In 2024, US regulatory agencies have collected over $19 billion from settlements with cryptocurrency companies, accounting for nearly two-thirds of the total settlements to date.

According to a report from CoinGecko on October 9, most of this money came from the bankrupt crypto exchange FTX and its affiliated trading firm Alameda, with $12.7 billion paid to the Commodity Futures Trading Commission (CFTC) in a settlement in August.

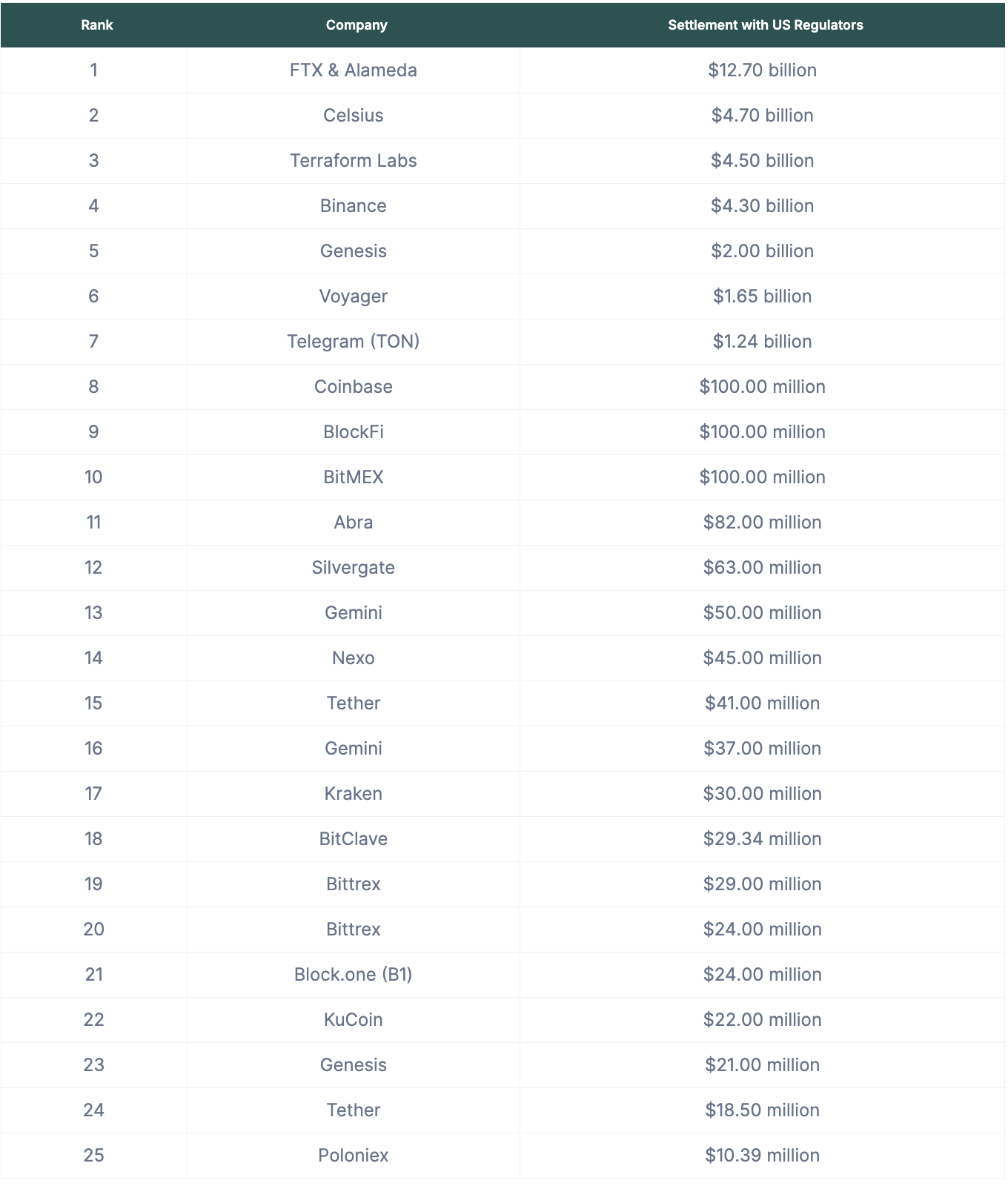

Top 25 lawsuits between crypto companies and US regulators, ranked by monetary value as of October 9, 2024 | Source: CoinGecko

In 2024, regulators reached 8 settlements, with a total value increasing by 78% compared to 2023, when only $10.87 billion was paid. Notably, this represents an 8,327% increase from 2022.

Over the past two years, the number of settlements with regulators has far surpassed all previous years combined | Source: CoinGecko

The total value of these settlements includes asset seizures, profit disgorgements, civil penalties, pre-judgment interest, and settlement payments, but does not include individual lawsuits against executives.

CoinGecko analyst Lim Yu Qian said the collapse of Celsius and Terraform Labs in mid-2022 marked a critical turning point, transitioning from a booming market to a downturn, culminating in the FTX bankruptcy and triggering a new wave of scrutiny from US regulators.

Terraform Labs' $4.47 billion settlement with the Securities and Exchange Commission (SEC) related to the collapse of the TerraUSD (UST) stablecoin in 2022 was the second-largest settlement of the year.

Genesis ranked third with a $2 billion settlement reached with the Office of the Attorney General (OAG) in August 2024. Genesis had filed for Chapter 11 bankruptcy in January 2023.

Although 2024 is not yet over, Qian believes that with the persistence of regulators, there will be more litigation settlements before the new year.

"In just the remaining few months, the value of settlements in 2024 has increased by 78.9% compared to 2023," she commented.

"With US regulators continuing to maintain close oversight of the cryptocurrency industry, 2024 may see even more litigation settlements than the previous year."

Qian also emphasized that one of the most notable settlements of 2023 involved a company still in operation at the time of the settlement.

"Binance's settlement is a major win for US regulators, as it is the only multi-billion-dollar settlement reached with an active cryptocurrency company, although its value only ranks fourth," she said.

In November 2023, Binance and former CEO Changpeng Zhao agreed to plead guilty to several charges, including Anti-Money Laundering violations, to resolve lawsuits with multiple US regulators, including the Department of Justice (DOJ), the Treasury Department, and the CFTC.

Since 2019, US regulators have collected approximately $31.92 billion from settlements with cryptocurrency companies.

Join Telegram: https://t.me/tapchibitcoinvn

Follow Twitter (X): https://twitter.com/tapchibtc_io

Follow Tiktok: https://www.tiktok.com/@tapchibitcoin

Mr. Teacher

According to Cointelegraph