BTC futures market liquidation reached about 4 trillion won

Glassnode "It's going to explode" evaluation

Joo Gi-young CEO, posting a bullish market forecast

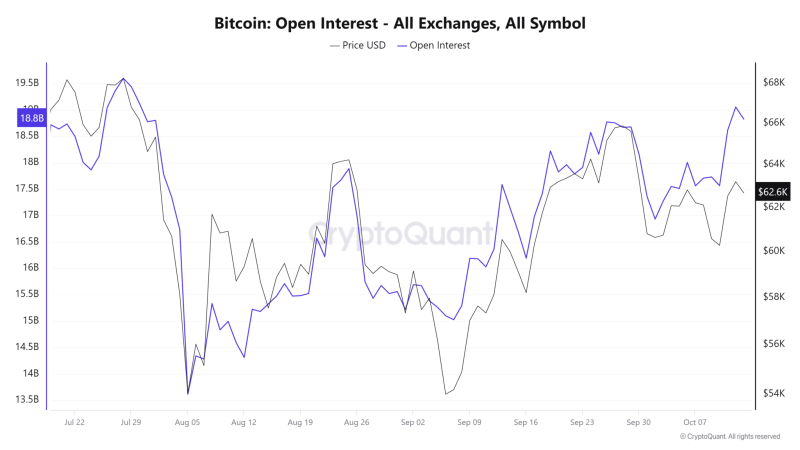

According to data from the on-chain analysis platform Glassnode, about $25 billion (approximately 33.905 trillion won) in open interest was liquidated in the afternoon of the 14th due to the sharp rise in BTC.

Glassnode pointed out that the majority of the liquidation was the funds of short (bearish) betting investors. This is because a large-scale liquidation occurred in the futures market as BTC surged, leading to an additional surge in BTC.

Glassnode evaluated that the large-scale liquidation that occurred in the futures market on the 14th was "going to explode." According to Glassnode's data, the open interest, which was around 175 billion won on the 10th, soared to 18 billion dollars on the 14th.

Meanwhile, the sharp rise in BTC and the resulting large-scale liquidation, which lifted BTC by 2.5% during the session, have fueled expectations of a bullish market both inside and outside the market. Joo Gi-young, CEO of Cryptoquant, posted a meaningful message on his X account on the 14th, saying "The bus leaves when you get off."

Reporter Kwon Seung-won ksw@