. In particular, as Bitcoin briefly fell below $60,000 and a large number of expirations are scheduled, it could have a short-term impact on the price.

The value of Bitcoin options is $1 billion, and the value of Ethereum is $510.88 million, with traders preparing for potential volatility.

Reasons why Bitcoin and Ethereum may show volatility today

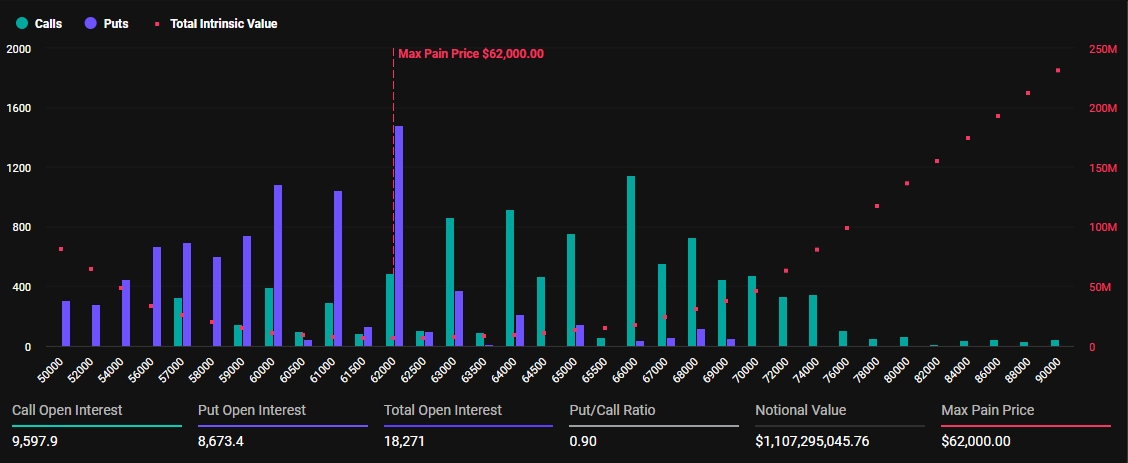

The Bitcoin (BTC) and Ethereum (ETH) contracts that are expiring today have increased significantly compared to last week. According to Deribit data, 18,271 Bitcoin option contracts are set to expire with a put-call ratio of 0.90 and a maximum pain price of $62,000.

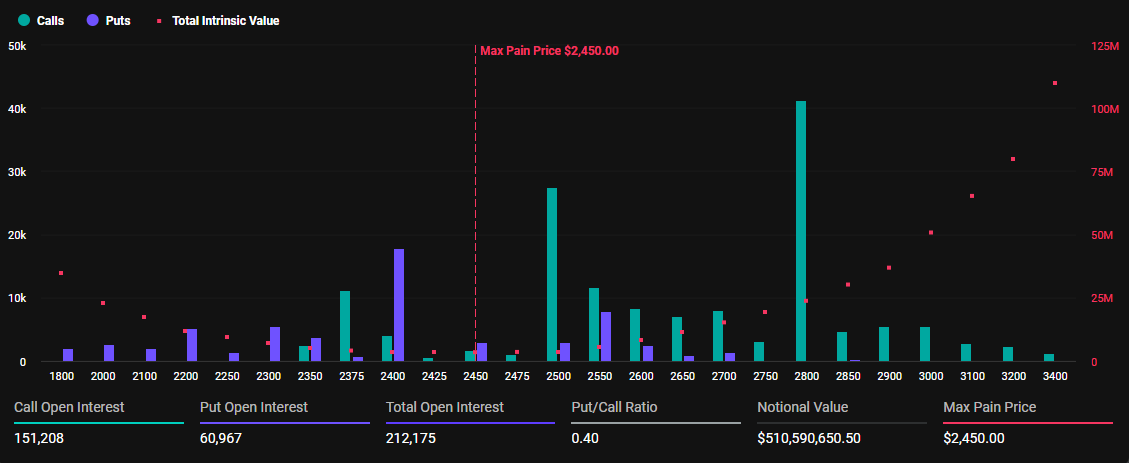

In the case of Ethereum, 212,175 contracts will expire today, with a put-call ratio of 0.40 and a maximum pain point of $2,450.

Read more: Introduction to Cryptocurrency Options Trading.

In the case of Bitcoin, the expiring options have briefly fallen below $60,000 and are generally showing a bullish trend. The pioneering cryptocurrency, with a maximum pain point of $62,000, is currently trading at $60,612 per week, well below the exercise price. Meanwhile, Ethereum is trading at $2,407, also lower than the maximum pain price of $2,450.

The maximum pain point is often an important indicator that guides market behavior. This represents the expiration point where the greatest financial loss would be incurred by all option holders who have contracts at that strike price.

"Watch the ratios and maximum pain levels. This will give you an idea of where the market is leaning," the analyst at Crypto Townhall suggested.

Bitcoin, Ethereum trading below maximum pain prices

As the Bitcoin (BTC) and Ethereum (ETH) options expiration approaches, both assets are expected to converge around their respective strike prices. This is the result of the maximum pain theory, which predicts that option prices will converge around the strike price where the largest number of contracts become worthless upon expiration.

The so-called "smart money," or large institutions, typically sell these options. They have an incentive to drive prices up to the "maximum pain" level through trading in the spot or futures markets. This strategy results in the greatest losses for the option buyers, who are the counterparties.

Ahead of expiration, both Bitcoin and Ethereum may move towards these maximum pain points. However, the price pressure will dissipate once the options have expired, and Deribit is expected to settle the contracts on Friday at 08:00 UTC.

For now, it appears that Bitcoin and Ethereum put option buyers may benefit. With the current market being weak, option sellers are likely to raise prices to mitigate their losses. In-the-money puts, where the asset price is below the strike price, allow holders to sell at a better price than the market rate.

Read more: 9 Best Cryptocurrency Options Trading Platforms.

Analysts at Greeks.live advise traders not to let their guard down, as these market shifts can open up new trading opportunities. The recent sector weakness can create favorable conditions for strategic moves.

Analysts also note that Bitcoin's implied volatility (IV) has been range-bound due to the recent market lull, which is ideal for building long-term calls at low levels. Additionally, block call trades (large buy or sell orders representing an institution's portfolio) have been gradually increasing this week.

"The key support level of $60,000 for cryptocurrencies continues to show weakness, and Ethereum is approaching its long-term support of $2,300, so market changes may be imminent. The first two weeks of Q4 this year have been sluggish, and the options market has also become more depressed. Current option positions have fallen to their lowest levels since 2023. However, a depressed market can also create new trading opportunities," the analysts pointed out.

Options expiration often causes short-term price volatility and market uncertainty. However, once traders adapt to the new price environment, the market tends to stabilize. Today's large-scale expiration can lead to similar outcomes for traders and investors, and potentially impact the future direction of the cryptocurrency market.