BNB price has seen a slight rebound, but will the lackluster network activity and unsatisfactory Binance Launchpad results limit its upside?

The native token of the BNB Chain rose 4.1% between October 10 and 11, showing resilience after briefly testing the $555 support level. Despite the broader Altcoin market declining 15.6% since July, the BNB price has remained relatively stable. This performance has solidified BNB's position as the third-largest cryptocurrency, with a market capitalization $15 billion higher than Solana.

Activity on the BNB Chain has been declining, which could pose a threat to the BNB price. Over the past week, on-chain activity on the BNB Chain has decreased by 37%, raising concerns among investors about the sustainability of BNB's recent strong performance. Traders are concerned that Ethereum's Layer-2 scaling solutions are gaining traction, particularly after the launch of the Base network, which provides fast and extremely low-cost integration with Coinbase (the leading US exchange and Web3 wallet provider).

It can be argued that the value of BNB is partly driven by Binance exchange products, including exclusive Launchpad access privileges and trading fee discounts, which may have reduced the demand for using BNB on the BNB Chain itself. However, beyond network transaction fees, BNB is widely used across the ecosystem's decentralized applications (DApps) for trading, staking, yield farming, real-world assets (RWAs), lending, Launchpads, gaming, and derivatives markets.

To assess whether the activity on the BNB Chain truly supports the BNB price, it is crucial to examine key metrics such as on-chain deposits and network fees.

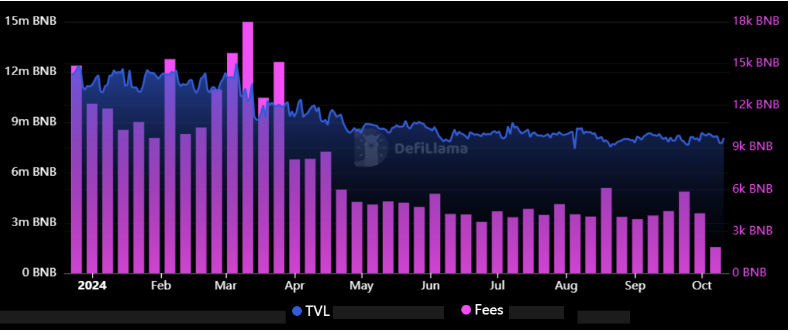

BNB Chain Total Value Locked (TVL) and fees (in BNB) Source: defillama

Currently, the Total Value Locked (TVL) on the BNB Chain is 8.1 million BNB, largely unchanged from two months ago. However, in the week ending October 7, network fees dropped to their lowest level in over four years. During this period, the cumulative fees amounted to 1,880 BNB, a significant 56% decrease from the previous week.

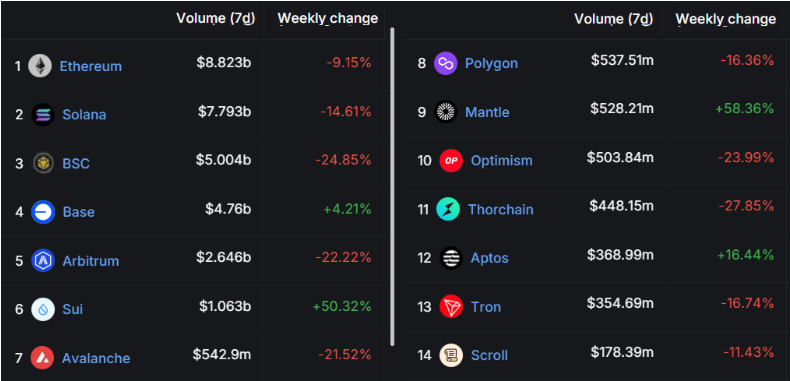

The decline in fees is primarily due to a 25% reduction in decentralized application (DApp) trading volume on the BNB Chain, which could potentially pose a concern for the price outlook of BNB. Underperforming projects include PancakeSwap, whose weekly trading volume declined by 25%, and Uniswap, which saw a 22% decrease. In comparison, according to defillama, Ethereum's DApp trading volume declined by 9% during the same period, while Solana's on-chain activity decreased by 15%.

Blockchain ranking by 7-day on-chain trading volume (USD) Source: defillama

Regarding deposits, Ethereum's Total Value Locked (TVL) stands at 19.2 million ETH, unchanged from two months ago. Meanwhile, the Solana network's TVL has soared to 40.9 million SOL, reaching a two-year high and reflecting a 26% growth over the past two months. Fundamentally, the activity on the BNB Chain is slightly lagging behind its competitors, which does not support the recent outperformance of BNB in the broader Altcoin market.

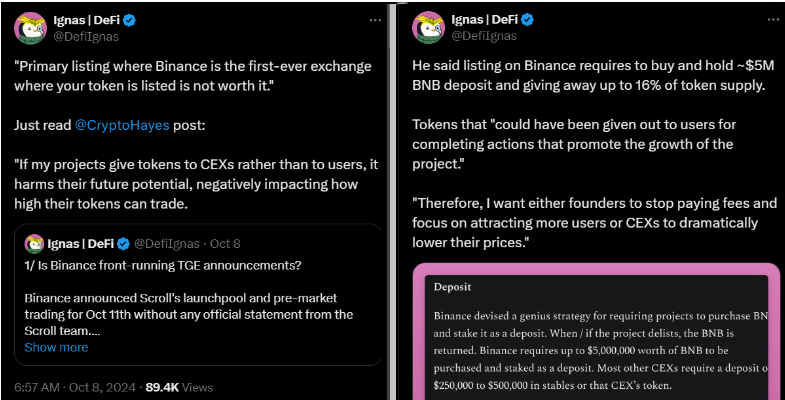

How sustainable is the Binance Launchpad? One factor limiting the upside of the BNB price is the growing criticism around Binance's listing fees. According to BitMEX co-founder and former CEO Arthur Hayes, token issuers are reportedly required to purchase and hold around $5 million worth of BNB and to grant up to 16% of the token supply.

Source: DefiIgnas

Ignas, the co-founder of Pink Brains DeFi Creator Studio, suggests that the Ethereum Layer-2 project Scroll could have issued its token through a decentralized Launchpool, allocating 5.5% of the supply to liquidity incentives. This approach could have boosted ecosystem activity and ultimately encouraged major centralized exchanges (CEXs) to list the token voluntarily. Ignas believes that paying to list on CEXs rarely creates long-term holding incentives.

Amid these criticisms, other market analysts have also expressed concerns about the recent poor performance of token launches on the Binance platform. Specifically, Hamster Kombat (HMSTR), Catizen (CATI), and DOGS have seen significant price declines. According to X platform user ZerebusX, "This is not the Binance we're used to, nor the Binance that CZ wants."

Therefore, the outlook for the BNB price is influenced by the subdued activity on the BNB Chain and the overall sentiment in the market towards Binance's services, including its Launchpad product.